Android powers the majority of the world’s smartphones, tablets, and connected devices, making its version adoption trends crucial for developers, businesses, and consumers alike. Android continues to evolve rapidly, with newer releases like Android 15 and 16 gaining traction while older versions still hold a notable presence. Understanding which Android versions are widely used helps app creators prioritize testing, security teams shore up defenses, and brands align features with user capabilities. From shaping mobile gaming experiences to influencing enterprise device management, version adoption reflects real-world tech priorities. Let’s dive into the latest adoption data and what it means for the ecosystem.

Editor’s Choice

- Android 15 is currently the most widely used Android OS version in early 2026, with about 22–24% market share of active devices.

- Android has ~3.9 billion users worldwide, making it the dominant global mobile platform.

- Android holds roughly 72–73% of the global smartphone OS market.

- Only about 40% of users adopt new Android releases quickly, highlighting slow adoption cycles.

- Older versions like Android 13 & 14 remain significant, with double-digit shares.

- Android still leads over rivals, while in the U.S., iOS holds a larger share (~58% vs. Android ~42%).

- Fragmentation continues, and older versions persist across regions for years.

Recent Developments

- Android 16 entered the adoption charts in 2025 and has steadily grown, with ~13% of devices running it by the end of 2025.

- Android 15 began gaining users rapidly after release, peaking near the top with ~24% share at various points in late 2025.

- The adoption pace of new versions varies widely by manufacturer and region.

- New releases often roll out first on Pixel and flagship devices before wider OEM adoption.

- Reports indicate that about 3 in 10 Android users remain on versions no longer supported with security updates, raising risk concerns.

- Google’s distribution tools now offer more granular insights into Android characteristics across devices.

- Consistent updates in the Android framework simplify version rollout for supported devices.

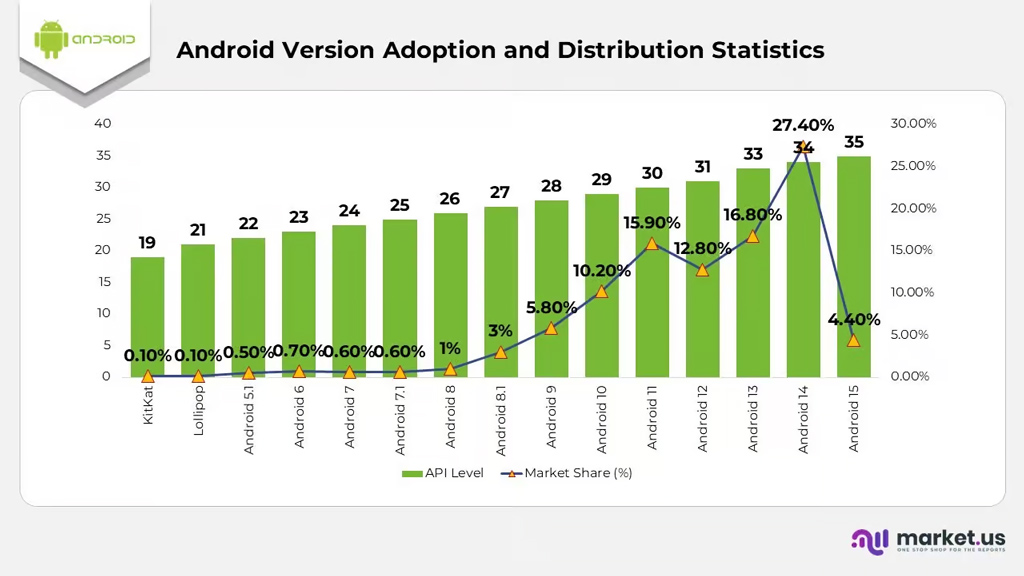

Android Version Adoption and Market Share Overview

- Android 14 (API Level 34) leads the ecosystem with a dominant 27.40% market share, making it the most widely adopted Android version globally.

- Android 13 maintains strong momentum, capturing 16.80% of active devices, highlighting sustained user upgrades to recent releases.

- Android 11 remains highly relevant with 15.90% adoption, reflecting its stability and long-term device support.

- Android 10 continues to power a significant portion of smartphones, accounting for 10.20% market share worldwide.

- Combined, Android 10 and newer versions control over 85% of the market, underscoring rapid modernization across the Android ecosystem.

- Android 12 holds 12.80% usage, showing moderate retention compared to adjacent releases.

- Android 15 adoption is still in early stages, currently representing 4.40%, as OEM rollouts and updates continue.

- Mid-generation versions like Android 9 (5.80%) and Android 8.1 (3.00%) show declining relevance as users migrate forward.

- Legacy systems, including Android 7 and earlier, each remain below 1% market share, signaling an early complete phase-out.

- The steady rise in API Levels from 19 to 35 reflects Android’s long-term platform evolution and increasing focus on security, performance, and AI-driven features.

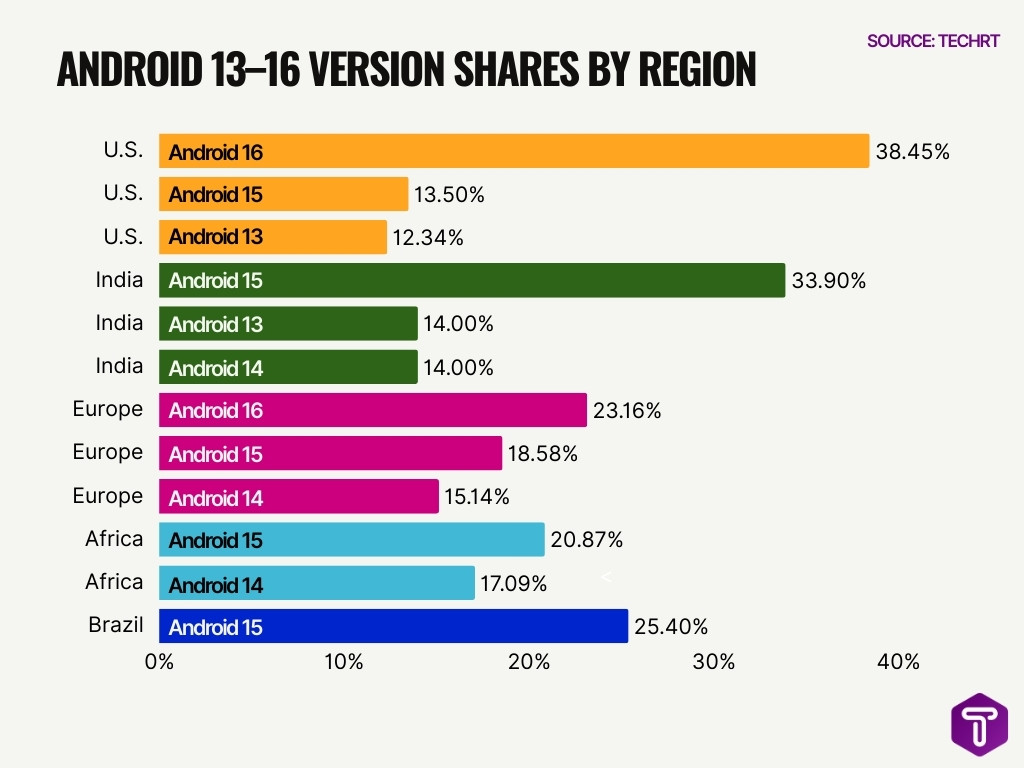

Android Version Market Share by Region

- In Europe, newer versions like Android 15 and 14 dominate, but older versions linger.

- In North America, the split shows strong adoption of newer versions but with legacy support.

- Asia shows broader distribution across more versions due to device diversity.

- Africa & LATAM have widespread Android usage across versions, often skewed toward mid-range devices.

- Regional differences affect update rollout timing and thus version adoption.

- High-end markets typically adopt newer versions faster.

- Lower-end devices prolong the lifespan of older Android versions.

Most Popular Android Versions

- Android 15 remains the most widely used Android OS version in early 2026, holding around 22.1–23.9% of all active devices globally.

- Android 14 commands a significant share, with sources showing it near 14–17% of devices in late 2025–early 2026.

- Android 13 also maintains strong usage, typically around 14–15% of devices worldwide.

- Android 16, though newer, rapidly climbed to about 13.3% of devices by the end of 2025.

- Older versions like Android 12 hold notable shares, approximately 10–11% globally.

- Android 11 and 10 together represent meaningful usage, with Android 10 around 4.7% and Android 11 higher in some distributions.

- Very early versions (e.g., Marshmallow and older) persist at low single-digit percentages across all devices.

Latest Android Version Adoption Rates

- Only about 40% of Android users update to a new OS release within the first few months after its launch.

- Android 16 saw slow initial adoption but surged in late 2025, contributing to ~13.3% share.

- Android 15 adoption peaked in 2025, with estimates showing parts of the year nearing 42.9% share before stabilizing lower.

- Newer versions typically take 12–18 months to reach mainstream adoption across devices.

- Android 14 adoption consistently remains high due to broad OEM support.

- Legacy versions often linger below official support thresholds but still contribute to aggregate share counts.

- Adoption speed varies heavily by manufacturer and region, with flagship devices updating fastest.

Android Version Adoption by Country

- In the U.S., Android 16 holds 38.45% among Android devices, while iOS leads overall mobile OS at 57%.

- India sees Android 15 at 33.9% and total Android penetration at 95%.

- Europe has broad Android 16 at 23.16%, 15 at 18.58%, and 14 at 15.14%.

- Africa features a mix with Android 15 at 20.87%, 14 at 17.09%, and older versions are significant.

- Brazil (APAC-like high penetration) shows Android 15 dominating at 25.4%.

- U.S. strong recent versions: Android 15 at 13.5%, 13 at 12.34%.

- India’s newer versions gain fast: Android 13/14 each over 14%.

- Regions with affordable devices, like Africa, run 10-20% on versions below 12.

Android Version Adoption Trends

- Android 15 holds 23.95% global market share in December 2025, leading adoption while users await carrier prompts.

- Older versions like Android 11 retain 8.98% share due to a gradual decline from long device lifecycles.

- Android 14 adoption plateaued at 14.22% after an initial post-release surge via OEM rollouts.

- Legacy versions comprised 13.27% globally, higher in emerging markets with diverse regional usage.

- Enterprise Android devices show 32% running version 4.0 or older, lagging due to stability priorities.

- Samsung devices, at 35.3% Android market share, dictate update patterns by brand strategies.

- New Android releases accelerate quarterly, with Pie averaging 118 days to significant OEM rollout.

- India exhibits 95.21% Android penetration with elevated legacy version usage compared to the US at 58.13% iOS preference.

Fastest Growing Android Versions

- Android 16 reached 41.54% market share by the end of December 2025, jumping from under 10% in Q3.

- Android 16 grew rapidly on premium devices, hitting 13.3% of all Android devices by December 2025.

- Android 15 adoption surged to nearly 50% in September 2025 before settling at 17.15% by year-end.

- Android 15 achieved 10.06% market share within 7 months of its September 2024 launch.

- Android 14 held 12.32% by the end of 2025 after declining from the top spot in June 2025.

- Android 14 reached 37% market share by January 2025, leading all versions.

- Mid-range OEMs drove Android 13 to a steady 13.9% distribution in late 2025.

- Android 12 and older versions stagnated below 11.4% combined by the end of 2025.

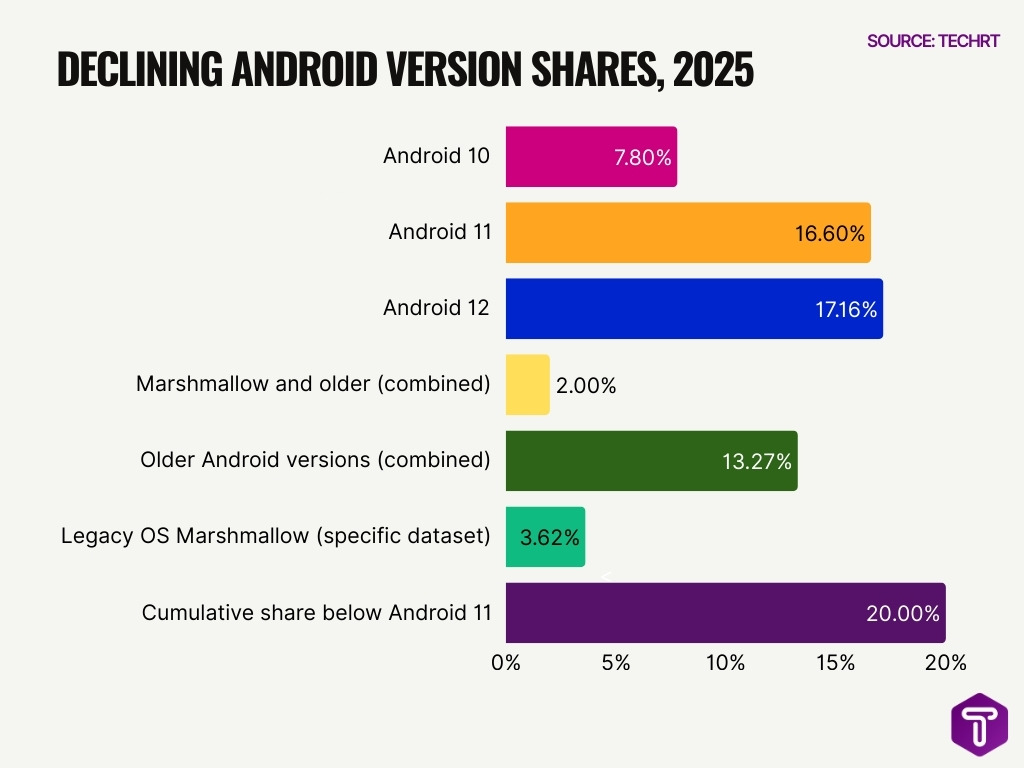

Declining Android Versions

- Android 10 holds 7.8% global market share among Android devices.

- Android Marshmallow and older versions combined under 2% worldwide.

- Older Android versions total 13.27%, persisting in low-end devices.

- Android 11 at 16.6% and Android 12 at 17.16% show a gradual decline.

- Android 10 dropped from over 9% in 2023 to 7.8% now.

- Advanced markets shed old versions 4% faster yearly than emerging regions.

- Legacy OS like Marshmallow at 3.62% in some datasets, mainly due to aging hardware.

- The cumulative share below Android 11 is now under 20% globally.

Android Version Usage Statistics

- Android 15 leads with 23.95% of active Android devices worldwide.

- Android 13 holds 14.73% market share among versions.

- Android 14 follows at 14.22% usage.

- Android 16 accounts for 13.28% of devices.

- Android 12 has 10.68% share.

- Android 11 represents 8.98% of active installs.

- Android powers 3.9 billion active devices globally.

- Legacy versions below Android 10 total under 13% combined.

- Android commands 72.77% global mobile OS market share.

Android Version Market Share by Device Type

- Android commands a dominant 72% global smartphone market share as of 2025.

- In tablets, Android holds a 44–48% share globally, trailing iPadOS at 52–56%.

- Smartphones represent 79% of total Android device shipments in Q3 2025.

- Flagship phones reach Android 15 adoption at 43.9%, outpacing budget models.

- Budget smartphones linger on Android 13 and 14 with 57.8% combined share.

- Android tablets average older versions due to delayed OEM updates across categories.

- Wear OS secures 40% of the wearables market, versus watchOS at 60% in 2025.

- IoT devices using Android derivatives like Wear OS grew 17% in shipments.

- The US tablet market sees iOS at 63%, Android at 37% per 2025 data.

Mobile vs Tablet Android Version Split

- Android versions run differently on smartphones versus tablets, with tablets often lagging in the uptake of the latest OS releases.

- In December 2025, Android 15.0 accounted for ~23.95% of combined mobile and tablet devices worldwide, the top version overall.

- Android 13 and 14 each held ~14–15% share, showing balanced use across both phones and tablets.

- Android 16 was approaching ~13.3% adoption across mobile and tablet hardware by the end of 2025.

- Older OS levels like Android 12 and 11 together still made up nearly ~20% of combined device usage.

- Tablets often adopt Android updates more slowly than phones, due to lower OEM prioritization and update cycles.

- Mid-range and budget tablets can remain on older versions longer than mid-range phones.

- In regions like North America and Europe, newer versions appear more quickly on tablets compared with emerging markets.

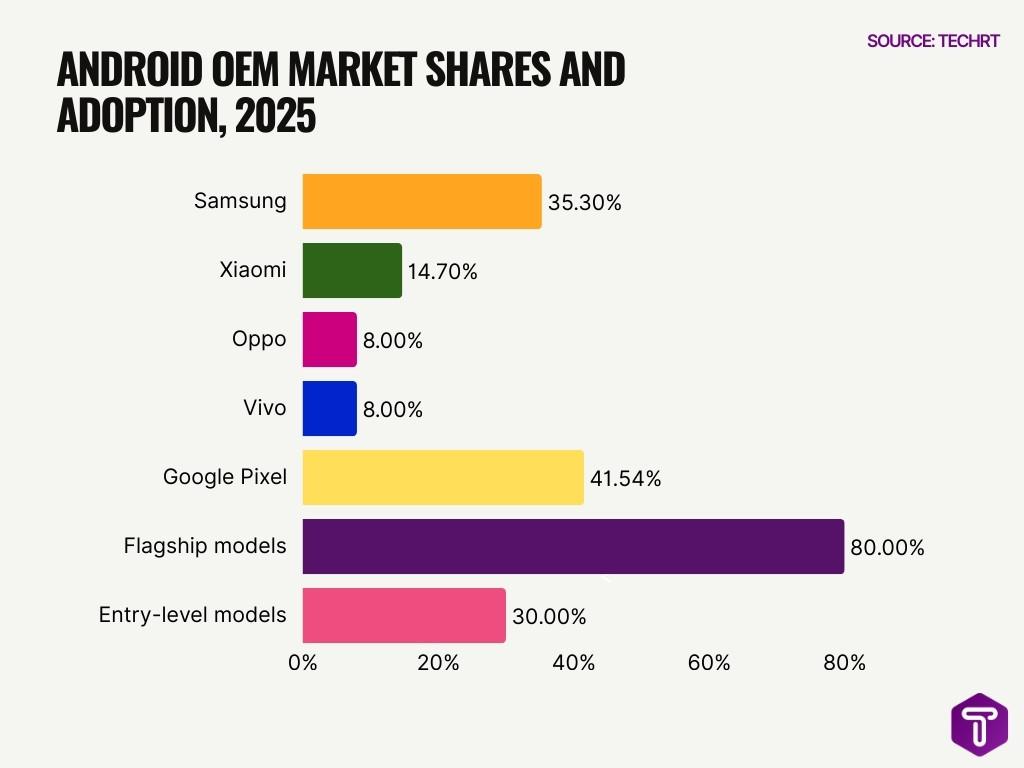

Android Version Adoption by Manufacturer

- Samsung commands 35.3% of the Android device market, leading version trends through high-volume shipments.

- Xiaomi holds 14.7% Android market share, with mid-range devices often lagging 2–3 months behind flagships in updates.

- Google Pixel devices achieve Android 16 adoption at 41.54% end-2025, first among OEMs for new releases.

- Oppo and Vivo each claim ~8% global shipments, focusing updates on premium models amid delayed mid-range rollouts.

- Huawei shipped over 70 million HarmonyOS devices in 2024, diverging from pure Android version adoption.

- Samsung matches Google’s Trunk Stable model, delivering One UI 8 on Android 16 shortly after the June 2025 launch.

- Pixel line receives new Android versions first, with betas on partners like Oppo, Vivo, Xiaomi following soon after.

- Flagship models across Samsung and Xiaomi see 80%+ latest version adoption within 6 months, vs <30% for entry-level.

Android Tablet Version Distribution

- As of late 2025, Android tablets mirror phone trends but generally run slightly older OS versions.

- Android 15.0 remains dominant on tablets, but typically with a lower incidence than on smartphones.

- Versions like Android 13 and 14 together have a larger slice of the tablet install base compared with the newest OS.

- A notable portion of tablets still operate on Android 12 or earlier, often due to extended device lifespans.

- Low-cost Android tablets in emerging markets remain on legacy versions longer.

- In premium tablet segments, more recent versions see faster uptake, aided by partnerships between manufacturers and carriers.

- Tablet OS distribution illustrates why developers must support multiple versions to ensure consistent app experiences.

Regional Differences in Android Adoption

- In North America, Android 15 holds 38.74% market share among Android versions, indicating quicker uptake of newer releases.

- Asia shows broader fragmentation with Android 15 at 27.34%, 13 at 14.92%, and 11 at 10.09%.

- Africa exhibits high fragmentation as older versions like Android 11 claim 10.51% alongside 15 at 20.87%.

- Europe aligns near global averages with Android 16 at 23.16% and 15 at 18.58%.

- Latin America (South America) has Android 14 leading at 34.44%, reflecting mid-range device prevalence.

- India, within Asia, boasts 95.21% overall Android adoption, driven by affordable OEMs.

- US (North America) sees only 41.61% total Android share vs iOS, favoring high-end, timely updates.

- Emerging markets like Africa hold 85.15% Android dominance with slower version upgrades.

Android Version Fragmentation

- The Android ecosystem remains highly fragmented, meaning users are spread across multiple OS versions simultaneously.

- Even years after release, older versions retain significant usage because many devices don’t update automatically.

- Fragmentation arises from Android’s open-source nature and varied OEM update policies.

- Developers must often support multiple versions to reach the largest active audience.

- Fragmentation impacts testing, security, and feature compatibility across apps.

- Some devices remain on versions that are no longer receiving security updates, adding risk.

- Regional update policies and carrier delays further entrench version diversity.

Android Version Adoption Forecast

- Analysts forecast Android 16 reaching 41.54% global adoption by the end of 2025, accelerating to over 50% by late 2026.

- Combined recent versions (Android 15+) hit 77% market share in Dec 2025, projected to surpass 85% older versions by late 2026.

- Android’s global user base grows to 3.9 billion active devices in 2025, expanding 8% yearly through 2026 via emerging markets.

- Android maintains 71-73% worldwide smartphone OS dominance in 2026, outpacing iOS despite 0.9% shipment dip.

- 5G subscriptions reach 3.5 billion globally by 2026, driving faster Android updates on optimized OEM devices.

- India hits 1 billion smartphone users by 2026, with 80% on 5G Android amid shortening replacement cycles.

- Android fragmentation narrows as Android 12-16 claim >80% share in 2025, forecasted >90% recent versions by 2026 end.

- Enterprise fleets lag with <20% on the latest Android 16 in 2026, prioritizing stability over rapid adoption.

Frequently Asked Questions (FAQs)

What percentage of Android devices worldwide run Android 15 as of early 2026?

About 21.7–23.95% of devices run Android 15, making it the most popular Android version globally.

What share of Android devices were running Android 16 in 2025?

Android 16 was installed on about 13.3% of Android devices in 2025.

What market share does Android hold of the global mobile OS market in 2025–2026?

Android controls roughly 71.7–73.9% of the global mobile OS market.

What percentage of the mobile Android version market share did Android 14 have in some datasets?

Android 14 accounted for about 14.22–24.51% of the Android version market share.

In India, what was the Android version distribution for Android 15 by late 2025?

In India, Android 15 held approximately 34.73% of the Android version market.

Conclusion

Android version adoption reflects an ecosystem that is diverse, evolving, and geographically varied. While newer versions like Android 15 and 16 capture growing loyalty, significant portions of devices still run older releases, underscoring the impact of fragmentation. Manufacturers, regions, and device types influence how quickly users transition to the latest OS, making it critical for developers and businesses to plan multi-version support. As global smartphone penetration continues rising and technology trends like 5G and AI accelerate, the Android version landscape will keep shifting. Exploring these statistics helps stakeholders optimize app compatibility, security strategies, and product roadmaps for the year ahead.

Leave a comment

Have something to say about this article? Add your comment and start the discussion.