The iPhone upgrade landscape reflects evolving consumer behavior, extended replacement cycles, and shifting preferences between iOS and Android. Users are holding onto devices longer, yet demand for new iPhone models remains robust, particularly in tech‑mature markets like the U.S. and Europe. Real‑world examples include corporate adoption influencing upgrade timelines and consumers leveraging trade‑in programs to soften purchase costs. Explore how these patterns influence Apple’s strategy and the broader smartphone market.

Editor’s Choice

- The average iPhone upgrade cycle in the U.S. was approximately 3.2 years in 2025, up from about 3.0 years in 2024, indicating longer device usage.

- 68.3% of iPhone users surveyed plan to upgrade to the iPhone 17 at launch, up from 61.9% before the iPhone 16 release.

- Around 54% of iOS users upgrade yearly, purchasing the newest model, while 22% upgrade every two years.

- Only 29% of buyers replace iPhones younger than two years, down from 41% five years ago.

- Over 90% of U.S. iPhone users remain loyal to the platform during upgrades, compared with 70–80% for Android.

- Global smartphone replacement cycle averages around 3.0–3.3 years, with iPhones consistently above that threshold.

- Android to iPhone conversions account for roughly a 4% yearly migration, adding millions of new iPhone users.

Recent Developments

- Apple introduced the iPhone 17 series, featuring performance boosts and new camera systems, driving upgrade interest in late 2025.

- iOS 26 rollout has been slower than expected, with only about 15.4% adoption among users early in 2026.

- Beta versions of iOS 26.3 were released, focusing on performance and security enhancements.

- Global smartphone shipments are projected to slightly decline in 2026 due to component cost pressures, affecting total iPhone volumes.

- Surveys show 51% of U.S. iPhone users are extremely likely to upgrade within 12 months, driven by aging devices.

- Apple continues to expand carrier and trade‑in incentives, particularly around new model launches.

- iPhone’s ecosystem features like Apple Intelligence and tighter cross‑device integration remain key marketing focal points for upgrades.

- Android vs iOS market dynamics show Android holding a larger global share, while iOS maintains strength in developed markets.

Average iPhone Upgrade Cycle

- 3.2 years is the average upgrade cycle for many U.S. iPhone users in 2025.

- This reflects a longer cycle compared to traditional 2‑year norms often promoted by carriers.

- Among corporate users, the cycle is slightly shorter at 2.6 years, due to performance needs.

- Only 29% of replacements involve devices younger than two years.

- Global smartphone replacement cycle averages 3.0–3.3 years, shorter than the iPhone cycle.

- Surveys indicate some consumers still upgrade every year (~21%), though this is not the majority pattern.

- Device longevity improvements (battery, durability, updates) are cited as a reason for longer cycles.

- Incentives like trade‑in credits help offset costs, potentially slightly shortening individual upgrade decisions.

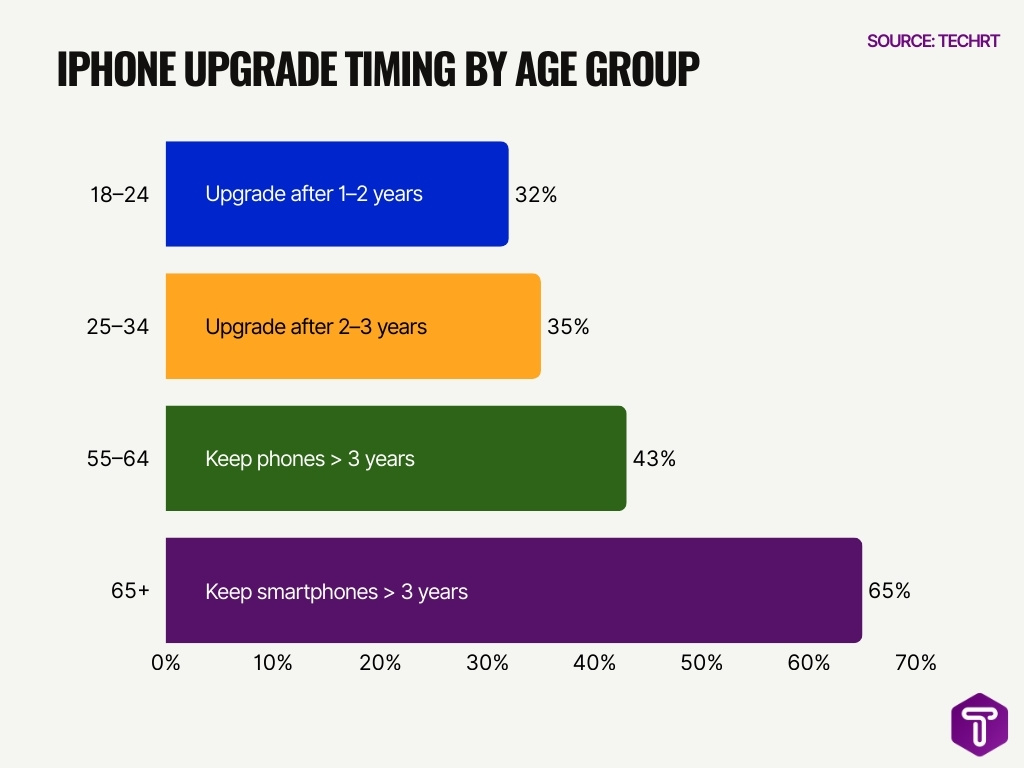

Upgrade Cycles by Age Group

- 88% of U.S. teens (13-19) own an iPhone, with 89% planning to buy another.

- 13% of 18-24-year-olds upgrade their iPhone in less than 1 year.

- 32% of young adults (18-24) upgrade smartphones after 1-2 years.

- 43% of users aged 55-64 keep phones for over 3 years.

- 65% of those 65+ retain smartphones beyond 3 years.

- 35% of 25-34-year-olds upgrade after 2-3 years.

- U.S. average smartphone upgrade cycle reaches 33 months.

- Apple brand loyalty stands at 85-92% across users.

- 90%+ of iPhone owners upgrade within the Apple ecosystem.

Global iPhone Upgrade & Replacement Trends

- iPhones command about 27.7% of the global smartphone market in 2026.

- Active iPhone users worldwide exceed 1.46 billion and continue growing.

- Apple’s expansion in regions like China includes over 20% share during the late 2025 months.

- Globally, Android remains dominant with around 72.47% OS share compared to iOS.

- Migration from Android to iPhone is adding roughly 4% new adopters each year.

- In the U.S., iOS holds roughly 59.31% market share as of early 2026.

- iPhone replacement cycles globally trend longer, especially in mature markets.

- Premium flagship models drive a disproportionate share of units replaced in high‑income regions.

Factors Influencing Upgrade Decisions

- Consumers received $1.34 billion in trade-in value during Q2 2025, driving a 60% year-over-year increase in smartphone upgrades.

- Price-sensitive non-flagship buyers in India face elongated replacement cycles amid 10-15% potential flagship price hikes from AI costs.

- Average traded-in smartphone age hit a record 3.88 years, up from 3.7 years, as higher trade-in credits extend upgrade cycles.

- 33% of smartphone purchases in 2023 used no-cost EMI financing plans, boosting carrier-driven upgrade flexibility.

- iPhone users show 90%+ retention rates, fueled by ecosystem services like iCloud and Apple Music, with 108 million subscribers.

- iPhones retain 15-25% more trade-in value than Androids, enhancing perceived long-term value over alternatives.

- iPhones lose only 70% of value after five years, versus over 80% for Samsung/Android, swaying consumer upgrade choices.

- 80% of a smartphone’s carbon footprint occurs in manufacturing, pushing users toward trade-ins over discards.

- 21.3% of consumers agree that social media campaigns boost smartphone upgrade interest, amplified by influencer endorsements.

- Global smartphone shipments grew just 2.9% in 2022 amid inflation, curbing economic-driven discretionary upgrades.

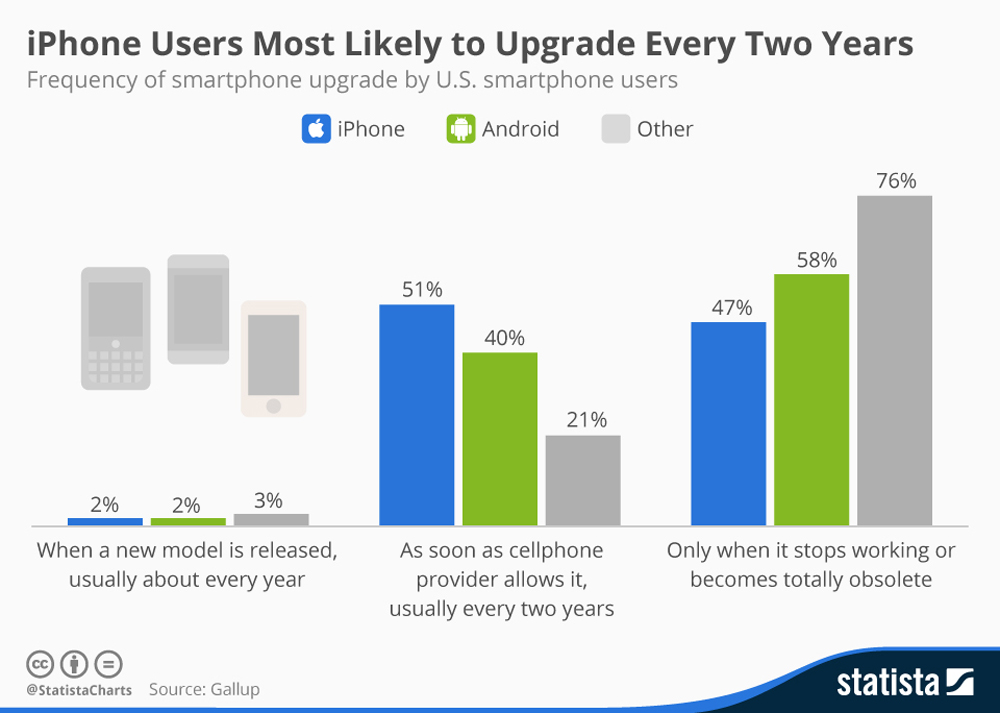

iPhone vs Android Upgrade Behavior in the U.S.

- Only 2% of iPhone users upgrade their smartphones every year, matching the 2% of Android users and 3% of other phone users, showing that annual upgrades are rare across all platforms.

- A majority of iPhone users (51%) upgrade every two years as soon as their cellphone provider allows it, compared with 40% of Android users and just 21% of other users.

- Nearly half of iPhone users (47%) wait to upgrade until their device stops working or becomes obsolete, indicating a strong balance between loyalty and practicality.

- Android users are more replacement-driven, with 58% upgrading only when their phone no longer works or is outdated.

- Users of other smartphone brands show the longest upgrade cycles, as 76% wait until their devices are completely obsolete before replacing them.

- Overall, iPhone users are the most likely to follow a predictable two-year upgrade cycle, reinforcing Apple’s strong retention and upgrade ecosystem in the U.S. market.

Factors Influencing Upgrade Decisions

- Consumers received $1.34 billion in trade-in value during Q2 2025, driving a 60% year-over-year increase in smartphone upgrades.

- Price-sensitive non-flagship buyers in India face elongated replacement cycles amid 10-15% potential flagship price hikes from AI costs.

- Average traded-in smartphone age hit a record 3.88 years, up from 3.7 years, as higher trade-in credits extend upgrade cycles.

- 33% of smartphone purchases in 2023 used no-cost EMI financing plans, boosting carrier-driven upgrade flexibility.

- iPhone users show 90%+ retention rates, fueled by ecosystem services like iCloud and Apple Music, with 108 million subscribers.

- iPhones retain 15-25% more trade-in value than Androids, enhancing perceived long-term value over alternatives.

- iPhones lose only 70% of value after five years, versus over 80% for Samsung/Android, swaying consumer upgrade choices.

- 80% of a smartphone’s carbon footprint occurs in manufacturing, pushing users toward trade-ins over discards.

- 21.3% of consumers agree that social media campaigns boost smartphone upgrade interest, amplified by influencer endorsements.

- Global smartphone shipments grew just 2.9% in 2022 amid inflation, curbing economic-driven discretionary upgrades.

iPhone Model Popularity & Upgrade Decisions

- iPhone 13 holds a 15.29% global market share as of the end of 2025, forming a massive upgrade base.

- iPhone 17 series launch demand surged 19% higher than iPhone 16 debut, with strong Pro model preference.

- Pro models captured 72% of iPhone 17 interest, far exceeding 64% for the iPhone 16 series.

- iPhone 16 Pro Max retains 82% of its value after 12 months, outpacing standard models significantly.

- iPhone 13 adoption stands at 10.18% worldwide as of March 2025, with Pro Max at 4.73%.

- 256GB iPhone storage commands top resale prices, up to $786 for 15 Pro Max 1TB variants.

- 128GB options dominate resale demand for balanced price and capacity in models like iPhone 13-15.

- iPhone 15 Pro and Pro Max claim 22% and 23% US sales share, dwarfing the standard 14%.

- Older iPhone 13 maintains a steady 15-16% share throughout 2025, signaling skipped upgrades.

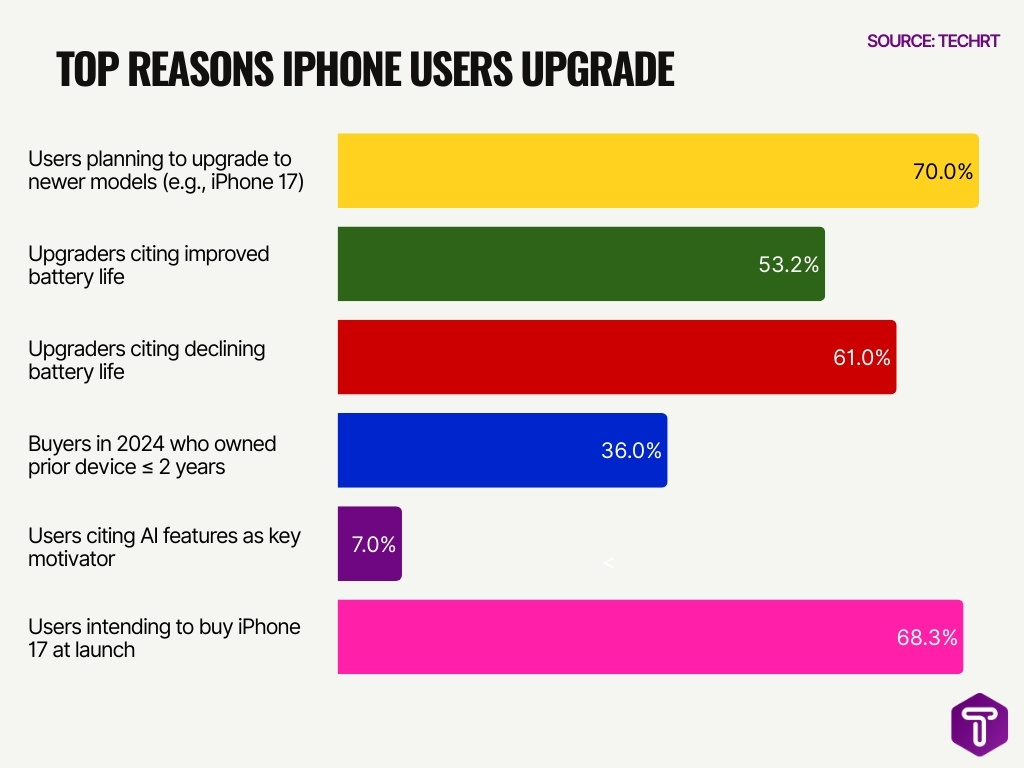

Reasons for iPhone Upgrades

- Nearly 70% of iPhone users plan to upgrade to newer models like the iPhone 17 series.

- 53.2% of upgraders cite improved battery life as their top reason amid degradation after 2-3 years.

- 61% upgrade primarily due to declining battery life on older devices.

- 36% of iPhone buyers in 2024 owned their prior device for 2 years or less, shortening upgrade cycles.

- Apple Intelligence drove record iPhone upgrades in fiscal Q1, with stronger sales where features are available.

- Only 7% cite AI features like Apple Intelligence as key upgrade motivators.

- 68.3% intend to buy iPhone 17 at launch, often for camera and design enhancements.

- Carrier subsidies rose $100 for iPhone 17, bundling with plans over 24-36 months to spur upgrades.

- iPhone Air models lost up to 47.4% resale value in 10 weeks, accelerating timely trades.

- Apple provides 5-6 years of iOS updates, prompting upgrades for ongoing security.

iOS Adoption & Its Impact on Upgrades

- Only ~16.3% of iPhones run iOS 26 as of early 2026.

- iOS 26.1 holds ~10.6% while iOS 26.2 has ~4.6% of the market.

- Over 60% of global iPhones still operate on iOS 18 versions.

- iOS 18.7 commands 33.83% and iOS 18.6 25.23% of users.

- In the US, nearly 75% of devices remain on iOS 18.

- iOS 26 adoption trails prior versions, with iOS 18 at 63% four months post-launch.

- 36% of new iPhone buyers upgrade after 2 years or less.

- 33% hold devices for 3+ years, extending upgrade cycles.

- Apple’s security support for older iOS reduces immediate update pressure.

iOS Adoption & Its Impact on Upgrades

- Only ~16.3% of iPhones run iOS 26 as of early 2026.

- iOS 26.1 holds ~10.6% while iOS 26.2 has ~4.6% of the market.

- Over 60% of global iPhones still operate on iOS 18 versions.

- iOS 18.7 commands 33.83% and iOS 18.6 25.23% of users.

- In the US, nearly 75% of devices remain on iOS 18.

- iOS 26 adoption trails prior versions, with iOS 18 at 63% four months post-launch.

- 36% of new iPhone buyers upgrade after 2 years or less.

- 33% hold devices for 3+ years, extending upgrade cycles.

- Apple’s security support for older iOS reduces immediate update pressure.

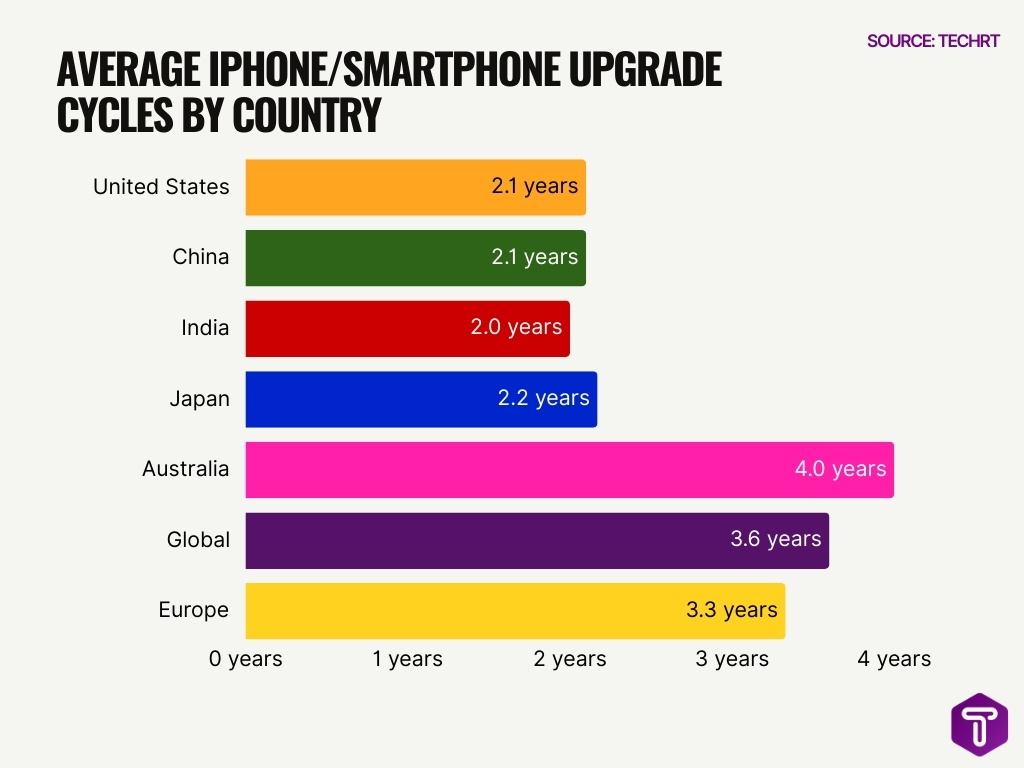

Upgrade Cycles by Country

- In the United States, iPhone holds a 58% market share, driving upgrades every 2.1 years on average.

- The US has over 155 million iPhone users, fueling steady upgrade activity in 2026.

- In China, iPhone upgrade cycles average 2.1 years, shorter due to carrier incentives.

- India sees iPhone upgrades every 2 years amid rapid user base growth.

- Japanese iPhone owners upgrade after 26 months, among the longest globally.

- In the UK, 26% of users now hold smartphones for 3-4 years before upgrading.

- Australia reports average smartphone replacement cycles of nearly 4 years amid low subsidies.

- The global smartphone upgrade cycle stands at 3.6 years, with the US at 2.1 years.

- 43% of Chinese smartphones last 1-2 years, boosting frequent trades.

- European users often delay upgrades beyond 2 years due to economic pressures.

Resale & Depreciation Effects on Upgrades

- By 2026, older iPhones like the iPhone 16 and 15 series have depreciated between ~47% and ~62% within one to two years of release.

- Newer models like the iPhone 17 256GB have lost ~34.9% of value since launch in 2025.

- Depreciation rates remain significant; iPhone 14 models may depreciate around ~75% over several years post‑launch.

- Pro and Pro Max variants generally retain value better than standard models, often depreciating below ~40% in the early months.

- iPhones tend to maintain higher resale values than many Android rivals, retaining an estimated ~57.1% after 24 months.

- Second‑hand markets are growing, with year‑over‑year volume increases, fueled by cost‑conscious consumers seeking value.

- Older devices flooding the market after new launches can temporarily depress resale prices.

- Trade‑in and resale prospects influence upgrade timing, stronger expected resale value can encourage earlier upgrades.

- Forecasts suggest depreciation trends may soften slightly if newer iPhone models retain more demand over time.

Consumer Intent to Upgrade iPhones

- Surveys show varying consumer intent; some indicate pent‑up demand, with over 50% of users extremely likely to upgrade in the next year.

- Other data highlights softness, with U.S. purchase intent dropping to ~17%—a 5‑year low in a mid‑2025 survey.

- Longer average device lifespans correlate with delayed upgrades; the average age of active iPhones has climbed beyond 22–30 months in many markets.

- Corporate iPhone users may upgrade more predictably, tied to workplace device refresh cycles.

- Consumer excitement for future features (e.g., rumored AI and foldable iPhones) could invigorate future upgrade intent.

- Economic factors (inflation, discretionary spending changes) shape willingness to invest in new devices.

- Promotional incentives and trade‑in offers remain strong motivators for upgrade action.

- A segment of the population prefers used or refurbished units over brand‑new devices to manage costs.

- Brand loyalty continues to influence upgrade plans, with many iPhone owners planning eventual upgrades.

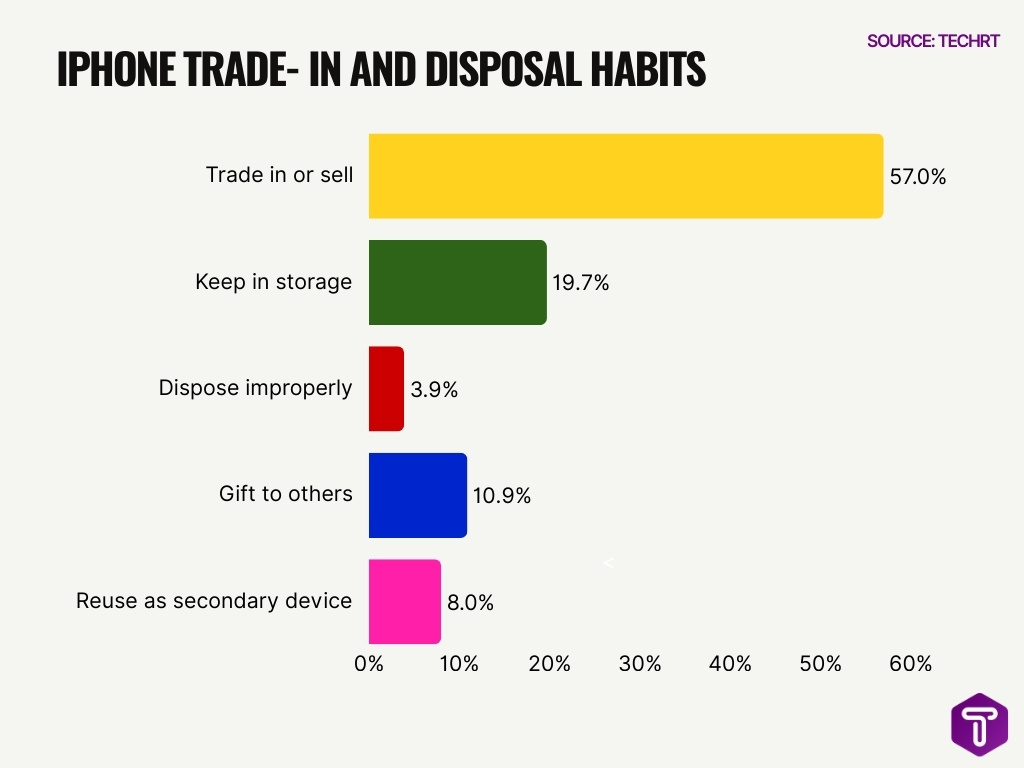

iPhone Trade-In and Disposal Habits

- About 57% of iPhone owners trade in or sell their old handset when upgrading.

- Roughly 19.7% keep old devices in storage, and 3.9% dispose of them improperly.

- 10.9% gift old iPhones to others, often family or friends.

- 8% reuse old iPhones as secondary devices after upgrades.

- Recycling programs through Apple and partners encourage more environmentally safe disposal.

- E‑waste concerns are increasing, pushing some users toward certified recycling.

- Trade‑in activity spikes around new model launches and holiday seasons.

- Disposal habits vary by region, with developed markets showing higher trade‑in rates.

Regional Upgrade Behaviors (e.g., US, China, India)

- U.S. holds 57-60% iPhone market share with average upgrade cycles exceeding 42 months.

- China iPhone shipments grew 4% YoY to 46.2 million units in 2025, capturing 16.2% share with 2.1-year cycles.

- India saw Apple reach a record 10.4% market share in Q3 2025 with 5 million quarterly shipments amid rising incomes.

- Europe’s smartphone replacement cycles lengthened to 40 months in 2020, trending longer due to cost factors.

- Japan reports 1.8-year average iPhone upgrade cycles and strong iPhone 16 performance.

- Southeast Asia experiences 25-31% iPhone growth in 2025, driven by iPhone 16 demand.

- Regions with robust second-hand markets saw global refurbished sales rise 5% YoY, with Apple at 56% share, influencing upgrades.

- India’s per-capita disposable income rose 4.7% CAGR from 2013 to 2023, boosting urban mid-cycle upgrades via financing.

Apple’s Market Position & Upgrade Influence

- Apple’s global iPhone user base exceeded 1.46 billion active devices in 2026, reflecting strong demand and upgrade potential.

- Apple controls roughly 27.7% of the global smartphone market, solidifying its premium segment leadership.

- In the U.S., Apple’s smartphone market share is around 57%+, underlining its influence on regional upgrade trends.

- iPhone market strength supports resilient trade‑in ecosystems and strong resale markets.

- Strategic ecosystem lock‑in through services (iCloud, App Store) helps drive repeat upgrades.

- Brand loyalty among iPhone owners remains high, with many upgrading within the Apple product family.

- Competitive pressures from Android manufacturers influence Apple’s feature prioritization and upgrade drivers.

- Apple’s innovation pipeline and anticipated features shape consumer expectations and upgrade interest.

- Macroeconomic factors and global supply chain conditions also impact Apple’s market dynamics.

Future Upgrade Cycle Predictions

- Analysts suggest upgrade cycles may plateau or extend further if new features don’t deliver transformative user value.

- Expected developments like a foldable iPhone by late 2026 could spark a fresh upgrade wave.

- Continued second‑hand market strength may encourage delayed new purchases in favor of refurbished options.

- AI enhancements and cross‑device integration may become key motivators for future upgrades.

- Innovation in battery tech and durability could lengthen device lifetime and delay upgrades.

- Trade‑in incentives are likely to evolve with more flexible financing and subscription models.

- Regional economic recovery or downturns will influence global upgrade pacing differently by market.

- Forecasts underscore iPhone’s resilience but highlight that meaningful leaps in features will dictate cycle acceleration.

Frequently Asked Questions (FAQs)

What percentage of iPhone users intend to upgrade to the iPhone 17 at launch?

68.3% of current iPhone users plan to upgrade to the iPhone 17 model at launch, up from 61.9% ahead of the iPhone 16 release.

What portion of iPhone owners keep a previous device for three years or more before replacing it?

In the U.S., 42% of iPhone buyers replacing an iPhone had owned their device for three years or longer in the 12 months ending September 2025.

What share of the global smartphone market did Apple capture in 2025?

Apple held a 20% global smartphone market share in 2025, the largest among manufacturers.

What percentage of iPhone buyers upgraded within two years in late 2024?

According to CIRP data, 36% of iPhone users upgraded within two years by the end of 2024, up from 31% the year before.

What proportion of iPhone users are on iOS 26 as of early 2026?

Only around 15.4% of iPhone users had adopted iOS 26 months after its launch, a much smaller share than earlier software versions.

Conclusion

The iPhone upgrade journey is defined by longer device lifespans, complex resale dynamics, and varied consumer intent across regions. Adoption of new software versions, like iOS 26, remains slower than historical norms, signaling cautious user behavior around upgrades. Resale and depreciation trends continue to shape upgrade timing, with robust second‑hand markets emerging. Regional nuances, from the U.S. to China and India, highlight how economic forces and local behaviors influence upgrade cycles.

Looking forward, Apple’s position in the premium segment and its innovation strategy will remain central to how users approach the next device refresh. As technology evolves and consumer priorities shift, understanding these patterns will be key for industry watchers and users alike.

Leave a comment

Have something to say about this article? Add your comment and start the discussion.