iMessage continues to be one of the most deeply embedded messaging platforms within the Apple ecosystem, especially in the United States. With its seamless integration into iPhones, iPads, Macs, and even Apple Watches, iMessage serves as a daily communication lifeline for millions. From casual chats to media-rich conversations and business use, its relevance continues to evolve with each software update and market shift.

Industries ranging from education to finance use iMessage features for both internal and client-side communication. Similarly, customer service teams, solopreneurs, and e-commerce brands leverage its convenience for fast responses and file sharing. As Apple increasingly refines privacy, AI, and cross-platform capabilities, understanding how iMessage is used today can offer valuable insight into broader digital messaging trends.

Below, we explore in detail the latest usage statistics, demographics, platform comparisons, and revenue influence of iMessage.

Editor’s Choice

- iMessage sends an estimated 8.4 billion messages per day as of 2022 estimates.

- iMessage usage in the United States dominates due to iPhone penetration rates exceeding 57%.

- Users spend an average of 1 hour and 36 minutes per day using iMessage.

- iMessage has seen steady user growth aligned with iPhone sales, especially in Gen Z demographics.

- In the U.S., more than 50% of smartphone users actively use iMessage.

- Global iMessage market share remains limited due to its Apple device exclusivity.

- Apple doesn’t monetize iMessage through ads, but its usage fuels broader ecosystem revenue.

Recent Developments

- Apple announced RCS support in iOS 18, improving messaging with Android users.

- End-to-end encryption and message sync were enhanced across devices in recent iOS updates.

- Apple added AI-powered message suggestions, summarizations, and photo search features.

- Contact Posters and Check In safety features were added to enrich communication.

- Business messaging capabilities improved via iMessage extensions and scheduling.

- Enhanced dictation and voice message transcription rolled out in iOS 17 and later.

- Tapback options were expanded to include new emoji-based responses.

- Apple’s emphasis on privacy and ecosystem integration drives continual iMessage updates.

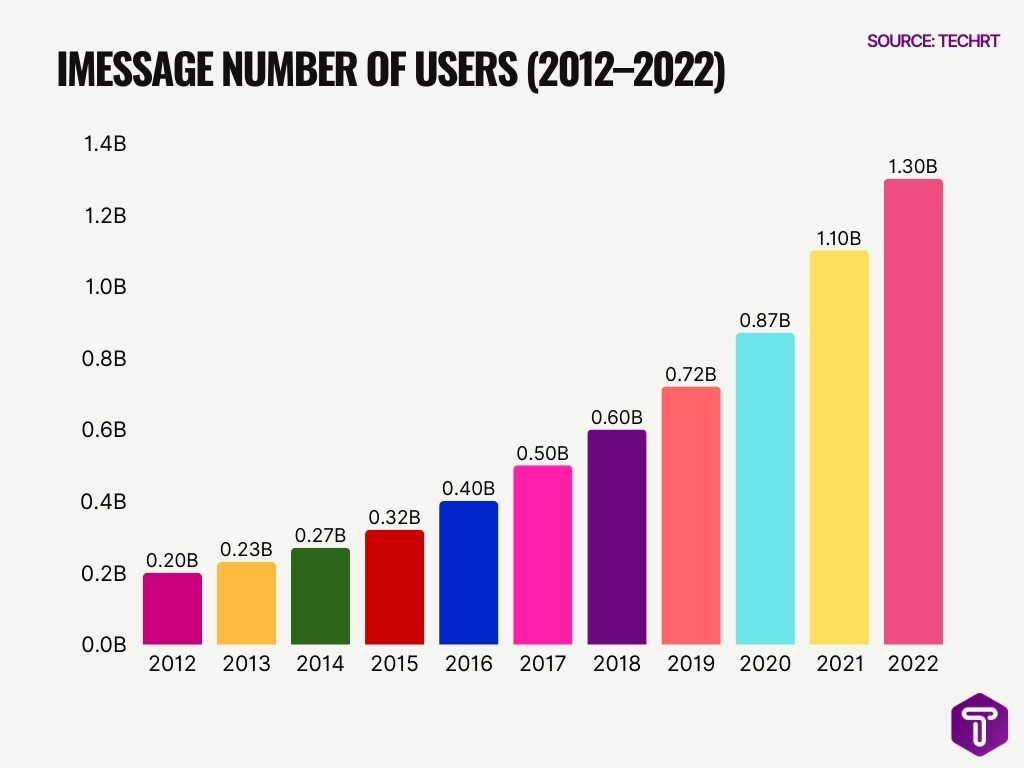

iMessage User Growth Over Time (2012–2022)

- iMessage users increased from 0.20 billion in 2012 to 1.30 billion in 2022, reflecting massive long-term platform expansion.

- The user base grew more than 6× in just 10 years, highlighting strong adoption across Apple’s ecosystem.

- iMessage crossed the 0.50 billion milestone in 2017, marking its transition into a truly global messaging platform.

- Growth accelerated after 2016, with users rising from 0.40 billion to 1.30 billion within six years.

- In 2020, the platform reached 0.87 billion users, benefiting from increased digital communication during the pandemic period.

- iMessage surpassed 1 billion users in 2021, adding nearly 0.20 billion new users in a single year.

- By 2022, iMessage firmly established itself among the world’s largest messaging platforms with 1.30 billion users.

- The steady year-over-year increase underscores strong iPhone adoption, ecosystem lock-in, and high user retention.

Global iMessage User Base

- iMessage has over 1.3 billion active Apple device users globally, but usage is skewed toward regions with high iPhone adoption.

- In the United States, nearly all iPhone users engage with iMessage daily.

- Outside the U.S., iMessage adoption remains limited due to Android dominance.

- Countries with higher iPhone sales, like Japan, Australia, and Canada, see broader iMessage use.

- WhatsApp, WeChat, and Telegram dominate in Europe, Asia, and Latin America.

- Despite lacking global dominance, iMessage sees high per-user activity in supported markets.

- iMessage remains a preferred messaging tool in markets where users prioritize privacy and device continuity.

- The exclusivity of iMessage makes it a secondary or niche tool in regions favoring Android.

Monthly Active Users

- While Apple doesn’t disclose MAUs, industry estimates suggest over 950 million iMessage monthly users in 2025.

- iPhone’s global installed base of 1.3+ billion indicates massive daily interaction with iMessage.

- Usage spikes seasonally during holidays, sales periods, and iOS updates.

- North America accounts for the largest share of monthly active iMessage users.

- Messaging frequency and time spent on iMessage increased post-pandemic.

- High user retention correlates with iOS loyalty and annual iPhone upgrades.

- Apple’s Services division, including iCloud and iMessage, saw rising engagement in 2025.

- Teen and Millennial usage significantly boosts monthly usage volume.

- iMessage MAUs are higher in regions with integrated device ecosystems.

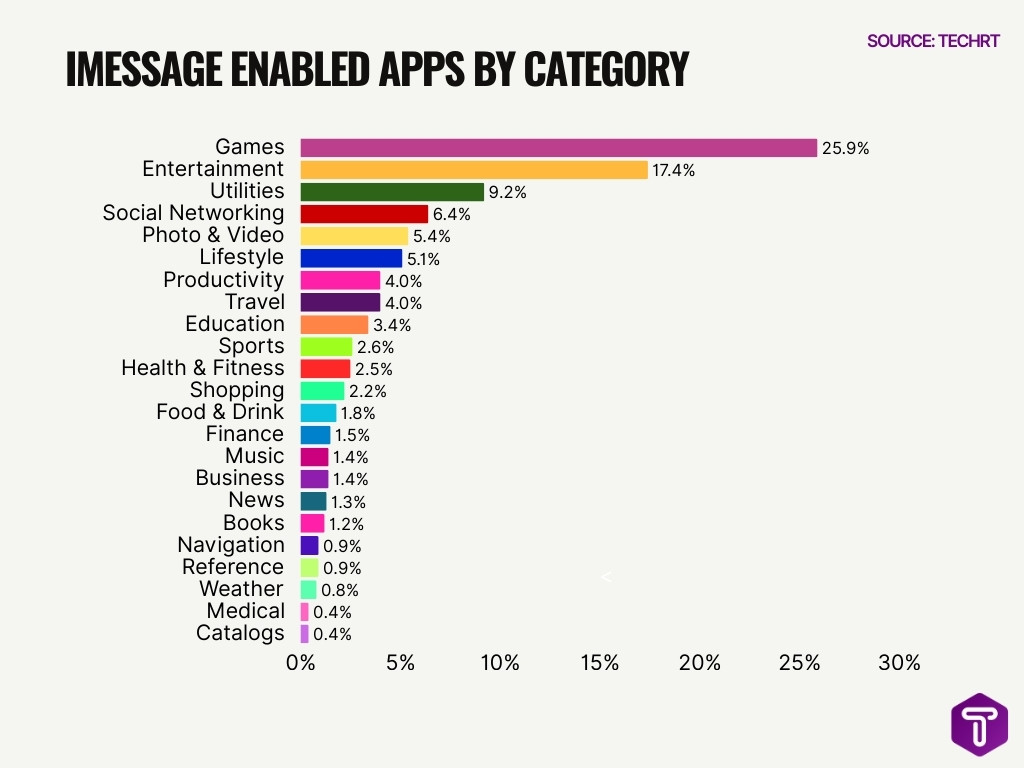

iMessage Enabled Apps by Category: Key Insights

- Games dominate iMessage integrations, accounting for 25.9%, making them the most common app category used within Apple’s messaging ecosystem.

- Entertainment apps rank second at 17.4%, highlighting strong demand for media sharing and interactive content inside iMessage.

- Utilities represent 9.2% of iMessage-enabled apps, showing that users frequently rely on functional tools directly within conversations.

- Social Networking apps hold 6.4%, reinforcing iMessage’s role as a social engagement layer beyond basic texting.

- Photo & Video apps contribute 5.4%, reflecting consistent usage of visual content and media enhancements in chats.

- Lifestyle apps account for 5.1%, indicating growing interest in personal and daily-use services through iMessage.

- Productivity and Travel apps each capture 4.0%, signaling moderate adoption of task-oriented and planning tools inside messages.

- Education apps make up 3.4%, suggesting limited but notable use of learning-related features within iMessage.

- Sports apps represent 2.6%, driven by live updates, scores, and fan engagement.

- Health & Fitness apps hold 2.5%, reflecting early-stage adoption of wellness-related interactions in messaging.

- Shopping apps account for 2.2%, indicating emerging use of commerce-related features inside chats.

- Food & Drink apps stand at 1.8%, often focused on ordering, recommendations, and sharing.

- Finance apps contribute 1.5%, showing cautious adoption due to security and privacy considerations.

- Music and Business apps each represent 1.4%, supporting content sharing and professional communication use cases.

- News apps account for 1.3%, highlighting the limited use of news consumption within iMessage.

- Book apps hold 1.2%, reflecting niche usage for reading and content discovery.

- Navigation and Reference apps each represent 0.9%, indicating minimal reliance on location and informational tools in chats.

- Weather apps account for 0.8%, typically used for quick updates and forecasts.

- Medical and Catalog apps are the least adopted, each at just 0.4%, showing very limited iMessage integration.

Daily Messages Sent

- As of 2022 estimates, iMessage users shared an estimated 8.4 billion messages per day across the platform.

- That figure places iMessage among the most actively used messaging systems in terms of daily traffic, even though Apple hasn’t published recent official counts.

- For context, WhatsApp had over 3 billion monthly active users and reported massive daily messaging volumes in 2025.

- Messaging trends in the US show users check messages dozens of times per day, suggesting high engagement across all platforms.

- While SMS/MMS volumes continue to decline, modern instant messaging (including iMessage) accounts for the vast majority of personal messaging traffic.

- RCS messaging surpassed 1 billion daily P2P messages in 2025 in the US alone, signaling broader messaging growth overall.

- Because iMessage is built into Apple devices by default, a large proportion of iPhone communications occur within the app rather than through other channels.

- Messaging apps combined reach a majority of smartphone users, with over 94% of internet users worldwide having used one recently.

Average Messages Per User

- Earlier research estimated that iMessage users spent approximately 1 hour and 36 minutes per day messaging across the app.

- That usage suggests hundreds of messages per user per day, though Apple does not publish exact counts.

- For comparison, heavy messaging users on platforms like WhatsApp routinely exchange hundreds of messages daily.

- In the US, smartphone owners generally check messaging apps over 100 times per day, implying frequent message exchange per user.

- Average message counts tend to be higher among younger demographics (Gen Z and Millennials) versus older age groups.

- The seamless integration of photos, videos, and reactions within iMessage often encourages higher per‑user message output.

- Messaging activity spikes significantly during holidays and major events, leading to temporary but sharp increases in average messages per user.

- Cross‑platform messaging growth suggests average daily messaging volumes are rising steadily industry‑wide.

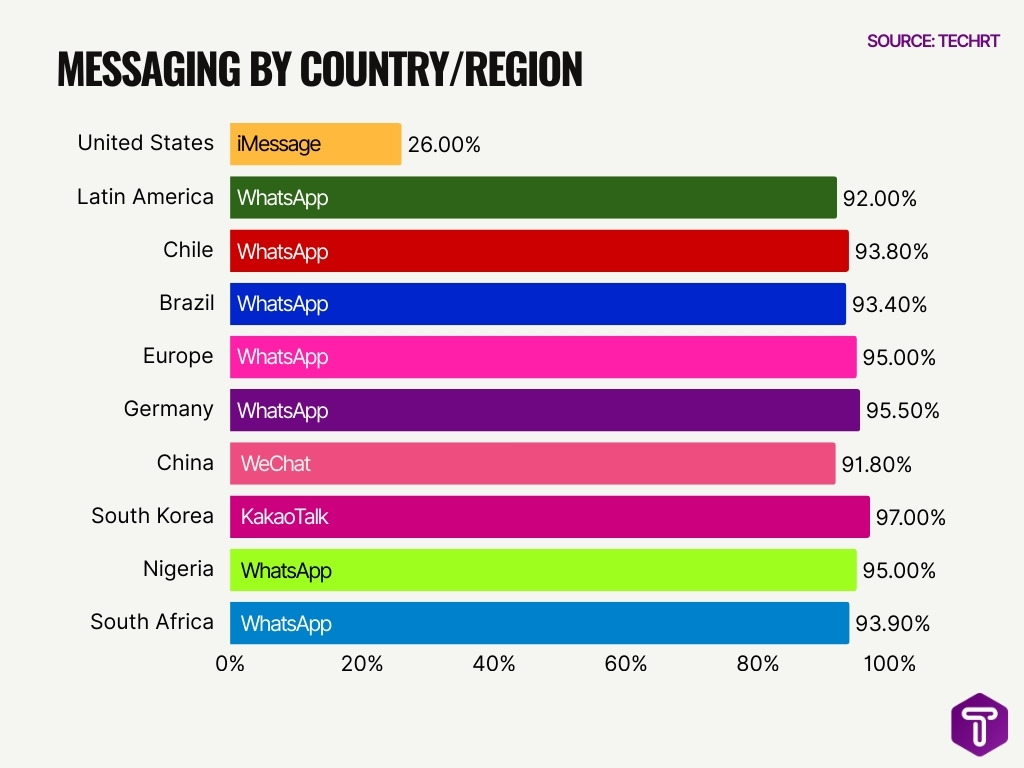

Market Share by Country

- In the United States, iMessage holds 26% of smartphone messaging users, tied to 58% iOS market share.

- WhatsApp dominates Latin America with over 92% penetration among internet users in countries like Chile (93.8%) and Brazil (93.4%).

- Europe’s DACH region sees WhatsApp at 95%+ penetration, with Germany at 95.5% among internet users.

- China favors WeChat with 91.8% of internet users and 1.38 billion global MAUs.

- Japan leads with LINE at 68.75%+ iOS share, boosting its dominance alongside 70 million local users.

- South Korea’s KakaoTalk commands 97% market share in messaging.

- India has 535+ million WhatsApp users, making it the top global market.

- Africa leads WhatsApp, with Nigeria at 95% South Africa 93.9% penetration.

- North America prefers iMessage due to 60%+ iOS share in the US and Canada.

Daily Usage Time

- iMessage users spend an average of 1 hour 36 minutes daily in the app.

- US smartphone users allocate 21% of app time to communication and social apps, including messaging.

- Messaging apps claim 8% of total smartphone usage minutes in the US.

- US teens average 4.8 hours daily on social media, much in messaging apps.

- Teens receive ~240 notifications daily, 25% during school from messaging apps.

- Messaging usage peaks at 8-9 PM evenings and rises during commutes.

- Live chat sessions in business average 13:41 minutes in duration.

- Group chats resolve issues in under 2 hours for 68% of cases.

- Cross-device Apple syncing boosts iMessage engagement across 1.5 billion devices.

- WhatsApp users, comparable to iMessage, spend 34-38 minutes daily messaging.

US Market Share

- iMessage remains strongest in the United States, where Apple holds roughly 57% to 60% of smartphone market share.

- In US messaging app penetration charts, iMessage typically ranks among the top channels used by half of smartphone users there.

- The prevalence of iPhones in the US accelerates iMessage adoption versus global markets.

- Messaging habits indicate Americans check messages frequently throughout the day, bolstering iMessage usage relative to SMS.

- iMessage usage growth in the US has been steady year‑over‑year, with smartphone adoption rising.

- With Apple’s integrated ecosystem, iMessage achieves high stickiness among existing Apple device owners.

- Market share estimates vary by age group, with younger users more heavily skewed toward iMessage.

- Alternative messaging apps still challenge iMessage, but mostly outside the domestic US market.

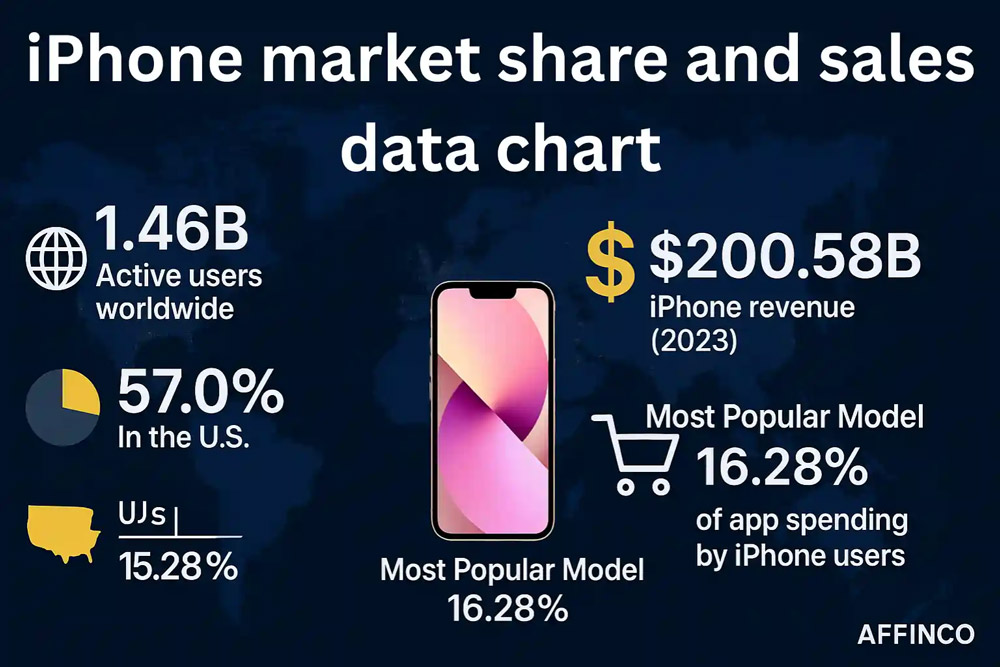

iPhone Market Share and Sales Highlights

- Apple’s iPhone ecosystem supports approximately 1.46 billion active users worldwide, highlighting its massive global installed base and long-term customer retention.

- In the United States, the iPhone commands a dominant 57.0% smartphone market share, making it the most widely used smartphone platform in the country.

- Globally, the iPhone accounts for around 15.28% of the total smartphone market share, reflecting strong performance despite intense competition from Android devices.

- Apple generated an impressive $200.58 billion in iPhone revenue in 2023, underscoring the iPhone’s position as the company’s largest revenue driver.

- The most popular iPhone model alone captures 16.28% of total iPhone sales, indicating highly concentrated demand around flagship devices.

- iPhone users contribute significantly to the app economy, accounting for 16.28% of total global app spending, reinforcing the platform’s premium user base and higher monetization power.

Demographic Breakdown by Age

- 95% of US adults aged 18-29 use text messaging on their phones.

- 18-24 year olds send/receive an average of 109.5 texts per day.

- 48% of Gen Z check text messages more than 10 times daily.

- 95% of 18-29 year olds and 91% of 30-40 year olds prefer texting as the primary channel.

- 92% of US cell owners over 50 use text messaging, often daily.

- 31% of US 18-34 year olds use WhatsApp, vs 11% of those 65+.

- 23% of Facebook Messenger US users are aged 25-34.

- 27% of WhatsApp users globally are aged 26-35.

- 80% of US 18-29 year olds use Instagram for messaging.

Gender Distribution

- Industry data on messaging apps suggests roughly balanced gender usage across major chat platforms.

- For WhatsApp, about 55.5% male vs. 44.5% female usage was reported in certain regions, indicating moderate gender skews depending on app and market.

- iMessage doesn’t publish official gender breakdowns, but broader messaging research shows near parity in usage.

- Messaging activity levels differ slightly by gender on some platforms, but trends are converging.

- Younger female users historically show slightly higher engagement in social communication apps, including messaging features.

- Male users, particularly under 35, may use messaging features within broader social networks more intensively.

- Gender distribution varies more by region and app than by platform inherently.

- Overall, mobile messaging gender splits remain within a few percentage points of even in most major markets.

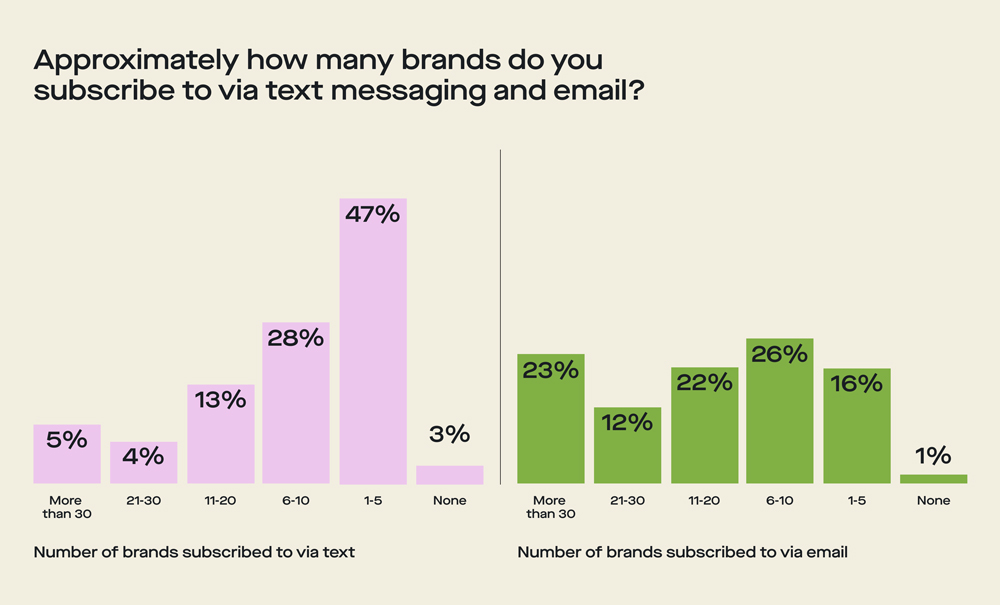

Brand Subscription Behavior via Text & Email

- Text messaging subscriptions are highly selective, with 47% of consumers subscribing to only 1–5 brands, making it the most common range.

- Nearly 28% of users follow 6–10 brands via text messages, indicating moderate engagement beyond the core few.

- 13% of consumers receive texts from 11–20 brands, showing a smaller but notable segment with broader opt-ins.

- Only 9% combined subscribe to 21+ brands via text (4% for 21–30 and 5% for more than 30), highlighting low tolerance for SMS saturation.

- A minimal 3% report no brand subscriptions via text, confirming SMS as a widely adopted but tightly controlled channel.

- Email subscriptions show much higher volume, with 26% of consumers subscribed to 6–10 brands, the largest email segment.

- 22% receive emails from 11–20 brands, reinforcing email’s role as a high-frequency marketing channel.

- 23% of users are subscribed to more than 30 brands via email, signaling significant inbox saturation.

- 16% limit email subscriptions to 1–5 brands, far lower than SMS, reflecting looser opt-in behavior.

- Just 1% report no email subscriptions, underscoring email’s near-universal reach.

- Key contrast: SMS favors precision and trust, while email enables scale and volume, making each channel effective for different stages of the marketing funnel.

Regional Usage Patterns

- WhatsApp holds a 47% global messaging market share with 3.1 billion monthly active users.

- iPhone commands 58% US smartphone market share, boosting iMessage usage.

- WeChat reaches 91.8% of China’s internet users, dominating the market.

- LINE boasts 97 million users in Japan, 78.6% of the population.

- WhatsApp achieves >90% penetration in Brazil, Mexico, and Nigeria.

- iMessage is limited by Apple’s 28% global OS share amid Android dominance.

- In the US, iMessage leads at 26% vs WhatsApp‘s 21% of smartphone users.

- WhatsApp penetration hits 93% among online users in Latin America.

- Android‘s 72% global share drives cross-platform app adoption in emerging markets.

Gen Z Adoption Rates

- Around 70–74% of Gen Z and Millennials say they communicate more in digital channels than in person, with 69.4% choosing messaging/SMS over phone calls if forced to keep only one option.

- 48% of Gen Z check their text messages more than 10 times per day, making them the generation most glued to texts and group chats.

- In workplace contexts, only 7% of Gen Z prefer phone calls, while instant messaging apps and texting together attract 35–40% of their communication preference.

- Over 60% of WhatsApp’s monthly active users in the U.S. are Gen Z and Millennials, confirming strong adoption among younger cohorts.

- Globally, about 50% of Gen Z cite WhatsApp as their favorite messaging app, though Snapchat and Instagram DMs rival it in the U.S. market.

- Among surveyed Gen Z students, 93% had Facebook, 95% Snapchat, and 88% Instagram accounts, with a majority holding multiple social media and messaging profiles.

- Gen Z represents 34% of U.S. iPhone users, compared with only 10% for Samsung, reflecting a strong commitment to Apple’s iMessage‑centric ecosystem.

- More than half of Gen Z users access social platforms (including messaging functions) several times a day, and nearly 20% report checking them hourly.

- Around 32% of Gen Z have even ended a relationship via an emoji, and 83% of Gen Z emoji users customize them, highlighting heavy multimedia and symbolic communication in chats.

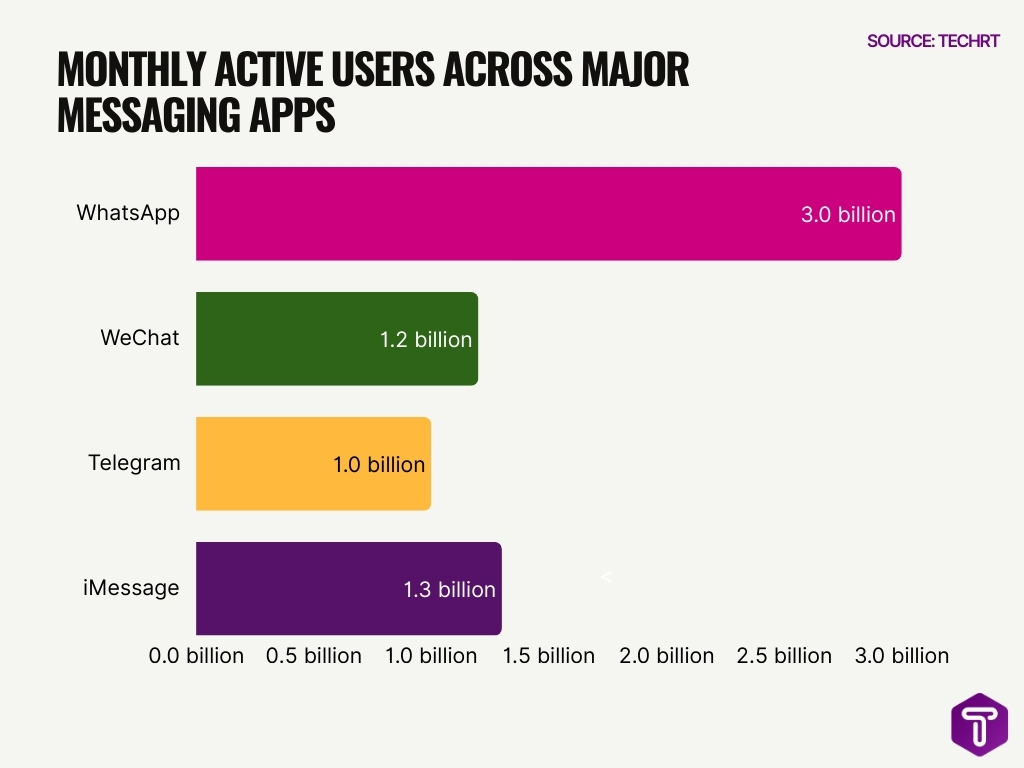

Comparison to Other Apps

- WhatsApp leads with over 3 billion monthly active users, dwarfing competitors like Telegram at 1 billion.

- Facebook Messenger boasts 1.01 billion monthly active users, maintaining a strong global reach.

- Snapchat has 932 million monthly users, with 38% aged 18-24 showing youth dominance.

- Telegram reports 196 million daily active users and rapid growth to 1 billion MAUs.

- WeChat commands 1.2 billion MAUs, primarily in China, where 78% of 16-64 year-olds use it.

- Signal, a privacy-focused niche app, has 70-100 million MAUs dedicated to secure messaging.

- iMessage reaches over 1.38 billion potential users in Apple’s ecosystem despite platform limits.

- WhatsApp users open the app 929.9 times monthly, far exceeding Messenger‘s 183.9.

- Snapchat attracts 82% of users under 35, emphasizing its appeal to younger demographics.

Comparison to WhatsApp

- WhatsApp has over 3 billion monthly active users globally in 2025–26, vastly exceeding iMessage.

- WhatsApp processes 150 billion messages daily, dwarfing iMessage volumes.

- 83% of WhatsApp monthly users engage daily, showing 80–90% retention.

- In the US, iMessage covers 26% of smartphones via 58% iPhone share.

- WhatsApp reached 124 million US monthly users by 2025.

- Brazil has 90%+ WhatsApp penetration; India boasts 535 million users.

- Africa sees 95% adoption in Nigeria and 97% in Kenya.

- WhatsApp users average 38 minutes of daily engagement worldwide.

- Latin America favors WhatsApp at 85–95% usage vs iMessage‘s low share.

Revenue and Monetization

- Apple does not directly monetize iMessage via ads, but the iPhone ecosystem drives device sales, services, and in‑app purchases.

- Messaging as a broader market was valued at ~$136 billion in 2025 and is growing rapidly.

- Some competitors generate revenue from business messaging and services.

- iMessage supports in‑app purchases, stickers, and Apple Pay transfers, which indirectly contribute to Apple’s services revenue.

- Messaging integration boosts Apple service subscriptions, amplifying long‑term revenue value.

- Strong iPhone sales, with over 150 million active iPhone units in the U.S., support messaging platform monetization indirectly.

- Revenue comparisons show cross‑platform apps generate distinct monetization streams like business APIs and ads that Apple doesn’t pursue in iMessage.

- Messaging platforms increasingly offer premium features and business integrations that expand revenue potential beyond core app use.

Frequently Asked Questions (FAQs)

How many active users does iMessage have worldwide?

iMessage is estimated to have around 1.3 billion active users globally as of the latest data.

What percentage of the global population was using iMessage in 2022?

In 2022, iMessage usage represented approximately 16.25% of the global population.

How many messages are shared on iMessage each day?

Around 8.4 billion messages are estimated to be shared daily on iMessage.

How many iPhone users are there worldwide as of 2026, which directly influences iMessage adoption?

There are over 1.46 billion active iPhone users globally in 2026.

What share of the smartphone market does iOS hold globally, impacting iMessage reach?

The iPhone, the primary iMessage platform, holds about 27.7% of the global smartphone market in 2026.

Conclusion

iMessage remains a cornerstone of messaging within the Apple ecosystem, particularly in the U.S., where iPhone penetration is high. While Apple doesn’t publish detailed user or revenue splits, industry trends show messaging habits vary widely by age, region, and platform choice. Globally, cross‑platform apps like WhatsApp hold larger user bases and greater daily message volumes, while iMessage excels where device integration and user retention are strongest. Messaging continues to evolve with demographic shifts and new monetization models shaping the future landscape.

Leave a comment

Have something to say about this article? Add your comment and start the discussion.