Mobile gaming is no longer a niche corner of the entertainment world; it’s a global powerhouse commanding billions in consumer spending. The mobile gaming industry continues to evolve rapidly, with monetization strategies, regional trends, and player behaviors shifting in response to market dynamics and technological innovation. From high-spending “whales” to casual players driving ad revenue, the ecosystem has diversified in complex ways.

In this article, we explore the latest data behind mobile game spending, offering insight into the platforms, demographics, and strategies driving this booming sector. Whether you’re a developer, marketer, or investor, the following statistics provide a data-driven view of the current mobile gaming economy.

Editor’s Choice

- Mobile gaming is projected to generate over $133 billion in global revenue in 2026, reinforcing its position as the largest segment of the gaming industry.

- Apple’s iOS users spend significantly more per player than Android users, even though Android records higher install volumes.

- In-app purchases continue to be the dominant monetization model, accounting for more than 60% of total mobile gaming revenue.

- Asia-Pacific remains the largest mobile gaming market by spend, led by China, Japan, and South Korea as the top contributors.

- Over 3.3 billion people worldwide are expected to be active mobile gamers in 2026, highlighting massive global adoption.

- The average annual spend per mobile gamer in the U.S. is forecast to reach $86, indicating strong monetization potential in mature markets.

- Rewarded ads are now integrated into over 78% of top-grossing mobile games, making them a critical monetization strategy.

Recent Developments

- Global mobile gaming revenue reached $128.6 billion in 2025, up from $120.4 billion in 2024.

- Casual and hyper-casual games led the download charts, while strategy and RPGs led revenue generation.

- The subscription monetization model saw a 22% increase in adoption year over year.

- Emerging markets like India, Brazil, and Vietnam experienced double-digit growth in player spending.

- AI-driven personalization is increasingly being used to optimize in-app purchases and ad placements.

- Playable ads became the fastest-growing ad format, adopted by 64% of top mobile games.

- Unity and Unreal Engine updates streamlined in-game economies to support live ops monetization.

- The U.S. Federal Trade Commission announced stricter guidelines on loot box disclosures in early 2026.

- Apple’s App Store updated policies around subscriptions, now requiring clearer auto-renewal prompts.

- Mobile esports saw a 15% increase in sponsorship revenue, driven by titles like PUBG Mobile and Free Fire.

Mobile Gaming Market Growth Outlook

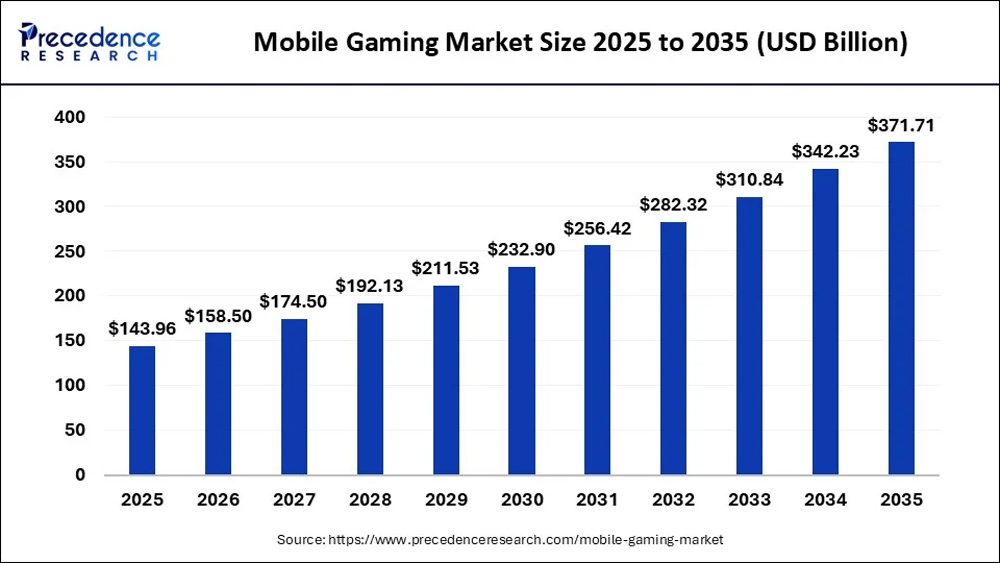

- The global mobile gaming market is projected to reach $143.96 billion in 2025, marking the starting point of a sustained growth cycle.

- Market size is expected to rise to $158.50 billion in 2026, reflecting steady year-over-year expansion.

- By 2027, mobile gaming revenue is forecasted to climb to $174.50 billion, driven by higher smartphone penetration and in-app spending.

- The market is set to cross $192.13 billion in 2028, highlighting accelerating user monetization trends.

- In 2029, global mobile gaming revenue is projected to reach $211.53 billion, reinforcing its dominance within the gaming industry.

- The market is expected to surpass $232.90 billion in 2030, supported by live-service games and advanced mobile hardware.

- By 2031, revenue is forecasted at $256.42 billion, reflecting strong momentum from emerging markets.

- The mobile gaming market is anticipated to reach $282.32 billion in 2032, fueled by 5G adoption and richer gameplay experiences.

- In 2033, the total market value is projected to grow to $310.84 billion, underscoring rising average revenue per user (ARPU).

- The market is forecasted to expand to $342.23 billion in 2034, driven by subscription models and in-game economies.

- By 2035, the global mobile gaming market is expected to peak at $371.71 billion, confirming mobile gaming as the largest and fastest-growing gaming segment globally.

Revenue Projections

- By 2027, mobile game revenue is projected to reach $153 billion, up from $133 billion in 2026.

- ARPU globally is forecast to grow from $38.8 in 2025 to $41.2 in 2026.

- Subscription revenue is projected to make up 10% of mobile game earnings by 2027.

- Game developers increasingly rely on hybrid monetization strategies to sustain revenue.

- The U.S. market is expected to surpass $27 billion in annual revenue by 2027.

- Mobile ad revenue (from in-game advertising) will exceed $50 billion globally in 2026.

- RPG and strategy genres will continue to dominate IAP revenue, with combined earnings over $45 billion in 2026.

- Casual games will grow ad revenue by 13% YoY, as rewarded ads gain traction.

- Emerging regions like MENA are projected to double their mobile game revenues by 2028.

- Seasonal events, battle passes, and live ops content are expected to drive 20% of total IAP revenue.

In-App Purchase Statistics

- In-app purchases (IAPs) account for 64% of mobile game revenue, making it the dominant model.

- The average in-app purchase per paying user globally was $16.87 in Q1 2026.

- Approximately 4.2% of mobile gamers make IAPs, up from 3.9% in 2025.

- In the U.S., the ARPPU (Average Revenue Per Paying User) is $48.21 in 2026.

- Gacha and loot box mechanics remain popular in RPGs, contributing to 32% of total IAP revenue.

- Limited-time bundles and daily deals boost conversion rates by 18% on average.

- Customization purchases (skins, avatars, themes) are a top IAP category, especially in casual and shooter games.

- Gamers aged 25–34 spend the most on IAPs, accounting for 41% of total purchase volume.

- In 2026, more than 30% of mobile games integrate a multi-tier IAP strategy, offering different value tiers.

- Events tied to IAPs, such as battle passes and premium currencies, show 70% higher purchase intent.

Top Grossing Games

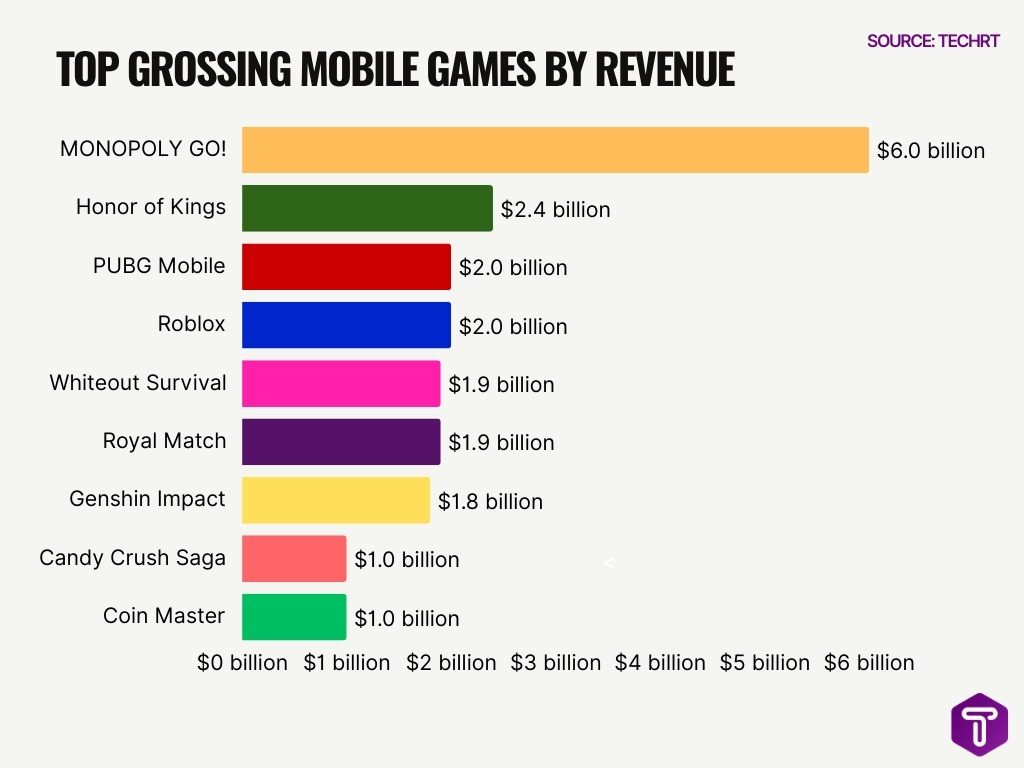

- Honor of Kings generated $2.4 billion in 2025, leading global mobile grossing charts.

- PUBG Mobile earned around $2 billion in 2025 from seasonal passes and skins.

- Genshin Impact produced $1.8 billion in mobile revenue in 2025 via gacha systems.

- Roblox hit $2 billion worldwide in 2025, up 30.2% year-over-year.

- Whiteout Survival secured $1.9 billion in 2025, ranking in the top 5 globally.

- MONOPOLY GO! surpassed $6 billion lifetime IAP by early 2026, fastest ever.

- Royal Match generated $1.9 billion in 2025 with strong casual growth.

- Candy Crush Saga reached $1 billion+ in 2025, dominating puzzle monetization.

- Call of Duty: Mobile maintains $30 million monthly revenue in 2026.

- Coin Master neared $1 billion in 2025, excelling in casual spending.

Mobile Game Spending by Genre

- RPGs are the top-grossing genre in 2026, with $26 billion in expected global revenue.

- Strategy games follow closely, generating $21.4 billion, largely from high-ARPU users.

- Puzzle games, including match-3 titles, earned $9.7 billion globally in 2025, rising in 2026.

- Action and shooter genres saw a combined revenue of $14 billion, led by Call of Duty: Mobile.

- Casual games dominate install volumes but rank fifth in monetization, at $8.3 billion.

- Casino games, including slots and card games, generate over $10.5 billion in annual revenue.

- Sports and racing genres maintain a niche but loyal spending base, at $3.4 billion combined.

- Simulation games, like farming or life simulators, saw 12% YoY revenue growth.

- Hyper-casual games earn primarily via ads, contributing $5.2 billion in ad-based revenue.

- Social casino games and real-money variants drive strong retention and in-app monetization.

Regional Spending Breakdown

- The Asia-Pacific region accounts for over 50% of total mobile game revenue, led by China and Japan.

- North America contributes 18% of global spend, with the U.S. being the largest individual market.

- Europe generates about 15% of mobile gaming revenue, led by the UK, Germany, and France.

- Latin America is one of the fastest-growing regions, expected to hit $5.8 billion in revenue in 2026.

- The Middle East and Africa regions are seeing a CAGR of 14% through 2028.

- India leads in download volume, but monetization remains lower compared to the user base.

- Brazil, Mexico, and Argentina show double-digit YoY growth in mobile gaming spend.

- Japan has the highest ARPU in the world, exceeding $100 per paying user.

- South Korea’s mobile gaming sector grew 9.6% in 2025, maintaining strength in competitive and RPG titles.

- Regional events and local pricing models drive higher engagement in non-Western markets.

U.S. Mobile Game Spending by Age Group

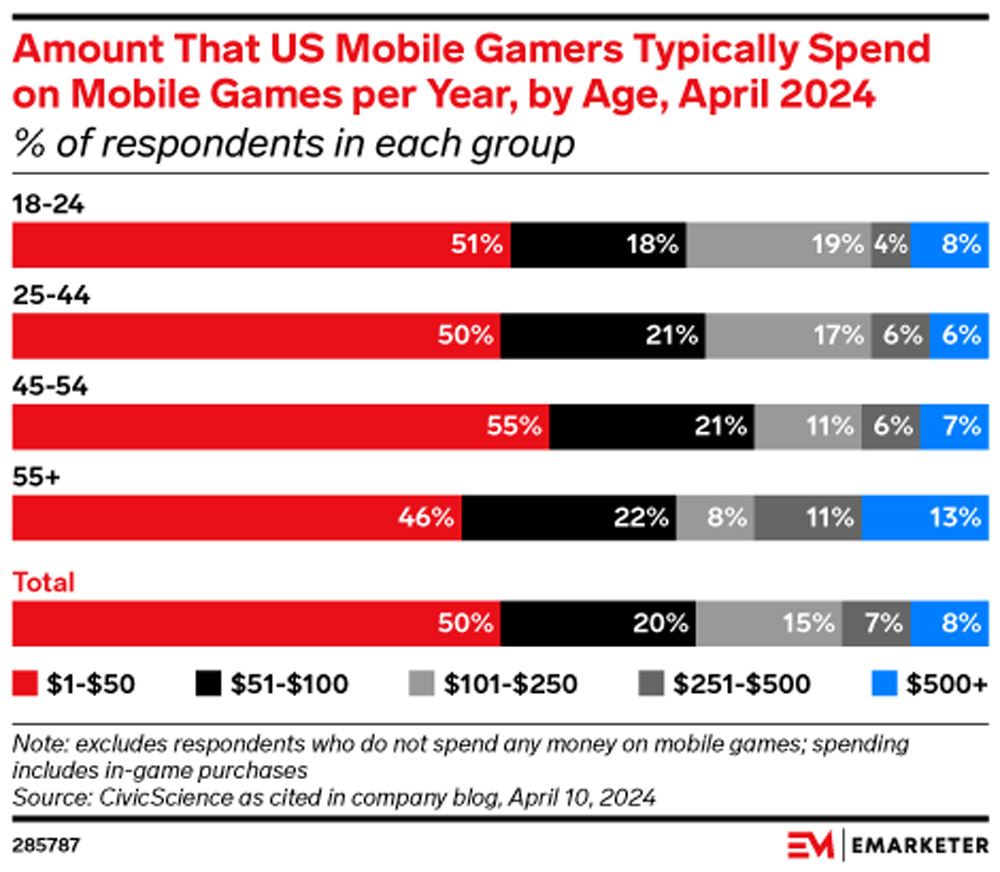

- Half of U.S. mobile gamers (50%) spend $1–$50 per year, confirming that low-spend players dominate the mobile gaming economy.

- Among 18–24-year-olds, 51% spend $1–$50, while a notable 8% already spend $500+ annually, signaling early high-value user formation.

- The 25–44 age group shows balanced spending behavior, with 21% spending $51–$100 and 17% spending $101–$250 per year.

- 45–54-year-old gamers are the most conservative spenders, with 55% keeping annual mobile game spending below $50.

- Players aged 55+ are the most likely high spenders, as 13% spend $500+ per year, the highest share across all age groups.

- Mid-tier spending ($101–$250) declines with age, dropping from 19% among 18–24 to just 8% among 55+ gamers.

- Spending above $250 per year rises with age, increasing from 12% in the 18–24 group to 24% among gamers aged 55+.

- Overall, only 15% of U.S. mobile gamers spend $101–$250 annually, highlighting a shrinking middle-spend segment.

- Just 8% of all U.S. mobile gamers spend $500+ per year, reinforcing the importance of whales in driving mobile game revenue.

- The data confirms that age strongly influences spending patterns, with younger users dominating volume and older users driving premium revenue.

Average Spend per User

- The global average spend per mobile gamer is $41.20 in 2026, up from $38.80 in 2025.

- U.S. gamers lead with an average annual spend of $86, among the highest globally.

- In Japan, the average spend per paying user exceeds $100 annually.

- Android users spend less per person than iOS users, but represent more total spend due to scale.

- High-income gamers spend 3.4x more than the average mobile user on in-app purchases.

- Subscribed users spend 18–24% more on additional purchases than non-subscribers.

- Casual gamers average $12.80 per year, while RPG players spend over $52 annually.

- Games using gacha mechanics see per-user spending levels that are 2–3x higher than standard monetization models.

- The average lifetime value (LTV) per user for top games exceeds $70 in core markets.

- Players aged 25–34 spend more than any other age segment, contributing over 35% of total revenue.

Whales vs Free Players

- In most freemium mobile games, a tiny fraction of players (often around 2–3%) contribute the majority of spending, while the vast majority play for free.

- Whales account for around 2% of users but contribute the largest share of spending, often between $500–$5,000 per player.

- A moderate spender segment often labeled “dolphins” makes up about ~13% of users and spends between $20–$500 each.

- Free players account for the majority of installs but generate most revenue indirectly through ads or occasional microtransactions.

- The heavy skew of spending behavior mirrors casino-like economics, where a few high spenders underpin profitability.

- Average spending by the broader paying player base is often many times higher than that of typical casual gamers, emphasizing monetization reliance on whales.

- Games using gacha mechanics, rewarding random in-game items for purchases, tend to generate disproportionate revenue from high spenders.

- Despite representing a minority, whales’ contributions significantly elevate mobile games into high-revenue brackets seen in top-grossing titles.

Monetization Models

- The freemium (free-to-play) model dominates mobile gaming, offering the game free while charging for items, boosts, or virtual currency.

- In-app purchases (IAP) remain a core revenue engine, allowing players to spend on additional content or progress.

- In-app advertising is increasingly lucrative, covering rewarded videos, interstitials, banners, and playable ads.

- Subscriptions are emerging as a stable monetization strategy, offering recurring revenue via perks like ad removal or exclusive content.

- Hybrid models, mixing IAP, ads, and subscriptions, are growing as developers diversify revenue channels.

- Rewarded ads have become especially effective, giving users optional incentives, such as extra lives, in exchange for engagement.

- Playable ads and offerwalls provide interactive experiences that also serve as monetization opportunities.

- Some premium games still use upfront pay-to-play models, though far less common than freemium strategies.

Average Number of Games Played Per Month

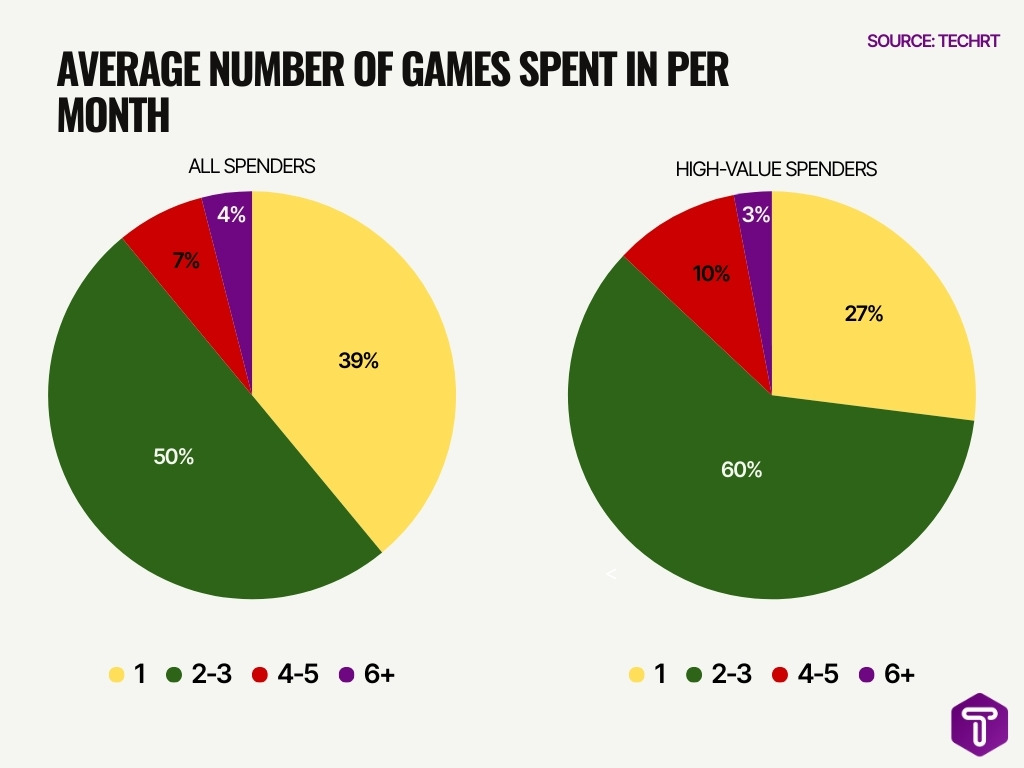

- Half of all spenders (50%) typically play 2–3 games per month, making this the most common engagement level among general players.

- A significant 39% of all spenders limit their activity to just 1 game per month, highlighting a strong preference for focused gameplay.

- Only 7% of all spenders engage with 4–5 games monthly, indicating limited multi-game exploration among average users.

- Heavy engagement is relatively rare, with just 4% of all spenders playing 6 or more games per month.

- Among high-value spenders, a dominant 60% play 2–3 games per month, reinforcing this range as the core spending segment.

- 27% of high-value spenders focus on 1 game per month, showing deeper investment in fewer titles.

- More active high-value players are still a minority, with 10% playing 4–5 games monthly.

- Extreme multi-game behavior remains niche even among top spenders, as only 3% of high-value spenders play 6+ games per month.

Year-Over-Year Trends

- Mobile gaming revenue stabilized and grew modestly in 2024–25 despite softer download growth.

- In-app purchase revenue is up ~4% year over year, with engagement also rising.

- Time spent playing mobile games increased roughly 8% year over year, even as downloads declined.

- Sessions per user also climbed, with 12% more sessions year over year, suggesting deeper engagement.

- Hybrid and rewarded ad revenue grew at a faster clip than traditional in-app purchases.

- Regional trends showed that Latin America and the Middle East’s IAP growth outpaced some established markets in recent years.

- Casual and hybrid-casual titles saw stronger engagement trends compared to some core genres.

- Predictions for 2026 suggest monetization-focused growth, even if install volume remains flat.

User Engagement Metrics

- Time spent in mobile games increased by ~8% year over year, signaling deeper engagement.

- Session counts rose about 12% year over year, reflecting higher play frequency.

- Active mobile gamers worldwide are estimated at ~3.3 billion, making mobile the most engaged gaming segment.

- Average mobile gamer owns multiple gaming apps, often 2.7 or more.

- Gaming engagement skews highest among players aged 18–34, the core spender demographic.

- Casual titles frequently show high repeat engagement due to short session lengths and accessibility.

- Rewarded ad engagement has surged as players opt into ads for in-game rewards.

- Live ops and seasonal events correlate with spikes in engagement metrics.

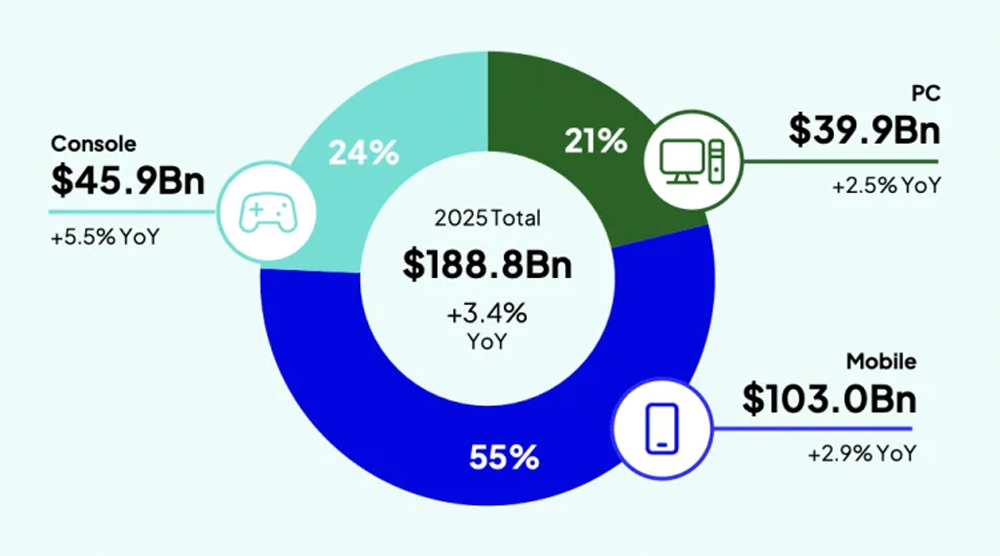

Global Gaming Market Revenue by Platform

- The global gaming market reached $188.8 billion in 2025, recording a +3.4% year-over-year growth across all platforms.

- Mobile gaming dominates the market with $103.0 billion in revenue, accounting for 55% of total gaming revenue and posting +2.9% YoY growth.

- Console gaming generated $45.9 billion, representing 24% of total market revenue, while delivering the strongest growth rate at +5.5% YoY.

- PC gaming contributed $39.9 billion, capturing 21% of overall gaming revenue and growing at +2.5% YoY.

- The data highlights a mobile-first gaming economy, with consoles outperforming other platforms in growth momentum despite a smaller revenue share.

Mobile Game Ad Spend and Monetization Trends

- The global in-game advertising market reached $10.82 billion in 2025, projected to hit $17.66 billion by 2030 at 10.2% CAGR.

- Over 70% of players prefer rewarded video ads over other formats, with completion rates exceeding 80%.

- Playable ads boost conversions by up to 319% vs. traditional video and 700% vs. static banners.

- 78% of mobile gamers willingly watch rewarded video ads for in-game benefits.

- Mobile game IAP revenue totaled $81.75 billion in 2025, up 1.3% YoY.

- Global app UA spend hit $78 billion in 2025, with remarketing at $31.3 billion (29% share).

- Hybrid monetization boosts revenues by 20-45% via balanced IAP and ads.

- Android now holds the majority of ad revenue share in mobile games, flipping from iOS dominance.

- In-game ad market forecast at $10.34 billion in 2025, growing to $33 billion by 2035 (12.3% CAGR).

Future Market Outlook

- Mobile gaming revenue projected to reach $173.4 billion by 2026, outpacing 47-50 billion installs.

- Revenue growth at 5.4% annually through 2030 surpasses 6-7% install declines.

- Hybrid models were used by 72% of the top 100 grossing games in 2026.

- AI personalization boosts retention by up to 30% and increases spend efficiency.

- India’s mobile gaming grows at 14.6% CAGR to $16.72 billion by 2034.

- Latin America revenue at 9.3% CAGR reaching $16.1 billion by 2030.

- Subscription models forecast 15%+ CAGR with $20 billion by 2026.

- Privacy rules like DPDP dent ad revenues via targeting limits.

- Live service events drive IAPs up 4% YoY despite 7% download drops.

- ARPU rises to $65 by 2029 for innovative monetization.

Frequently Asked Questions (FAQs)

How much did consumers spend on mobile game in‑app purchases and paid games in 2025?

Consumers spent approximately $167 billion on mobile in‑app purchases and paid games across iOS and Google Play in 2025, up about 10.6% year‑over‑year.

What was the total mobile game spending worldwide in 2025?

Global consumer spending on mobile games reached about $81.8 billion in 2025.

What share of mobile gamers make in‑app purchases?

Only about 1.83% of mobile gamers spend money on in‑app purchases, according to recent industry data.

How many mobile game downloads did India record in FY 2024‑25?

India recorded about 8.45 billion mobile game installs in FY 2024‑25, ranking it as the highest‑download market by volume.

What is the projected CAGR for the global mobile gaming market from 2026 to 2035?

The global mobile gaming market is expected to grow at a CAGR of about 9.95% between 2026 and 2035.

Conclusion

Mobile game spending continues to expand as audiences grow, monetization strategies evolve, and engagement deepens across regions and platforms. Despite shifts in downloads and market dynamics, the industry’s resilience is evident in rising revenue forecasts, diversified ad and IAP models, and expanding global audiences. Developers that finely balance monetization with user experience will likely shape the next wave of growth. As the market advances through and beyond, these trends underscore why mobile gaming remains one of the most lucrative and dynamic sectors in digital entertainment.

Leave a comment

Have something to say about this article? Add your comment and start the discussion.