Cloud gaming has shifted from a niche experiment to mainstream digital entertainment, letting players stream high‑end games without expensive consoles or gaming PCs. As internet speeds improve and 5G expands, more users access game libraries instantly on phones, smart TVs, and laptops. In the U.S. and global markets, cloud gaming is reshaping how industry leaders scale services, lower hardware barriers, and deliver AAA titles almost anywhere. Real‑world examples include major telecoms bundling cloud gaming into 5G packages and developers optimizing titles for streamed play. Explore this article to understand the latest usage statistics and what they mean for gamers and businesses alike.

Editor’s Choice

- Cloud gaming market value expected to exceed $19.3 billion in 2025, up from $13.65 billion in 2024.

- Some forecasts project market revenues hitting ~$121.8 billion by 2032.

- Global cloud gaming users are projected to exceed 455 million by 2025.

- Market CAGR estimates vary widely, with ranges from ~28% to ~50%+ through the late 2020s, depending on the research source.

- Cloud gaming currently represents around 38% of the global online video gaming market (2025).

- North America and Asia‑Pacific remain leading adoption regions with strong year‑on‑year growth.

- Smartphones account for the largest share of cloud gaming devices due to accessibility and mobility.

Recent Developments

- In 2025, cloud gaming services expanded cross‑platform support across smart TVs and mobile devices.

- Major telecoms and 5G carriers began bundling cloud gaming with data plans to boost user adoption.

- Cloud gaming tech reduced latency via edge server deployments in key metro regions.

- Subscription bundles saw increased interest from mainstream gamers transitioning from traditional console gaming.

- Partnerships between publishers and cloud providers increased, aiming at exclusive streamed content releases.

- Telemetry and analytics improvements helped optimize performance for low‑latency competitive games.

- Gaming revenue reports suggest cloud gaming adoption is rising despite general market volatility in other segments.

- AI‑driven backend tools began shaping personalized game‑recommendation and adaptive streaming quality.

Cloud Gaming Global Market Growth Overview

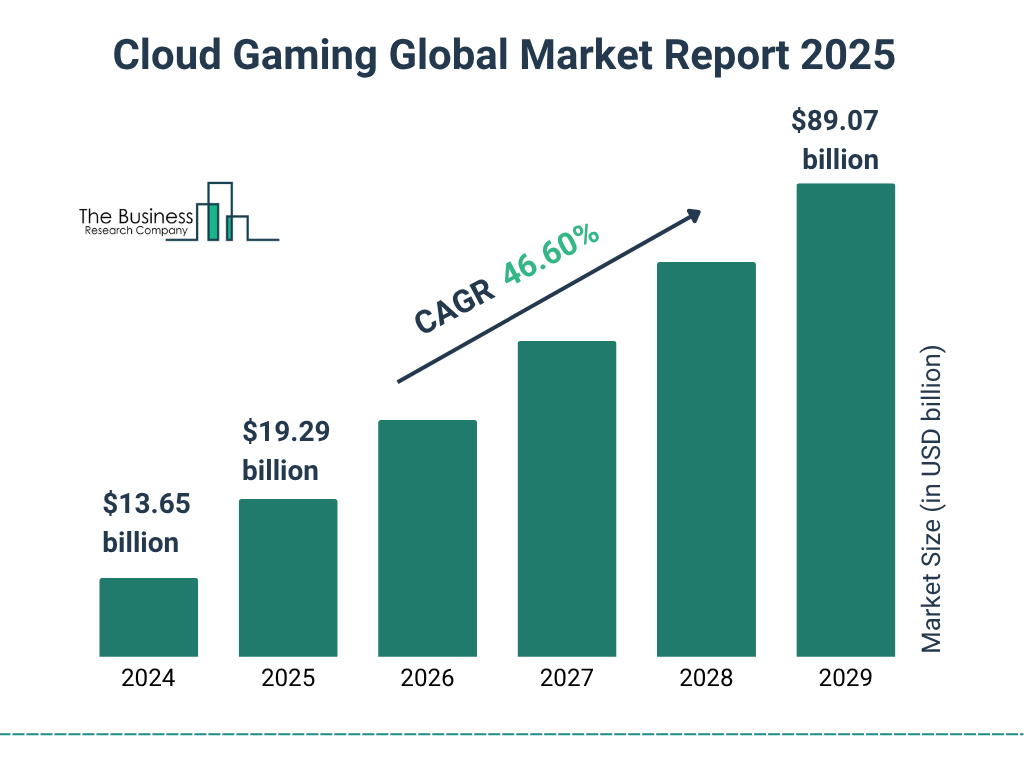

- The global cloud gaming market stood at $13.65 billion in 2024, highlighting the early but fast-scaling phase of cloud-based gaming adoption.

- Market value is projected to rise to $19.29 billion in 2025, reflecting strong year-over-year growth driven by improved cloud infrastructure.

- By 2026, the cloud gaming industry is expected to reach approximately $27.2 billion, signaling accelerating consumer and platform adoption.

- The market is forecast to cross $38.3 billion in 2027, showing rapid expansion across multiple devices and regions.

- In 2028, global cloud gaming revenue is estimated to climb to nearly $53.9 billion, fueled by rising broadband penetration and subscription models.

- By 2029, the cloud gaming market is projected to surge to $89.07 billion, marking one of the fastest-growing segments in the gaming industry.

- Overall, the market is expected to grow at a robust CAGR of 46.60% between 2024 and 2029, underscoring explosive long-term growth potential.

Market Growth Projections

- Many reports forecast cloud gaming CAGR mid‑2020s to early 2030s in the 30–50% range.

- One projection estimates a 50.0% CAGR from 2025 to 2032.

- Other sources indicate a ~34.7% CAGR from 2025 to 2032.

- Some research mentions a ~28.25% CAGR from 2026 to 2031.

- Forecast models vary with geography, device adoption, and broadband growth rates.

- Cloud gaming growth is tied closely to internet infrastructure investments and industry adoption.

- Growth projections through the 2030s illustrate cloud gaming evolving toward mass adoption.

- Analysts caution that operational costs and latency challenges could moderate growth in some markets.

Market Growth Rate (CAGR)

- The projected CAGR estimates differ by report: 28.25% to 50.0% across the mid‑late 2020s.

- A forecast of ~34.7% CAGR (2025–2032) suggests strong, sustained growth.

- Some sources cite a CAGR above 40% in the early forecast period,s reflecting early adoption acceleration.

- CAGR estimates are influenced by assumptions about 5G availability and regional broadband rollout.

- High CAGR values imply tech and service providers see significant growth potential.

- Lower CAGR estimates reflect conservative scenarios tied to infrastructure bottlenecks.

- Analysts expect CAGR to moderate over time as the market matures and competition increases.

- Understanding CAGR ranges helps gauge opportunity across device makers, platforms, and developers.

Cloud Gaming User Penetration Across Europe

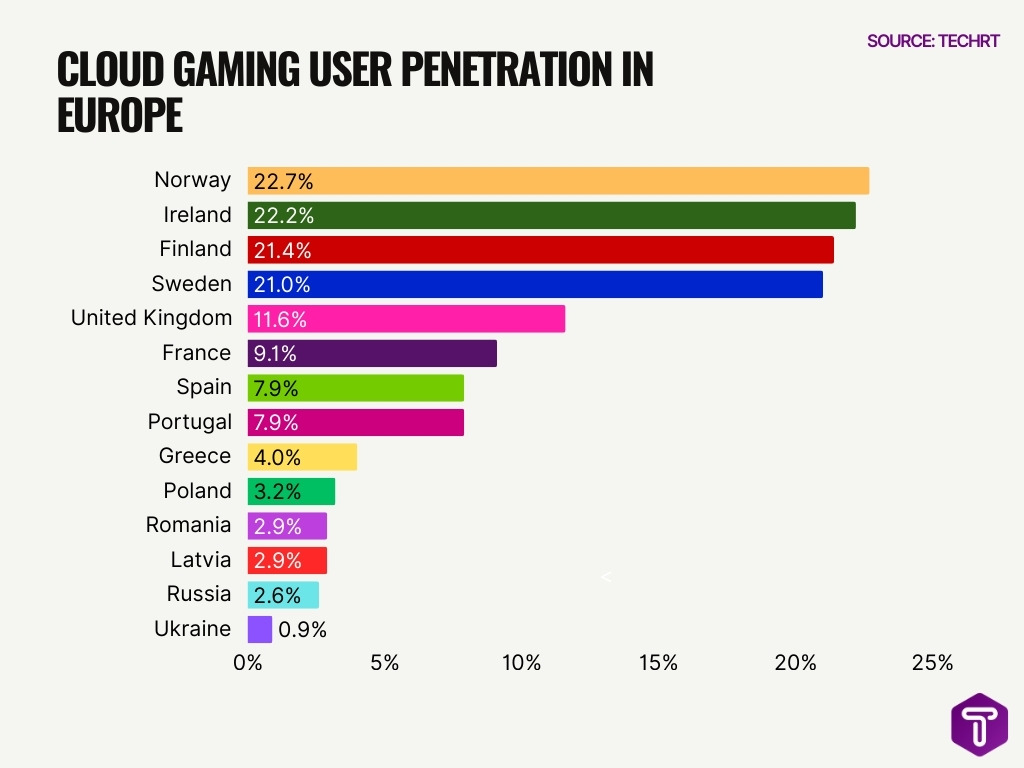

- Norway leads Europe in cloud gaming adoption with a 22.7% user penetration rate, highlighting strong broadband infrastructure and early tech adoption.

- Ireland follows closely at 22.2%, positioning it among the top cloud gaming markets in Europe.

- Finland (21.4%) and Sweden (21.0%) show similarly high penetration, confirming Nordic dominance in cloud gaming usage.

- The United Kingdom records 11.6% penetration, placing it in the mid-adoption tier among major European economies.

- France reaches 9.1%, reflecting steady but slower adoption compared to Northern Europe.

- Spain and Portugal both report 7.9%, indicating balanced Southern European growth in cloud gaming usage.

- Greece stands at 4.0%, showing early-stage adoption within the European market.

- Poland posts 3.2% penetration, suggesting emerging interest but limited mainstream usage so far.

- Romania and Latvia each register 2.9%, underscoring low penetration levels in parts of Eastern Europe.

- Russia reports 2.6%, while Ukraine records just 0.9%, marking the lowest cloud gaming adoption rates in the region.

Number of Cloud Gaming Users

- The global cloud gaming user base reached ~395.9 million in 2024 as players shifted to device‑agnostic gaming experiences.

- Users are projected to grow to ~455.4 million in 2025 as streaming adoption continues.

- Forecasts suggest the user count may approach ~493 million by 2027.

- Early market estimates had predicted ~349 million users by 2025, illustrating rapid actual adoption.

- According to industry surveys, 60% of surveyed gamers have tried cloud gaming at least once by 2025.

- A recent community report found 47% of cloud gamers play exclusively in the cloud among active users.

- In mid‑2025, usage surveys reported 51% of cloud gamers engage daily with services.

- Nearly 29% of active cloud gamers spend 30+ hours per week on cloud platforms.

Regional User Statistics

- North America accounts for a significant share of global cloud gaming adoption, partly due to widespread broadband and 5G access.

- Asia‑Pacific holds the largest regional cloud gaming market share (~46%) in 2025, showing strong growth.

- Europe displays strong double‑digit growth in cloud gaming users, given infrastructure investments.

- Emerging markets in Latin America and Southeast Asia show rising cloud gaming adoption, though from smaller bases.

- China and India are among the fastest-growing user regions due to large mobile gaming populations.

- Penetration in North America often exceeds global averages, reflecting higher disposable income and data access.

- 5G deployment speeds in parts of Europe and Asia have accelerated cloud gaming engagement.

- Regional differences in ARPU reflect variations in spending power and subscription pricing models.

Cloud Gaming by Country

- The United States holds a 38% global cloud gaming market share with 10.1% user penetration rate.

- The UK boasts 11.6% cloud gaming penetration, while Germany, the UK, and France drive 27% of Europe’s market.

- China commands 24% market share, fueled by a massive online gaming population.

- India’s cloud gaming market projected to hit $0.6 billion by 2026 amid smartphone boom.

- Japan’s cloud gaming sector is expected to reach $1.16 billion by 2026, with high broadband penetration.

- Norway leads Europe at 22.7% penetration, signaling above-average growth in smaller nations.

- The Middle East and Africa grow at the fastest 29.35% CAGR as networks advance.

- Asia Pacific dominates with 46-47.9% global share in 2025.

- The US market is valued at $1.37 billion in 2025, growing at 46.23% CAGR.

Device Usage Statistics

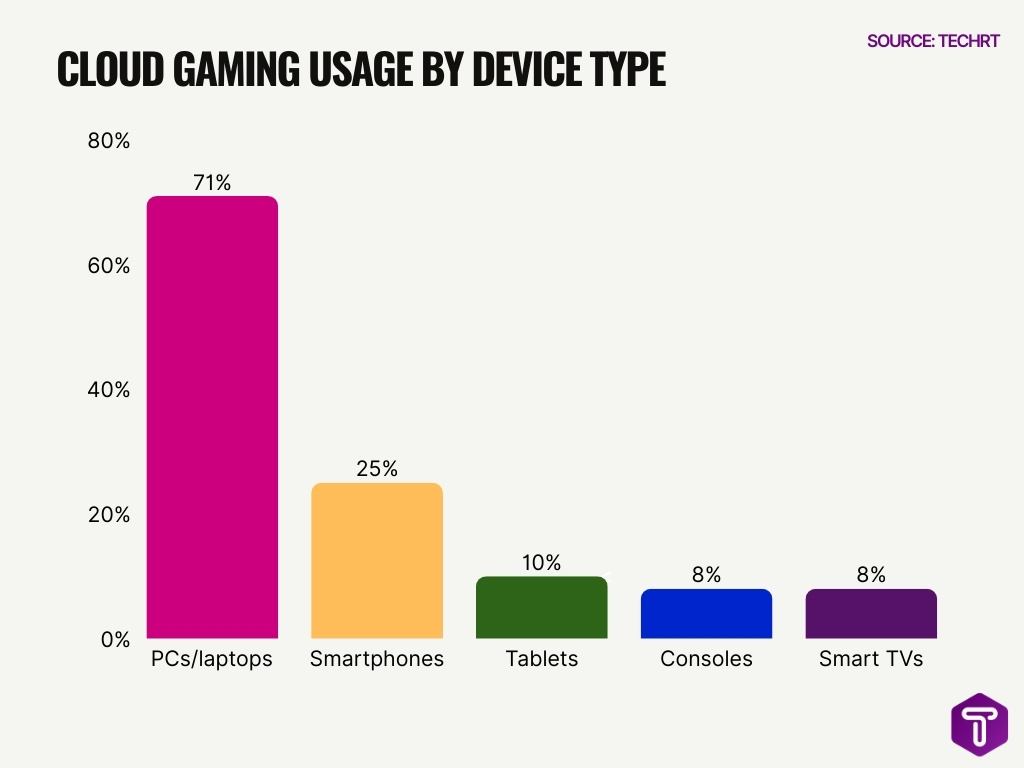

- 71% of cloud gamers use PCs or laptops as their primary device for cloud gaming.

- 25% of players access cloud gaming via smartphones, prioritizing mobility.

- Tablets account for 10% of cloud gaming usage among surveyed players.

- Consoles represent 8% of the device mix for cloud gamers.

- Smart TVs see 8% adoption in cloud gaming, remaining niche.

- 72% of gamers engage in cross-device play across multiple platforms regularly.

- Asia Pacific holds over 45% market share, driven by mobile emphasis.

- North America and Europe show PC dominance with 17.3 million and 8 million users, respectively.

- 51% of cloud gamers play daily, boosted by 5G and Wi-Fi 6 connectivity.

Gamer Type Breakdown

- Casual gamers hold 53% of the cloud gaming market in 2025.

- Lifestyle gamers grow at a 29.01% CAGR through the late 2020s.

- Casual players comprise 41% of cloud gamers with <5 hours weekly playtime.

- Hardcore players make up 29%, spending 30+ hours weekly on cloud gaming.

- 47% of cloud gamers play exclusively via cloud services.

- 51% of cloud gamers play daily.

- Casual gamers account for 53% of the cloud gaming market share in 2025.

- 41% use hybrid cloud and local hardware setups.

Popular Cloud Gaming Platforms

- Xbox Cloud Gaming integrates with Xbox Game Pass Ultimate, which reached over 35 million subscribers as of mid-2025.

- NVIDIA GeForce NOW boasts over 25 million registered users globally as of 2025.

- Global cloud gaming subscriber base is projected to hit 25 million by 2025, up from 10 million in 2020.

- Xbox Cloud Gaming now operates in nearly 30 countries, with 45% growth in cloud streaming hours year-over-year.

- Boosteroid serves over 4.5 million active users worldwide, with 60% user surge in users on ChromeOS.

- Antstream Arcade gained over 700,000 new players in 2025, plus 200,000 monthly active users.

- Amazon Luna holds a 0-5% share of the global cloud gaming market as of 2022 estimates.

- Cloud gaming market valued at $15.74 billion in 2025, expected to reach $159.26 billion by 2034.

- PlayStation Portal cloud streaming sees 70% adoption among PS Plus Premium owners.

Cloud Gaming Market Share by Key Players

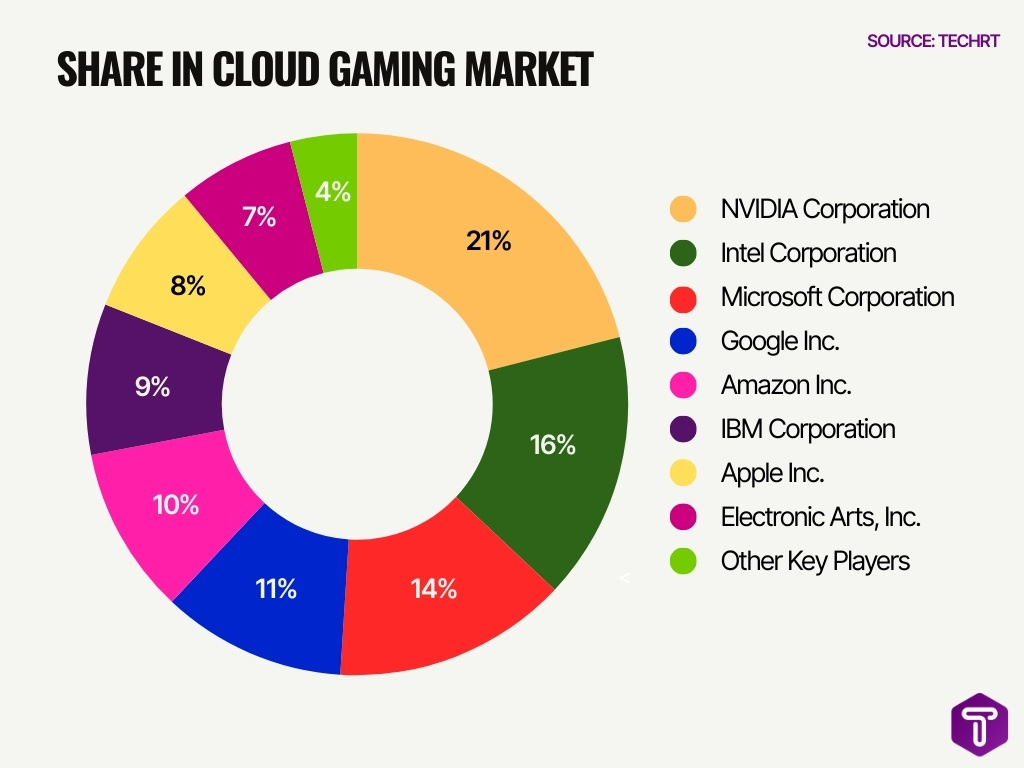

- NVIDIA Corporation leads the cloud gaming market with a dominant 21% market share, driven by its strong GPU ecosystem and cloud-based gaming infrastructure.

- Intel Corporation holds the second-largest share at 16%, reflecting its growing investments in cloud computing and gaming-focused processor technologies.

- Microsoft Corporation captures 14% of the market, supported by Xbox Cloud Gaming and deep integration with Azure cloud services.

- Google Inc. accounts for 11% market share, leveraging its global cloud network and gaming distribution capabilities.

- Amazon Inc. controls 10% of the cloud gaming market, powered by AWS infrastructure and its expanding gaming services.

- IBM Corporation maintains a 9% share, highlighting its enterprise-focused cloud solutions entering the gaming ecosystem.

- Apple Inc. holds an 8% market share, benefiting from its hardware-software ecosystem and premium user base.

- Electronic Arts, Inc. represents 7% of the market, driven by popular game franchises and cloud-based game delivery partnerships.

- Other key players collectively account for 4%, indicating a fragmented competitive landscape beyond major technology giants.

Platform Subscriber Numbers

- Xbox Game Pass reached ~37 million subscribers by mid-2025, powering Xbox Cloud Gaming access.

- GeForce NOW boasts over 25 million registered users globally as of 2025.

- Boosteroid expanded to 7.8 million users in 2025 through global infrastructure growth.

- Antstream Arcade gained over 700,000 new players with 200,000 monthly active users in 2025.

- Global cloud gaming market projects 25 million subscribers by 2025, up from 10 million in 2020.

- PlayStation Plus, with cloud features, leads at 51.6 million subscribers in Q1 2025.

- Xbox Cloud Gaming hit 13.2 million subscribers by the end of 2021, maintaining a competitive edge.

- Cloud gaming users are expected to reach 455.4 million in 2025, with 5.8% penetration rate.

- Amazon Luna estimated 270,000 active users in 2021, share was under 5% in 2022.

User Satisfaction Rates

- According to a major gaming survey, ~80% of players who tried cloud gaming reported a positive experience by late 2025.

- Positive feedback often highlights accessibility without expensive hardware and convenience across devices.

- However, around ~70% of cloud gamers spend less than a quarter of their playtime in the cloud, indicating room to improve habitual usage.

- Satisfaction tends to rise with stronger broadband and low‑latency 5G connections, underscoring the role of connectivity quality.

- Competitive and professional gamers sometimes cite latency and performance concerns as barriers to full adoption.

- Casual and mobile gamers show higher satisfaction rates due to ease of access and instant playability.

- As platforms add higher resolution options and reduced lag, satisfaction and retention are expected to improve.

- Ongoing upgrades in streaming tech and backend infrastructure directly impact user experience scores positively.

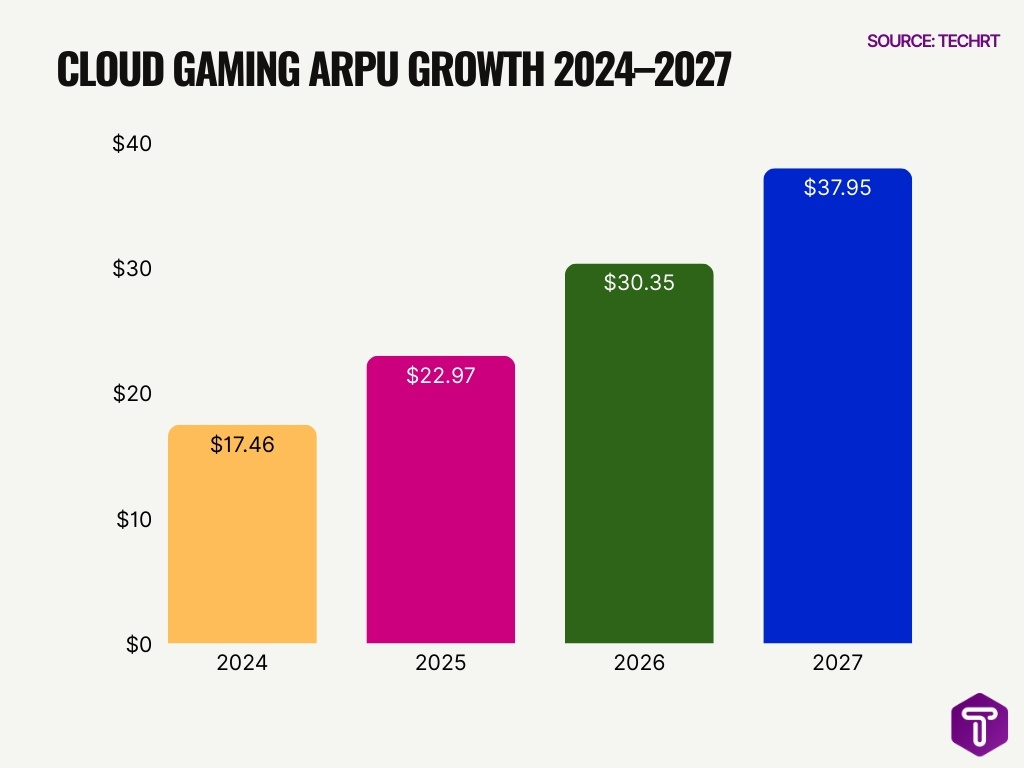

Average Revenue Per User (ARPU)

- Historical data shows ARPU rising from $17.46 in 2024 to $22.97 in 2025.

- Projections indicate ~$30.35 ARPU in 2026 as monetization improves.

- Further long‑term estimates show ARPU may reach ~$37.95 by 2027.

- Earlier years saw ARPU fluctuate around $14‑17, illustrating growth acceleration by the mid‑2020s.

- The rise in ARPU correlates with expanding subscription services and premium tiers in cloud gaming.

- Inclusion of cloud access in bundled services contributes to higher revenue per user.

- Enhanced catalog offerings and exclusive titles are cited as drivers of increasing monetization.

- Services that combine cloud gaming with broader digital ecosystems often report higher ARPU than standalone cloud products.

Service-Specific Usage Highlights

- Xbox Cloud Gaming is now accessible in 29 countries, expanding global user reach.

- Xbox’s exit from beta and enhancements like 1440p resolution contribute to deeper engagement.

- GeForce NOW’s library exceeds 4,000 games, and upgrades support higher resolutions and device types.

- Amazon Luna integrates with Twitch and offers subscription tiers with curated game channels.

- Some services emphasize bringing AAA titles to low‑power devices via cloud streaming, reducing hardware barriers.

- Browser‑based and native apps are emerging to broaden access without dedicated client downloads.

- Cross‑platform support is a key differentiator in service usage trends.

- Cloud platforms often offer free or low‑cost trials to attract new users, fostering wider adoption.

Impact of Internet Connectivity & 5G on Usage

- 5G slashes cloud gaming latency to under 10ms, vs 50-100ms on 4G.

- Global cloud gaming market to hit $25 billion by 2030, with a CAGR of 45%, fueled by 5G.

- 83% of players report higher satisfaction with low-latency 5G networks.

- Regions with >50% 5G coverage see 3x faster cloud gaming subscriber growth.

- Edge computing paired with 5G reduces round-trip times by 60-80%.

- Stable broadband boosts average session times by 45% in cloud gaming.

- Mobile cloud gaming users to reach 1.2 billion by 2028, driven by 5G rollout.

- Cloud gaming demands 15-30 Mbps speeds; 5G averages 300 Mbps.

- 6G prototypes target sub-1ms latency, enabling seamless VR cloud gaming.

Frequently Asked Questions (FAQs)

What is the projected value of the global cloud gaming market in 2026?

The global cloud gaming market is estimated at USD 4.81 billion in 2026.

At what compound annual growth rate (CAGR) is the cloud gaming market expected to grow from 2026 to 2035?

The cloud gaming market is forecast to grow at a 43.31% CAGR from 2026 to 2035.

How many cloud gaming users are projected globally by 2026?

The total number of cloud gaming users is expected to reach 482.3 million in 2026.

What was the estimated cloud gaming revenue growth rate in 2025 compared to 2024?

Cloud gaming services saw an ~28.1% annual revenue growth, increasing from $6.4 billion in 2024 to $8.2 billion in 2025.

What percentage share of the market did the Asia‑Pacific region hold in 2025?

The Asia‑Pacific region held the largest cloud gaming market share at 46% in 2025.

Conclusion

Cloud gaming is no longer niche; it’s an expanding digital frontier. Adoption is rising across gamer types, from casual players to dedicated streamers. Leading platforms like Xbox Cloud Gaming, NVIDIA GeForce NOW, and Amazon Luna are scaling users with broad device support and compelling content libraries. Satisfaction rates trend upward alongside improved network speeds and 5G rollout. Connectivity remains a core driver, and enhanced broadband and next‑gen mobile networks will power deeper engagement. As the cloud gaming ecosystem matures, it continues to reshape how games are played, monetized, and experienced worldwide.

Leave a comment

Have something to say about this article? Add your comment and start the discussion.