The gaming subscription market has shifted from a niche trend to a core pillar of the wider digital entertainment ecosystem. Subscription-based access to games, where players pay recurring fees instead of buying standalone titles, now fuels monetization strategies across console, PC, mobile, and cloud platforms. This model helps gamers access expansive libraries, enjoy continuous updates, and publishers secure predictable revenue streams.

Real-world examples include Microsoft’s Xbox Game Pass generating nearly $5 billion in annual revenue and PlayStation Plus reporting over 50 million subscribers, underscoring the commercial impact of gaming subscriptions. Dive deeper into the latest figures and dynamics shaping this market.

Editor’s Choice

- Global gaming subscription market expected to reach approximately $13.1 billion in 2026, up from about $12.94 billion in 2025.

- Subscription gaming services are anticipated to expand to nearly $47 billion by 2035.

- Over 35 million Xbox Game Pass subscribers as of mid‑2025.

- PlayStation Plus reported 51.6+ million subscribers in early 2025.

- Subscription revenues from Game Pass and PlayStation Plus in the U.S. topped $3.6 billion in 2025.

- The cloud gaming segment is valued at around $2.36 billion in 2025, with strong growth ahead.

- Adoption rates for gaming subscriptions are highest in emerging markets (40%+) compared to ~20% in the U.S.

Recent Developments

- Xbox Game Pass reported nearly $5 billion in revenue over the last year (FY25).

- Microsoft increased the Game Pass Ultimate price by 50% to roughly $29.99/month in 2025.

- PlayStation Plus added 163 new games across all subscription tiers in 2025.

- Emerging markets like India and Indonesia show 40%+ subscription adoption.

- Console hardware price hikes have influenced subscription uptake and perceived value.

- Cross‑platform integration and AI recommendations are boosting engagement.

- Cloud gaming hours on Game Pass increased 45% year‑over‑year.

- Hybrid subscription models (bundles with streaming or perks) are gaining traction.

Subscription-Based Gaming Market Growth Overview

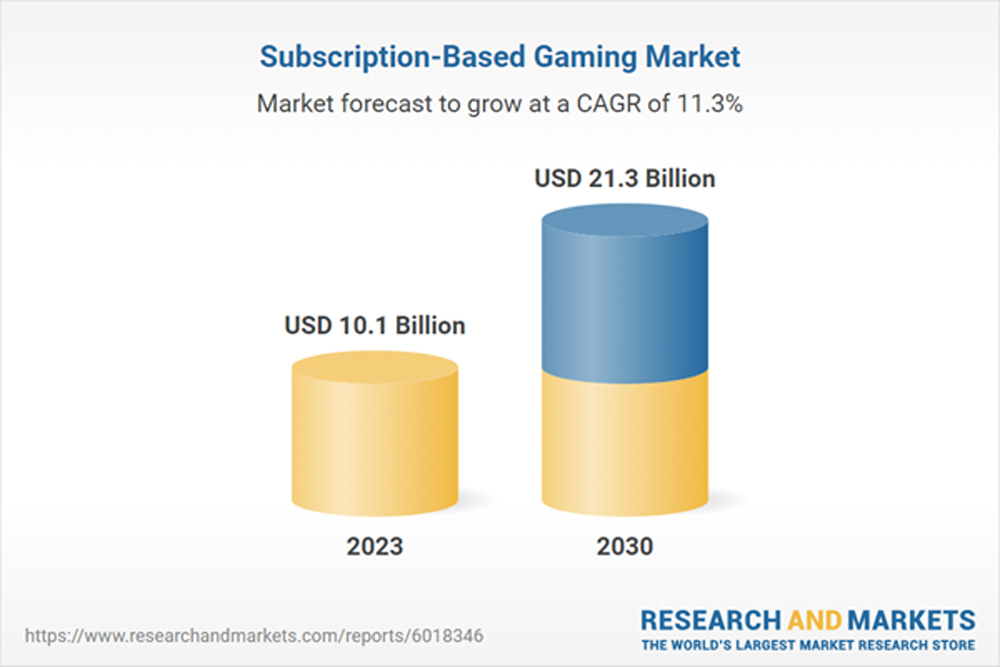

- The subscription-based gaming market was valued at $10.1 billion in 2023, highlighting its strong foothold in the global gaming ecosystem.

- Market revenue is projected to reach $21.3 billion by 2030, reflecting rapid expansion over the forecast period.

- The industry is expected to grow at a robust CAGR of 11.3%, indicating sustained long-term demand for subscription gaming services.

- This growth underscores increasing consumer preference for recurring-access gaming models over one-time purchases.

- The sharp rise in market value between 2023 and 2030 signals strong monetization potential for publishers and platform providers.

Subscriber Numbers Worldwide

- Xbox Game Pass reached 34–37+ million subscribers in 2025.

- PlayStation Plus had 51.6+ million subscribers early in 2025.

- Adoption rates vary widely by region, and emerging markets exceed 40% subscription usage.

- U.S. gamers contributed to $3.6 billion+ subscription earnings in 2025.

- Cloud gaming services engaged an estimated 23.7 million gamers in 2025.

- The gaming community size globally is around 3.6 billion players in 2025.

- Console and PC segments account for significant dual‑platform subscription overlap.

- Subscription launch rates continue to improve with added day‑one titles.

Adoption and Penetration Rates

- ~35–40% of active gamers subscribed to at least one gaming service in 2025.

- Emerging markets like India and Indonesia achieved over 40% gamer adoption rates.

- U.S. gamer adoption stayed solid at ~20% for subscription services.

- PlayStation Plus hit 51.6 million subscribers in Q1 2025.

- Xbox Game Pass reached ~37 million subscribers with 12% YoY growth.

- 68% of Game Pass users chose the Ultimate high-value tier.

- Cloud gaming user penetration expanded to 5.8% globally in 2025.

- 81% retention rate for gaming subscriptions boosted user bases in 2025.

- Asia-Pacific captured 41.2% of the global subscription revenue share.

Regional Market Shares

- North America held 72.35% of global subscription-based gaming revenue in 2025.

- Asia-Pacific is forecast to have the fastest 10.6% CAGR in subscription gaming through 2031.

- Console subscriptions generated 54.35% of 2025 revenue at $6.52 billion globally.

- The gaming subscription market reached $11.75 billion in 2024, growing at 13.4% CAGR to 2035.

- North America leads gaming subscription services due to high broadband and console ownership.

- The LAMEA region exhibits the fastest 14.5% CAGR in subscription gaming through 2031.

- Cloud streaming grows at 11.05% CAGR, challenging download-to-device dominance.

- US video game content sales rose 1% overall in 2025, boosted by subscriptions.

- Latin America gaming market valued at USD 25.70 billion in 2025, with 9.3% CAGR ahead.

Platform Revenue Breakdown

- Mobile gaming continues to dominate overall gaming revenue, generating $92.6 billion in 2024 and accounting for nearly 49% of total industry revenue.

- By 2025, mobile gaming revenue projections exceed $111–$125 billion, underscoring its lead position.

- Console gaming brought in approximately $45–$51 billion in 2025, representing about 23–28% of global gaming revenue.

- PC gaming also generated close to $43 billion in 2025, almost on par with console revenue.

- Subscription‑related revenue, e.g., Game Pass and PS Plus, accounted for a significant share of digital content and services, especially in console and PC ecosystems.

- Cloud gaming remains smaller but rapidly expanding, contributing several billion dollars in revenue and expected to grow at a high CAGR through 2031.

- Download‑to‑device or direct download subscriptions held around 60%+ of subscription market share in 2025.

- North America commanded over 70% of subscription revenue in 2025.

- Premium subscription tiers represented nearly 50% of subscription‑related revenue by the end of 2024.

- Family and bundled tier segments are growing with a double‑digit CAGR through 2031, indicating diversified subscription monetization.

Console Gaming Statistics

- Xbox Game Pass generated nearly $5 billion in revenue during the fiscal year 2025, a record for the service.

- Game Pass reached about 37 million subscribers by early 2025, up from previous years.

- PlayStation Plus revenue was estimated at $3.8 billion in 2025, outpacing Game Pass revenue.

- PlayStation Plus had roughly 51.6 million subscribers as of Q1 2025.

- The US gaming subscription segment saw $3.6 billion in spending on services like Game Pass and PS Plus in 2025.

- Console subscriptions like Game Pass and PS Plus represent a growing share of digital services revenue for Microsoft and Sony.

- Console market share in gaming revenue remains strong, supporting subscription growth with ongoing hardware and exclusive content engagement.

- Cross‑platform console content, expanding titles to both PS and Xbox, impacts subscription attractiveness.

- Subscription services often bundle multiplayer, discounts, and game libraries, boosting value perception.

- Price changes, such as Game Pass Ultimate increases, continue to influence revenue and subscriber retention dynamics.

PC Gaming Statistics

- PC gaming revenue remained robust at around $43 billion in 2025, closely trailing console revenue.

- Digital distribution channels on PC, e.g., Steam, dominate, where subscription models complement direct game purchases.

- Subscription uptake on PC includes both game libraries, Game Pass for PC, Ubisoft+, and platform ecosystem benefits.

- Active monthly users on major PC platforms exceed hundreds of millions globally, supporting subscription demand.

- PC gaming’s role in subscriptions is bolstered by cross‑platform integration, Play Anywhere, and cloud boosts.

- Competitive digital storefronts contribute to diversified revenue, though conversion from free users to paying subscribers varies.

- Esports, live services, and DLC on PC provide incremental engagement outside traditional subscriptions.

- Subscription models on PC often include additional perks like early access or curated libraries.

- Growth in indie titles and third‑party partnerships pushes subscription content variety.

- Steam’s dominant market share anchors PC gaming’s revenue base, indirectly supporting subscription ecosystems.

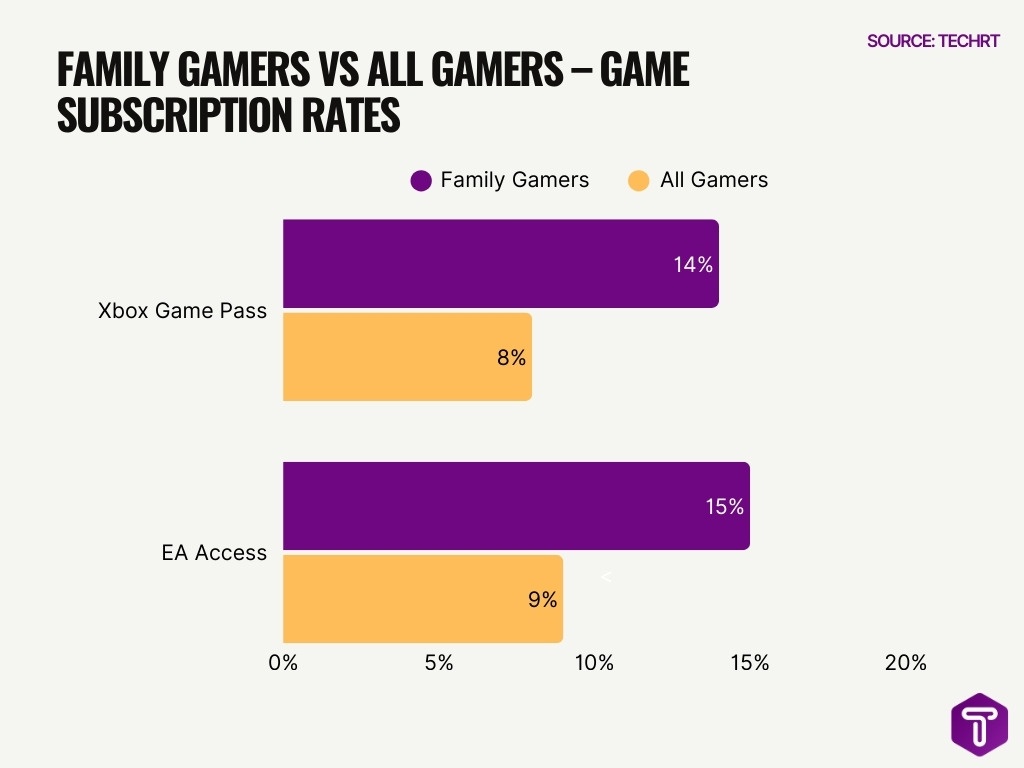

Family Gamers Are More Likely to Subscribe to Game Services

- Family gamers show significantly higher adoption of gaming subscription services compared to the broader gaming population.

- 14% of family gamers subscribe to Xbox Game Pass, nearly double the 8% subscription rate seen among all gamers.

- EA Access records the highest uptake among family gamers at 15%, outperforming the 9% adoption rate across the overall gamer base.

- Across both platforms, family gamers consistently lead by a 6 percentage-point margin, highlighting stronger engagement with subscription models.

- The data indicates that family-focused households are more inclined toward value-driven, recurring game subscriptions that offer shared access and diverse content libraries.

Mobile Gaming Statistics

- Mobile gaming generated $125 billion in revenue in 2025, marking a 9% year-over-year growth.

- Mobile gaming accounted for ~49% of global gaming revenue in 2024.

- There are 3.3 billion active mobile gamers worldwide in 2025.

- Global mobile game downloads reached 50.4 billion in 2025, down 7.2% YoY.

- Strategy games led with $13 billion in revenue, topping RPGs at $11 billion in 2025.

- Asia Pacific held the largest share at over 50% of mobile gaming revenue in 2024-2025.

- Android captured over 70% of mobile gaming downloads as of 2025.

- The U.S. generated $25.5 billion in mobile gaming revenue in 2024.

- The subscription-based gaming market reached $12.94 billion in 2025.

- Mobile gamers logged 444.63 billion hours of gameplay in 2025, up 0.9% YoY.

- Mid-core games collected $44.68 billion, the highest genre revenue in 2025.

Cloud vs Download Models

- Download‑to‑device subscription models held ~60%+ of subscription market share in 2025.

- Cloud gaming markets are poised for rapid expansion, from $3.34 billion in 2024 to an estimated $40.20 billion by 2031.

- Cloud gaming services reduce hardware dependency, pushing subscriptions to lower‑end devices.

- Cloud adoption growth rates outpace traditional download services in several regions.

- Subscription bundles that include cloud access increase user flexibility and choice.

- Cloud streaming can expand market reach in areas with weaker console/PC penetration.

- Hybrid models let gamers download titles and stream others without local installs.

- Cloud is particularly strong for mobile and tablet platforms with limited local storage.

- Latency and network quality remain key adoption factors for cloud gaming subscriptions.

- Cloud‑based subscription revenue is forecast to grow at a two‑digit CAGR through 2031.

Top Services Performance

- PlayStation Plus commands 51.6 million subscribers in early 2025.

- Xbox Game Pass reached 37 million subscribers throughout 2025.

- PlayStation Plus generates $3.8 billion in revenue, surpassing Xbox Game Pass.

- Subscription services account for 30% of console companies’ content revenue.

- Essential tier holds 55%, Extra 23%, and Premium 22% of PS Plus subscribers.

- Game Pass Ultimate drives 68% of total Xbox subscription revenue.

- Engagement metrics show 2.5x active users over total subscribers for top services.

- Cloud gaming boosts performance by 40% in subscription retention rates.

- Free trials achieve 45% conversion to paid subscriptions industry-wide.

- Exclusive titles increase renewal rates by 35% during launch windows.

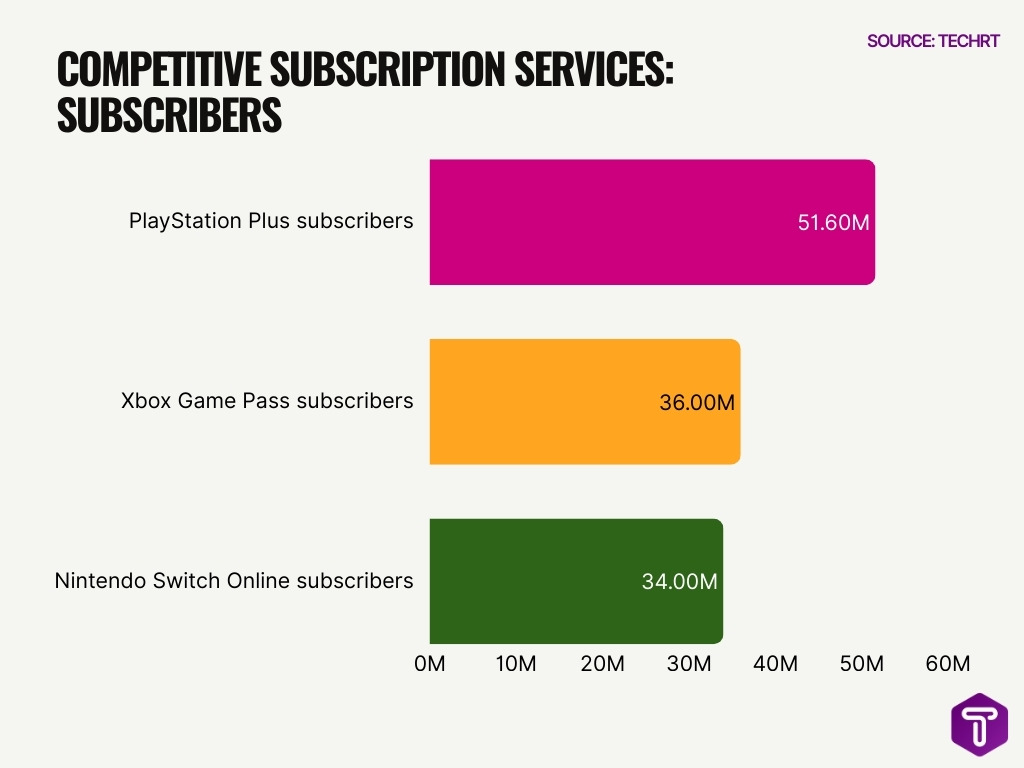

Competitive Landscape Analysis

- PlayStation Plus commands 51.6 million subscribers, dwarfing rivals in the competitive landscape.

- Xbox Game Pass trails with 35-37 million subscribers as of mid-2025.

- Nintendo Switch Online maintains ~34 million paying members despite a year-over-year dip.

- EA Play boasts ~13 million active players across platforms.

- US gamers poured $3.6 billion into Game Pass and PlayStation Plus subscriptions in 2025 YTD.

- The gaming subscription services market hit $27.67 billion in 2025, eyeing 13.4% CAGR.

- Gaming subscriptions face 5-9% monthly churn rates industry-wide.

- Cloud gaming sector valued at $15.74 billion in 2025, surging 26.8% annually.

- PlayStation Plus generated $3.8 billion in annual revenue, 33% of PSN services.

- Total gamers in subscriptions exceed 120 million worldwide.

Xbox Game Pass Stats

- As of early 2025, Xbox Game Pass had grown to about 37 million subscribers, up roughly 12 % year‑on‑year from previous periods.

- Game Pass remains one of the fastest‑growing game subscription services in the world, consistently adding millions of players annually.

- Microsoft reported that Game Pass contributed nearly $5 billion in annual revenue in the 12 months ending June 2025, a record for the service.

- Game Pass users tend to play broadly; subscribers averaged access to roughly 18 different titles per year in 2024.

- Cloud play engagement for Game Pass has increased significantly, with 45 % more hours streamed year‑over‑year on the service by late 2025.

- Game Pass now offers tiered plans, Essential, Premium, and Ultimate, aimed at different player types, including day‑one access to major releases at the highest tier.

- The Ultimate tier price rose to $29.99 per month in late 2025, a 50 % hike from previous pricing, but with expanded benefits like Ubisoft+ Classics and Fortnite Crew.

- Expansion of cloud gaming access into all major Game Pass tiers has broadened reach beyond consoles to PC and mobile/cloud devices.

- Xbox reported approximately 500 million monthly active users across its gaming platforms in mid‑2025, underscoring Game Pass’s ecosystem influence, though not all are subscribers.

PlayStation Plus Stats

- PlayStation Plus retained the largest subscriber base among gaming subscription services in early 2025 with about 51.6 million subscribers worldwide.

- The service benefits from mandatory subscription requirements for online multiplayer on PlayStation consoles.

- PlayStation Plus has multiple tiers: Essential, Extra, and Premium, adding games, cloud storage, and classic titles as tier benefits.

- As of mid‑2025, roughly 23.7 million gamers held Premium or higher PlayStation Plus subscriptions.

- Active monthly PlayStation Network users hovered around 123 million in mid‑2025, supporting a deep subscriber base.

- PlayStation Plus contributed substantially to Sony’s service revenues, which grew alongside gaming hardware and software sales through 2025.

- Quarterly PlayStation Plus additions often spike in line with blockbuster exclusives and seasonal game drops.

- PlayStation Plus Premium’s cloud streaming of select titles enhances library access without local installation.

- PlayStation Plus subscriber growth continues despite competitive pressure from Xbox Game Pass’s bundled ecosystems.

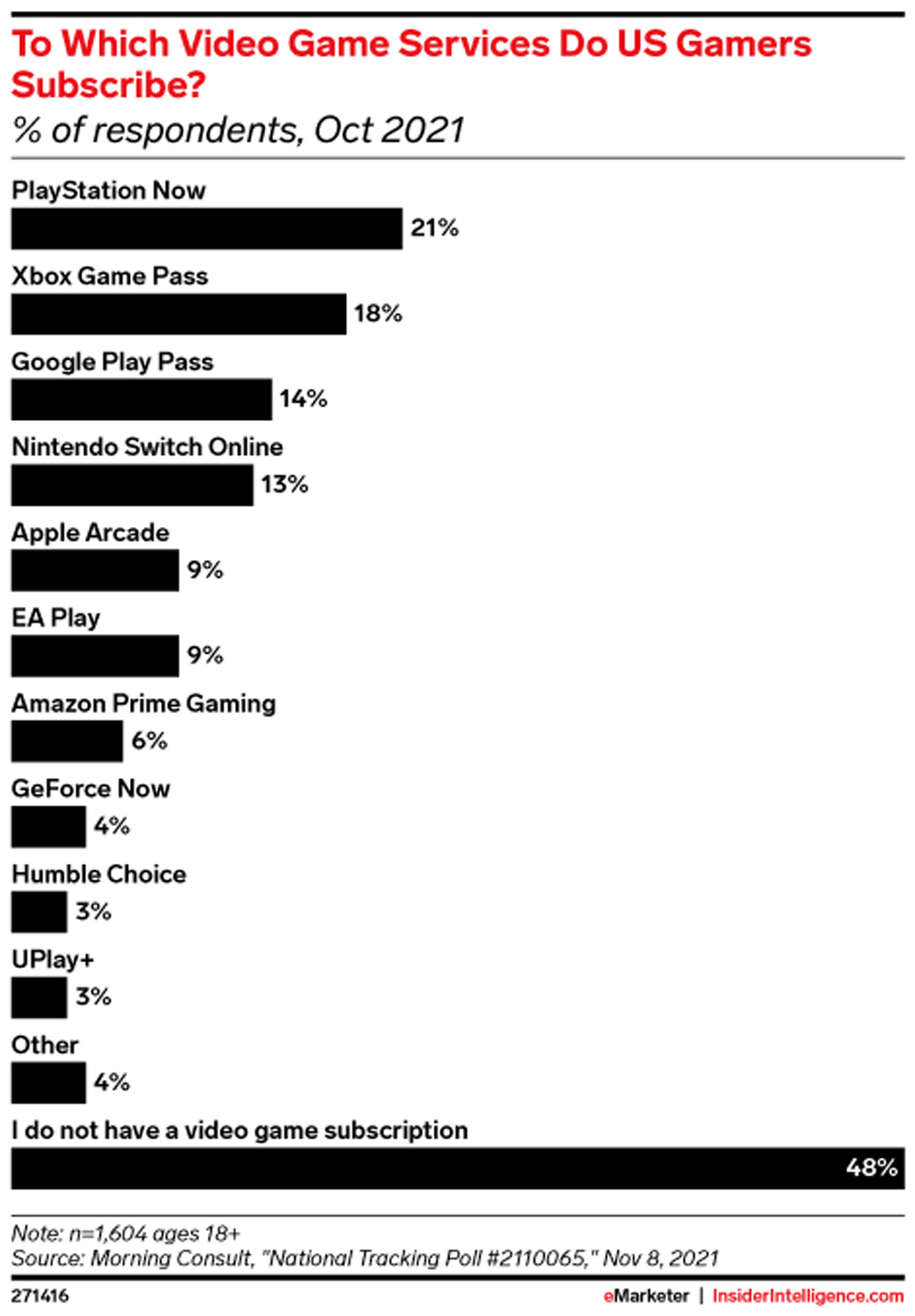

U.S. Video Game Subscription Trends

- Nearly half of U.S. gamers (48%) reported that they do not subscribe to any video game service, highlighting a large untapped subscription market.

- PlayStation Now leads the market at 21%, making it the most subscribed video game service among U.S. gamers.

- Xbox Game Pass follows closely with 18%, reinforcing its position as a strong competitor in the subscription gaming space.

- Google Play Pass accounts for 14% of subscriptions, showing solid adoption in the mobile gaming segment.

- Nintendo Switch Online reaches 13%, reflecting steady demand from console-focused gamers.

- Apple Arcade and EA Play each hold 9%, indicating moderate but meaningful engagement with publisher-backed gaming services.

- Amazon Prime Gaming attracts 6% of respondents, suggesting gaming is a secondary benefit rather than a primary subscription driver.

- Cloud gaming services remain niche, with GeForce Now at 4%, signaling early-stage adoption in 2021.

- Humble Choice and UPlay+ each register 3%, underscoring their limited reach compared to mainstream platforms.

- Smaller or alternative services collectively account for 4%, pointing to a fragmented long-tail of gaming subscriptions.

Demographic Usage Patterns

- Approximately 35–40 % of active gamers worldwide used at least one gaming subscription service in 2025.

- Millennials captured the largest segment of subscription market share (~45 %) in 2025, with Gen Z usage rising fast.

- North American gamers lead in subscription spending and adoption rates compared with other regions.

- Subscription adoption tends to be higher among players aged 18 – 34 than in older age brackets, reflecting digital‑first preferences.

- Console owners more frequently subscribe to services than PC‑only gamers, tied to multiplayer access perks.

- Cloud gaming uptake skews younger, especially among mobile gamers without consoles or high‑end PCs.

- Urban and high‑income demographics show higher subscription penetration rates.

- Casual gamers often use basic/essential tiers, while dedicated players gravitate toward premium plans.

- Subscription lifecycle data indicates higher retention where services provide continual new content and cloud features.

Growth Drivers and Trends

- The subscription-based gaming market reached $11.53 billion in 2024, projected to hit $24.18 billion by 2030 at 13.3% CAGR.

- Xbox Game Pass cloud gaming engagement surged 45% year-over-year in 2025.

- Xbox Game Pass grew to over 35 million subscribers by mid-2025, up from 34 million in 2024.

- Day-one Game Pass launches boost large publishers’ daily active users by 3.5x in the first 30 days.

- Cross-platform gaming sees 72% of global gamers playing on two or more platforms.

- 5G rollout enables sub-20ms latency for cloud gaming, driving adoption.

- India’s online gaming market expanded 23% YoY to US$ 3.8 billion in FY24.

- Asia game subscription revenue forecast to grow from $6.5 billion in 2025 to $9.4 billion by 2029.

- Live events in subscriptions retain over 75-85% of new users post-event.

Frequently Asked Questions (FAQs)

How large is the global gaming subscription market as of 2025?

The global gaming subscription market was valued at about $11.53 billion in 2024 and is projected to be roughly $12.9–$13.0 billion by the end of 2025.

How many gamers worldwide subscribe to gaming services?

Over 120 million gamers subscribe to gaming services globally, representing about 35% of the active gamer population as of 2025.

What is the expected growth rate (CAGR) for gaming subscriptions through 2030?

The subscription‑based gaming market is expected to grow at a CAGR of about 13.3%–13.4% between 2025 and 2030/2035.

How many subscribers do leading gaming subscription services have?

PlayStation Plus had approximately 51.6 million subscribers in Q1 2025, while Xbox Game Pass had around 37 million subscribers in 2025.

How much revenue did Xbox Game Pass generate recently?

Xbox Game Pass reached nearly $5 billion in annual revenue over 12 months ending mid‑2025.

Conclusion

The gaming subscription landscape stands at a pivotal juncture, driven by robust subscriber growth, evolving tier structures, and a competitive push between industry giants like Xbox Game Pass and PlayStation Plus. Subscription adoption now touches a substantial share of global players, especially among younger and urban demographics, and continues to reshape how games are played, monetized, and marketed. With cloud gaming engagement rising sharply and forecasts suggesting continued expansion through the decade, subscriptions will remain central to gaming’s business models.

As platforms innovate and users demand flexibility and value, the future of gaming subscriptions will be defined by diversity, inclusivity, and seamless play experiences across devices.

Leave a comment

Have something to say about this article? Add your comment and start the discussion.