Discord stands tall as one of the most influential communication platforms on the internet. Originally launched for gamers, it has reshaped how communities gather, collaborate, and converse online, from study groups to creator networks. Its growth in registered users and engagement metrics demonstrates its expanding role in digital communication. From gaming guilds coordinating play sessions to brands hosting real‑time fan discussions, Discord’s impact spans both personal and professional use cases. Explore the latest data below to understand how Discord is evolving.

Editor’s Choice

- 771 million projected registered users by the end of 2026, up 11.9% from 2025.

- 300 million+ forecasted monthly active users (MAUs) in Q4 2026.

- Approximately 656 million registered users by late 2025.

- 260 million monthly active users in 2025, up from 230 million prior year.

- Around 30–31.5 million daily active users in 2025, implying roughly 12% of monthly users log in daily at current MAU levels.

- $561 million annual revenue in 2025.

- 9% share of the US chat app market in 2025.

Recent Developments

- Discord is expected to diversify revenue beyond Nitro, including ad‑driven products and Sponsored Quests by 2026.

- More than 55% of users will be non‑gamers by 2026, showing broader platform appeal.

- AI‑focused servers (e.g., Midjourney) may exceed 23.5 million members.

- Discord continued global expansion in Asia‑Pacific, Europe, and the Americas markets in late 2025.

- The platform is exploring IPO plans targeting a 2026 entry, signaling growth ambitions.

- Enhanced video and live interaction features have rolled out to support creator communities.

- Expanded moderation and community tools debuted to strengthen user safety.

- Nitro subscription tiers and perks were updated to increase paid user conversion.

Overview and Growth Timeline of Discord

- Discord launched in 2015 as a voice and text tool for gamers.

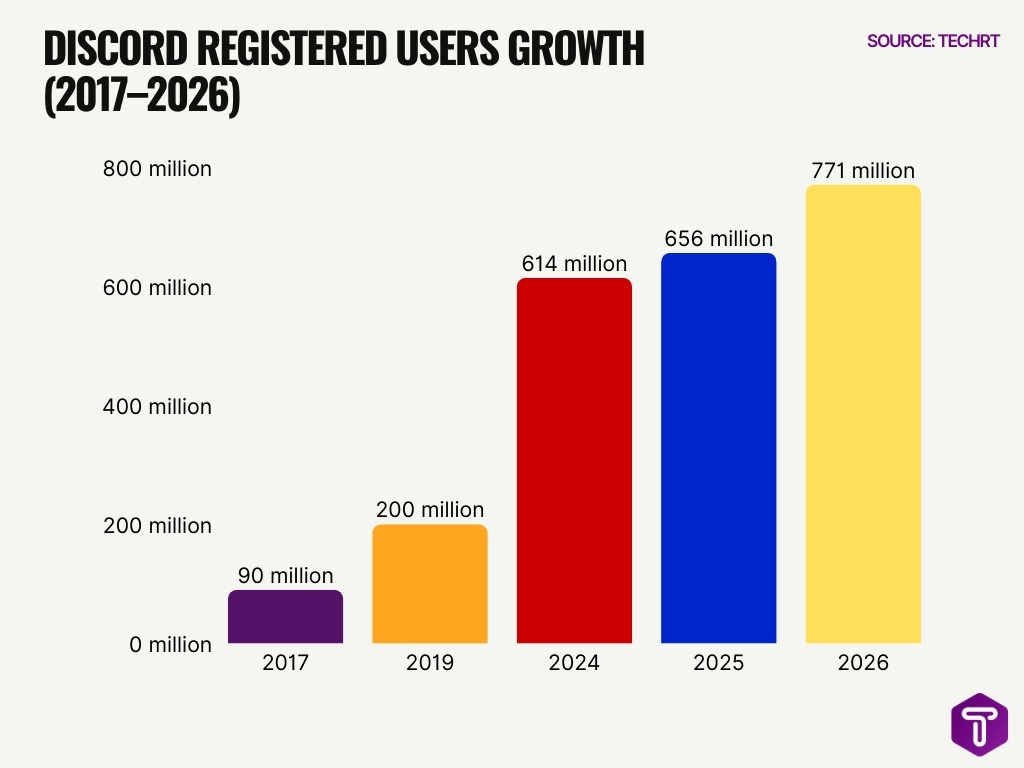

- 2017: registered users 90 million.

- 2019: Discord reached 200+ million registered users.

- 2021: valuation hit $15 billion after major funding rounds.

- 2023: MAUs reached 200 million, reflecting rapid growth.

- 2024–2025: surge in non‑gaming communities and creator use cases.

- 2025: Discord continued to diversify beyond gaming into education and business servers.

- 2026: Discord forecasted new monetization channels and expanded global reach.

Key Statistics from 2025 to 2026 for Discord

- 656 million registered users by late 2025.

- 771 million projected by the end of 2026 (11.9% growth).

- 260 million MAUs in 2025, up from 230 million the year prior.

- MAUs forecast to exceed 300 million by Q4 2026.

- 30 million daily active users (2025).

- DAU/MAU ratio is closer to 12% in 2025 when aligning ~31.5M DAUs with ~259M MAUs.

- Revenue $561M in 2025.

- Nitro remains the primary revenue driver even as ad streams grow.

Registered Users Insights on Discord

- Discord had 656M registered accounts by late 2025.

- Registered users grew from 614M in 2024, based on leading user‑count projections for Discord.

- Projected 771M registered users by the end of 2026.

- The registered base has nearly doubled in recent years.

- Growth reflects broad adoption beyond gaming communities.

- Registration spikes align with new feature rollouts.

- Growth in Asia‑Pacific and Europe contributes strongly.

- Non‑gaming segments now outnumber core gaming registrants.

Regional Distribution of Discord Users

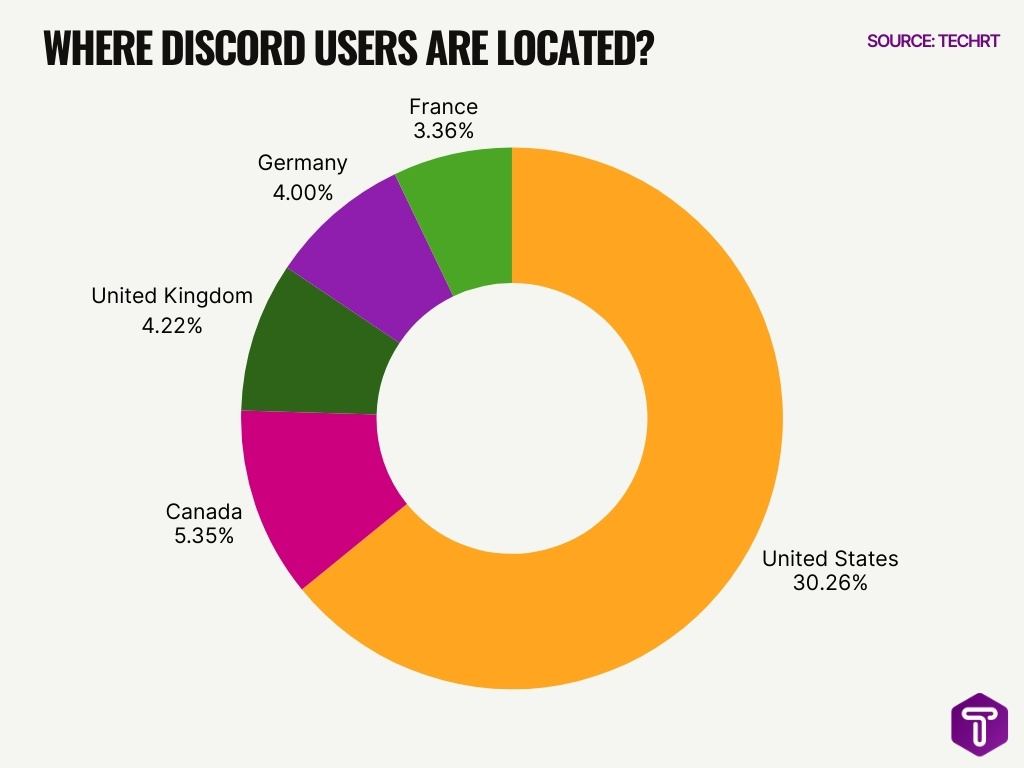

- The United States accounts for 30.26% of Discord users.

- Canada holds 5.35% of the user base.

- The United Kingdom contributes 4.22% of users.

- Germany and France each have about 4% and 3.36%, respectively.

- Discord’s Asia‑Pacific region is the largest overall geographic block (34% of MAUs).

- India, Brazil, and Russia each register 5% of app downloads, reflecting growing markets.

- U.S. mobile and desktop usage patterns show strong desktop dominance but rising mobile traction globally.

- Overall, Discord has a truly global footprint, with engagement across the Americas, Europe, and APAC regions.

Monthly Active Users on Discord

- 260M MAUs recorded in 2025.

- This figure rose from 230M the year before.

- Discord MAU count reflects 13.8% YOY growth.

- Forecasts place MAUs north of 300M by 2026 Q4.

- MAUs represent roughly 39–40% of registered users when comparing about 259M MAUs to 656M total accounts in 2025.

- Discord’s North America accounts for 28% of MAUs.

- The Asia‑Pacific region holds 34% of MAUs.

- The U.S. alone hosts 70M+ monthly users as of 2025.

Daily Active Users on Discord

- 31.5 million estimated daily active users (DAUs) in 2025, up from 29 million the year before.

- DAUs grew by 8.6% from 2024 to 2025, reflecting ongoing engagement increases.

- Approximately 12% of monthly active users log in daily, an indicator of sticky usage habits.

- Discord users spend an average of 94 minutes per day on the platform, surpassing time spent on some mainstream social apps.

- 1.1 billion messages are sent across Discord daily, illustrating high conversational volume.

- The platform facilitates 4 billion+ minutes of conversation each day.

- Daily voice chat sessions last 53 minutes on average for voice users, longer than many competing platforms.

- Many users engage with 7 different servers daily, highlighting diversified activity patterns.

User Engagement Trends in Discord

- Discord’s users generate an estimated 1.1 billion messages per day worldwide.

- Average weekly active time is 3.4 hours per user (204 minutes), signaling deep interactions.

- Users access the platform on multiple devices, with 81% of traffic via desktop, a higher ratio than many social apps.

- Direct traffic accounts for 75% of visits, showing strong user intent.

- Discord users typically visit 10 pages per site session, suggesting exploration and activity.

- Voice users typically remain 34% longer in sessions than text‑only users.

- Users often participate in multiple server contexts concurrently, with daily engagement spanning gaming, social, and topic‑based clusters.

- Community discussions contribute to cross‑platform engagement, extending beyond Discord into social and video networks.

Age Group Demographics Using Discord

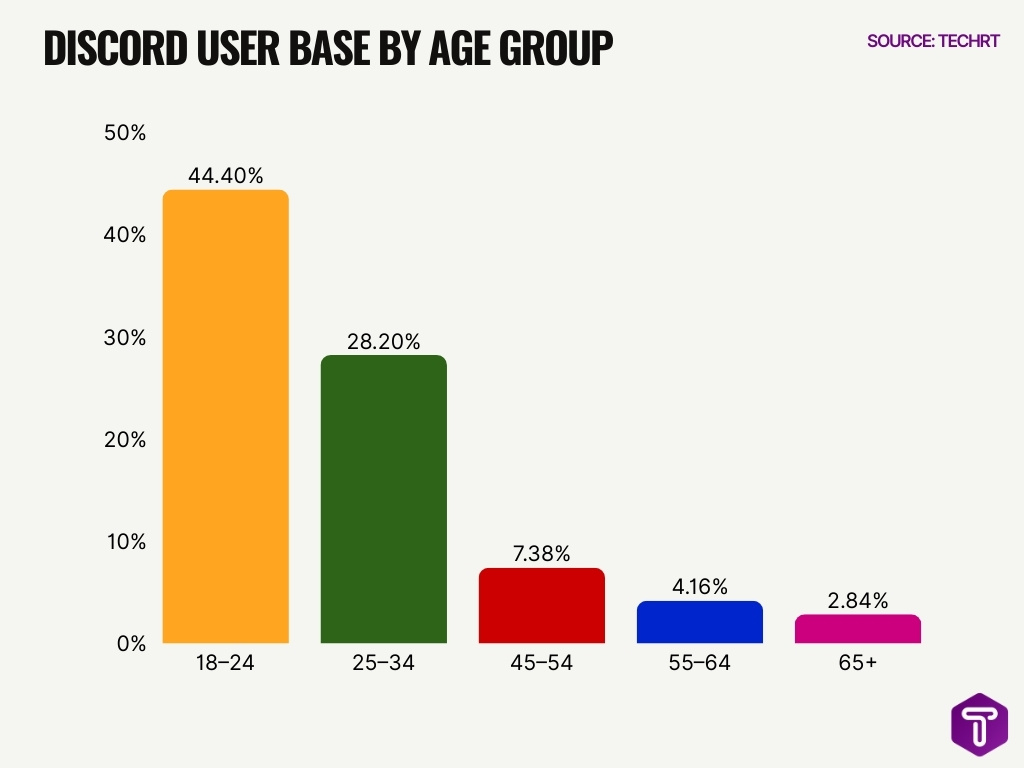

- About 44.4% of users are aged 18–24, making this cohort the largest age group.

- Adults aged 25–34 comprise 28.2% of the user base.

- 20.6% of users fall in the 16–24 bracket (data from earlier 2025 estimates).

- Smaller portions, such as 7.38% aged 45–54 and 4.16% aged 55–64, indicate a broader age reach.

- 2.84% are over 65, highlighting modest older adoption.

- Age distribution shows the majority (over 70%) is under 35, aligning with digital native usage patterns.

- Discord continues to attract young millennials as long‑term users, even as its community ages up.

- Engagement is especially high among users aged 18–34, supporting targeted marketing and community strategies.

Gen Z and Teen Usage of Discord

- Gen Z (typically ages 18–24) comprises the single largest demographic cluster on Discord, with 41.32% of users aged 18-24.

- 35% of Gen Z actively use Discord, surpassing Reddit at 30% and Twitch at 24%.

- 37% of U.S. adults aged 18–34 have a Discord account.

- Over 60% of students report having Discord accounts for study groups and creative projects.

- 44% of teenage gamers use Discord to connect and communicate.

- 28% of U.S. teens use Discord, with teen boys at 34% versus girls at 22%.

- 16-24-year-olds average 2.4 hours weekly on Discord, exceeding older users’ 1.4 hours.

- 70% of Discord users are under 34, highlighting youth dominance.

- Gen Z users aged 16-25 spend 3.4 hours weekly on the app.

Gaming vs Non‑Gaming Activity on Discord

- Around 78% of Discord users use the platform for non‑gaming reasons, signaling broad community roles.

- About 36% of video gamers use Discord daily or weekly.

- Only 22% of users cite gaming as their sole use case.

- A majority of servers are still related to gaming categories, with 75% of active servers tied to gaming interests.

- Discord facilitates gaming and non‑gaming communities like art, tech, education, and crypto.

- Many non‑gaming servers focus on creativity, study groups, or social topics.

- Gaming presence remains strong due to voice chat coordination and community features.

- Engagement patterns show crossover, where gamers also participate in non‑gaming discussions.

Most Popular Servers on Discord

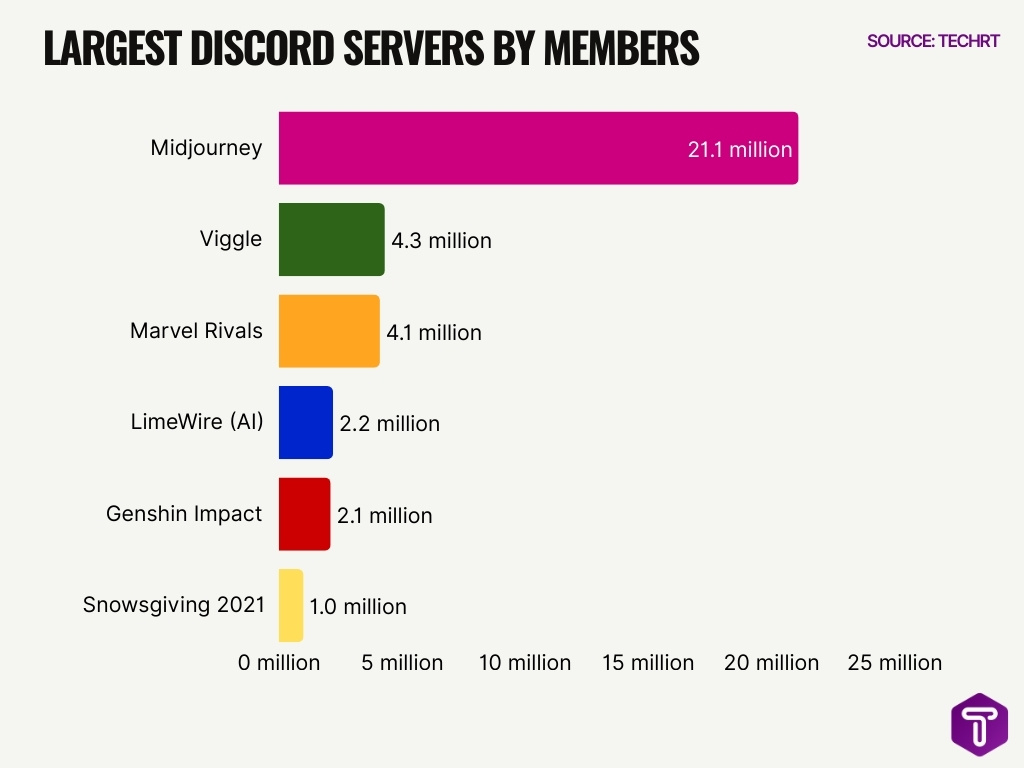

- Midjourney tops with 21.1 million members.

- Viggle ranks second at 4.3 million members.

- Marvel Rivals leads gaming servers with 4.1 million members.

- LimeWire has 2.2 million members in AI communities.

- Genshin Impact’s official server boasts 2.1 million members.

- MEE6 bot serves 21+ million servers.

- Discord runs 19 million weekly active servers.

- Snowsgiving 2021 hit 1 million members.

- Top servers contribute heavily to Discord’s traffic within a platform‑wide total of over 1.1 billion messages sent daily.

Server Statistics and Trends in Discord

- Discord hosts over 32.6 million servers as of early 2026.

- Server count has risen from 6.7 million in 2020 to tens of millions today.

- Gaming servers remain the largest segment, approximately 74–75% of total servers.

- About 90% of servers have fewer than 15 members, showing many small, tight‑knit groups.

- Education, tech, and music servers are among the fastest‑growing categories.

- Total server growth reflects diverse community interests beyond gaming.

- Discord server creation spikes often align with trending topics and cultural moments.

- Servers facilitate thematic gathering spaces, central to user engagement and activity retention.

Messaging and Voice Activity Across Discord

- Discord users send over 1 billion messages daily, platform‑wide.

- Voice chat sessions average 53 minutes per day for engaged users.

- College‑aged users (18–24) spend 117 minutes per day on the platform, often in voice channels.

- Users in voice channels stay connected 34% longer than text‑only members.

- Peak message activity occurs 8 PM–11 PM local time across global regions.

- Discord ranks #3 in daily engagement among U.S. Gen Z users for social platforms.

- Text channel chats remain the core interaction method, with topic‑based threads driving repeat activity.

- Rich media sharing (images, embeds) accounts for a substantial proportion of daily messaging volume.

Discord Account Removals by Violation (Q4 2023)

- Child Safety violations led all categories, with 116,219 accounts removed, highlighting Discord’s strong enforcement against harmful content involving minors.

- Exploitative and Unsolicited Content resulted in 52,612 removals, reflecting ongoing efforts to curb spam, scams, and abusive promotions.

- Regulated or Illegal Activities caused 32,633 account bans, showing strict action against unlawful behavior on the platform.

- Violent and Graphic Content accounted for 23,264 removals, emphasizing moderation against disturbing and explicit material.

- Harassment and Bullying led to 10,320 account removals, reinforcing Discord’s policies against online abuse.

- Deceptive Practices triggered 6,470 bans, targeting fraud, impersonation, and misleading activities.

- Violent Extremism violations resulted in 6,109 removals, underlining Discord’s stance against radical and terrorist content.

- Hateful Conduct caused 3,313 accounts to be removed, reflecting measures against hate speech and discriminatory behavior.

- Platform Manipulation led to 2,878 bans, addressing coordinated abuse, botting, and artificial engagement.

- Self-Harm Concerns resulted in 1,070 removals, showing monitoring of content linked to mental health risks.

- Identity and Authenticity violations caused 156 account removals, focusing on fake profiles and impersonation.

- Misinformation was the least penalized category, with only 19 accounts removed, indicating limited enforcement actions in this area during Q4 2023.

App Download and Install Trends for Discord

- Discord mobile app reached 614 million registered users globally by 2024, projected to hit 656 million in 2025.

- Q4 2023 Discord downloads totaled 23.7 million worldwide, up slightly from 23.4 million in Q4 2022.

- Discord mobile downloads grew with 11.37 million monthly average, ranking as one of the top 5 messaging apps.

- U.S. accounts for 25% of all global Discord app downloads.

- India shows 65.77% mobile traffic share, the highest among key markets like Brazil at 7.95%.

- The U.K. contributes 5% of Discord downloads with 34.18% mobile traffic.

- U.S. Discord traffic is 39.76% mobile vs 60.24% desktop, with mobile sessions rising.

- Discord app ranks top 5 in monthly downloads among free social apps globally.

- Q4 2020 saw a download peak of 48 million, spiking after major updates.

- Mobile app revenue hit $31 million in Q4 2023, up 6% YoY amid Nitro promotions.

Revenue and Monetization of Discord

- Discord generated $561 million in revenue in 2025, up 29% year‑on‑year.

- Nearly half of the revenue stems from mobile app purchases and Nitro purchases.

- The platform has maintained $50M+ revenue per quarter consistently since 2021.

- Discord’s monetization remains user‑driven, with paid upgrades rather than traditional ads.

- Enterprise and creator monetization tools are expanding, including paid membership tiers.

- Estimated valuation discussions project Discord’s value above $20B based on growth and revenue trends.

- Nitro benefits, server boosts, and premium features continue to deepen monetization.

- Robust community ecosystem (bots, productivity tools) drives ongoing subscription revenue.

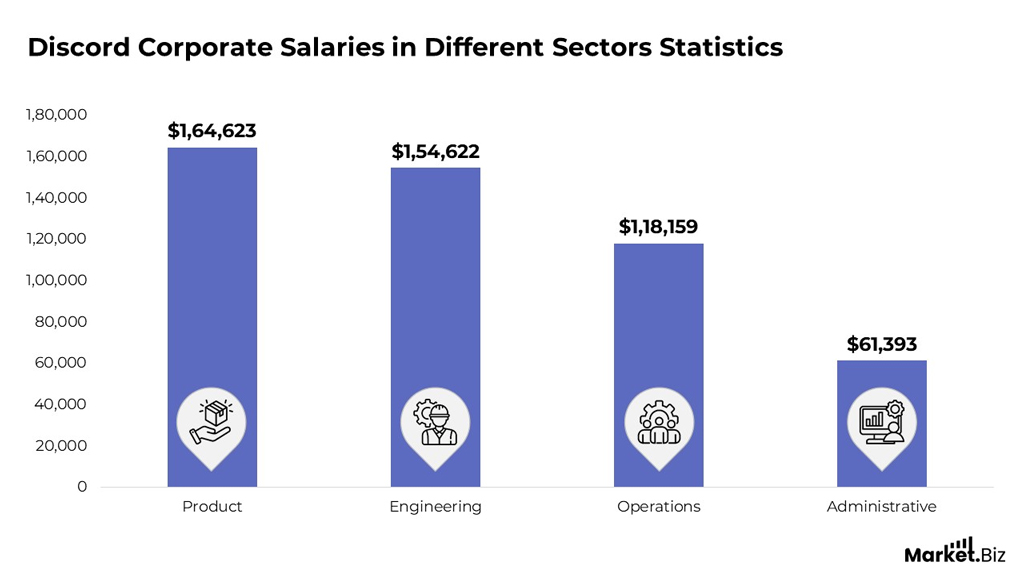

Discord Corporate Salaries by Sector

- Product sector leads with the highest average salary of $164,623, highlighting its strong value in Discord’s corporate structure.

- Engineering roles earn an average of $154,622, reflecting high demand for technical and development expertise.

- Operations professionals receive around $118,159, showing solid compensation for managing daily business functions.

- Administrative positions record the lowest average salary at $61,393, indicating comparatively lower pay in support roles.

- The salary gap between Product and Administrative roles exceeds $103,000, emphasizing major compensation differences across departments.

- Overall, technical and strategic roles at Discord command significantly higher pay than operational and administrative positions.

Nitro Subscriptions and Paid Users on Discord

- Discord has 7.3 million Nitro subscribers in 2025, up 17% year-over-year.

- Nitro subscriptions generated $450 million, comprising 80% of Discord’s $561 million total revenue.

- Over 614 million users have utilized Nitro’s paid services as of 2025.

- Nitro pricing starts at $2.99/month for Basic and $9.99/month for full Nitro.

- Each Nitro subscription includes 2 free server boosts, with 30% off additional ones.

- Discord’s ARR reached $725 million by the end of 2024, driven largely by Nitro and boosts.

- Nitro users average $47 annual spend on subscriptions and server boosts.

- Gaming communities represent 74% of 28.4 million total servers, incentivizing Nitro perks.

- 259.2 million monthly active users provide a vast potential for Nitro conversion growth.

Market Share and Competitor Comparison for Discord

- Discord holds 9% U.S. chat app market share in 2025.

- WhatsApp commands over 44% global messaging market share in 2025.

- Facebook Messenger reaches 16.3% of global internet users in 2025.

- Telegram holds 44.44% market share ahead of Discord‘s 29.41% projection.

- Discord had 200 million+ monthly active users worldwide in 2025.

- Discord users send 850 million messages daily on average.

- Users spend an average of 94 minutes daily on Discord.

- Discord hosts 32.6 million active servers, 75% gaming-related.

- Over 12 million active bots power 28% of Discord server messages.

- 35% of Gen Z use Discord, outranking Reddit and Twitch.

Frequently Asked Questions (FAQs)

How many monthly active users does Discord have as of 2025?

Discord had around 259 million monthly active users in 2025.

What is Discord’s total registered user count in 2025?

Discord has about 656 million registered users as of 2025.

How much revenue did Discord generate in 2025?

Discord generated $561 million in total revenue in 2025.

How many Discord servers exist globally as of 2025?

There are approximately 32.6 million Discord servers worldwide by 2025.

What share of Discord users are based in the United States?

About 29.07% of Discord’s global user base comes from the United States.

Conclusion

Discord’s evolution illustrates a platform that has grown well beyond its gaming origins into a core venue for digital communities, creators, and teams. From massive servers like Midjourney’s 19.9M members to over 560M app installs, the scale of activity across messaging, voice, and engagement highlights its vast reach. Revenue trends, with $561M in 2025 revenue, show that users are willing to pay for enhanced experiences, while Nitro continues to be a central monetization engine.

In a crowded messaging landscape, Discord’s focus on persistent communities, deep engagement, and cross‑platform usage keeps it competitive alongside global giants. These statistics reflect both scale and community intensity, data that matters for marketers, creators, and strategists who are shaping the future of online communication.

Leave a comment

Have something to say about this article? Add your comment and start the discussion.