iPhone feature usage reflects how deeply integrated Apple’s ecosystem remains in everyday life. From how often users update their devices to time spent on screens, these trends reveal shifting behavior among consumers in the US and globally. Businesses now tailor app development for iOS users, and advertisers adjust campaigns based on engagement metrics tied to iPhone usage patterns. In healthcare and education sectors, screen time and app preferences help shape digital well‑being strategies. Explore this data‑rich overview to understand what iPhone users are doing most and how this impacts broader tech trends.

Editor’s Choice

- 1.56 billion active iPhone users worldwide as of 2025, up from prior years.

- iOS holds about 27.9% of the global smartphone OS market, as Android leads.

- iPhone market share in the US is around 59% in 2025.

- Daily smartphone time averages 4–5 hours, with significant iOS engagement.

- iOS 26 adoption remains low in early 2026, significantly below historical norms.

- Apple projected to ship ~247 million iPhones in 2025, a record pace.

- iPhone’s global share 20% in recent shipment data, competitive with Samsung.

Recent Developments

- Apple’s iOS 26 rollout started in late 2025, introducing a UI redesign and new features.

- Early 2026 adoption metrics show only ~16–18% of iPhones on iOS 26.

- This adoption is much lower than previous iOS rollouts at similar points.

- Apple has released iOS 26.3 beta with performance and security improvements in 2026.

- Ongoing updates aim to enhance connectivity and camera performance for current iPhones.

- Feature adjustments include new system patches and UI refinements.

- Developers highlight the need to encourage quicker OS updates, given slow uptake.

Global iPhone User Base & Demographics

- There are an estimated 1.38 billion iPhone users globally.

- Growth continues year‑over‑year from prior estimates of 1.56 billion.

- ~151 million iPhone users reside in the US, a leading regional base.

- iPhone ownership represents about 20% of global smartphone users.

- Gender distribution shows a slight female majority (~51%) vs male (~49%) among iPhone users.

- A large portion of users are aged 25–34, indicating strong Millennial/Gen Z representation.

- iPhone’s affluent user base often correlates with higher income brackets than some competitors.

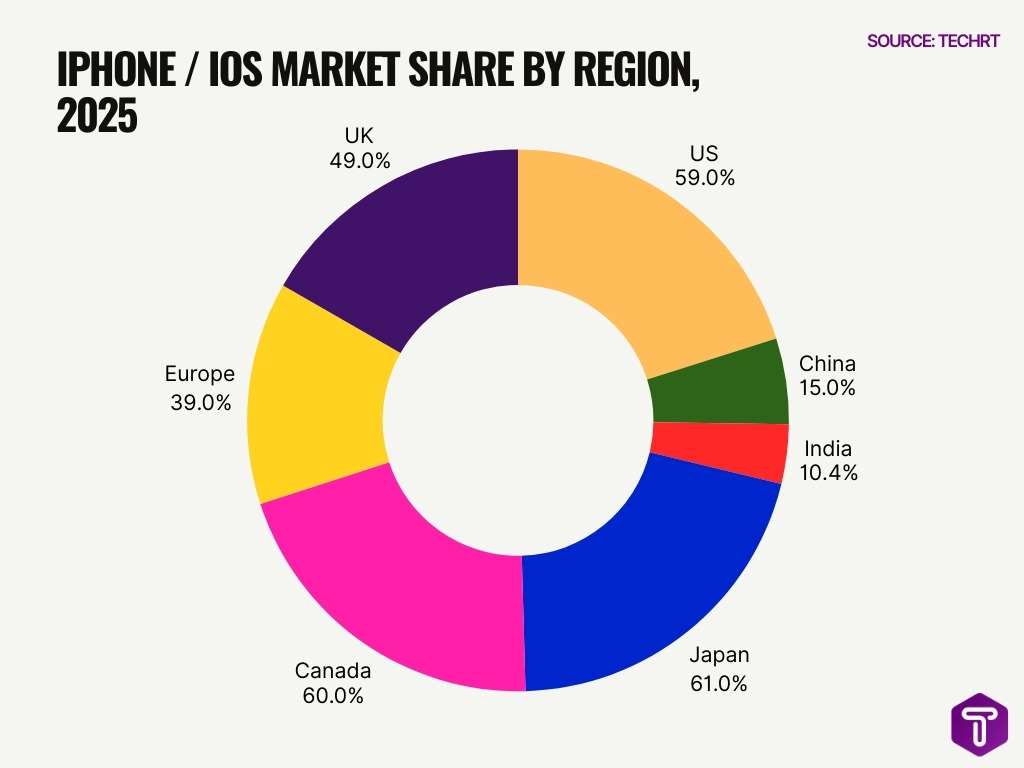

iPhone Market Share (Global & Regional)

- Globally, iOS holds ~27% of the smartphone OS market in 2025.

- Android dominates with ~72% global smartphone OS share in 2025.

- In the US, iPhone commands ~59% market share as of late 2025.

- Apple topped 2025 global smartphone shipments with 20% share, surpassing Samsung‘s 19%.

- In China, iPhone shipment share reached 15% in Q3 2025.

- India saw iPhone hit a record 10.4% market share in Q3 2025.

- Japan boasts ~61% iPhone market share in 2025 projections.

- Canada reports iOS at ~60% of the mobile OS market in late 2025.

- In Europe, iOS captures ~39% mobile OS share by the end of 2025.

- UK iPhone share stands at ~49% in late 2025.

iOS Update Adoption Rates

- As of early 2026, iOS 26 adoption is only ~16–18% among users.

- Versions of iOS 18 still dominate with over 60% usage, while iOS 26 adoption is around 16% a few months post‑launch.

- Adoption of new OS versions trails historical norms seen in iOS 17 and previous versions.

- Factors for slow adoption include user hesitance around UI redesigns.

- Security updates remain available on older iOS versions, reducing update urgency.

- Apple’s push with incremental releases like iOS 26.3 reflects attempts to accelerate uptake.

- Developers monitor adoption rates to optimize app compatibility.

Average Daily Screen Time

- Average global smartphone users spend ~4 hrs 37 min per day on phones.

- In the US, daily usage may exceed 5 hours per day.

- iPhone owners contribute significantly to this mobile engagement trend.

- Social networking apps often consume the largest share of daily smartphone time.

- Entertainment content usage accounts for ~1.2 hrs daily on mobile apps.

- Gaming usage averages ~1 hr/day among mobile users.

- Productivity tools and health apps share smaller daily time slices.

- These patterns shape how app developers prioritize feature engagement.

Screen Time by Demographics

- US adults’ screen time averages ~7 hours per day, reflecting broad smartphone engagement across age groups.

- 41% of teens spend over 8 hours on screens daily, showing heavier usage among younger users.

- Gen Z individuals average about 9 hours of screen time daily, above the general population figures.

- Average daily mobile app screen time across smartphone users is ~4 hrs 37 min.

- Across age groups, 18–29 and 30–49 year olds show the highest adoption of social and messaging apps compared to older cohorts.

- Users check their phones ~58 times per day on average, spread across work and personal hours.

- In 2025, about 88% of mobile time is spent inside apps vs. browsers, indicating app dominance.

- Engagement patterns vary by age, with older groups leaning toward utilities and news apps, while young adults favor social and entertainment apps.

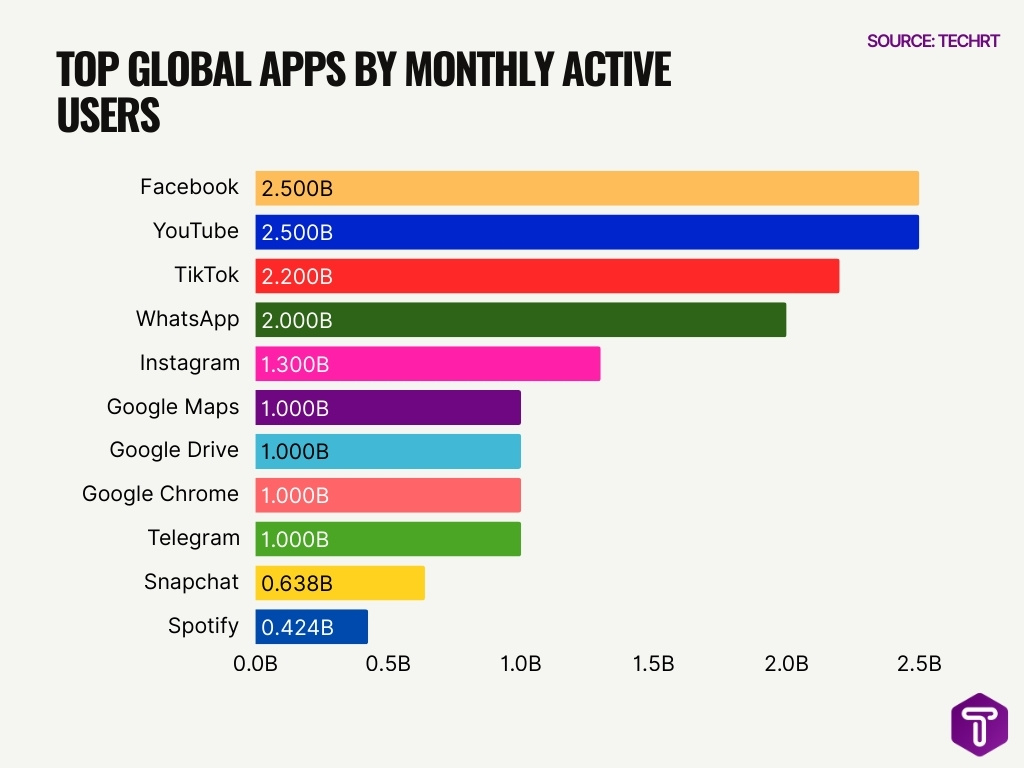

Most Used Apps

- Facebook and YouTube both reach ~2.5 billion monthly users, topping global usage charts.

- TikTok reaches ~2.2 billion monthly users, cementing its position among the top used apps.

- WhatsApp has ~2 billion monthly active users worldwide.

- Instagram engages ~1.3 billion monthly users globally.

- Google Maps, Drive, and Chrome each maintain ~1 billion monthly users, reflecting utility usage.

- Messaging platforms like Telegram (~1 billion) and Snapchat (~638 million) hold strong footprints.

- Spotify has ~424 million monthly users, underscoring music and audio usage.

- Work and productivity tools like Google Docs/Drive show high global adoption.

Top Downloaded Apps

- ChatGPT topped free app downloads in the US in 2025 on Apple’s charts.

- Instagram led worldwide downloads with 52 million in October 2025.

- TikTok recorded 42 million global downloads in October 2025.

- WhatsApp hit 36 million downloads worldwide in October 2025.

- ChatGPT achieved 45 million global downloads in September 2025.

- Telegram garnered 24 million worldwide downloads in October 2025.

- The iOS App Store saw over 38 billion annual downloads in 2025.

- CapCut reached 23 million global downloads in October 2025.

- TikTok amassed 436.82 million downloads in H1 2025 worldwide.

Social Media Usage

- Users spend an average of ~2 hours and 24 min per day on social media globally.

- 65% of mobile screen time is devoted to social and messaging apps combined.

- Social platforms continue to increase passive engagement via AI‑recommended streams, up ~44% from 2023–25.

- Short‑form video formats added increased weekly engagement, significantly boosting total social media usage.

- Mobile gaming time, measured alongside social usage, is estimated at ~4.2 hours per day on average in some markets.

- Time spent on social media has stayed largely stable year‑over‑year, with minor quarterly variations.

- Younger users disproportionately dominate social platform engagement compared to older demographics.

- Changes in platform preferences (e.g., video‑first experiences) influence daily social usage patterns.

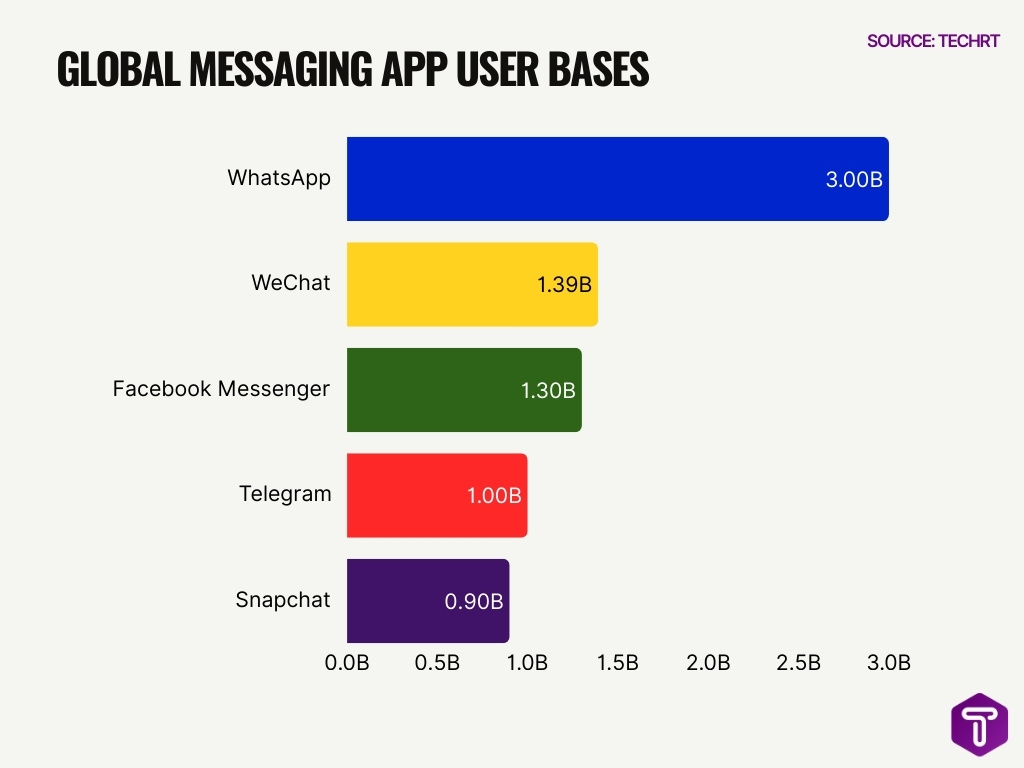

Messaging App Statistics

- WhatsApp leads with ~3 billion users worldwide, the most used instant messaging platform.

- WeChat has ~1.39 billion users, reflecting strong regional engagement in Asia.

- Facebook Messenger reaches ~1.3 billion users globally.

- Telegram reports ~1 billion monthly active users, expanding its global footprint.

- Snapchat has ~900 million messaging and interactive social users.

- iMessage usage remains high among iPhone users in the US, though exact active user data varies by region.

- Global instant messaging engagement continues to grow, now a core daily communication channel.

- Cross‑platform messaging activity contributes to increased screen time and user retention.

Entertainment App Usage

- Entertainment apps see 83.85% user adoption worldwide.

- Apple TV engagement rose ~36% in 2025.

- Spotify boasts 713 million monthly active users.

- Global mobile gamers number 3.2 billion active users.

- The OTT streaming market is valued at $227.29 billion in 2025.

- Social media and entertainment apps account for over 40% of total mobile app usage.

- Average daily video streaming time reaches 2 hours.

- 70% of US digital media time is spent in mobile apps.

- 3.2 billion mobile game downloads reached 49.6 billion in 2024.

Gaming App Engagement

- Mobile gaming holds a significant share of app engagement time, often clocking several hours per week among regular gamers.

- Gaming titles commonly appear among the most downloaded and engaged apps globally.

- In some user groups, mobile games are cited as eating up large chunks of daily screen time.

- Google Play and App Store combined downloads continue rising yearly, with games a leading category.

- Casual gaming retains broad appeal across demographics, from teens to adults.

- Competitive and multiplayer mobile titles drive repeat usage and engagement metrics.

- Many top‑ranked games integrate social features that extend beyond pure gameplay.

- Growing mobile gaming trends contribute to overall app revenue and time‑on‑device patterns.

Productivity Tool Adoption

- Productivity apps generated over $30 billion in revenue in 2024, rising ~17% from the year before. This growth reflects increasing reliance on mobile tools for work and organization.

- Office suite and task management apps account for a large portion of this revenue, showing how users depend on mobile productivity tools.

- Mobile app usage trends indicate that productivity usage time rose by ~22% from 2024 to 2025, highlighting growing engagement.

- Around 88% of time on smartphones happens in apps, where productivity tools compete alongside other categories for user attention.

- The typical user installs 80+ apps, but only uses about 9 apps daily, suggesting productivity tools must earn a spot in core routines.

- Globally, mobile business intelligence and productivity integration are rising as firms push mobile workflow solutions.

- Cross‑platform productivity app usage supports remote and hybrid work patterns, especially among US adult workers aged 25–54.

- Notifications from productivity apps contribute to frequent daily engagement spikes throughout the workday.

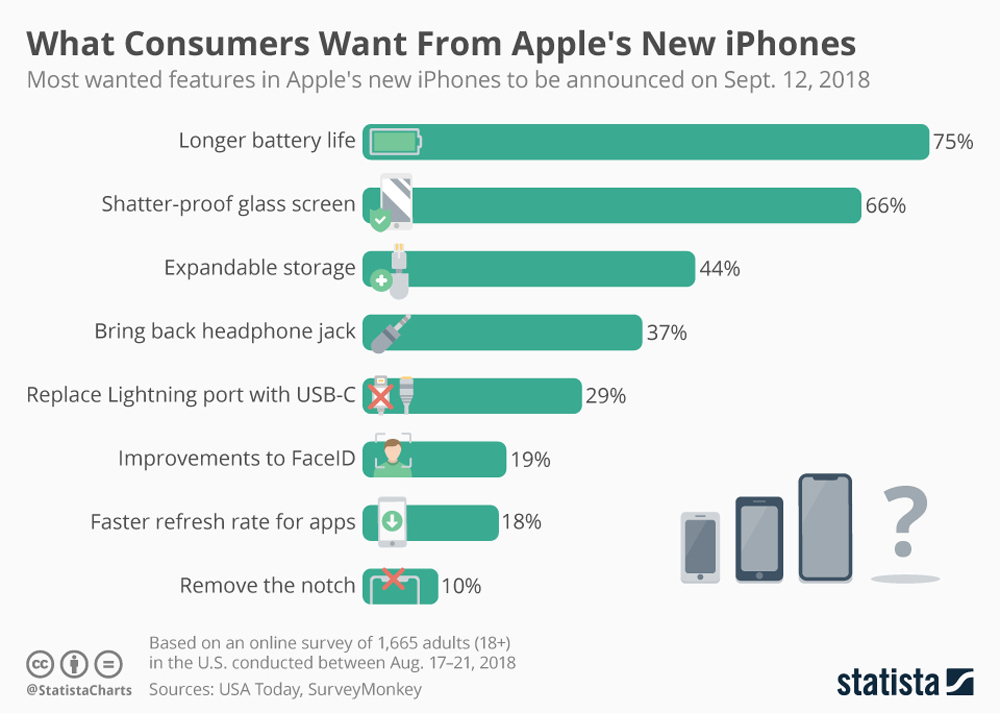

What Consumers Want From Apple’s New iPhones

- Longer battery life is the top consumer priority, with 75% of respondents saying improved battery performance is the most important upgrade.

- Shatter-proof glass screens are highly demanded, as 66% of users want stronger and more durable displays.

- Expandable storage options are requested by 44% of consumers, highlighting frustration with fixed internal storage limits.

- Bringing back the headphone jack remains important to 37% of users, showing continued demand for wired audio support.

- Replacing the Lightning port with USB-C is favored by 29% of respondents, reflecting growing preference for universal charging standards.

- Improvements to Face ID are desired by 19% of consumers, indicating interest in more accurate and faster biometric authentication.

- Faster refresh rates for apps matter to 18% of users, emphasizing expectations for smoother scrolling and better visual performance.

- Removing the notch is the least requested change, cited by just 10% of respondents, suggesting design concerns are a lower priority than functionality.

Music Streaming Stats

- Music streaming apps generated roughly $53.7 billion in global revenue in 2024, reflecting strong monetization and user adoption.

- Nearly a third of all music streaming app revenue came from subscription services.

- Paid music streaming accounts worldwide reached over 750 million subscribers as digital revenue overtook physical formats.

- In the US, streaming comprised about 84% of total music revenue in 2024.

- Spotify held about 31.7% of the global market share among music streaming platforms in 2024.

- Apple Music captured around 12.6% of the global streaming market in the same period.

- Mobile music streaming often complements social media and video usage in daily phone routines.

- Revenue growth in music apps shows resilient demand and a continued shift from ownership to access models.

Camera Feature Usage

- Smartphone cameras are among the most frequently used features, replacing standalone cameras for everyday photography and video.

- Users rely on camera apps to capture documents, receipts, and QR codes, making them integral to mobile productivity.

- iPhone camera engagement often peaks around social and creative usage, especially among younger demographics.

- Newer camera features like enhanced night mode and cinematic video contribute to steady usage increases year‑over‑year.

- Short‑form video creation (Reels, Shorts, TikTok videos) drives frequent camera engagement.

- In-app photo editing and AR effects further extend the time spent in camera applications.

- Camera usage correlates with social app engagement patterns due to integrated sharing features.

- Smartphone cameras often replace specialized photography gear for casual and mid‑level users.

Photo and Video Usage

- Social media and entertainment apps account for over 40% of total mobile app usage.

- 91% of businesses use video as a key marketing tool tied to social engagement.

- Indians average 5 hours daily on smartphones for videos, gaming, and social media.

- Smartphones capture 92.5% of all photos worldwide, driving visual app interactions.

- Visual content gets shared 40 times more than text on social media platforms.

- Users share 6.9 billion photos daily on WhatsApp, boosting messaging engagement.

- 71% of mobile users prefer vertical videos optimized for phone screens.

- Video content will account for 82% of global internet traffic by 2025.

- Social media apps claim 101 minutes average daily usage per user.

- 94% of smartphone users hold phones vertically when consuming videos.

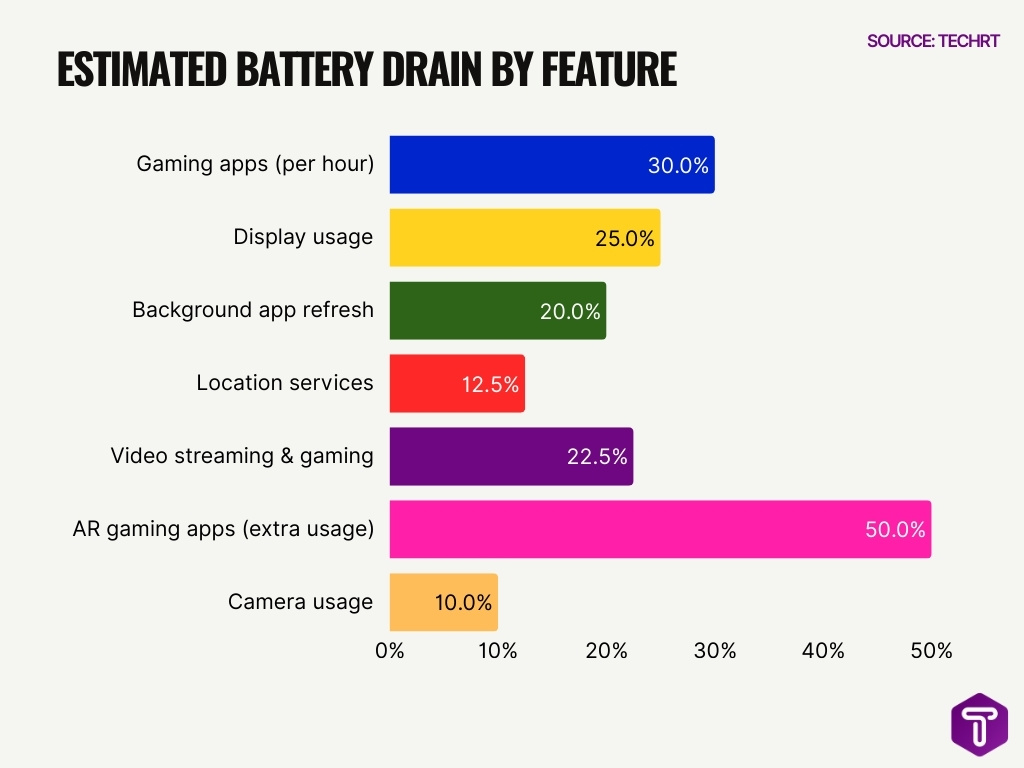

Battery Usage by Feature

- Gaming apps consume 30% of battery capacity per hour of active play.

- Display usage accounts for 20-30% of total battery drain.

- Maximum screen brightness drains battery twice as fast as moderate levels.

- Background app refresh contributes 15-25% to overall power consumption.

- Location services use 10-15% of total battery drain.

- Video streaming and gaming represent a 15-30% drain during active sessions.

- AR gaming apps increase battery usage by 40-60% over standard apps.

- Camera usage typically drains 5-15% of the battery during active operation.

Payment Feature Adoption

- Over 5.3 billion people use digital wallets worldwide, showing rapid growth in mobile payments.

- Apple Pay alone has an estimated ~640–650 million users globally, reflecting strong adoption among iPhone owners.

- Digital wallets are expected to process trillions of transactions annually as mobile commerce expands.

- Around 40% of online purchases are made via mobile devices in many regions.

- Mobile wallet adoption continues to grow in both in‑store and online purchase contexts.

- Contactless payments via NFC or QR codes remain popular for quick checkouts.

- Security and convenience remain top factors driving mobile payment adoption.

- iPhone users often favor integrated wallet features for peer‑to‑peer transfers and subscriptions.

Frequently Asked Questions (FAQs)

What percentage of iPhone users had adopted iOS 26 by early 2026?

About 16% of iPhone users were running some version of iOS 26 on their devices in January 2026.

How many active iPhone users exist globally in 2026?

There are around 1.56 billion active iPhone users worldwide in 2025, with the base projected to keep growing in 2026

What is the iPhone’s share of the global smartphone market in 2026?

The iPhone holds about 27–28% of the global smartphone market by late 2025, based on recent OS and vendor share data.

What is the average daily time spent on iOS apps?

iPhone users spend roughly 3 to 5 hours per day on iOS apps across categories.

How many people globally were using Apple Pay by 2024?

Apple Pay had approximately ~640 million active users worldwide by 2025, and its user base continues to expand.

Conclusion

iPhone feature usage paints a detailed picture of how modern smartphone owners allocate attention and time. From productivity tools generating billions in revenue to music streaming commanding significant user engagement, mobile usage continues to diversify and deepen. Camera and photo tools remain central to everyday interaction, while payment features like Apple Pay expand in both usage and importance.

Daily battery constraints and visual content consumption shape where and how users interact with their devices. These insights offer a clear lens into evolving user behavior, insights that developers, marketers, and business leaders can leverage to build better experiences around how people truly use their iPhones today.

Leave a comment

Have something to say about this article? Add your comment and start the discussion.