Short‑form video content has reshaped social interaction, entertainment, and brand marketing. Both TikTok and Instagram Reels continued to dominate how people consume mobile video, driving billions of views and engagement moments daily. Instagram Reels attracts attention within the broader Instagram ecosystem, while TikTok fuels viral discovery and trend propagation. This dynamic affects influencers, brands, and advertisers across industries, from retail campaigns to political messaging. Explore this article to understand the latest data shaping the TikTok vs. Reels landscape.

Editor’s Choice

- In 2025, 35% of all time spent on Instagram was dedicated to Reels.

- TikTok reached 1.88 billion monthly active users by 2025.

- Instagram’s platform surpassed 3 billion monthly users in 2025.

- Instagram Reels are played over 200 billion times per day across Meta’s platforms.

- TikTok users spend an average of 60–95 minutes daily on the app.

- Instagram posts integration with Reels now accounts for 35% of in‑app time spent.

- TikTok engagement rates remain significantly higher than Reels on average.

Recent Developments

- Meta’s Instagram reached 3 billion monthly active users, propelled by Reels integration.

- Instagram launched an iPad app focused on Reels to directly compete with TikTok.

- Instagram expanded Reels recording limits up to 3 minutes, enhancing content flexibility.

- TikTok remains under regulatory scrutiny in several markets, influencing platform strategy.

- Instagram experimented with creator incentives of up to $50K/month to attract talent from TikTok.

- Reels resharing on Meta platforms now exceeds 4.5 billion shares daily.

- Instagram’s Reels algorithm prioritizes content for users within the existing follower network.

- TikTok continues algorithmic personalization that drives viral reach globally.

TikTok vs Instagram Reels Key Statistics

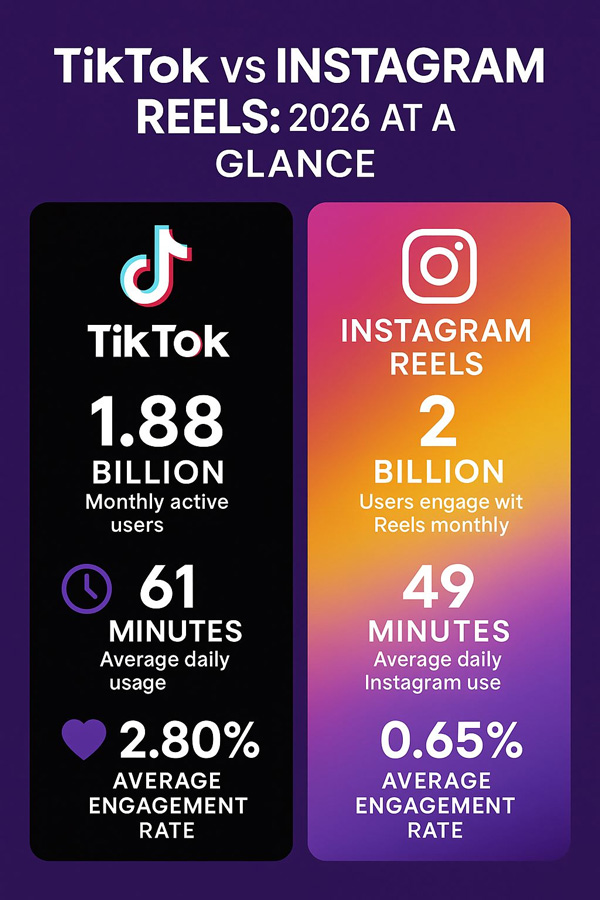

- TikTok reaches 1.88 billion monthly active users, highlighting its massive and highly engaged global audience.

- Instagram Reels records 2 billion users engaging monthly, giving it a slight lead in overall reach among short-form video platforms.

- TikTok users spend an average of 61 minutes per day, indicating deeper daily content consumption and stronger user stickiness.

- Instagram users spend around 49 minutes per day on the platform, reflecting solid but comparatively lower daily engagement.

- TikTok delivers a 2.80% average engagement rate, showcasing significantly higher interaction with short-form content.

- Instagram Reels reports a 0.65% average engagement rate, pointing to lower engagement intensity despite its broader user base.

- TikTok’s engagement rate is over four times higher than Instagram Reels, making it more effective for driving interactions.

- TikTok outperforms Instagram Reels in time spent and engagement, while Instagram Reels leads in total user reach.

Engagement Rates

- TikTok’s short‑form videos maintain high engagement rates, projected above 3% in 2025.

- Instagram Reels hold lower typical engagement, around 0.65% average.

- Some comparisons show TikTok video engagement near 7.4%, above Reels at ~4.3%.

- TikTok accounts between 100K–500K followers saw ~9.74% engagement vs Reels’ ~6.59%.

- Instagram overall saw an approximate 0.45% engagement rate in early 2025.

- Reels deliver more consistent comment interaction than other post formats on Instagram.

- TikTok often reports 20–30% higher interaction volume per post than Reels.

- Industry benchmarks indicate short‑form video engagement remains one of the highest across social platforms.

Comments per Video

- TikTok’s average comments per video grew significantly in recent years, reflecting rising user interaction per piece of content.

- In 2024, TikTok averaged ~66 comments per post, up ~74% from the previous year.

- Instagram Reels showed smaller gains, going from ~18 to ~24 comments per Reel from 2023–24.

- TikTok’s comment growth indicates greater user willingness to respond directly to content.

- Reels’ comment rates remain lower, though still valuable for community growth.

- Some creators note TikTok comments often spark trend extensions (like remix challenges), enhancing visibility.

- Instagram’s comment distribution tends to be more follower‑centric rather than discovery‑driven.

- Platforms with deeper engagement comments often see longer content lifespan.

Shares per Post

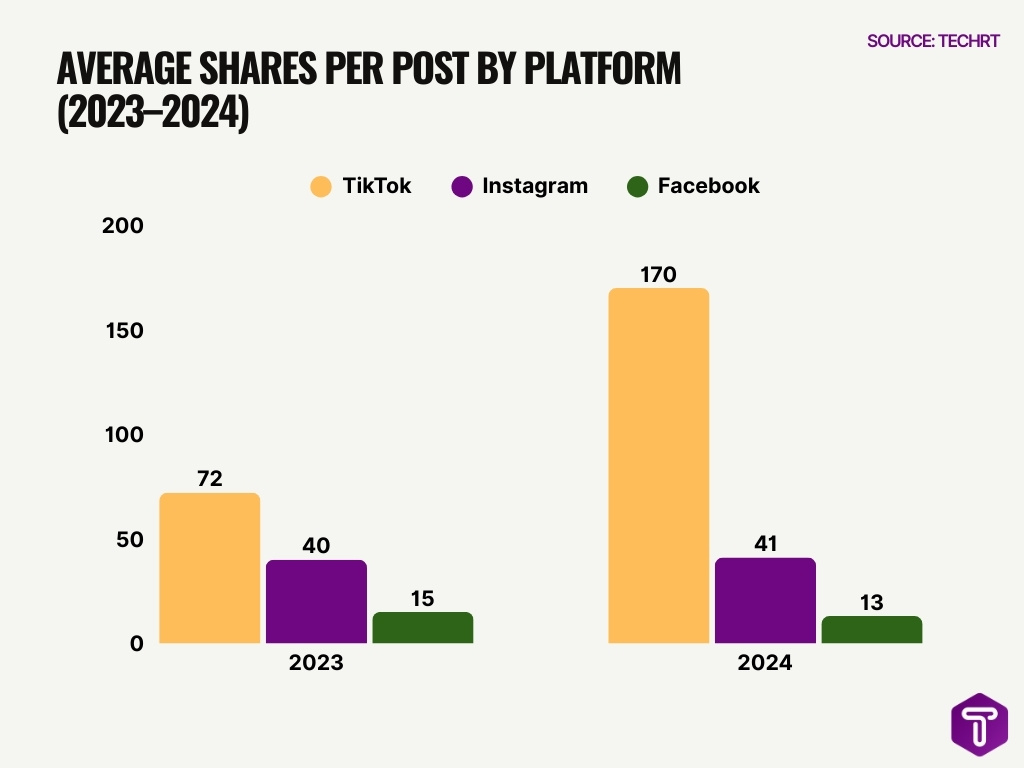

- TikTok users averaged ~170 shares per post in 2024, quadrupling Facebook’s ~13.

- Instagram shares per post edged up from ~40 to ~41 between 2023-2024.

- TikTok’s share count more than doubled from 72 in 2023 to 170 in 2024.

- Facebook shares per post declined from 15 in 2023 to 13 in 2024.

- TikTok’s engagement rate hit 2.50% in 2024, leading social platforms.

- Instagram’s engagement rate dropped to 0.50% in 2024 from 0.70% prior.

- TikTok comments per post surged 73.7% to 66 in 2024.

- Instagram comments rose 33.3% to 24 per post in 2024.

- Brands on TikTok see 4x higher engagement per follower than on Instagram.

Reach and Impressions

- Instagram Reels deliver an average reach rate of ~30.8%, higher than many traditional post types.

- Reels typically outperform static images and carousels in both reach and impressions.

- TikTok’s reach is powered by its For You feed, which often exposes content to non‑followers.

- Some industry comparisons show Instagram Reels ads achieve broader named reach due to the Meta ecosystem’s scale.

- TikTok’s algorithmic reach often leads to high first‑time discovery rates for new creators.

- Brands using both platforms often combine Reels for reach and TikTok for virality.

- On average, short‑form videos across platforms are responsible for 90% of global internet traffic by 2025.

- Higher reach translates to increased impression counts on both platforms compared to static content.

Video Lengths

- TikTok videos 15-30 seconds achieve the highest completion rates and share rates.

- 86% of TikTok videos are under 1 minute, yet longer ones get 63.8% more watch time.

- Instagram Reels under 15 seconds boast a 57% completion rate, dropping to 36% over 60 seconds.

- Reels 60-90 seconds deliver the highest engagement rates and 24% more shares.

- Videos under 90 seconds retain 50% of viewers on short-form platforms.

- TikTok 20-30 second videos retain viewers 37% longer than those over 1 minute.

- Mid-length 30-60 second TikTok videos balance reach with 6.9 seconds median watch time.

- 15-second Reels target 60-70% retention, while 60+ second ones achieve 30-40%.

Editing Tools

- TikTok’s integrated editor allows on‑platform video trims, filters, effects, and audio syncing, powering viral trends.

- Instagram launched Edits, a dedicated short‑form editing companion app with AI features and green‑screen tools.

- Edits gained 5+ million downloads in its first 4 days, showing strong creator interest.

- Both platforms support stickers, AR effects, transitions, and text overlays, catering to creative needs.

- TikTok’s editor remains popular for trend reshaping and remixing clips.

- Reels’ editor is favored for brand polish and caption integration.

- External tools like CapCut (for TikTok) and third‑party editors remain widely used for advanced effects.

- Editing sophistication often boosts watch time and shareability on both platforms.

Instagram vs. TikTok Age Demographics Breakdown

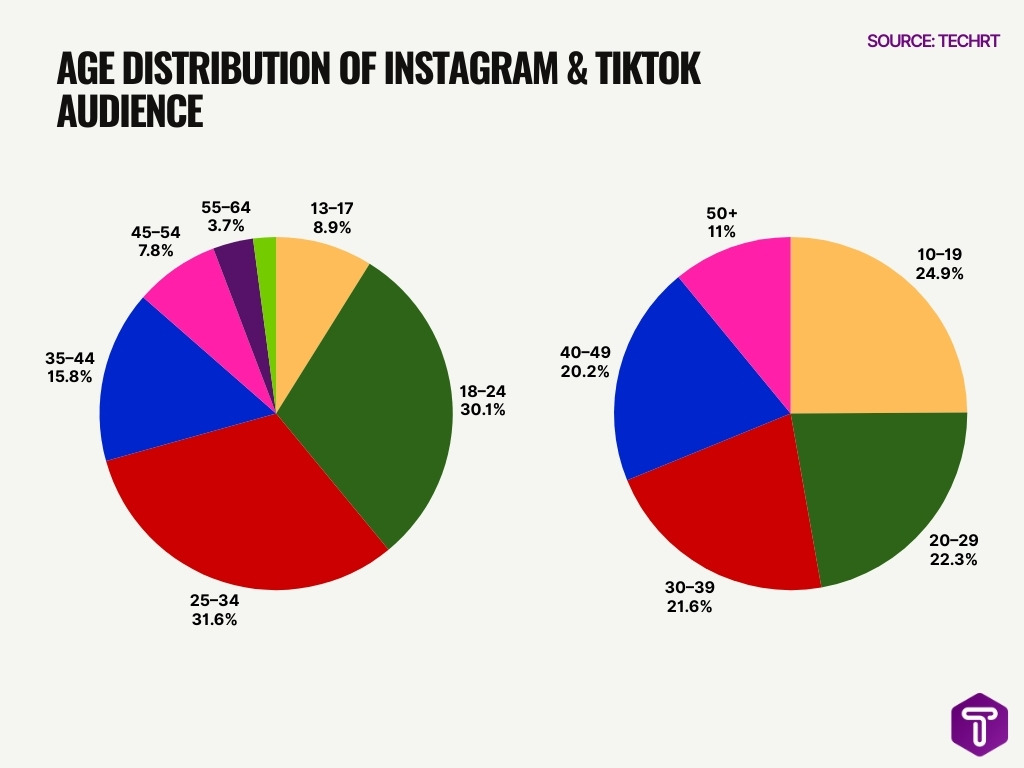

- Instagram’s largest user segment is aged 25–34, accounting for 31.7% of its global audience, making it the platform’s core demographic.

- Users aged 18–24 represent 30.2% of Instagram’s audience, highlighting the platform’s strong appeal among Gen Z and young Millennials.

- Teen users (13–17) make up 8.9% of Instagram users, indicating a smaller but still notable teenage presence.

- Adults aged 35–44 account for 15.8% of Instagram’s user base, showing solid engagement among mid-career professionals.

- Older age groups on Instagram decline sharply, with 45–54 at 7.8%, 55–64 at 3.7%, and 65+ at just 2.1%.

- TikTok is most popular among users aged 10–19, who represent 25.0% of its total audience, reinforcing its strong Gen Z dominance.

- Young adults aged 20–29 account for 22.4% of TikTok users, keeping the platform highly attractive to college-age users and early professionals.

- The 30–39 age group contributes 21.7%, signaling TikTok’s rapid adoption among Millennials.

- Users aged 40–49 make up 20.3%, demonstrating TikTok’s growing penetration into older demographics.

- Adults aged 50+ represent 11.0% of TikTok’s audience, indicating broader age diversification compared to earlier years.

- Instagram skews toward young and mid-age adults, while TikTok shows a more evenly distributed audience across age groups.

- TikTok captures younger users earlier, whereas Instagram maintains stronger retention in the 25–34 age bracket.

- Advertisers targeting Gen Z may find TikTok more effective, while brands focused on Millennials and working professionals benefit more from Instagram.

Algorithm Differences

- TikTok assigns 1 point for likes, 2 for comments, 3 for shares, 4 for completion, and 5 for rewatches in its algorithm.

- 55% of Instagram Reels views come from non-followers, prioritizing discovery over loyal networks.

- TikTok’s For You feed receives 80% of engagement within the first few hours post-upload.

- Instagram Reels influencers achieve 2.08% engagement rates, the highest among content formats.

- TikTok’s engagement rate dropped 26% since 2022, intensifying the For You page competition.

- Reels account for 50% of time spent on Instagram, driving 24% usage increase.

- TikTok surfaces videos to 300 initial viewers; 50 points needed for broader promotion.

- 65-80% of Reels reach comes from non-followers via algorithmic testing.

- Instagram’s Your Algorithm lets users tweak Reels signals for instant personalization.

Advertising Metrics

- In 2025, Reels video ads averaged roughly 5.2% engagement rates vs TikTok’s 6.8%.

- Instagram typically delivers higher conversion efficiency and direct sales performance.

- TikTok generally leads in ad virality and interaction, especially with younger demos.

- Reels ads often show lower CPM and CPC costs, appealing to cost-focused marketers.

- TikTok’s ad platform invests in trend-triggered formats, boosting discoverability.

- Instagram’s broader placement options across Meta apps expand impression potential.

- Both platforms support shopping-centric ad formats, blending ecommerce with video.

- Advertisers combine TikTok for awareness and Reels for conversion metrics.

Most Watched Videos

- TikTok users watch an average of 265 videos per day, compared to 177 on Instagram Reels in 2025, highlighting a substantial difference in consumption volume.

- Reels and TikTok each dominate short‑form viewing, with Reels hitting over 200 billion daily plays across Instagram and Facebook.

- On average, Reels account for ~35% of all Instagram usage time, reinforcing its central role in video engagement.

- TikTok’s top trending videos regularly exceed 100 million views within hours of posting, due to its algorithmic reach.

- Instagram Reels’ most-watched clips often cross the 10 million view threshold, especially when shared across Meta’s platforms.

- Viral TikTok content spreads faster globally because discovery isn’t restricted to followers.

- Reels perform strongly in niche interest communities, boosting cumulative views among dedicated segments.

- Cross‑platform reposts frequently drive additional views, from TikTok to Reels and vice versa.

Instagram Reels vs. TikTok: Median Video Views Worldwide

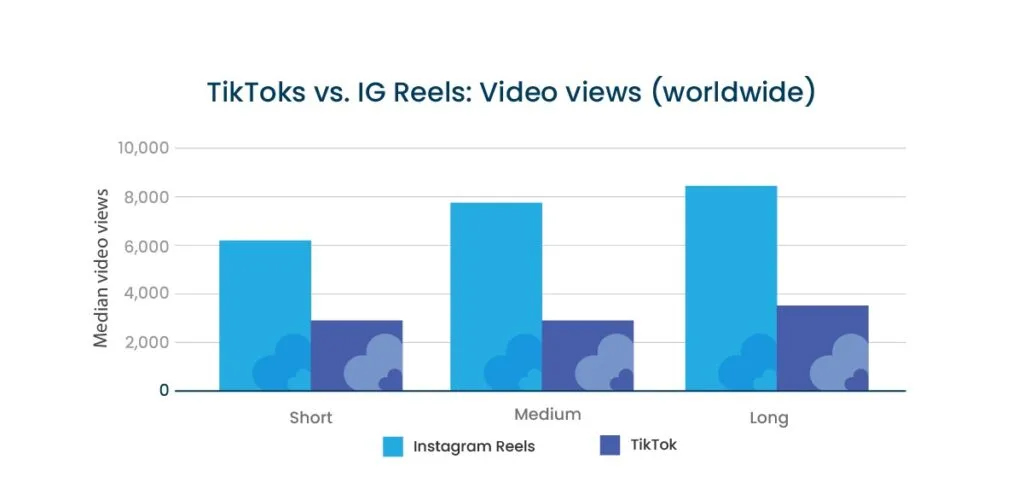

- Instagram Reels consistently outperform TikTok across all video lengths, delivering 2× to 3× higher median video views globally.

- Short Instagram Reels generate 6,200 median views, compared to 2,800 views on TikTok, highlighting a strong early-engagement advantage for Reels.

- Medium-length Reels average 7,900 views, while TikTok remains nearly flat at 2,900 views, showing limited scalability on TikTok for mid-length content.

- Long Instagram Reels perform best overall, reaching 8,600 median views, significantly ahead of TikTok’s 3,500 views.

- Instagram Reels show a clear upward trend with video length, indicating that longer content benefits more from Instagram’s distribution algorithm.

- TikTok’s median views increase only marginally from short to long videos, suggesting weaker incremental reach gains as content length increases.

- The data indicates that Instagram Reels favor longer-form vertical videos, making them more effective for sustained visibility and reach.

Brand & Creator Adoption Trends

- Brands report 32% higher ROI on influencer campaigns with TikTok vs. Instagram.

- TikTok delivers 1.74 ROAS compared to Instagram’s 1.61 in ad spend returns.

- Fashion brands allocate 10-20% of marketing budgets to social campaigns, split between TikTok awareness and Instagram conversions.

- Micro-influencers achieve 7.5% engagement on TikTok vs. 3.65% on Instagram for under 100k followers.

- Only 20.7% of Instagram creators post Reels regularly despite 140 billion daily views.

- Meta offers $10,000-$50,000 monthly bonuses to lure TikTok influencers to Reels.

- TikTok UGC posts gain 70% more engagement than brand content on Instagram.

- Shoppable Instagram Reels drive 22% higher engagement and 30% sales uplift.

- TikTok Creator Rewards pay $0.40-$1.00 per 1,000 views, accessible to most creators.

Content Lifespan & Long‑Tail Reach

- TikTok videos receive 72% of total views on day one, with 35 days to reach 95% lifetime views.

- 80% of TikTok engagement occurs within the first few hours, yet resurfacing extends visibility for weeks.

- Instagram Reels take 70-75 days to accumulate 95% of lifetime views via Explore recommendations.

- Long-tail views on TikTok often exceed 50% of total plays after the first 24 hours for viral content.

- TikTok post half-life averages 9.67 days in 2025, enabling prolonged For You Page distribution.

- Reels achieve 2x impressions of other formats, persisting 14+ days in feeds and shares.

- Niche TikTok videos gain traction over weeks through hashtag and sound resurfacing mechanisms.

- Meta’s AI recommendations boost Reels watch time by 8-10%, enhancing long-tail performance.

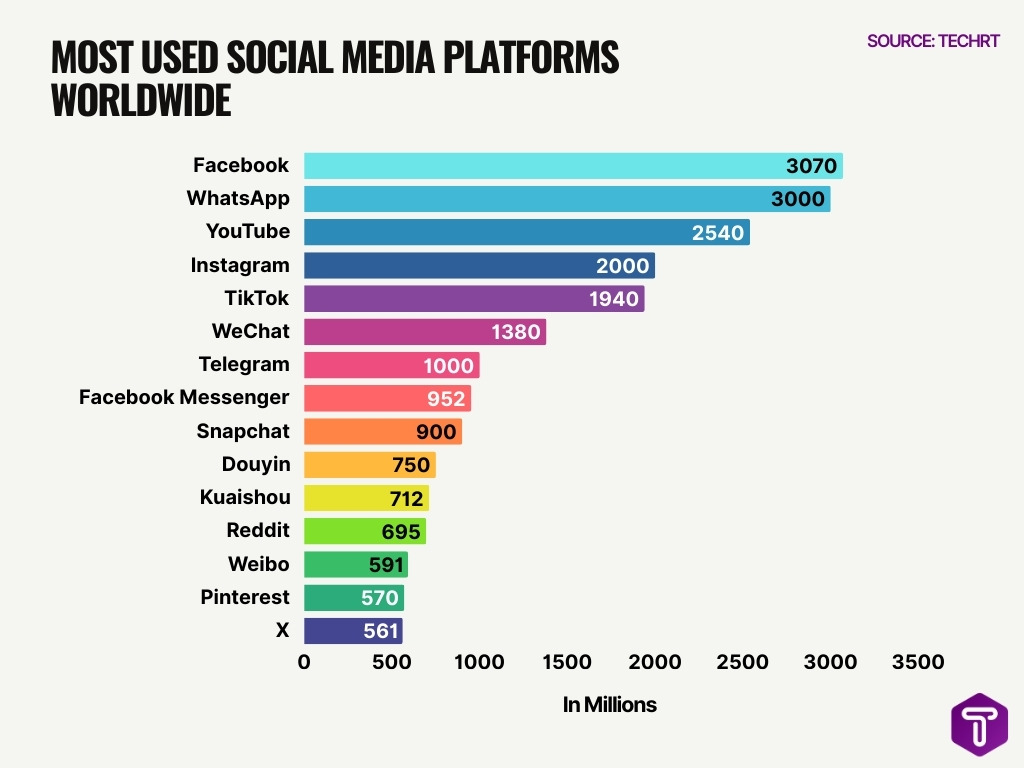

Most Used Social Media Platforms Worldwide

- Facebook leads the global social media landscape with 3,070 million active users, making it the largest platform worldwide by reach.

- WhatsApp follows closely with 3,000 million users, highlighting the massive global adoption of private messaging.

- YouTube records 2,540 million active users, reinforcing its position as the dominant global video platform.

- Instagram reaches 2,000 million users, driven by visual content, Reels, and influencer ecosystems.

- TikTok amasses 1,940 million active users, underscoring its rapid growth and short-form video dominance.

- WeChat serves 1,380 million users, functioning as a super-app for messaging, payments, and services in China.

- Telegram surpasses 1,000 million users, reflecting growing demand for privacy-focused communication platforms.

- Facebook Messenger maintains 952 million active users, remaining a key player in instant messaging despite platform overlap.

- Snapchat engages 900 million users, with particularly strong traction among Gen Z and younger audiences.

- Douyin records 750 million active users, highlighting the scale of China’s domestic short-video market.

- Kuaishou attracts 712 million users, competing closely with Douyin in China’s short-form video ecosystem.

- Reddit reaches 695 million active users, driven by community-based discussions and interest-focused forums.

- Weibo reports 591 million users, remaining influential in China’s real-time news and social commentary space.

- Pinterest counts 570 million active users, performing strongly in visual discovery, shopping, and inspiration-led search.

- X records 561 million users, maintaining relevance in real-time news, politics, and public discourse.

Monetization Opportunities

- TikTok’s global ad revenue forecast for 2026 is ~$34.8 billion, with U.S. revenue surpassing $17 billion.

- Instagram generated an estimated $66.9 billion in revenue in 2024, forming a significant base for Reels monetization.

- Both platforms support paid partnerships, live gifts, and ecommerce integrations for creators.

- TikTok’s creator fund and ad revenue share programs continue to grow, incentivizing high‑quality content.

- Instagram’s commerce features tie Reels directly to in‑app shopping and product tagging.

- Sponsored content on TikTok frequently commands higher engagement‑driven payouts for brands.

- Creators often combine affiliate links and direct product sales to diversify income beyond platform revenue shares.

- Emerging formats like paid subscriptions and premium content provide additional monetization for both platforms.

Regional Usage Patterns

- Indonesia boasts 108 million TikTok users aged 18+, reaching 53.5% of adults.

- Vietnam has 70 million monthly active TikTok users, fueling Southeast Asia‘s 460 million total.

- Southeast Asia TikTok penetration surges with 160 million users in Indonesia alone.

- Instagram commands 185 million US users, 53.5% of the population.

- 76% of US adults aged 18-29 actively use Instagram.

- India leads Instagram Reels with 363 million viewers, dominating Tier 2/3 growth.

- TikTok captures 36.2% of global users as Gen Z (18-24 years).

- 60% of TikTok‘s downloads come from Gen Z worldwide.

- Brazil drives Latin America with 141 millionInstagram users for Reels expansion.

- Urban US sees 55%Instagram usage vs 37% in rural areas.

Platform Growth Trends

- TikTok reached ~1.59–1.67 billion monthly active users by 2025 and continues steady growth.

- Instagram’s total platform user base surpassed 3 billion monthly active users.

- Reels accounts for a growing share of Instagram usage time, approaching 40%+ of on‑app engagement.

- Daily short‑form consumption trends continue upward across both platforms.

- TikTok’s unique user growth remains robust, particularly among under‑35 users.

- Instagram’s expansion into integrated commerce and video shopping supports sustained Reels growth.

- The ongoing short‑form video boom is expected to account for a majority of overall social media engagement by 2026.

- Competitive pressure from video formats like YouTube Shorts pushes both platforms to innovate feature sets.

Frequently Asked Questions (FAQs)

How many monthly active users does TikTok have compared to Instagram (including Reels)?

TikTok reached 1.88 billion monthly active users globally by 2025, while Instagram surpassed 3 billion total monthly active users.

What percentage of time is spent on Instagram dedicated to Reels?

Instagram Reels now account for 35% of all time spent on the app.

How do engagement rates compare between TikTok and Instagram Reels?

For accounts with 100,000–500,000 followers, TikTok’s engagement rate was ~9.74% compared to Instagram Reels’ ~6.59%.

What is the typical daily usage time for TikTok vs. Instagram users?

TikTok users spend about 60–95 minutes daily on the platform, roughly 10–30 minutes more than the average Instagram user.

How many people interact with Instagram Reels each month, and how many Reels are played daily?

More than 2 billion people interact with Reels monthly, and over 200 billion Reels are played daily across Instagram and Facebook.

Conclusion

Instagram Reels and TikTok now stand as pillars of the short‑form video era. Statistically, TikTok holds an edge in daily consumption and viral reach, while Reels benefit from Instagram’s vast user base and commercial ecosystem. Brands and creators increasingly adopt hybrid strategies that leverage both platforms to balance awareness and conversion goals. Regional preferences and monetization models continue to evolve, underscoring that short‑form video is not a fad but a mainstay of global digital engagement. As video formats compete and grow, understanding where your audience watches and interacts, and why, will shape content success in the year ahead.

Leave a comment

Have something to say about this article? Add your comment and start the discussion.