Ad blockers have become a core part of the online experience for many users, reshaping how digital ads are delivered and viewed. Roughly one‑third of internet users regularly avoid ads to improve privacy, page speed, and overall browsing comfort. With mobile browsing now dominant, ad blockers also play a role in reducing data usage and boosting responsiveness on congested networks. These trends affect everyone from marketers refining campaign strategies to publishers balancing user experience with revenue. Read on as we break down the most important ad blocker usage statistics shaping digital media today.

Editor’s Choice

- ~32.5% of global internet users use ad blockers at least sometimes as of 2025–2026.

- An estimated 900 million+ users actively block ads worldwide.

- Around 33% of US internet users employ ad blockers.

- Men are significantly more likely to use ad blockers than women.

- Mobile accounts for a majority of ad blocker activity globally.

- Some regions in APAC exceed 40% ad blocker penetration.

- Publishers face multi‑billion‑dollar revenue impacts from these trends.

Recent Developments

- Research shows 21% of global consumers use ad blockers regularly, with another 11% using them sometimes.

- Ad blocker adoption remains highest among adults aged 25–34, indicating strong usage among younger demographics.

- Browser policy changes, such as Google’s shift to MV3, have raised discussions on ad blocker effectiveness, but early studies show no significant drop in blocking ability.

- Mobile ad blockers increasingly focus on privacy protection rather than just ad removal.

- Ad blockers are adapting to new ad formats, including native and in‑app ads.

- The rise of built‑in browser ad filters affects third‑party blocker usage trends.

- Publishers increasingly implement acceptable ads and whitelist strategies to balance revenue needs.

- Ad blocker tool developers release regular filter updates to counter new ad delivery methods.

Global Statistics on Ad Blocker Usage

- Approximately 32.5% of internet users globally use ad blockers at least sometimes.

- That translates to over 900 million active users worldwide.

- Historical trends show ad blocker adoption peaked near 37% in Q3 2021 before moderate declines.

- Data from GWI indicates a significant share of global users engage ad blockers occasionally.

- User preferences vary widely by region, with some countries reporting over 40%+ adoption.

- Ad blockers are now common on both desktop and mobile platforms.

- Emerging internet markets show rising adoption as users prioritize speed and privacy.

- Gender and age differences persist in usage rates worldwide.

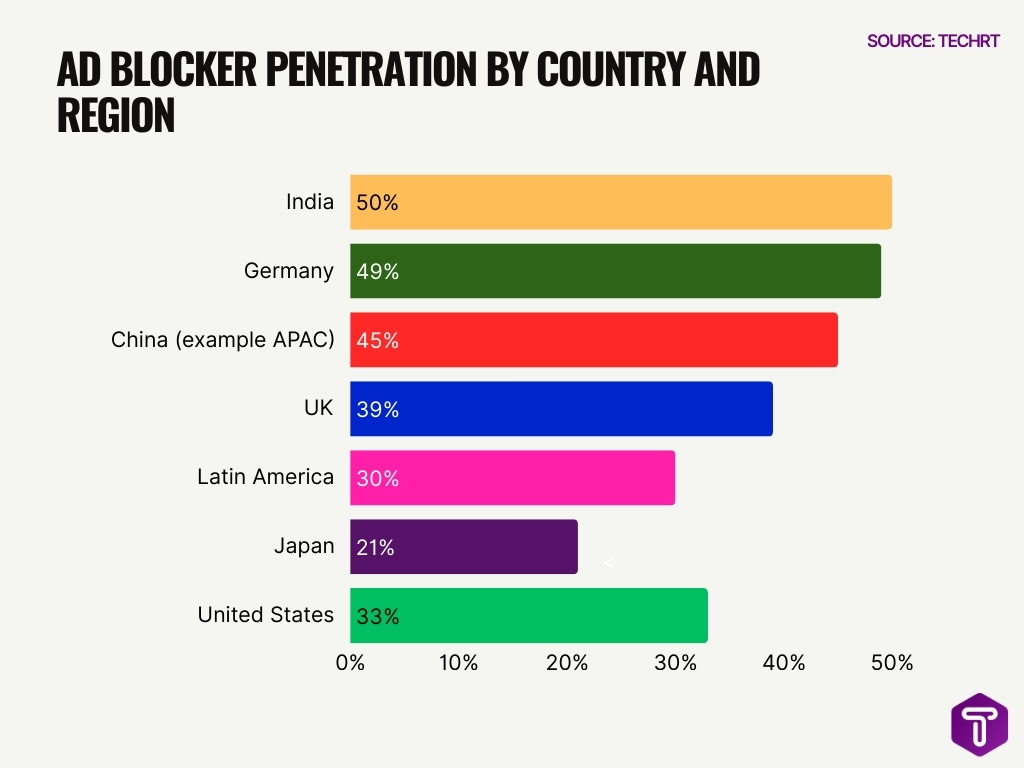

Country‑Level Trends in Ad Blocker Usage

- Around 33% of American internet users utilize ad blockers.

- In some APAC markets like China, adoption rates exceed 45%.

- India sees roughly 50% adoption in specific reports, largely driven by mobile use.

- UK ad blocker usage hovers near 39% according to regional studies.

- European leader Germany reports near 49% usage among internet users.

- Japan’s adoption remains lower at around 21%.

- Southeast Asia markets often surpass global usage averages.

- Latin American adoption is around 30% in key markets.

How People in the US Use Ad Blockers

- About 33% of US internet users report using an ad blocker on at least one device in 2025–2026.

- Desktop remains the primary entry point, with roughly 6 in 10 US ad blocker users installing tools on laptops or PCs first.

- Mobile usage continues to rise, with over 45% of US ad blocker users now blocking ads on smartphones.

- Privacy concerns rank as the top motivation for US users, cited by more than 60% of respondents.

- Faster page loading is a close second, mentioned by around 55% of users.

- Nearly 4 in 10 US users enable ad blockers specifically on news and media sites.

- Younger adults aged 18–34 account for the largest share of US ad blocker adoption.

- A growing number of US users selectively disable blockers for trusted sites, signaling mixed attitudes toward digital ads.

Usage of Ad Blockers in the UK

- Roughly 38–40% of UK internet users use an ad blocker as of 2025.

- The UK consistently ranks among the top five European markets for ad blocker penetration.

- Desktop usage dominates, with about 65% of UK ad blocker users blocking ads primarily on computers.

- Mobile ad blocker adoption in the UK has climbed past 35%, driven by younger audiences.

- Privacy and data tracking concerns influence over half of UK users who install ad blockers.

- UK users are more likely than US users to block ads on news and publishing websites.

- About 1 in 3 UK users say excessive video ads push them toward ad blockers.

- Adoption remains highest among users aged 25–44, reflecting strong uptake among working professionals.

Ad Blocker Usage in the UK by Age Group

- 36% of adults aged 16–24 in the UK use pop-up or ad-blocking software, highlighting strong adoption even among the youngest internet users.

- Usage peaks among 25–34-year-olds at 46%, making this age group the highest ad-blocker users in the country.

- 44% of adults aged 35–44 rely on ad-blocking tools, showing sustained usage across core working-age users.

- Adoption remains high among 45–54-year-olds at 41%, indicating continued resistance to online advertising in midlife demographics.

- Usage declines to 33% among 55–64-year-olds, reflecting a gradual drop as age increases.

- Only 26% of users aged 65–74 report using ad-blocking software, signaling lower adoption among older internet users.

- The lowest usage is seen in the 75+ age group at 17%, underscoring a significant generational gap in ad-blocker adoption.

- On average, 36% of UK adults use some form of ad-blocking or pop-up blocking software, emphasizing its widespread impact on digital advertising.

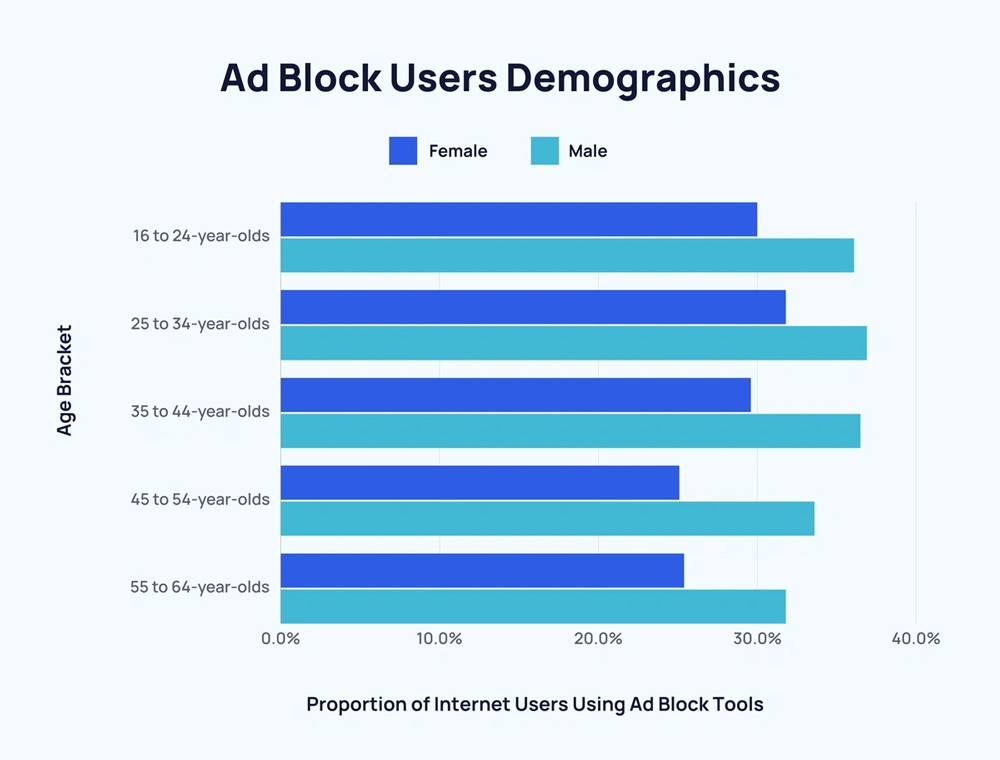

Ad Blocker Usage by Age and Gender

- Among 16 to 24-year-olds, 30% of female users and 36.1% of male users report using ad blocker tools, showing a clear gender gap even in the youngest cohort.

- In the 25 to 34 age group, ad blocker adoption rises to 31.8% among females and peaks at 36.9% among males, making this the highest-usage bracket overall.

- For users aged 35 to 44, usage remains high, with 29.6% of women and 36.5% of men actively blocking ads while browsing.

- Among 45 to 54-year-olds, adoption declines but stays significant at 25.1% for females and 33.6% for males, indicating continued reliance on ad-blocking tools in midlife demographics.

- In the 55 to 64 age bracket, 25.4% of female users and 31.8% of male users still use ad blockers, confirming sustained usage even among older internet users.

Device Preferences for Ad Blocker Users

- Globally, 54.4% of ad blocker users are on mobile versus 45.6% on desktop, showing mobile has already overtaken traditional computers in usage share.

- Desktop ad blocker usage still reaches 416 million users worldwide, slightly trailing the 496 million users on mobile devices.

- Mobile ad blocking has grown from 99 million users in 2014 to 496 million in 2023, marking a more than 5x increase in less than a decade.

- In 2023–2024, around 9% of global consumers used ad blockers on both web browsers and mobile devices, indicating notable multi-device adoption.

- Overall, ad block installation reached nearly 1 billion users globally, split roughly 54% mobile and 46% desktop/laptop usage.

- Mobile ad blocking is expanding rapidly, with usage growing about 30% year-over-year since 2022, driven by smartphone-first browsing habits.

- Smart TVs and other connected devices account for about 15% ad blocker usage, still far below mobile and desktop penetration.

- Desktop and laptop style browsing remains substantial, with ad blocker usage rates around 37% on traditional computers compared to 48% on mobile devices.

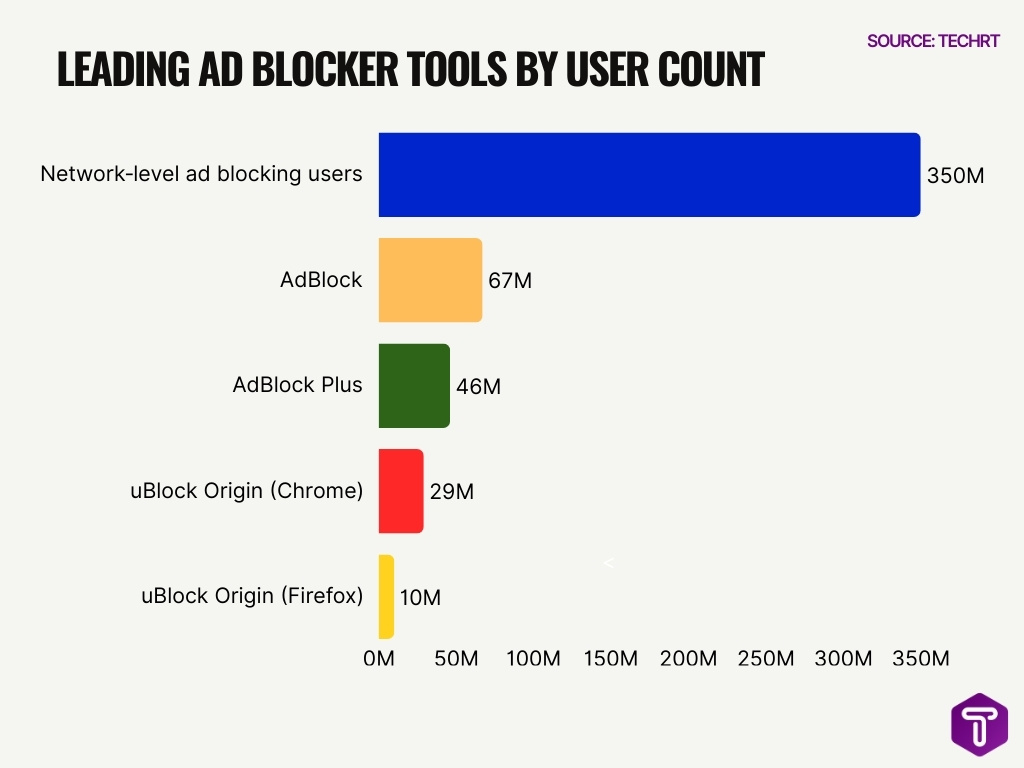

Most Popular Tools for Ad Blocker Use

- uBlock Origin boasts over 29 million active users on Chrome and 10 million on Firefox as of December 2025.

- AdBlock leads extensions with 67 million users, while AdBlock Plus has 46 million.

- uBlock Origin commands a 38% market share among ad-blocking browser extensions.

- Desktop ad-blocking sees uBlock Origin and AdBlock Plus dominating with a combined 78% share.

- AdGuard blocks 12,450 ads per day on average, saving 2.1 GB of bandwidth monthly.

- Privacy Badger appeals to privacy-focused users by blocking trackers via learning algorithms.

- Browser extensions account for the majority of ad blocking, with top tools exceeding 1M installs rarely (only 0.2%).

- Safari content blockers serve Apple’s 52% mobile browsing market share.

- Network-level ad blocking reaches over 350 million users globally.

- AI-powered ad blockers achieve 95-99% effectiveness against banners, surpassing traditional 85-95%.

Trends Over Time in Ad Blocker Adoption

- Global ad blocker usage peaked around 2021, then stabilized through 2024–2026.

- Mobile ad blocking has shown the fastest growth rate over the past five years.

- Desktop usage has remained relatively flat, with minor year-over-year changes since 2023.

- Younger generations continue to adopt ad blockers earlier in their digital lives.

- Browser policy changes have shifted how users install and manage ad blockers, not overall demand.

- Regions with rising mobile internet costs show higher adoption growth.

- Increased awareness of data privacy laws has reinforced long-term usage trends.

- Adoption is moving from “always-on” blocking toward selective and site-specific use.

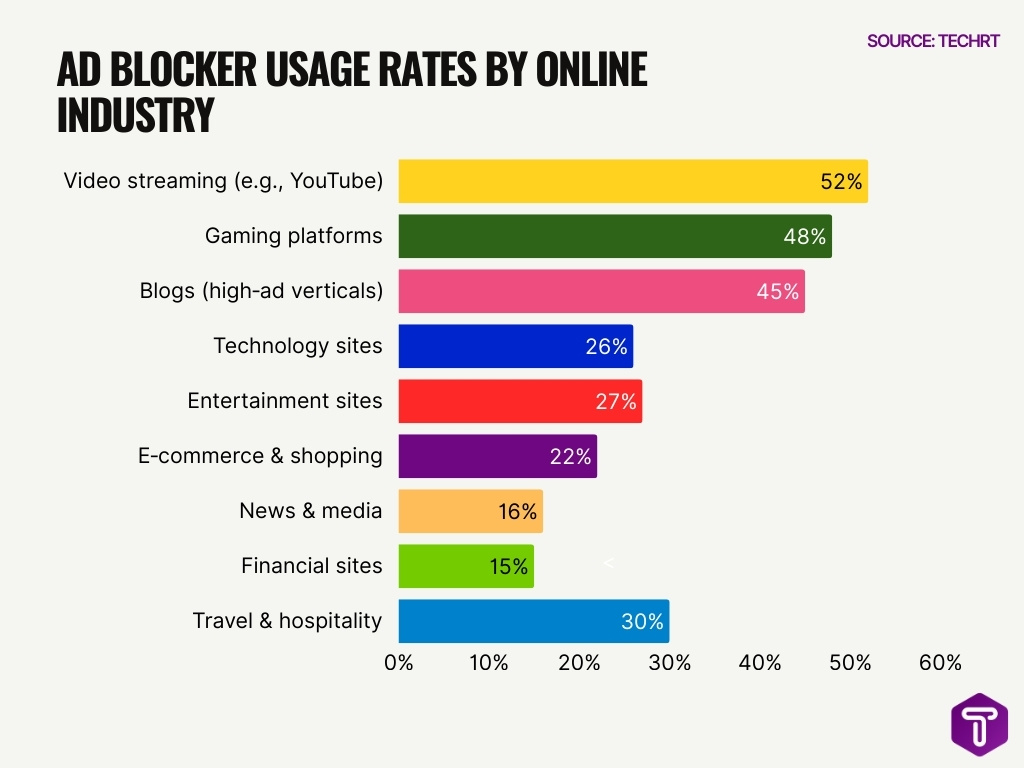

Industry‑Based Rates of Ad Blocker Usage

- News and media sites face a 16% ad blocker rate, among the highest rates online.

- Entertainment sites in arts and entertainment encounter a 27% blocking rate.

- Gaming platforms report up to a 48% ad blocker usage rate.

- Technology sites experience 26% ad blocking on computers and electronics.

- E-commerce and shopping verticals see a 22% ad blocker penetration.

- Financial sites maintain a lower 15% blocking rate due to security needs.

- Video streaming like YouTube faces a 52% ad blocking rate.

- Blogs in high-ad verticals suffer 30–45% blocking, impacting revenue

- Travel and hospitality sectors note declines from 20–30% ad blocking.

Revenue Losses Caused by Ad Blocker Adoption

- Ad blockers cost publishers $54 billion in lost ad revenue in 2024, representing ~8% of global digital ad spend.

- Publishers lost $47 billion globally to ad blockers in 2023.

- US publishers face average ad blocking rates of 26–33%.

- EU ad blocking rates exceed 30%, reaching 40% overall and 49% in Germany.

- Average publishers lose 10–40% of potential ad revenue to blockers.

- 912 million active ad blocker users worldwide as of 2023.

- Desktop ad blocking affects 32–40% of users globally.

- Southeast Asia leads with ad blocker adoption over 65%.

- News publishers saw digital ad revenue drop by ~25% from blocking in 2023.

- Some publishers recover up to 40% of blocked revenue via whitelisting.

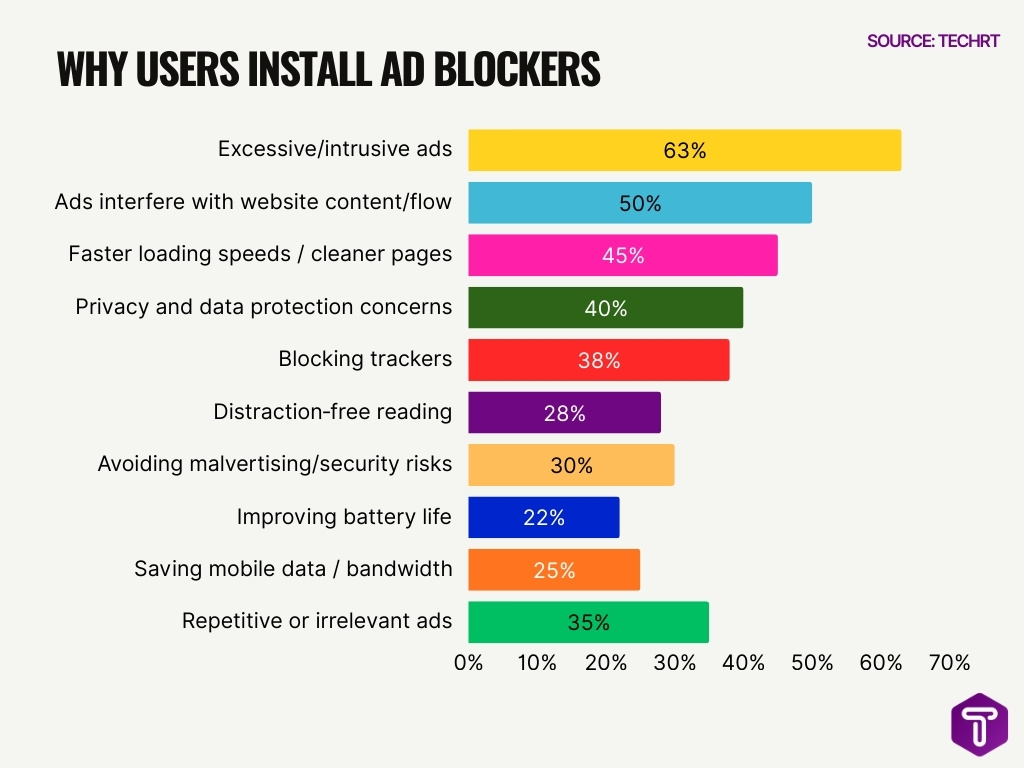

Why People Choose to Use Ad Blockers

- 63% of users install ad blockers due to excessive or intrusive ads disrupting their experience.

- Over 50% say ads interfere with website content or browsing flow.

- Around 40% cite privacy and data protection concerns as a key reason for blocking ads.

- About 45% aim for faster loading speeds and cleaner web pages by using blockers.

- Nearly 30% install blockers to avoid malvertising and potential security risks.

- 35% of users mention repetitive or irrelevant ads, reducing browsing enjoyment.

- Around 25% use ad blockers to save mobile data and reduce bandwidth consumption.

- More than 38% value the ability to block trackers that monitor online behavior.

- Roughly 28% report using ad blockers to maintain a distraction-free reading experience.

- About 22% say ad blockers improve battery life on mobile or laptop devices.

Implications for Marketers and Publishers

- Marketers must now account for blocked impressions, which alter audience measurement and campaign planning.

- Targeting strategies have shifted toward first‑party data and contextual ads less affected by blockers.

- Publishers increasingly deploy anti‑adblock prompts, encouraging users to whitelist sites.

- Acceptable ad programs aim to balance user experience with ad visibility, helping sustain revenue.

- Some publishers diversify with subscription models and premium content as an alternative income.

- Marketers are investing in native advertising and nonintrusive formats that users tolerate better.

- Data analytics now emphasize viewable and engaged impressions over raw serve counts.

- Cross‑platform measurement becomes critical as blockers distort traditional ad metrics.

Frequently Asked Questions (FAQs)

What percentage of global internet users currently use ad blockers?

About 31.5% to 42.7% of global internet users use ad blockers, depending on the reporting source and year.

How many people worldwide actively use ad blockers?

Nearly 912 million to over 1 billion people worldwide use ad blockers on some device.

What share of ad blocker users are on mobile devices?

Mobile accounts for approximately 54.4% to 63% of all ad‑blocking activity globally.

What percentage of internet users in the US use ad blockers?

About 33% of internet users in the United States use ad blockers.

How much advertising revenue is estimated to be lost due to ad blockers?

Ad blockers have been estimated to cause up to about $54 billion in lost advertising revenue globally.

Conclusion

Ad blocker usage reflects both user demand for better browsing experiences and persistent challenges for digital revenue models. With roughly one‑third of the world’s internet users opting to block ads and billions in potential revenue at stake, understanding tools, motivations, and market implications is essential for publishers and marketers alike. The landscape continues to evolve as technology adapts to privacy priorities and shifts in consumer behavior. Staying ahead requires nuanced strategies that respect user preferences while safeguarding monetization.

Leave a comment

Have something to say about this article? Add your comment and start the discussion.