Mobile gaming has rapidly shifted from a casual pastime to a dominant force in interactive entertainment. Today’s mobile games generate substantial revenue, attract billions of players, and influence consumer behavior across regions. In the U.S., mobile titles contribute significantly to gaming revenue and user engagement, while globally, emerging markets continue to expand the industry’s footprint. From social simulation games to competitive battle royales, mobile gaming’s diversity fuels innovation and monetization. Explore the latest data below to see how this fast-moving sector is shaping.

Editor’s Choice

- The global mobile gaming market was valued at roughly $143.96 billion in 2025 and is forecast to rise further in 2026.

- In 2025, mobile games accounted for around 55% of total global gaming revenue with $103 billion in earnings.

- There were over 3.3 billion mobile gamers worldwide in 2025, reflecting a massive audience scale.

- Mobile in‑app purchase revenue grew approximately 4% in 2024 year‑over‑year.

- Casual mobile game sessions climbed by 12% in 2024 compared to 2023.

- Asia‑Pacific represented the largest regional revenue share in 2024 for mobile gaming.

- Average Revenue Per User (ARPU) is projected to increase in the coming years as monetization diversifies.

Recent Developments

- Mobile gaming continues to see steady revenue growth, with in‑app purchase (IAP) spending rising even amidst broader industry shifts.

- Studies show that time spent in mobile gaming increased significantly, suggesting deeper engagement patterns.

- Developers are focusing on hybrid monetization, combining ads and IAPs for better lifetime value.

- Growth in session frequency and duration was notable between 2023 and 2024.

- Casual game categories led expansion in Western markets, while Asia saw diversified performance.

- Advanced analytics and AI tools are increasingly used to optimize retention and monetization strategies.

- Mergers and acquisitions in mobile gaming are shaping industry consolidation and competitive portfolios.

- Newer titles are achieving rapid adoption, reflecting robust digital distribution and social sharing trends.

Global Market Overview

- The mobile gaming segment dominated over half of the global $188.8 billion games market in 2025.

- Mobile revenue grew by an estimated 2.9% from 2024 to 2025, illustrating a mature but resilient ecosystem.

- Forecasts show the total mobile gaming market will remain one of the largest entertainment sectors globally in 2026.

- Asia‑Pacific was the largest market by revenue share in 2024, signaling continued growth influence.

- North America and Europe displayed stable mobile monetization and user engagement trends.

- Mobile gaming revenue represented about 49% of all gaming revenue in 2024.

- Smartphone accessibility remains the primary driver of mobile gaming’s global growth.

- Emerging markets in Latin America and Africa are showing the fastest user base expansion rates.

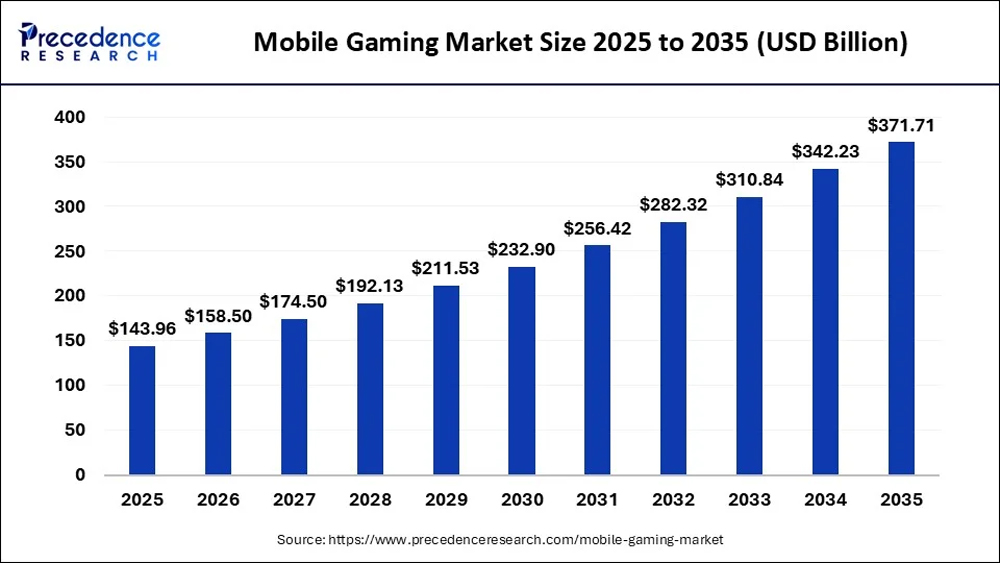

Mobile Gaming Market Size Growth Outlook

- The global mobile gaming market is valued at $143.96 billion in 2025, highlighting the industry’s strong foundation and widespread adoption.

- Market revenue is projected to reach $158.50 billion in 2026, reflecting steady year-over-year growth driven by increasing smartphone penetration.

- By 2027, the market will expand to $174.50 billion, supported by rising in-app purchases and mobile esports engagement.

- The industry is expected to surpass $192.13 billion in 2028, signaling accelerating monetization across casual and mid-core games.

- In 2029, global mobile gaming revenue is forecast at $211.53 billion, crossing the $200 billion milestone.

- The market is projected to grow to $232.90 billion in 2030, fueled by cloud gaming integration and 5G adoption.

- By 2031, mobile gaming revenue will reach $256.42 billion, reflecting increasing player engagement and retention.

- The industry is expected to hit $282.32 billion in 2032, driven by AI-powered personalization and advanced game design.

- In 2033, the market size is forecast at $310.84 billion, marking a shift toward high-value premium mobile titles.

- Revenue is projected to climb to $342.23 billion in 2034, supported by expanding emerging markets and cross-platform play.

- By 2035, the global mobile gaming market is expected to reach $371.71 billion, confirming mobile gaming as the largest and fastest-growing gaming segment worldwide.

Number of Mobile Gamers

- There were over 3.3 billion mobile gamers worldwide in 2025.

- The total active video gamer population was around 3.32 billion in 2025 across all platforms.

- Mobile games account for a substantial portion of overall player numbers, reflecting universal accessibility.

- Smartphone penetration continues to broaden the global gamer base, even in developing regions.

- Annual increases in new mobile players indicate strong user acquisition trends.

- Engagement metrics like session frequency and playtime are increasing, indicating active user growth.

- Casual and midcore players form the majority of mobile gaming audiences globally.

- Future forecasts suggest the mobile gamer count may continue ascending through 2030.

Regional Market Distribution

- Asia-Pacific holds 1.48 billion mobile gamers, over half the global total in 2025.

- China boasts 683 million gamers, with mobile dominating 73.3% of sales in 2025.

- India surpassed 500 million gamers in 2025, fueled by 8.45 billion mobile installs.The

- The United States features strong penetration with mobile gaming revenue at $25-52 billion in 2025.

- Europe leads with 162 million players in key markets like the UK, Germany, and France.

- APAC captures 47-52% of global mobile revenue, valued at $72.9-87.6 billion in 2025.

- Latin America grows rapidly, with the gaming market at $25.7 billion in 2025 amid a smartphone surge.

- MENA has 507.6 million mobile players generating $4.7 billion in revenue in 2025.

- MEA sees 78% of gamers spending on mobile, averaging $26.9 per player annually.

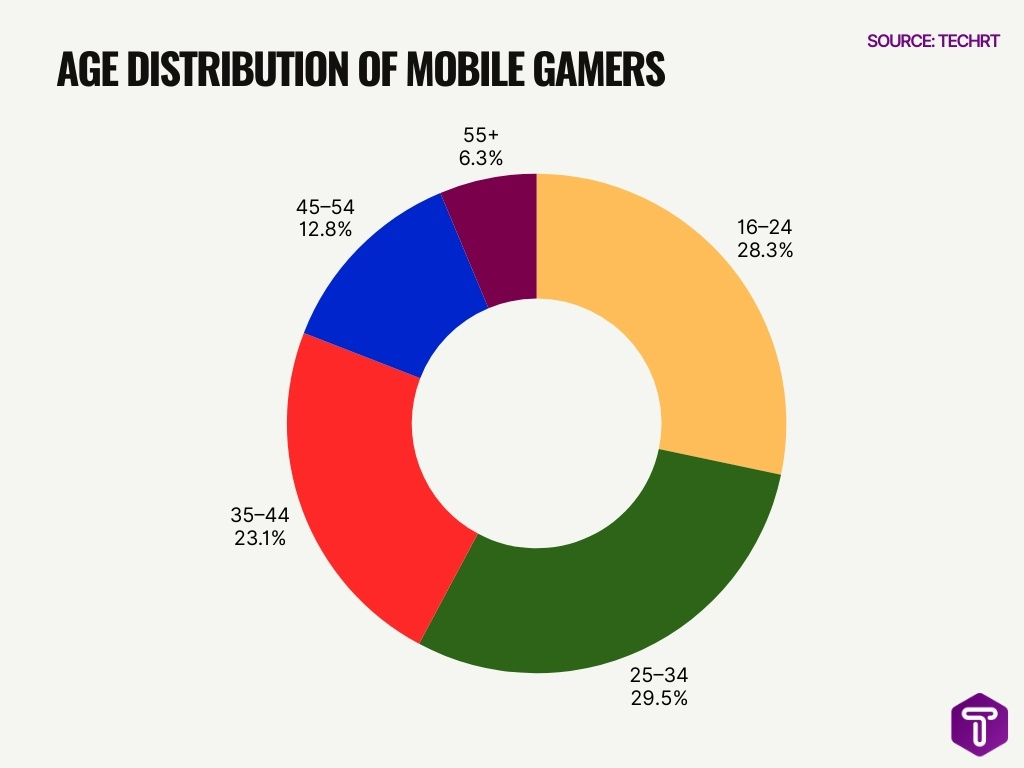

Age Distribution

- The largest age clusters among mobile gamers are typically 18–24 and 25–34, each accounting for a substantial share.

- 28.3% of mobile gamers are 16–24, showing strong youth engagement.

- 29.5% fall in the 25–34 bracket, representing core spending power.

- 23.1% are aged 35–44, indicating continued interest beyond young adulthood.

- 12.8% are 45–54, showing that mid‑life players remain active.

- 6.3% are 55+, highlighting engagement among older adults.

- Regional age patterns suggest markets like India and China have proportionally younger gamer bases.

- Demographic distinctions help shape localized content and marketing strategies.

Gender Distribution

- Mobile gaming shows near parity between male and female players, with males at roughly 53.6%.

- Female participation stands at around 46.4%, reflecting broad appeal across genders.

- Some reports indicate slight variations by region, with female engagement stronger in the U.S. mobile sector.

- Gender differences in game preferences influence title design and monetization choices.

- Certain genres like puzzle and casual games skew toward higher female participation.

- Competitive and strategy genres often attract a marginal male majority.

- Balanced gender representation underscores mobile gaming’s universal reach.

- Developers increasingly leverage gender insights to tailor accessibility and community features.

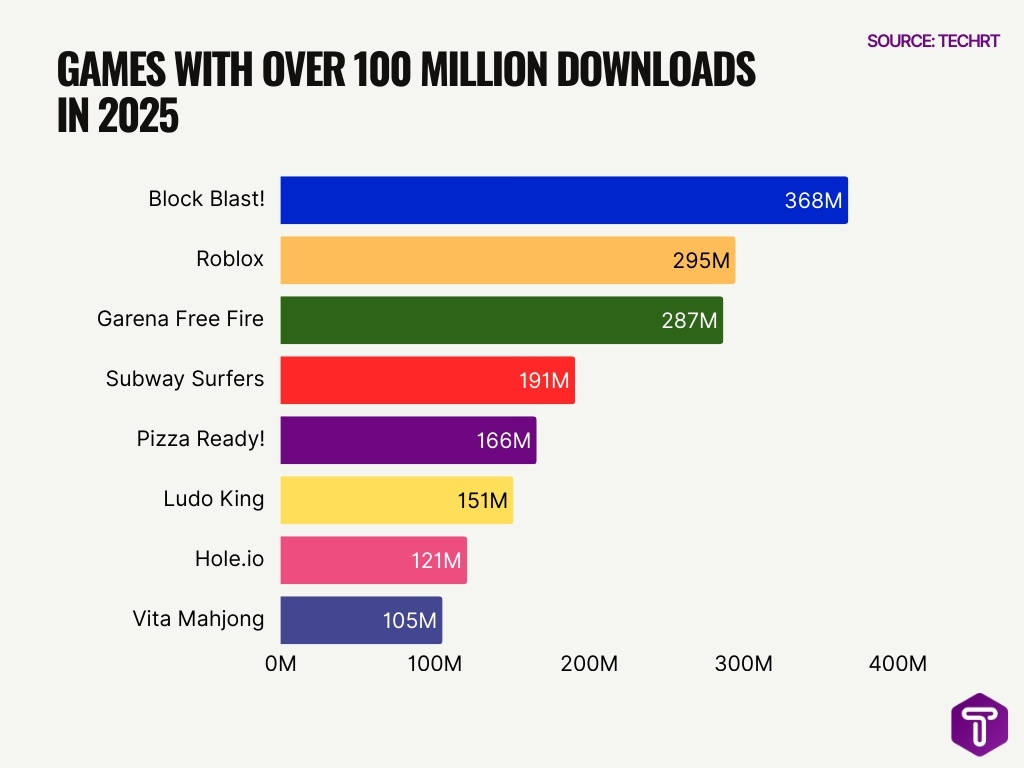

Top Mobile Games

- Block Blast! achieved 368 million global downloads in 2025, leading all mobile games.

- Roblox secured 295 million mobile installs worldwide in 2025.

- Garena Free Fire recorded 287 million downloads in 2025, strong in emerging markets.

- Subway Surfers hit 191 million installs globally during 2025.

- Pizza Ready! garnered 166 million downloads in 2025, down slightly from 2024.

- Ludo King amassed 151 million installs in 2025, dominant in India.

- Hole.io reached 121 million global downloads in 2025.

- Vita Mahjong surged to 105 million installs in 2025, up significantly year-over-year.

- 14 titles exceeded 100 million downloads each in 2025.

Most Downloaded Games

- Block Blast! led 2025 downloads with 368 million installs worldwide.

- Roblox secured second place with 295 million downloads across mobile platforms.

- Free Fire achieved 287 million downloads, dominating the battle royale genre.

- Subway Surfers garnered 191 million installs, maintaining classic runner status.

- Pizza Ready! attracted 166 million downloads in the casual segment.

- Ludo King recorded 151 million installs, boosting board game popularity.

- Vita Mahjong rose with 126 million downloads in the puzzle category.

- Free Fire Max contributed 129 million to the combined 279 million Free Fire totals.

- The mobile games market hit 59.2 billion total downloads in 2025, up 4% year-over-year.

Highest Grossing Games

- Honor of Kings topped 2025 mobile revenue at close to $2.4 billion worldwide.

- Last War: Survival earned close to $2.2 billion, up 42.5% year-over-year.

- Roblox generated $2 billion in mobile revenue, growing 30.2% Y/Y.

- Whiteout Survival and Royal Match each secured $1.9 billion in 2025.

- Monopoly Go led some charts with $2.21 billion in annual revenue.

- PUBG Mobile hit $1.15 billion despite recent declines.

- Candy Crush Saga posted $1.08 billion, with April alone at $108.25 million.

- Genshin Impact contributed $511 million amid sustained success.

- Tencent titles like Honor of Kings and PUBG Mobile dominated the top ranks.

- Strategy games like Last War showed strong YoY gains nearing $2.2 billion.

Popular Game Genres

- Simulation games ranked among the most downloaded mobile genres globally in 2025, appealing to broad casual audiences.

- Strategy and RPG titles led revenue generation, with strategy games making about $17.5 billion and RPGs generating roughly $16.8 billion in IAP revenue in 2025.

- Puzzle games also performed strongly, earning about $12.2 billion and attracting mass install volumes.

- Casino and social casino genres brought in roughly $11.7 billion in mobile revenue.

- Shooter and action genres, while smaller in revenue, remained popular with dedicated communities.

- Sports games generated around $2.7 billion from mobile in‑app purchases in 2025.

- RPG subgenres like MMORPG and squad RPG continued to command loyal user‑spend patterns.

- Across markets, casual puzzle and simulation genres often dominate download charts, even as midcore titles lead monetization.

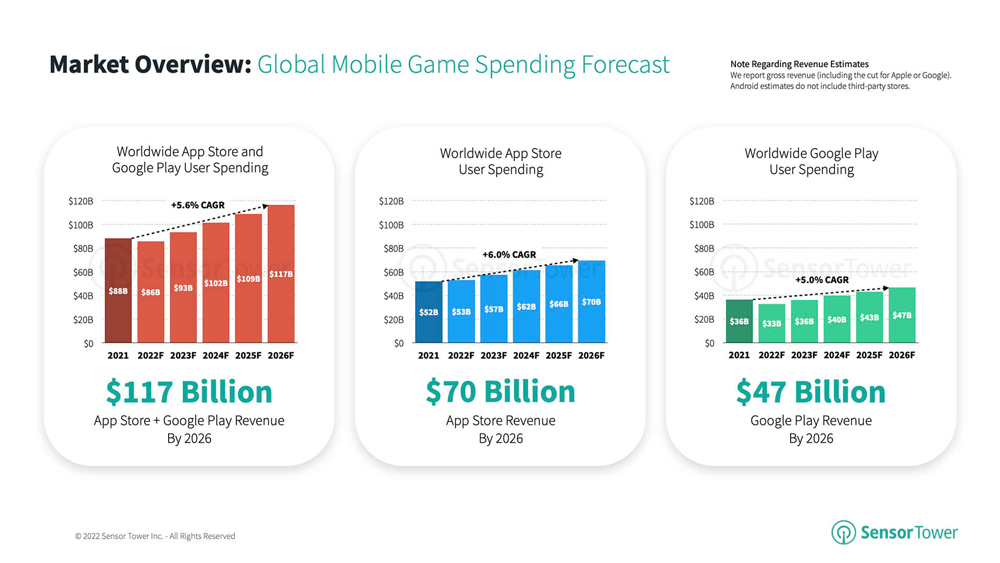

Global Mobile Game Spending Forecast Insights

- Global mobile game user spending across the App Store and Google Play is projected to reach $117 billion by 2026, highlighting the continued monetization strength of the mobile gaming market.

- Combined App Store + Google Play revenue is expected to grow at a +5.6% CAGR between 2021 and 2026, indicating steady long-term expansion despite short-term fluctuations.

- Total worldwide spending dipped slightly from $88 billion in 2021 to $86 billion in 2022, before rebounding strongly in the following years.

- Global mobile game revenue is forecast to rise from $93 billion in 2023 to $102 billion in 2024, signaling a clear post-slowdown recovery phase.

- By 2025, total mobile game user spending is expected to climb to $109 billion, setting the stage for a new all-time high in 2026.

- Apple’s App Store is projected to generate $70 billion in mobile game revenue by 2026, reinforcing its position as the largest mobile gaming marketplace.

- App Store gaming revenue is forecast to grow at a +6.0% CAGR, outpacing overall market growth and reflecting higher monetization per user.

- App Store user spending is expected to increase from $52 billion in 2021 to $62 billion in 2024, demonstrating consistent year-over-year gains.

- By 2025, App Store mobile gaming revenue is projected to reach $66 billion, before crossing the $70 billion milestone in 2026.

- Google Play mobile game spending is projected to reach $47 billion by 2026, representing a significant share of global mobile gaming revenue.

- Google Play gaming revenue is forecast to grow at a +5.0% CAGR between 2021 and 2026, slightly below the App Store growth rate.

- Google Play user spending declined from $36 billion in 2021 to $33 billion in 2022, but is expected to recover to $36 billion in 2023.

- Mobile game spending on Google Play is forecast to rise steadily to $40 billion in 2024 and $43 billion in 2025, before reaching $47 billion in 2026.

- Overall, the data highlights strong long-term growth momentum for mobile gaming, driven by in-app purchases, expanding global smartphone adoption, and improving monetization strategies across both major app stores.

Downloads by Genre

- Puzzle and simulation games consistently occupy high positions in global download rankings due to their broad appeal.

- Casual titles such as Block Blast! show that accessible gameplay leads to millions of installs across regions.

- Genres with social elements (like multiplayer or community integration) drive retention and repeat downloads.

- Battle royale shooters and competitive action games like PUBG Mobile have surpassed 1 billion total Play Store downloads as of early 2026.

- Strategy titles that combine depth with mobile accessibility also appear frequently in genre download charts.

- Puzzle, simulation, and casual genres show the broadest demographic reach among mobile players.

- Frequent seasonal events and updates help genres maintain upward download trends year over year.

- Hybrid game genres that blend casual and competitive elements gain user attention and boost install volume.

Monetization Models

- Free-to-play models generate 95% of mobile app revenue through IAP and ads, making paid upfront downloads negligible.

- Hybrid monetization is adopted by 72% of mobile game makers, combining IAP and ads.

- Rewarded video ads comprise the most lucrative format, used by 82% of developers and boosting revenues 20-40%.

- In-app purchases account for 62% of total mobile gaming revenue in top titles.

- Subscriptions project $13.1 billion in 2025, growing 16% annually for stable revenue.

- Microtransactions drive the majority of spending, powering top-grossing games like Honor of Kings at $2.5 billion.

- Ads represent 26% of revenue, with 82% of gamers preferring free games with ads over paid versions.

- Behavior-driven strategies increase ad revenue 43% per user by adapting to player progression.

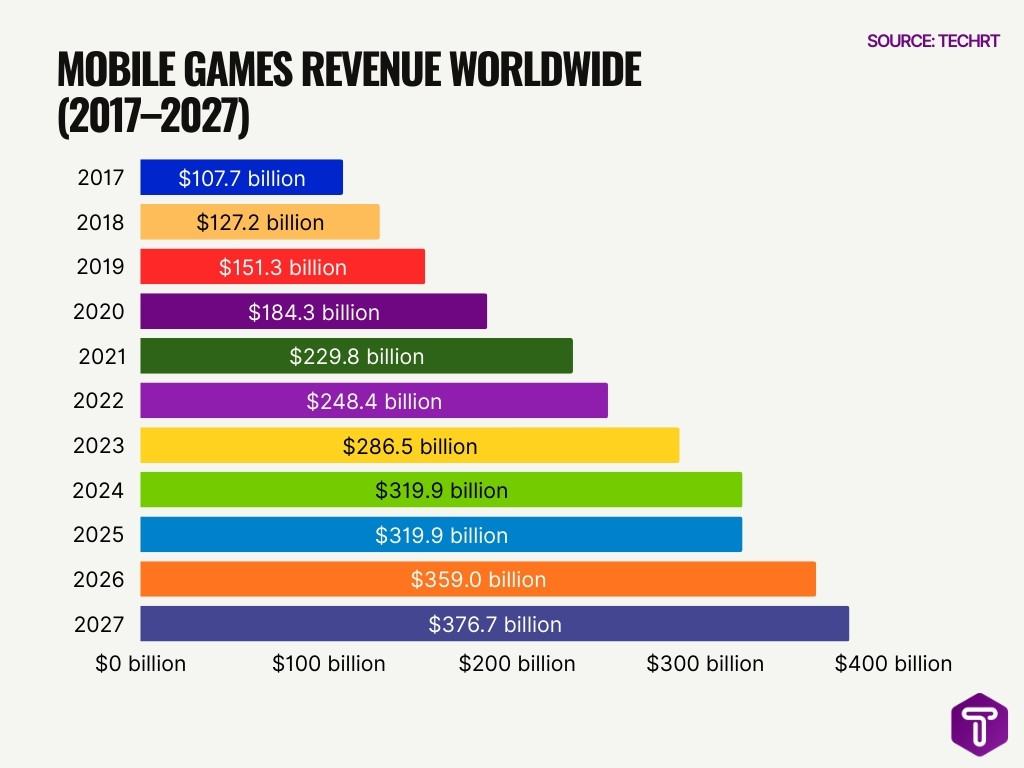

Mobile Games Revenue Growth Worldwide

- Global mobile gaming revenue increased from $107.7 billion in 2017, highlighting the early acceleration of the mobile games economy.

- In 2018, worldwide mobile games revenue climbed to $127.2 billion, reflecting rising smartphone penetration and app adoption.

- The market expanded further to $151.3 billion in 2019, driven by freemium models and in-app purchases.

- During 2020, mobile games generated $184.3 billion, supported by increased user engagement during global lockdowns.

- Revenue surged to $229.8 billion in 2021, marking a major growth phase for mobile-first gaming platforms.

- In 2022, the global mobile games market reached $248.4 billion, maintaining strong year-over-year expansion.

- The industry crossed $286.5 billion in 2023, showing sustained momentum despite broader economic uncertainties.

- Mobile games revenue is estimated at $319.9 billion in 2024, reinforcing mobile as the largest segment in the gaming industry.

- The market is expected to remain at $319.9 billion in 2025, indicating a short-term stabilization phase.

- By 2026, global mobile gaming revenue is projected to jump to $359.0 billion, signaling renewed growth.

- The market is forecast to reach $376.7 billion by 2027, underscoring the long-term scalability and monetization strength of mobile gaming.

In‑App Purchases

- In‑app purchases (IAPs) are the primary revenue engine for mobile games, projected to reach nearly $130 billion in 2025 across platforms.

- IAP growth remained positive even when overall download rates dipped in some markets.

- A small percentage of paying players, often called “whales,” contribute disproportionate spending.

- Games with competitive or progression‑based purchases often see higher IAP revenue.

- Subscription‑based IAPs help stabilize revenue streams in long‑running titles.

- IAP models now include consumables, non‑consumables, and recurring content purchases.

- Developers tailor IAP offerings to player behavior and engagement patterns.

- Optimizing IAP timing and value perception remains a key strategy for maximizing lifetime value.

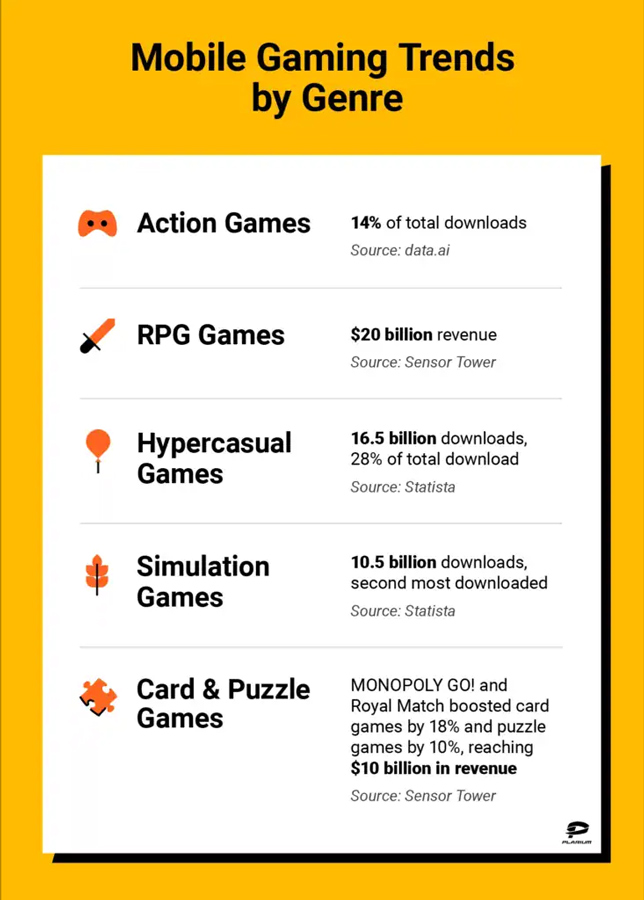

Mobile Gaming Trends by Genre

- Action games accounted for 14% of total mobile game downloads, highlighting their continued popularity among competitive and fast-paced gameplay audiences.

- RPG games generated nearly $20 billion in revenue, reinforcing their strong monetization power through in-app purchases and long-term player engagement.

- Hypercasual games recorded 16.5 billion downloads, capturing 28% of total downloads and remaining the most downloaded mobile gaming genre globally.

- Simulation games reached 10.5 billion downloads, ranking as the second most downloaded genre and benefiting from broad appeal across age groups.

- Card and puzzle games saw strong growth, with card games up 18% and puzzle games growing 10%, collectively generating around $10 billion in revenue, driven by hit titles like MONOPOLY GO! and Royal Match.

Advertising Revenue

- In‑app ads generate around $39.8 billion in mobile game advertising revenue globally, rivaling in‑app purchases as a core monetization channel.

- In‑game and in‑app ad revenue in India is projected to nearly double from $584 million (2024) to $1.1 billion (2029), outpacing overall gaming revenue growth.

- Rewarded video eCPMs typically range from $8–20, with US iOS rewarded formats reaching about $19.63 in Q4 2024, making them 2–3x higher than standard formats.

- Some premium rewarded video placements can achieve eCPMs up to $100, far above banner and interstitial averages in many mobile game genres.

- Around 78% of mobile gamers are willing to watch rewarded video ads in exchange for in‑game rewards, boosting both engagement and monetization.

- Rewarded ad units can deliver about 71% higher ROAS and 3.5x better engagement than forced ad formats when integrated at natural decision points.

- Programmatic game ad revenues are growing quickly, with mobile game advertising on track to reach $39.8 billion, driven by automated buying via DSPs and platforms like Chartboost.

- Top ad networks dominate mobile ad revenues, with the leading 5 iOS networks controlling about 88% of ad revenue share, indicating strong dependence on major programmatic platforms.

- Strategic ad placement and optimization can significantly lift returns, as leading networks like Google AdMob and AppLovin together command over 50% of Android ad revenue share.

Frequently Asked Questions (FAQs)

What was global mobile gaming revenue in 2024?

Mobile gaming generated approximately $92 billion in revenue in 2024, capturing around 49% of total gaming market revenue.

How much revenue is the mobile gaming market projected to reach by 2026?

The mobile gaming market is projected to reach about $98 billion in revenue by 2026.

How many mobile game downloads occurred globally in 2024?

There were roughly 49 billion mobile game downloads worldwide in 2024.

What is the expected CAGR for the mobile gaming market from 2025 to 2030?

The global mobile gaming market is forecast to grow at a CAGR of approximately 10.2% from 2025 to 2030.

How many mobile gamers are estimated worldwide by the end of 2025?

Mobile gamers are projected to number about 3.5 billion globally by the end of 2025.

Conclusion

Mobile gaming’s evolution continues with diverse genres driving both downloads and spending. From strategy and RPG titles dominating revenue charts to casual puzzles leading install figures, players engage across categories. Hybrid monetization models that mix ads, subscriptions, and in‑app purchases keep revenue resilient even as overall downloads fluctuate. Advertising revenue is growing rapidly alongside IAPs, creating more avenues for developers to earn. As markets expand globally and monetization tactics adapt to player behavior, mobile gaming remains a core pillar of the digital entertainment landscape.

Leave a comment

Have something to say about this article? Add your comment and start the discussion.