User retention defines how many users keep returning to an app after install. It remains the key metric that separates hit apps from those that fade fast. With the average mobile app seeing steep drop‑offs after install, retention data reveals whether users find real value in an experience or lose interest within days. Higher retention leads to stronger revenue, better user lifetime value (LTV), and healthy app growth. For developers and marketers, understanding retention isn’t just technical; it’s essential for sustainable success in a crowded market. In this article, we break down the latest iOS app retention statistics and benchmarks, helping you benchmark performance and uncover actionable insights.

Editor’s Choice

- Average Day 1 retention for mobile apps globally ~26% in 2026 benchmarks.

- iOS users show higher Day 1 retention (~27%) vs Android (~24%).

- Average Day 30 retention across apps hovers at ~7%.

- iOS retention at Day 30 can be 3–4%, indicating strong stickiness.

- Apps lose ~77% of daily active users within 3 days after install.

- Organic installs yield higher retention at 30 days than paid installs.

- Retention varies sharply by app category, with finance and news often outperforming others.

Recent Developments

- The median Day 1 retention benchmark has stabilized at around 26–27% globally in early 2026.

- New retention strategies focus on onboarding, personalization, and value delivery within the first session.

- iOS continues to outperform Android in retention, likely due to ecosystem consistency and user behavior trends.

- Early 2026 data shows retention rates plateau for many categories, signaling a need for deeper engagement tactics.

- Industry reports indicate retention improvements tied to push notifications and in‑app messaging.

- Increased focus on cohort analysis helps teams diagnose early drop‑offs by user source or campaign.

- Retention continues to be a more valuable metric than installs for measuring app health and product‑market fit.

- Privacy changes and tracking limitations affect how retention data is collected and interpreted.

iOS App Retention Overview

- Retention measures how many users return to an app after install over specific time windows.

- Most retention tracking focuses on Day 1, Day 7, and Day 30 after installation.

- Day 1 retention reflects first impressions and onboarding success.

- Day 7 retention shows habit formation and early engagement.

- Day 30 retention indicates long‑term value and product stickiness.

- Across all platforms, retention typically drops steeply in the first week.

- Apps with strong network effects or habitual use tend to retain users better.

- High retention often correlates with robust in‑app engagement strategies.

- Cohort analysis helps benchmark retention by install date, campaign, or user segment.

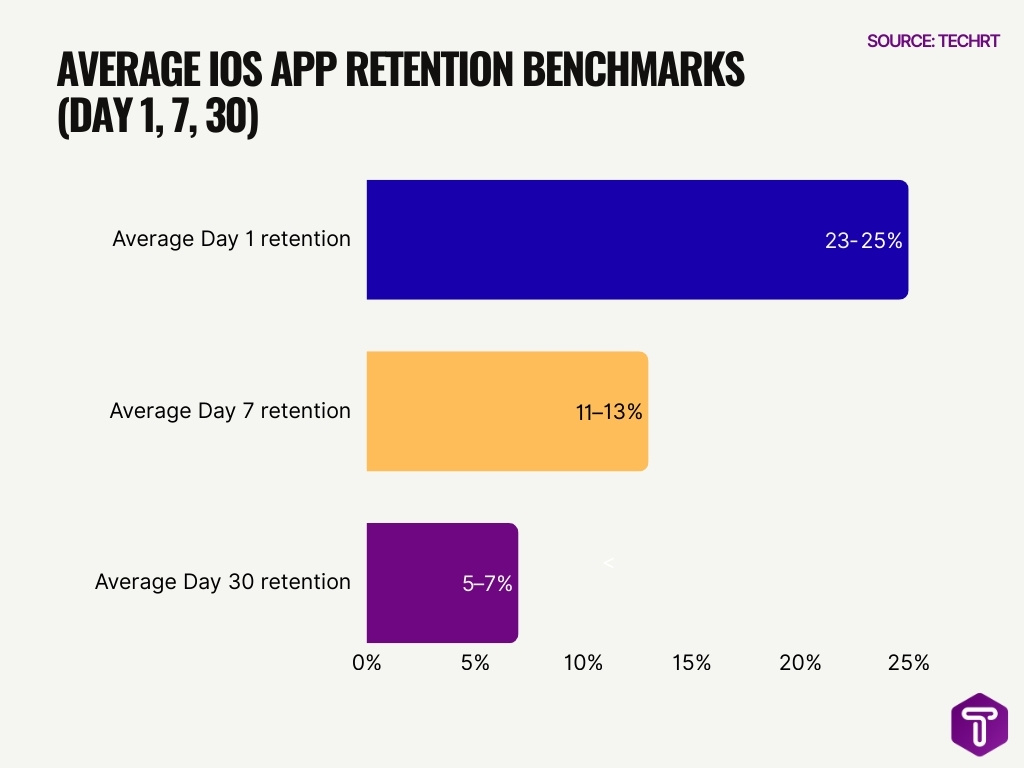

Average iOS Retention Rates

- Average Day 1 retention across iOS apps is roughly 23–25%, higher than Android benchmarks.

- Day 7 retention averages around ~11% to 13% across mobile apps, reflecting early drop‑off.

- Day 30 retention typically sits near ~5% to 7%, indicating long‑term stickiness challenges.

- Top‑tier apps, driven by strong onboarding and engagement loops, can exceed 20% retention at Day 30.

- iOS retention benchmarks tend to outperform combined platform metrics, which hover near 7% Day 30 average globally.

- Retention varies by region; developed markets like North America often show slightly higher rates.

- Users who engage with push notifications and in‑app messaging show higher retention through Day 7 and Day 30.

- Across categories, finance and productivity apps tend to retain users longer than lifestyle or casual games.

What is App Retention Rate

- App retention rate equals the percentage of users who return after install within a period.

- Formula: (Users active after X days ÷ Users who installed) × 100.

- Retention rate can be tracked daily, weekly, or monthly.

- It’s a key indicator of user engagement and product relevance.

- Retention differs from churn, which measures user loss.

- Higher retention often leads to greater lifetime value (LTV).

- Retention curves visualize drop‑off over time.

- Lower retention suggests gaps in onboarding or core value delivery.

Why Track iOS Retention

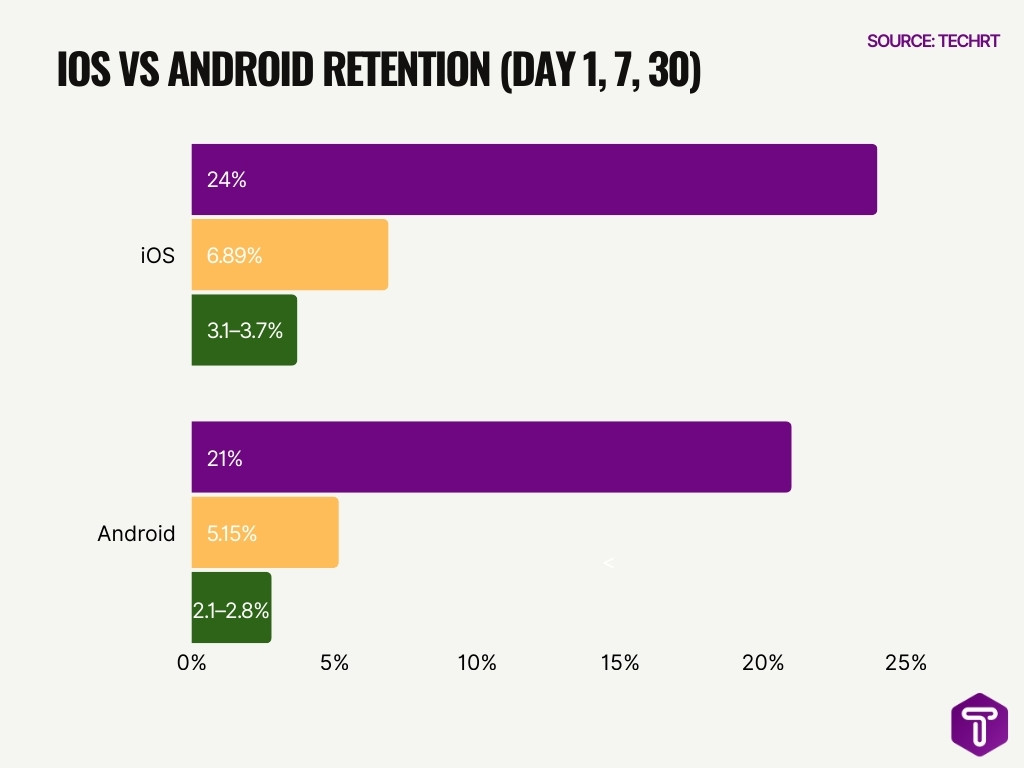

- iOS apps achieve 24% Day 1 retention vs Android’s 21%.

- iOS averages 27% Day 1 retention, outperforming Android benchmarks.

- iOS Day 30 retention reaches 3-4%, higher than Android’s 2%.

- Apps with UX redesigns from retention tracking see 30% higher retention rates.

- Retargeted users tracked via retention generate 37% more revenue.

- 5% retention improvement boosts profits by 25–95%.

- Predictive LTV from retention data yields 2.5x higher ROI.

- Cohort analysis reveals 16.5% Day 7 retention post-updates.

- Segmented retention tracking increases Day 1 retention by 20%.

- Strong retention signals product-market fit with rising engagement metrics.

Popular iOS App Store Categories by Market Share

- Games dominate the iOS App Store, accounting for 12.68% of all available apps, making it the largest and most competitive category.

- Business apps represent 10.35% of the marketplace, highlighting strong demand for enterprise, productivity, and professional tools.

- Education holds a significant 9.79% share, reflecting continued growth in e-learning and skill-development apps.

- Utilities make up 9.22%, showing consistent demand for essential system, security, and optimization apps.

- Lifestyle apps account for 7.93%, driven by user interest in wellness, habits, and daily living solutions.

- Food & Drink apps contribute 6.58%, supported by rising usage of food delivery, recipes, and restaurant platforms.

- Shopping apps capture 5.26% of the App Store, reflecting strong mobile commerce adoption.

- Health & Fitness apps represent 5.08%, underlining sustained focus on personal health and digital fitness.

- Productivity tools hold 4.84%, emphasizing steady demand for task management and workflow apps.

- Finance apps account for 4.16%, fueled by growth in mobile banking, payments, and personal finance tools.

- Entertainment apps comprise 3.92%, spanning streaming, content consumption, and media platforms.

- Travel apps make up 3.26%, supported by increased reliance on booking, navigation, and trip-planning apps.

- Medical apps hold 2.53%, reflecting niche but growing adoption of digital health and clinical tools.

- Sports apps account for 2.37%, catering to live scores, fitness tracking, and fan engagement.

- Social Networking represents 2.16%, a relatively smaller share compared to usage intensity.

- Music apps comprise 1.93%, primarily driven by streaming and audio platforms.

- News apps account for 1.66%, indicating selective demand for digital journalism and real-time updates.

- Photography apps hold 1.61%, despite high engagement from photo editing and camera tools.

- Reference apps represent 1.41%, serving specialized information and lookup needs.

- Navigation apps account for 1.06%, dominated by a few major mapping platforms.

- Books form the smallest segment at 0.97%, reflecting a niche but loyal reader base.

Day 1 Retention Benchmarks

- The widely accepted Day 1 retention benchmark is ~25% across mobile platforms.

- iOS Day 1 benchmarks slightly outpace Android benchmarks (~24% vs ~21%).

- Gaming and social applications hover around 28–29% Day 1 retention, among the highest verticals.

- Health & fitness apps show strong Day 1 rates near 27%, driven by habitual use.

- Fintech and financial apps often land near 22% Day 1, with commitment‑based user behavior.

- Utility and entertainment apps maintain ~20–21% Day 1 retention.

- Shopping apps lag with ~18% Day 1 retention, reflecting episodic engagement.

- Food & drink and travel app Day 1 retention can fall below 16%, highlighting high competition.

Day 7 Retention Benchmarks

- Day 7 retention averages ~10% to 15% across iOS and other platforms.

- Apps with habit‑forming features (social, productivity) often hit ~15%+.

- Finance and banking applications frequently retain ~17% by Day 7, one of the highest verticals.

- Shopping and marketplace apps see ~10.7% average Day 7 retention.

- Casual games typically slip below 10% by Day 7, reflecting drop‑off after initial engagement.

- News apps see varied Day 7 performance due to event‑driven spikes and quick churn.

- Productivity and business apps can achieve steadier retention through workflow integration.

- Lifestyle and utility apps often fall near the lower end of Day 7 averages (~8% to 12%).

Day 30 Retention Benchmarks

- Across mobile apps, Day 30 retention ~5–7% is common.

- News apps can retain users at ~11.3% Day 30, among the highest.

- Fintech and digital banking show ~11.6% Day 30 retention, reflecting habitual financial management.

- Shopping apps average ~5.0% Day 30 retention.

- Gaming and social verticals often see ~2.4% to ~2.8% Day 30 retention due to a rapid drop‑off.

- Health & fitness and food & drink apps linger near ~3.7% Day 30 retention.

- Productivity and utility apps fall between ~3.0% to ~4.1% Day 30.

- Travel apps often mirror entertainment sectors, with around ~3.0% Day 30 retention.

iOS vs Android Retention

- iOS achieves 24% Day 1 retention, outperforming Android‘s 21%.

- iOS Day 7 retention stands at 6.89%, compared to Android‘s 5.15%.

- By Day 30, iOS retains 3.1-3.7% of users versus Android‘s 2.1-2.8%.

- Android Day 1 retention averages 24%, dropping to 6% by Day 30.

- iOS shows 24–25% Day 1 retention, falling to 3–4% at Day 30.

- Gaming apps exhibit identical 1.7% Day 30 retention on both iOS and Android.

- Dating apps on iOS retain 2.7% at Day 30, a 35% edge over Android‘s 2%.

- Finance apps see iOS at 3.1% Day 30 retention, slightly above Android‘s 3.0%.

- iOS advantage widens to +46% over Android by Day 30 retention.

Gaming App Retention Rates

- Gaming apps show strong initial engagement, with Day 1 retention often above 28–32% across both iOS and Android.

- By Day 7, retention dips sharply, averaging around 7.9%–12.6% depending on genre.

- Day 30 retention rates for games typically fall between 2.3% and 5.4%, among the lowest of major app categories.

- Hyper‑casual games often show the highest Day 1 numbers but also some of the steepest drop‑offs.

- Mid‑core strategy and multiplayer titles frequently outperform simple casual games by retaining social engagement loops.

- Social and competitive gaming titles see higher Day 7 retention due to peer interactions and leaderboards.

- Games that release frequent updates and events tend to retain up to 20% more users by Day 30 than those with static content.

- Reward systems and cumulative progression mechanics can boost retention by up to two‑thirds relative to baseline.

Social Media App Retention

- Social apps start with relatively high Day 1 retention near 26–28% as users explore networks and content feeds.

- Day 7 retention for social apps often centers around ~9.3–10.7%, depending on content and notifications.

- Day 30 rates generally range from ~2.8% to ~3.9%, below some utility and finance categories.

- Engagement features like personalized feeds and friend activity alerts are critical for longer retention.

- Apps that effectively integrate video and short‑form content see higher week‑over‑week engagement.

- Network effects, where friends and community keep users returning, remain key retention drivers.

- Strong onboarding that highlights why users should connect with friends can raise Day 7 rates notably.

- Features such as stories, direct messaging, and personalized notifications help sustain interaction beyond Day 30.

Fintech App Retention Rates

- Fintech and digital banking apps demonstrate among the highest Day 30 retention rates, around ~11.6%.

- Day 1 retention often exceeds 30% for banking and financial apps due to ongoing utility.

- Day 7 rates for fintech apps typically rest around 15–17.6%, stronger than many entertainment or lifestyle categories.

- Secure onboarding and real‑time alerts (balances, transactions) help users form habits quickly.

- Budgeting and investment features that show immediate value raise Day 7 and Day 30 retention.

- Apps that include bill reminders, savings insights, or daily summaries see higher routine engagement.

- Fintech retention varies based on demographics; younger users tend to engage more frequently.

- Personalized financial recommendations are linked to greater long‑term user loyalty.

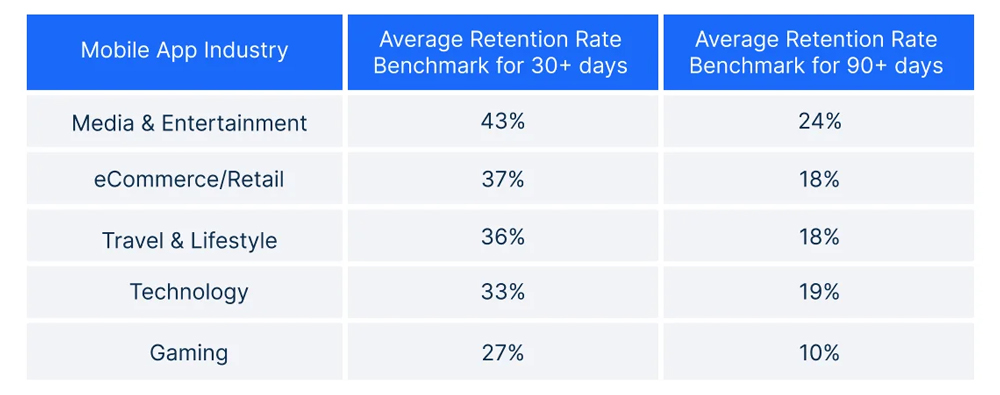

Mobile App Retention Benchmarks by Industry

- Media & Entertainment apps lead retention performance, achieving 43% retention after 30+ days and maintaining a strong 24% retention beyond 90 days.

- eCommerce and retail apps record solid engagement with 37% user retention at 30+ days, though long-term retention declines to 18% after 90+ days.

- Travel and lifestyle apps show comparable mid-term loyalty, reaching 36% retention at 30+ days, with 18% of users retained after 90+ days.

- Technology apps maintain steady user interest, posting 33% retention beyond 30 days and a relatively resilient 19% retention at 90+ days.

- Gaming apps face the steepest drop-off, with only 27% retention after 30+ days and just 10% of users remaining active after 90+ days, highlighting high churn risk.

Shopping App Retention Stats

- Shopping apps typically retain ~5.0%–5.6% of users at Day 30.

- Day 1 retail retention generally runs near ~24–25%.

- Marketplace subcategories (e.g., multi‑vendor platforms) can retain ~8.7% by Day 30, stronger than single‑brand apps.

- Day 7 retention averages around ~10.7% for e‑commerce.

- Seasonal sales, personalized deals, and loyalty programs boost repeat visits.

- Flash sales and push notifications around cart activity increase return visits significantly.

- Free shipping and points incentives correlate with higher long‑term retention.

- Higher retention is often found in apps that combine browsing, wishlists, and social sharing.

Lifestyle App Retention Data

- Lifestyle categories, including wellness and hobbies, show ~3.6% Day 30 retention on average.

- Day 1 retention usually lies between 20–26% depending on app specificity.

- User interest in personalization and goal tracking relates to retention above the category mean.

- Apps that integrate daily habits and community features see better mid‑term engagement.

- Health & fitness variants within lifestyle often perform slightly better than general lifestyle apps.

- Engagement incentives like streaks, rewards, and check‑ins increase return frequency.

- Lifestyle retention is highly seasonal; holiday periods can spike usage drastically.

- In categories like food delivery and local events, real‑time offers sustain higher retention.

Customer Retention Statistics You Should Know in 2026

- Acquiring a new customer costs up to 5× more than retaining an existing one, highlighting why retention strategies deliver stronger ROI.

- Businesses that prioritize customer retention are 60% more profitable than those focused mainly on acquisition.

- Existing customers have a 60%–70% chance of making a repeat purchase, compared to much lower conversion rates for new buyers.

- Repeat customers spend 67% more than first-time buyers, significantly increasing lifetime value.

- Small businesses generate over 61% of total revenue from repeat customers alone.

- Customers who purchase more than once spend 62% more on average, reinforcing the value of long-term relationships.

- A 5% increase in customer retention can drive profit growth of 25% to 95%.

- U.S. businesses lose an estimated $136 billion every year due to customer churn.

- Companies that respond quickly on social media see customers spend 20%–40% more.

- 53% of customer churn is caused by poor onboarding, weak relationships, or inadequate service.

- 96% of consumers say good customer service is critical for building brand loyalty.

- The global loyalty program market is projected to reach $28.65 billion by 2030.

- 95% of companies report that loyalty program members spend more annually than non-members.

- 79% of consumers are more likely to buy from brands that offer loyalty programs.

- 81% of customers say they would purchase again after a great customer experience.

- 61% of consumers switch brands after just one bad experience.

- 62% of shoppers will not buy from an online store that does not offer free returns.

- 83% of consumers say good service is key to staying loyal to a brand.

- 74% of consumers believe unhappy employees negatively impact the customer experience.

- 96% of customers would continue buying from a company that apologizes for its mistakes.

- Average customer retention rates vary by industry, with banking at 75%, retail at 63%, hospitality at 55%, and SaaS at around 35%.

- Email remains the top retention channel, used by 89% of businesses, followed by 63% using social media to engage customers.

- 52% of customers prefer calling a business for support, showing the continued importance of human interaction.

Factors Affecting Retention

- Poor onboarding increases churn by 74% in the first 90 days.

- Optimized onboarding improves Day 30 retention to 40%.

- Push notifications boost Day 7 retention by 3x.

- Personalization lifts long-term engagement by 35%.

- Apps loading over 3 seconds see 53% user drop-off.

- Feature updates increase retention by 25% post-launch.

- Social features in gaming raise D90 retention by 45%.

- Lifecycle messaging reduces churn by 20-30%.

- iOS averages 27% Day 1 retention vs Android’s 24%.

Improving iOS App Retention

- Simplify onboarding to get users to value quickly; ideal Day 1 engagement raises retention.

- Use behavioral push notifications to re‑engage users at drop‑off points.

- Leverage personalization engines to tailor content and recommendations.

- Implement periodic rewards and loyalty incentives for repeat actions.

- Optimize app performance to reduce crashes and latency.

- Blend social features like sharing and community forums to increase habit formation.

- Use cohort analysis to refine user‑specific improvements.

- Track retention metrics regularly to inform iterative product decisions.

Frequently Asked Questions (FAQs)

What is the average Day 1 retention rate for iOS apps?

The average iOS app retains about 25‑27% of users on Day 1 after installation.

How many iOS users remain active by Day 30 on average?

By Day 30, iOS apps typically retain roughly 4–8% of users long‑term.

What is the global average mobile app retention across Day 1, Day 7, and Day 30?

Global benchmarks show about 26% Day 1, ~13% Day 7, and ~7% Day 30 retention across mobile apps.

How many of their daily active users do apps lose within the first 3 days?

Mobile apps lose approximately 77% of daily active users within the first 3 days after install.

How does 30‑day retention compare between iOS and Android?

iOS apps hold around 3-4% retention at 30 days, generally higher than Android’s 2.6–6%.

Conclusion

iOS app retention remains a key metric for app success in a competitive marketplace. Retention drops steeply across all categories between Day 1 and Day 30, but strategic onboarding, personalization, and engagement features can significantly reduce churn and increase long‑term loyalty. While categories like fintech and marketplace apps show stronger retention, all apps benefit from continual optimization and user‑centric features that reinforce daily value. Use these benchmarks as a guide, not a rule, and focus experimentation on your app’s unique audience to improve retention over time.

Leave a comment

Have something to say about this article? Add your comment and start the discussion.