The battle between Android and iPhone usage continues to shape the global smartphone landscape. Android remains dominant worldwide, powering billions of devices across regions, while iPhone holds strong in key markets such as the United States. This competition influences everything from app development and revenue to user behavior and device loyalty. Real-world examples include mobile developers prioritizing iOS for higher spending users and telecom carriers offering Android devices to price-sensitive customers. These dynamics underline the ongoing impact of platform preference across industries. Explore the statistics below to understand how Android and iPhone stack up in usage and market share.

Editor’s Choice

- Android controls ~72–73% of the global smartphone operating system market as of late 2025.

- iOS holds ~27–28% of the worldwide mobile OS market share.

- In the United States, iPhone leads with ~59% market share.

- Globally, Android accounts for more than twice the market share of iPhone.

- Apple led global smartphone shipments in 2025 with 20% share.

- Smartphone shipments grew ~2% year-over-year in 2025.

- Android’s global user base is several billion, compared with over a billion iPhone users.

Recent Developments

- Android continued to maintain a ~72% worldwide OS market share by late 2025.

- iOS remained steady at around 27–28% of global smartphone usage.

- Apple led global smartphone shipments with ~20% share in 2025, overtaking Samsung.

- Global smartphone shipment volume rose ~2% in 2025, down from higher growth in 2024.

- Apple saw ~10% year-over-year growth in shipments in 2025.

- Flagship iPhones like the iPhone 16 and 17 series contributed strongly to sales growth.

- Emerging markets showed increased interest in both Android and iPhone devices.

- The broader smartphone market expansion is slowing in 2026 due to component constraints.

- Android continued evolving with the widespread adoption of Android 15 and 16 versions.

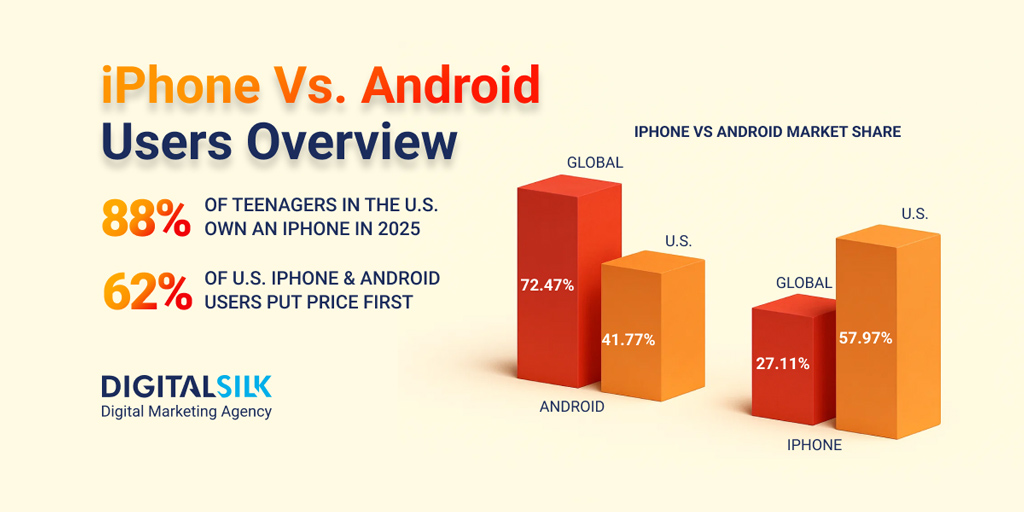

iPhone vs. Android Users Overview

- Android dominates the global smartphone market, holding a 72.47% market share worldwide, compared to 27.11% for iPhone, highlighting Android’s broader international reach.

- The U.S. smartphone market tells a different story, where iPhone leads with a 57.97% market share, while Android accounts for 41.77%, reflecting Apple’s strong domestic dominance.

- iPhone adoption among U.S. teenagers is exceptionally high, with 88% of teens owning an iPhone in 2025, reinforcing Apple’s cultural and ecosystem influence among younger users.

- Price remains the most influential purchasing factor, as 62% of U.S. iPhone and Android users state that cost is their top priority when choosing a smartphone.

- Android’s global leadership is driven by affordability and device variety, while iPhone’s U.S. success is powered by brand loyalty, ecosystem integration, and premium positioning.

Android vs iPhone Market Share Worldwide

- Android holds around 71–73% of the global mobile OS market as of late 2025.

- iOS stands at roughly 27–28% globally.

- Android’s dominance has held consistently for years, with a share above 70% since the early 2010s.

- Android usage is roughly 2.5 times larger than iOS globally.

- Together, Android and iOS cover well over 95% of the global smartphone OS market.

- Android’s share benefits from a range of devices at multiple price points worldwide.

- iOS’s share remains stable due to strong loyalty and ecosystem lock‑in.

- Growth in markets like India and Asia has slightly increased iOS adoption, though Android still leads.

iPhone vs Android Market Share in the US

- In the United States, iPhone dominates with 57.97% share of smartphone OS usage.

- Android accounts for roughly 41.77% of the US market.

- iOS has led the US smartphone market for most of the 2010s and 2020s.

- iPhone’s US leadership often reflects higher brand loyalty and carrier deals.

- Android’s share in the US fluctuates with seasonal sales and promotions.

- The US remains one of the few major markets where iPhone outpaces Android significantly.

- US iPhone adoption trends correlate with premium device preferences.

- Android still holds strong in budget and mid‑range segments across the US.

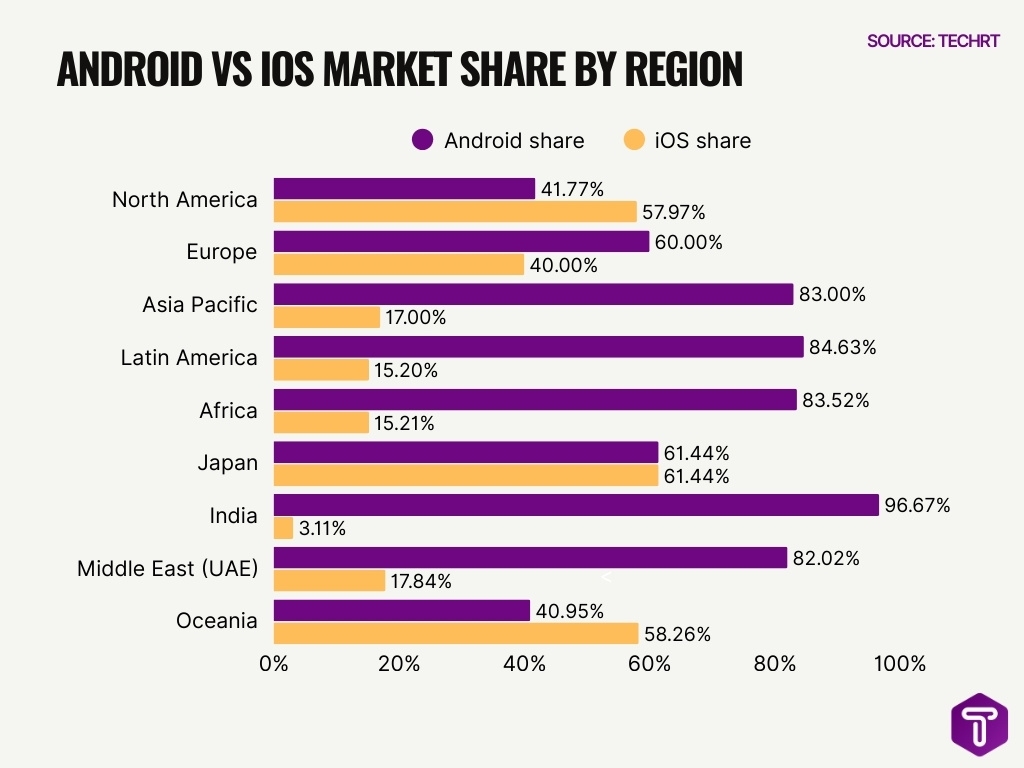

Apple vs Android Market Share in Major Regions

- In North America, iOS leads with ~58–60% usage share.

- Europe sees Android at ~60% versus iOS ~39–40%.

- Asia Pacific has Android dominating at 83% against iOS 17%.

- Latin America shows Android 84.63% to iOS 15.2%.

- Africa reports Android 83.52%, while iOS 15.21%.

- Japan favors iOS with 61.44% market share.

- India has Android 96.67% dominating iOS 3.11%.The

- The Middle East (UAE) sees Android 82.02% over iOS 17.84%.

- Oceania leads with iOS 58.26% against Android 40.95%.

iPhone vs Android Users Worldwide

- Android users globally number in the billions (well over 3–4 billion).

- iPhone users worldwide exceed 1–1.5 billion active devices.

- Android’s user base is more than double the iPhone user base.

- Android growth is driven by emerging markets and affordable devices.

- iPhone user growth is strongest in developed markets and premium segments.

- Active Android devices continue to expand due to diverse hardware offerings.

- iPhone user numbers rise with new model launches and ecosystem demand.

- Global user trends show stable preferences with occasional shifts based on pricing.

User Demographics: Age, Gender, Income

- iPhone users earn an average of $53,251 annually, 43% higher than Android users’ $37,040.

- Globally, 60% of males use Android while 54% of females do.

- In the U.S., 58% of adults aged 18-34 prefer iPhones over Android’s 41%.

- Worldwide, 57% of Gen Z users choose Android compared to iPhone’s 31%.

- Android holds 60% among global Gen X users, versus iPhone’s 22%.

- In the U.S., 68% of 18-29-year-olds use iPhones.

- Females globally favor the iPhone at 31%, slightly above males’ 28%.

- Android users span broader income brackets with more even distribution.

- Older U.S. groups (55+) show near parity: 49% iPhone, 51% Android.

- iPhone users average 4 hours 54 minutes daily screen time, 32% more than Android users’ 3 hours 42 minutes.

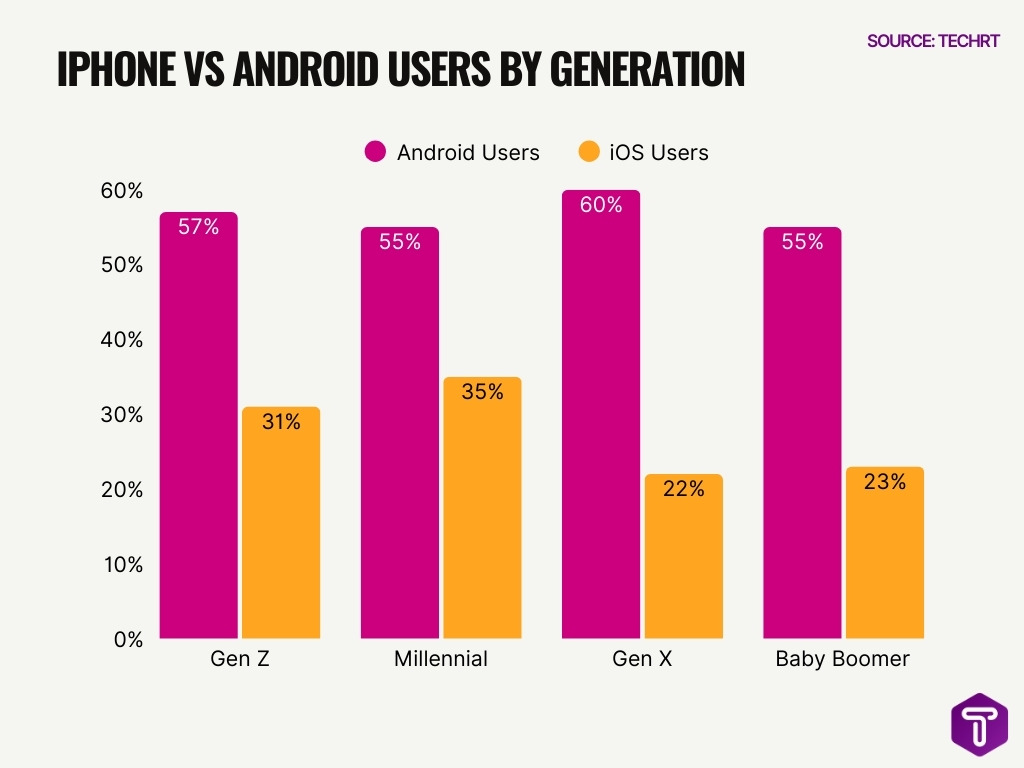

iPhone vs Android Users by Generation Worldwide

- Android dominates across all generations, with usage ranging from 55% to 60%, clearly outperforming iOS worldwide.

- Gen X shows the strongest preference for Android, with 60% of users choosing Android compared to just 22% using iOS.

- Among Gen Z, Android leads at 57%, while 31% of younger users prefer iOS, reflecting a stronger iPhone appeal among younger demographics.

- Millennials lean heavily toward Android, with 55% usage, but also represent the highest iOS adoption among all generations at 35%.

- Baby Boomers favor Android at 55%, more than double the 23% share held by iOS in this age group.

- iOS adoption peaks with younger and middle-aged users, while Android maintains a consistent majority share across every generation analyzed.

The Key Differences Between Android vs iPhone Users

- iPhone users spend $12.77 per app on average, over 2x more than Android’s $6.19.

- iPhone users average 4 hours 54 minutes daily screen time, 32% more than Android users’ 3 hours 42 minutes.

- Android loyalty stands at 91%, slightly higher than iPhone’s 88%.

- 18% of iPhone users switched from Android, while only 11% of Android from iPhone.

- iPhone users earn $53,251 annually, 43% more than Android’s $37,040.

- 93% of iPhone users adopt the latest iOS within 6 months, vs Android’s 20%.

- iPhone users send 58 texts daily vs Android’s 26, and take 12 selfies vs 7.

- 75% of iPhone users recover data after breaches, higher than Android’s 55%.

Device Variety and Price Range

- Android offers budget devices under $200, like the Samsung Galaxy A16 5G and the Moto G Power.

- iPhone models start at around $599 for base variants and exceed $1,399 for Pro Max, like the iPhone 17 Pro Max at $1,499.

- Mid-range Android phones priced $200–$600 dominate with a market projected at $609B in 2025.

- Flagship Android like Galaxy S25 Ultra at $1,199 compete with iPhones in the premium segment over $800.

- Android foldables shipments surged 14% in Q3 2025, capturing 2.5% of total smartphones.

- Rugged Android phones market to reach $5.2B by 2029 with 7.5% CAGR for harsh environments.

- Android holds 72% global market share vs iOS 28%, with 3.5B active devices over iPhone’s 1.5B.

- Android spans the mass-market $100–$400, capturing 56% volume sales globally.

iPhone vs Android Smartphone Sales Worldwide

- In Q3 2025, Android smartphones accounted for ~79% of global quarterly sales.

- iPhone global sales in the same quarter reached roughly 17% market share.

- Apple shipped about 247.8 million iPhones in 2025.

- Android annual device shipments exceeded 1 billion units globally.

- Apple secured higher industry profits due to premium pricing and services.

- Android sales growth remains concentrated in emerging markets.

- iPhone sales spikes often coincide with new model launches and promotions.

- Overall industry forecasts suggest continued growth in unit sales.

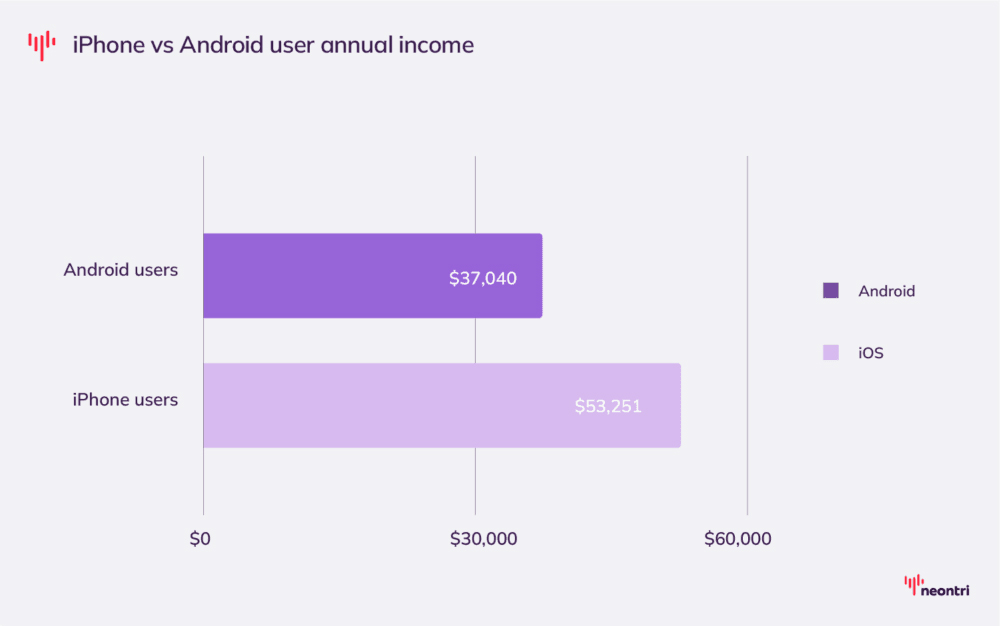

iPhone vs Android Users: Annual Income Comparison

- iPhone users report a significantly higher average annual income of $53,251, highlighting a stronger association between iOS adoption and higher earning power.

- Android users earn an average of $37,040 per year, reflecting a broader user base across mid- and lower-income segments.

- The income gap between iPhone and Android users stands at $16,211 annually, underscoring a clear socio-economic divide between the two ecosystems.

- iPhone ownership is more common among higher-income consumers, which helps explain stronger spending on apps, subscriptions, and premium services within the iOS ecosystem.

- Android’s affordability and device variety continue to attract users with more price-sensitive purchasing behavior, contributing to its lower average income profile.

Best-Selling Smartphones on Android vs iOS

- In Q3 2025, Apple’s iPhone 16 was the world’s best‑selling smartphone with about 4% of global shipments, topping all models.

- The iPhone 16, 16 Pro, 16 Pro Max, and 16e held the top 4 spots in the global best‑selling smartphone list in Q3 2025.

- All iPhone 16 models except the 16e sat in the $600+ premium bracket, giving Apple a majority of premium best‑seller slots in Q3 2025.

- Samsung filled the remaining 5 places in the global top‑10 with Galaxy A‑series Android phones (A16 5G, A06, A36, A56, A16 4G) in Q3 2025.

- The Galaxy A16 5G ranked 5th globally and was the top‑selling Android smartphone model in Q3 2025.

- Budget and midrange Galaxy A‑series devices made up all of Samsung’s entries in the global top‑10, while no Samsung flagship appeared in Q3 2025.

- Across the top‑10 list, Apple and Samsung each accounted for 5 models, underscoring a tightly balanced best‑seller race between iOS and Android in Q3 2025.

- As of late 2025, Android held about 72.8% global smartphone OS market share versus 26.8% for iOS, even as iPhones dominated premium best‑selling spots.

App Ecosystem: iPhone vs Android

- Google Play Store hosts ~2.5 million apps, while the Apple App Store offers around 1.9 million apps.

- The Apple App Store focuses on high‑value categories such as productivity and lifestyle.

- Android’s broader app ecosystem includes more distinct app categories (49 vs 26) than iOS.

- Both app stores contribute more than 90% of global mobile app downloads.

- Daily, about 1,200 new apps are released worldwide.

- Android’s open ecosystem has attracted alternative stores and sideloading options.

- Apple’s curated ecosystem emphasizes quality and security.

- Free apps dominate both ecosystems; Android has a higher proportion of free apps.

- Developers often prioritize iOS first due to higher monetization potential per user.

iPhone vs Android App Spending

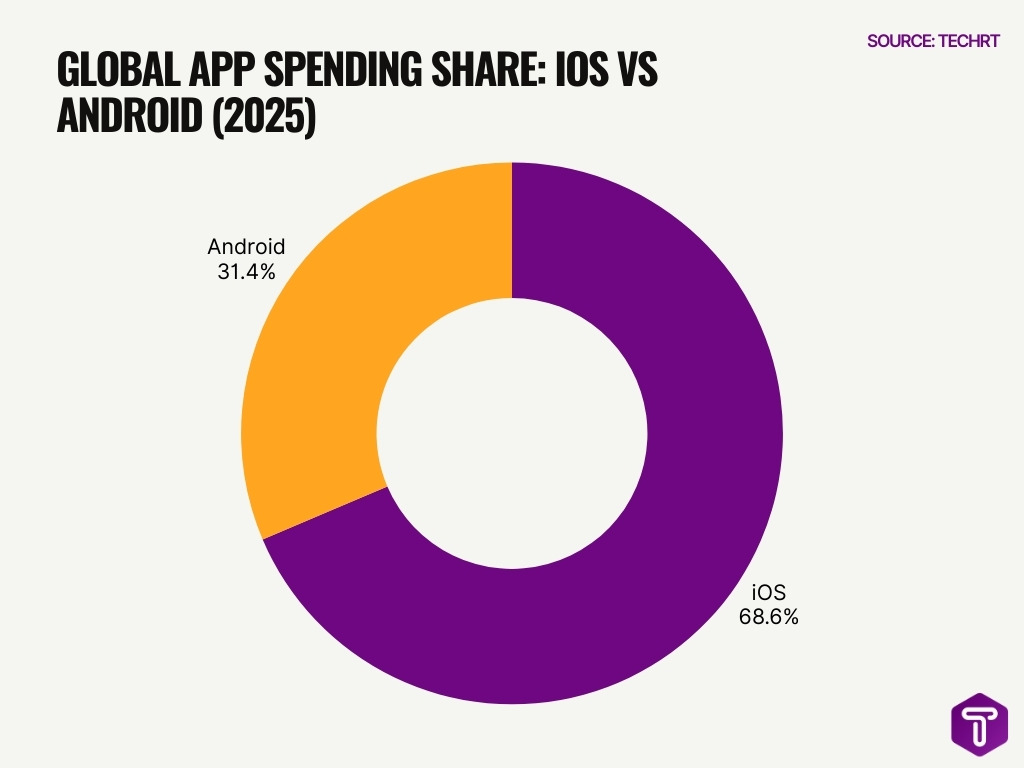

- iPhone users accounted for 68.6% of global app spending in 2025, versus Android’s 31.4%.

- App Store spending reached $142 billion in 2025, more than double Google Play’s $65 billion.

- iOS users spend $140 annually on apps, compared to $69 for Android users.

- iOS average spend per app is $12.77, twice Android’s $6.19.

- iOS monthly app spend averages $10.4 per user, versus Android’s $1.4.

- iOS in-app purchase average is $1.07 per transaction, over double Android’s $0.43.

- iOS gaming revenue hit $90 billion in 2025, ahead of Android’s $80 billion.

- iOS subscription revenue reached $50 billion, dominating streaming services.

- iOS ARPU stands at $138, nearly double Android’s $72.

App Revenue Data: iOS vs Android

- Global app revenue in 2024 reached about $150.1 billion, with iOS capturing ~68% (~$102 billion).

- Projections for 2026 estimate the App Store at $161 billion and Google Play at around $72 billion.

- iPhone users spend roughly $12.77 per app on average, compared to $6.19 for Android users.

- Monthly spending per user shows iOS at about $10.40 vs Android’s $1.40.

- Apple’s subscription revenue from apps is nearly three times higher than Google Play’s.

- Streaming and entertainment apps lead iOS revenues.

- Android excels in ad‑driven and freemium models.

- Total mobile app revenue across both ecosystems, including ads, exceeds $400 billion globally.

Popular App Categories Among iPhone vs Android Users

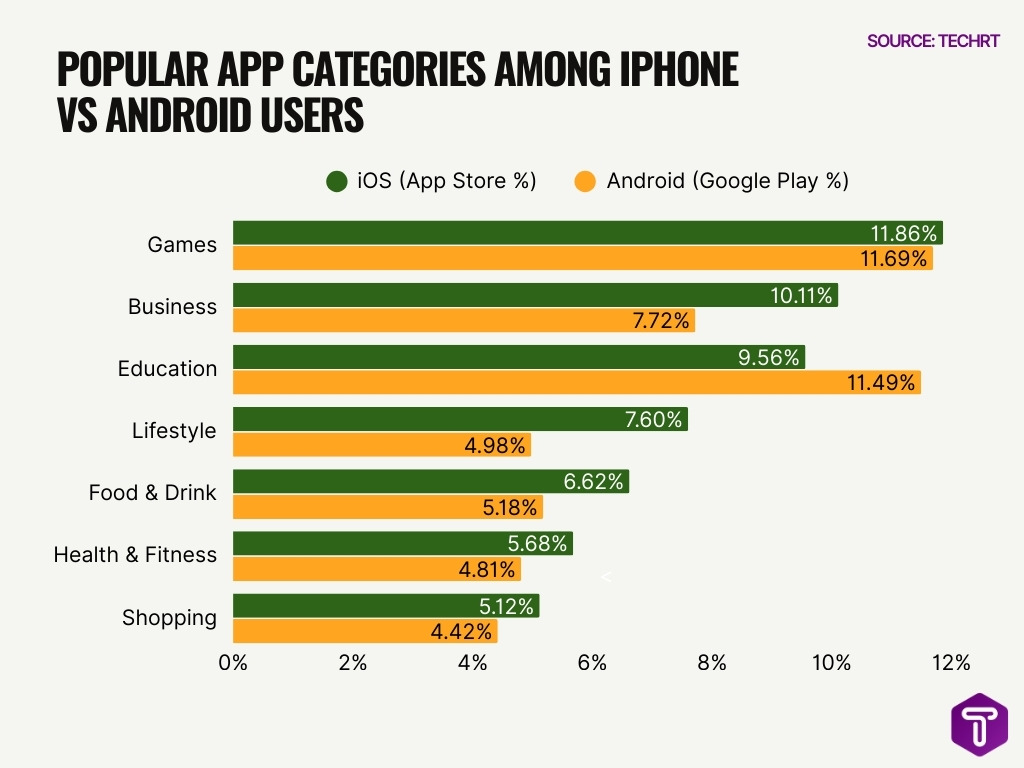

- Games dominate both platforms, accounting for 11.86% on iOS and 11.69% on Android, making gaming the most popular app category across smartphone users.

- Business apps are more popular on iPhones, with 10.11% on iOS compared to 7.72% on Android, highlighting stronger professional and productivity usage among iPhone users.

- Education apps see higher adoption on Android, representing 11.49% of Android apps versus 9.56% on iOS, indicating Android’s wider reach in learning-focused segments.

- Lifestyle apps perform significantly better on iOS, capturing 7.60% on the App Store compared to 4.98% on Google Play, reflecting stronger lifestyle and premium app engagement among iPhone users.

- Food & Drink apps show moderate usage on both platforms, with 6.62% on iOS and 5.18% on Android, suggesting consistent consumer interest regardless of ecosystem.

- Health & Fitness apps are more prevalent on iOS, accounting for 5.68%, while Android trails at 4.81%, aligning with iPhone’s stronger focus on wellness and fitness ecosystems.

- Shopping apps are slightly more popular on iPhones, with 5.12% on iOS compared to 4.42% on Android, reinforcing higher commerce-driven app adoption among iOS users.

Customer Loyalty iPhone vs Android

- Android retains 89–91% of its users, slightly higher than iPhone’s 85–88%.

- 18% of iPhone users switched from Android, vs 11% of Android users from iPhone.

- iPhone users keep devices for avg 4.2 years, Android avg 3.1 years.

- 29% of iPhone owners kept their prior device 3+ years, vs 21% for Android.

- 61% of iPhone buyers had a previous phone ≥2 years, only 43% for Android.

- 93% of iPhone users are on the latest OS within 6 months, vs 20% Android users.

- 8% of iPhone users consider switching, a higher 12% for Android.

- Day 30 app retention: iOS 3.1–3.7%, Android 2.1–2.8%.

- 75% iPhone users recover data post-breach, vs 55% Android users.

Advertising and Marketing Trends

- Android’s install base (~3 billion+ devices) creates strong ad reach and impressions.

- iOS ads command a higher cost‑per‑thousand (CPM).

- Android supports hyper‑casual games and ad‑monetized strategies.

- Apple’s privacy policies have reshaped ad targeting.

- Identifier controls on iOS influence ad performance.

- Android campaigns often focus on affordability and diversity.

- iPhone marketing highlights design, performance, and ecosystem.

- App install ads remain a major digital ad segment.

The Future of iPhone vs Android

- Global app revenue is forecasted to reach $233 billion by 2026, with iOS capturing 85% of profits.

- Android ecosystem poised for growth via alternative app stores mandated by EU regulations in 2026.

- iOS is expected to open to third-party stores following DMA compliance, boosting competition.

- AI features in mobile OS to drive 40% higher user engagement by 2027.

- Privacy enhancements will prioritize end-to-end encryption, adopted by 92% of premium users.

- Android is projected to hit 87% market share in emerging markets like India and Africa by 2026.

- iPhone AR integration forecasted to reach 500 million active users with Vision Pro synergy.

- Developers favor Android for scale (3.9 billion devices) over iOS revenue ($100B+ annually).

- Data privacy trends to influence 65% of app installs, favoring iOS security features.

Frequently Asked Questions (FAQs)

What is the global smartphone OS market share for Android vs iPhone in 2026?

Android holds approximately 71–75% of the global smartphone operating system market share, while iPhone (iOS) accounts for about 25–28% of the market.

What percentage of smartphone users in the United States prefer iPhone over Android?

In the U.S., iPhone usage ranges around 57–59%, compared with Android usage at roughly 40–42% of the smartphone market.

How many active users do Android and iPhone platforms have worldwide?

Android has an estimated 3.9–4.5 billion active users globally, while iPhone (iOS) has about 1.4–1.8 billion active users worldwide.

What was the market share split for Android vs iPhone smartphone shipments in Q3 2025?

In Q3 2025, Android smartphones made up ~79% of worldwide smartphone shipments, while iPhone devices captured around 17% of shipments.

How much revenue do iPhone vs Android app ecosystems generate globally?

iOS app store revenue represented about 67–68% of total app revenue in 2025, generating over $80–$100 billion, while Android app revenue accounted for the remaining ~32–33%.

Conclusion

The Android vs iPhone landscape reflects a balance of volume and value. Android dominates in global reach and app count, while iPhone excels in revenue per user and monetization strength. App ecosystems continue to evolve, Android’s scale supports broad accessibility and ad‑driven models, while iPhone’s focused marketplace yields stronger app spending and subscription engagement. Customer loyalty remains high on both sides, and future trends suggest innovation in privacy, AI, and cross‑platform interconnectivity will define the next chapter of mobile competition. These insights offer clarity for developers, marketers, and users navigating the mobile ecosystem’s ongoing evolution.

Leave a comment

Have something to say about this article? Add your comment and start the discussion.