Mobile internet has become one of the most powerful forces shaping how people connect, work, and consume information worldwide. Approximately 6 billion people were online, representing about 74% of the global population, a notable rise from 5.8 billion in 2024. 93.9% of people access the internet via mobile devices, highlighting its central role in daily life. From enabling mobile banking in emerging markets to powering video streaming and social media engagement, the mobile internet is now indispensable. Continue exploring the statistics that define mobile internet usage and the key trends shaping global connectivity.

Editor’s Choice

- ~6 billion people were using the internet globally in 2025, about 74% of the world’s population.

- Mobile devices account for over 60% of global internet traffic.

- ~5.78 billion unique mobile users worldwide in late 2025.

- In the U.S., ~94% of the population accesses the internet via mobile devices.

- Average mobile data use per smartphone hit ~23 GB per month in 2025.

- India emerged as the top mobile data consumer, with ~36 GB per user per month.

- 5G networks covered ~55% of the world’s population by the end of 2025.

Recent Developments (2025, 2026)

- Global internet use climbed to ~6 billion users in 2025, up from 5.8 billion in 2024.

- The offline population fell to ~2.2 billion in 2025, down from 2.3 billion in 2024.

- 5G now represents around 3 billion mobile broadband subscriptions worldwide.

- 5G coverage reached ~55% of the global population by late 2025.

- Global smartphone shipments grew ~2% year‑over‑year in 2025.

- Competition in major markets (e.g., India) intensified with free AI and data offers, boosting mobile engagement.

- India’s mobile network traffic reached ~162 exabytes in the first 9 months of 2025.

- The mobile industry maintained growth while cutting operational carbon emissions despite traffic surges.

Global Mobile Internet Penetration

- 74% of the world’s population was online in 2025.

- Global internet penetration rose from 71% in 2024 to 74% in 2025.

- High‑income countries saw ~94% internet use, nearing universal access.

- Low‑income countries saw only ~23% internet use in 2025.

- Mobile web usage continues to rise, with 74% of households using mobile internet by early 2026.

- Eastern Asia now holds ~24.6% of global internet users.

- Despite gains, more than one‑quarter of the global population remained offline.

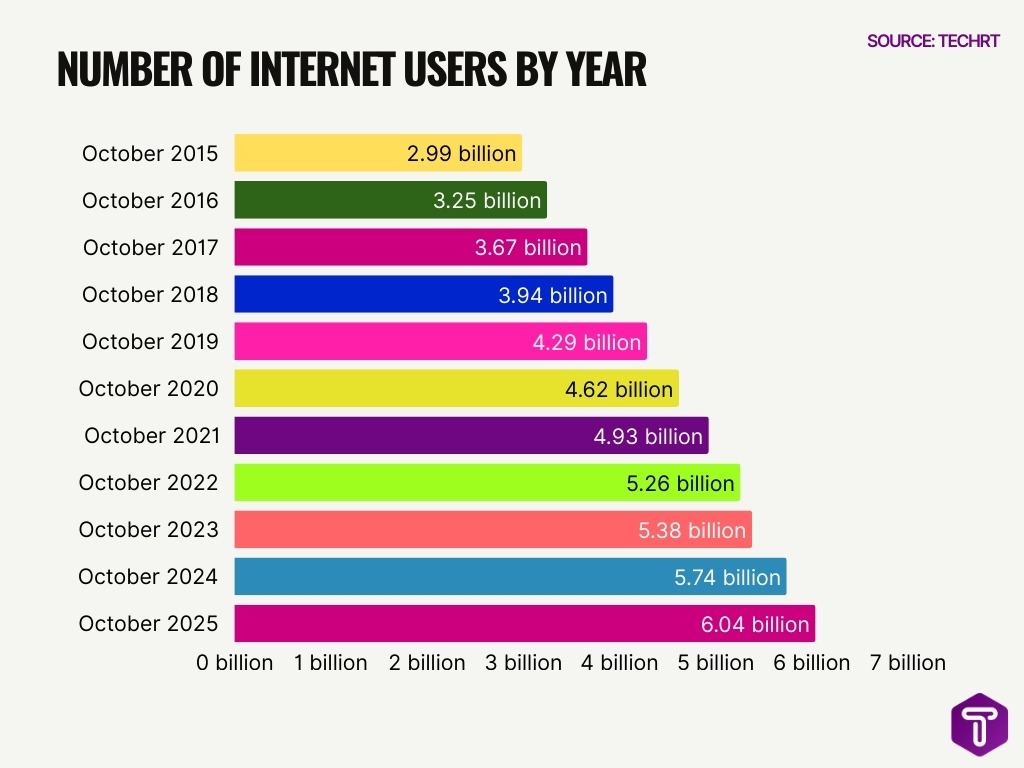

Global Internet User Growth Over Time

- The global internet user base expanded from 2.99 billion in 2015 to 6.04 billion in 2025, reflecting a near doubling in a decade.

- Internet adoption crossed the 3 billion mark in 2016, highlighting a major milestone in global digital connectivity.

- By 2019, the number of users reached 4.29 billion, demonstrating steady pre-pandemic growth in online access worldwide.

- Global internet usage surged to 4.62 billion in 2020, indicating accelerated adoption driven by remote work, online education, and digital services.

- The user base climbed further to 4.93 billion in 2021, sustaining momentum even after the initial pandemic-driven spike.

- In 2022, global internet users surpassed 5.26 billion, marking the entry into the five-billion-user era.

- Growth moderated slightly in 2023, with users reaching 5.38 billion, reflecting increasing market maturity in developed regions.

- Internet users increased significantly again in 2024, hitting 5.74 billion, supported by expanding access in emerging markets.

- By 2025, global internet users are projected to reach 6.04 billion, underscoring the internet’s role as a core global utility.

- Overall, the consistent year-over-year rise highlights long-term structural growth in global internet adoption rather than short-term spikes.

Mobile Internet Traffic Share

- Mobile devices made up ~58.3% of global internet traffic as of mid‑2025.

- Growth from earlier years marked a shift toward mobile dominance.

- In the U.S., mobile traffic accounts for ~47% of web traffic.

- Desktop remained relevant but trailed mobile in many regions globally.

- By 2026, mobile penetration approached 74% globally.

- Mobile traffic share continues to rise with app‑centric usage patterns.

- Increased video and social media consumption boosted mobile traffic share.

Mobile Data Consumption Overview

- Global mobile data usage continues its steep climb, with smartphone users averaging ~23 GB per month in 2025, up sharply from earlier years as richer content and cloud usage rise.

- Analysts project global monthly mobile data traffic could approach hundreds of exabytes per month by 2025 as connections and content demand grow.

- 5G’s share of mobile data traffic is forecast to hit ~43% by the end of 2025 5G’s share of mobile data traffic is forecast to hit ~43% by the end of 2025, up from about 34% at the end of 2024, indicating faster speeds and heavier consumption patterns.

- Mobile data traffic growth remains robust in both mature and emerging markets as video, cloud, and interactive services expand.

- In high‑income economies, high‑resolution video and streaming apps are driving disproportionate increases in data consumption.

- Sub‑Saharan Africa is among the fastest‑growing regions for mobile internet, with mobile users projected to exceed ~600 million by 2025, driven by lower‑cost access and network expansion.

- Mobile data consumption often outpaces fixed broadband in developing countries, where mobile is the primary access method.

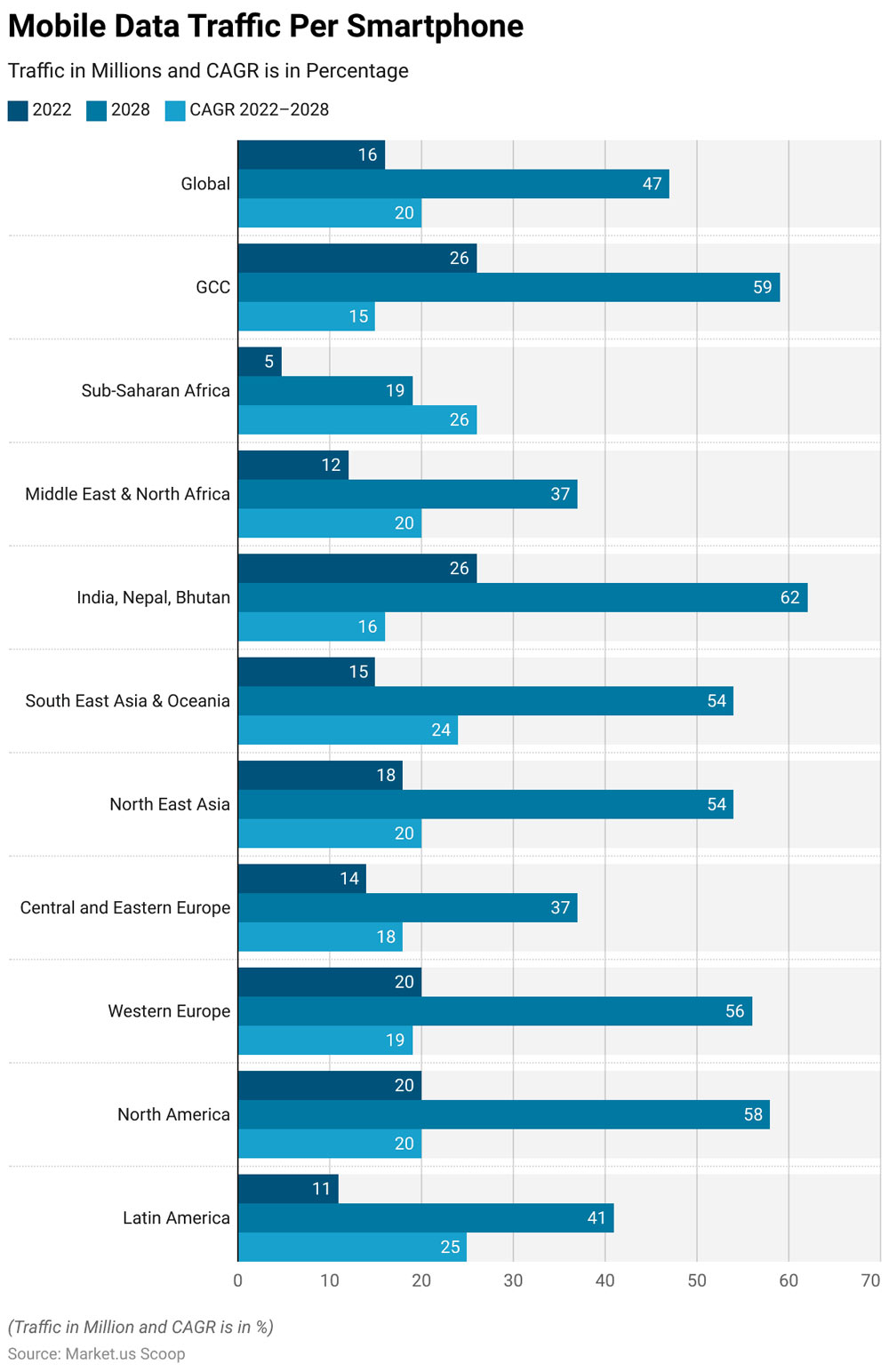

Mobile Data Traffic Per Smartphone: Key Regional Insights

- Global mobile data traffic per smartphone is projected to increase from 16 million in 2022 to 47 million by 2028, reflecting a strong 20% CAGR over the period.

- India, Nepal, and Bhutan are expected to record the highest mobile data traffic, rising from 26 million in 2022 to 62 million in 2028, supported by a 16% CAGR.

- GCC countries show consistently high usage, with mobile data traffic growing from 26 million to 59 million per smartphone by 2028, despite a comparatively moderate 15% CAGR.

- North America is forecast to see mobile data traffic climb from 20 million in 2022 to 58 million in 2028, maintaining a robust 20% CAGR driven by advanced 5G adoption.

- Western Europe is projected to increase mobile data consumption from 20 million to 56 million per smartphone, supported by a steady 19% CAGR.

- North East Asia is expected to experience significant growth, with mobile data traffic expanding from 18 million in 2022 to 54 million in 2028, reflecting a 20% CAGR.

- South East Asia & Oceania show strong momentum, as mobile data traffic per smartphone is forecast to rise from 15 million to 54 million, driven by a high 24% CAGR.

- The Middle East & North Africa are projected to nearly triple mobile data usage, increasing from 12 million in 2022 to 37 million in 2028, with a 20% CAGR.

- Central & Eastern Europe is expected to grow from 14 million to 37 million per smartphone, supported by an 18% CAGR over the forecast period.

- Latin America stands out for rapid expansion, with mobile data traffic increasing from 11 million to 41 million, backed by a strong 25% CAGR.

- Sub-Saharan Africa records the fastest growth rate globally, with mobile data traffic per smartphone rising from 5 million in 2022 to 19 million in 2028, achieving a 26% CAGR.

Data Usage by Country

- China has 1.123 billion internet users with 79.7% penetration rate as of June 2025.

- India leads globally with average mobile data usage of 36 GB per smartphone user per month.

- The United States boasts 97% smartphone penetration with over 317 million users in late 2025.

- Brazil records 101.02 mobile phone subscribers per 100 inhabitants in 2023.

- Indonesia has 356 million cellular connections, equating to 125% of the population in early 2025.

- Mexico achieves 83.3% internet penetration with 110 million users at the start of 2025.

- Taiwan reaches 95.3% internet penetration and 87.12% mobile internet rate in 2025.

- Globally, mobile data traffic averages 21 GB per smartphone monthly in 2025.

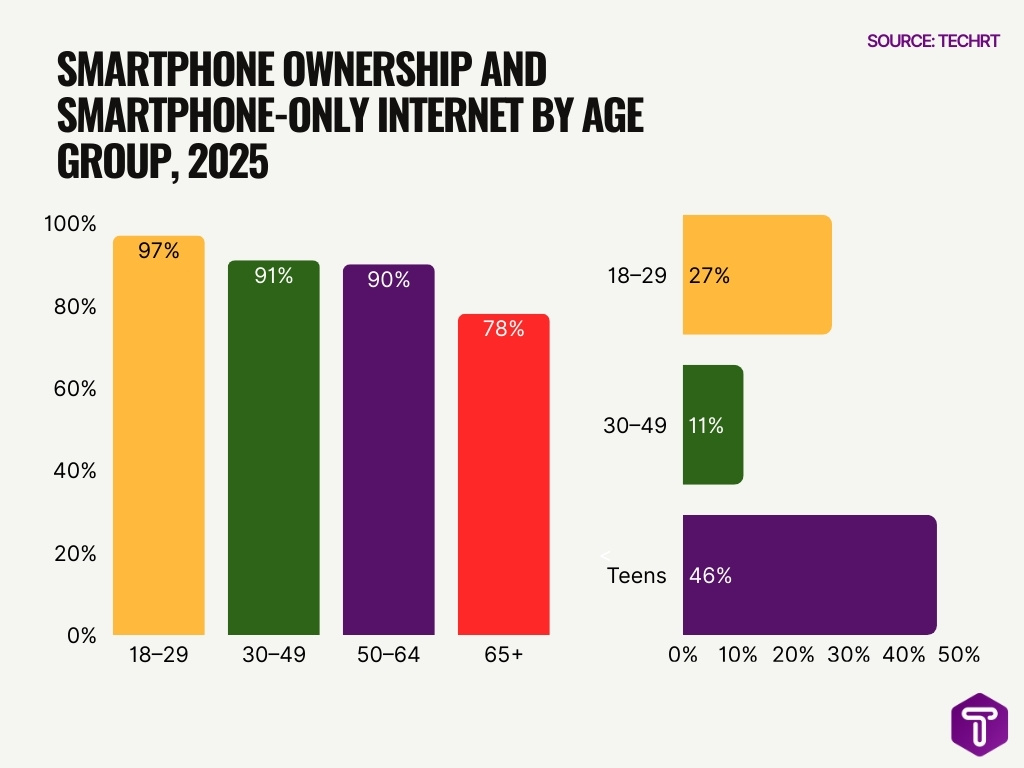

Usage by Demographics

- Younger users consistently register stronger mobile internet use, with smartphone ownership nearing 97% among U.S. adults aged 18–29.

- Older adults are increasingly connected too; smartphone ownership among U.S. adults over 65 reaches ~76%.

- Students and youth often log high daily usage, with a significant share reporting constant online access.

- Mobile internet adoption among lower‑income groups has expanded as device affordability improves globally.

- Gender gaps in access persist in some regions, with ownership and usage rates slightly higher among males in parts of Asia and Africa.

- Across many markets, smartphone access tends to be higher in urban populations than in rural ones.

- Engagement patterns differ by age; younger users favor social and entertainment apps, while older adults disproportionally access news and messaging services.

Mobile Data by Age Group

- In 2025, 97% of 18-29-year-olds own smartphones, the highest among age groups.

- Gen Z (18-24) averages 9+ hours daily smartphone usage, dominating mobile data with video and gaming.

- 91% of 30-49 year olds own smartphones and show 11%smartphone-only internet reliance.

- 90% of 50-64 year olds own smartphones, balancing productivity and social mobile use.

- 78% of 65+ seniors own smartphones in 2025, up significantly, butwith the lowest penetration rate.

- 46% of teens use the internet almost constantly via mobile, varying by household access.

- 14% of 18-24 year olds exceed monthly mobile data allowances, far higher than older groups.

- 23 GB average monthly mobile data per smartphone user in 2025, led by younger cohorts.

- 27% of 18-29 year olds are smartphone-only internet users in 2025.

Usage by Income Level

- High-income countries report 16.2 GB average monthly mobile broadband traffic per subscription, 8x higher than 2 GB in low-income economies.

- Low-income households increase education data use by 24MB monthly on unlimited plans, vs 15MB for high-income groups.

- In low-income countries, 1GB of mobile data costs 10.9% of average monthly income, down from 13.4%.

- 95% of people over 10 own mobile phones in high-income countries, vs 56% in low-income ones.

- Disadvantaged households boost overall data consumption disproportionately after switching to unlimited plans.

- 27% of US adults in households under $30,000 are smartphone-only internet users.

- Rural areas have 28% fewer mobile internet users than urban areas due to income and coverage gaps.

- In LMICs, basic smartphones cost women up to 24% of their monthly income, vs 12% for men.

- Low-income countries show an urban-rural internet use ratio of 2.9, narrowing from 3.1.

- 5G users consume 2-3x more data than 4G, favoring high-income premium plans.

Urban vs Rural Usage

- Urban populations consistently show higher mobile connectivity and data usage compared to rural counterparts.

- Rural areas, especially in Africa and South Asia, still lag but are rapidly closing the gap with expanding mobile networks.

- Urban residents often consume more video and high‑bandwidth content.

- Rural users rely on mobile internet for essential services and communication as fixed broadband remains scarce.

- In some countries, government programs aim to boost rural mobile access to promote digital inclusion.

- Urban usage rates often double rural levels in parts of Latin America and Asia.

- Mobile usage patterns increasingly reflect broader socio‑economic divides between urban and rural regions.

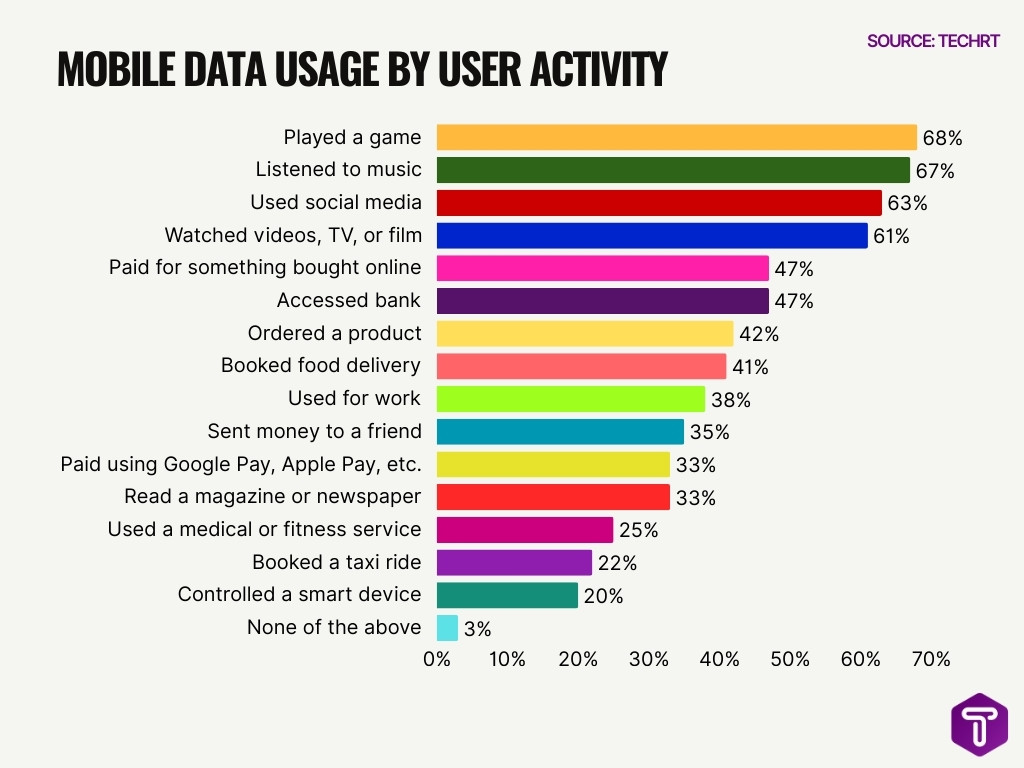

Mobile Data Usage by User Activity

- Gaming is the top mobile data activity, with 68% of users reporting that they played games using mobile internet.

- Music streaming ranks second, as 67% of users used mobile data to listen to music on their devices.

- Social media remains a core daily activity, with 63% of users accessing social networking platforms via mobile data.

- Video consumption continues to surge, as 61% of users watched videos, TV, or films on mobile networks.

- Mobile payments are widely adopted, with 47% of users paying for online purchases using mobile data.

- Mobile banking usage matches e-commerce payments, as 47% of users accessed their banking services on mobile.

- Online shopping via mobile is mainstream, with 42% of users ordering products through mobile internet.

- Food delivery apps show strong penetration, as 41% of users booked food deliveries using mobile data.

- Work-related mobile internet usage is significant, with 38% of users relying on mobile data for professional tasks.

- Peer-to-peer money transfers are common, as 35% of users sent money to friends via mobile networks.

- Digital wallets continue to grow, with 33% of users paying via Google Pay, Apple Pay, or similar services.

- Mobile news consumption remains relevant, with 33% of users reading magazines or newspapers on mobile.

- Health and fitness apps show moderate usage, as 25% of users accessed medical or fitness services via mobile data.

- Ride-hailing adoption is lower but notable, with 22% of users booking taxi rides through mobile internet.

- Smart home integration is still emerging, as 20% of users control smart devices using mobile data.

- Only 3% of users report no mobile data usage, highlighting near-universal dependence on mobile internet.

Video Streaming Statistics

- Over 1.4 billion users engage with the video streaming market worldwide.

- 85% of consumers watch streaming content daily, averaging 1 hour 22 minutes per session.

- YouTube boasts 2.70 billion monthly active users, with 63% of views from mobile devices.

- 122 million people log into YouTube daily for video consumption.

- Short-form videos under 1 minute achieve 50% engagement rates, dominating mobile screen time.

- 69% of U.S. viewers prefer smartphones for weekly video streaming over connected TVs.

- 88% of Gen Z (ages 13-24) use mobile devices for weekly video viewing.

- 82% of global internet traffic will be video by 2026, fueled by mobile usage.

- 5G enables widespread 4K and 8K streaming on mobile devices with higher bandwidth.

- Video streaming drives 74% of smartphone data traffic by the end of the decade.

Top Mobile Apps

- WhatsApp boasts over 3 billion monthly active users worldwide.

- Users open WhatsApp around 23 times daily, topping messaging apps in sessions.

- Threads hit 141.5 million daily active mobile users, surpassing X‘s 125 million.

- Instagram garners 817 million global downloads, ranking high in social apps.

- TikTok and YouTube consume 840 MB–1 GB per hour of video streaming.

- Mobile e-commerce drives 59% of total ecommerce sales, $2.51 trillion in revenue.

- Smartphones account for 77% of retail site visits but 68% of orders.

- Google Maps users average 50 sessions monthly, each lasting ~3 minutes.

- Roblox leads mobile gaming with 76 million daily active users worldwide.

- Remote work adoption hit 48% of the global workforce in 2025, boosting productivity apps.

Social Media Usage

- 5.66 billion people use social media worldwide, 69% of the global population.

- 93.8% of internet users have at least one social media account.

- Average daily time spent on social media is 2 hours 23 minutes across 7-8 platforms.

- TikTok averages 95 minutes daily use per user on mobile.

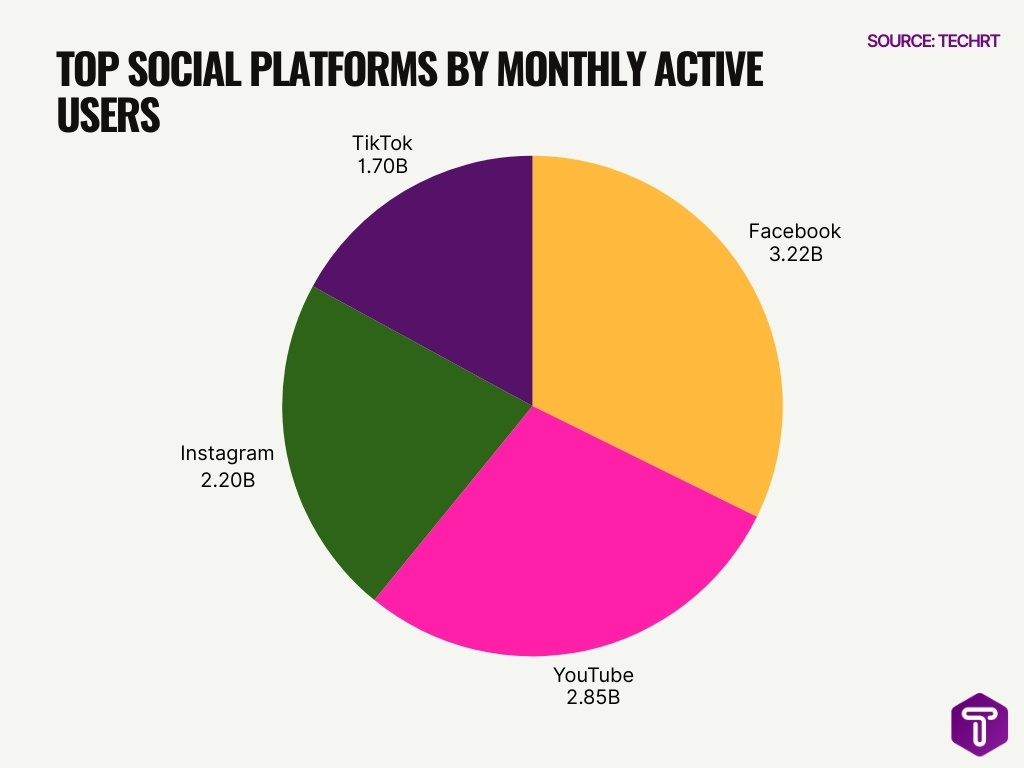

- Facebook has 3.22 billion MAU, and YouTube follows with 2.85 billion.

- Instagram reaches 2.2 billion MAU, and TikTok has 1.7 billion on mobile.

- WhatsApp messaging sees 20+ daily opens per user.

- Short-form videos boost TikTok to 1 hour 37 minutes.

- The 18-34 age group drives 70% of social media data consumption.

5G Adoption Trends

- 5G networks now cover ~55% of the global population, reflecting rapid rollout and infrastructure expansion.

- Around 3 billion 5G subscriptions were recorded in 2025, about one‑third of all mobile broadband subscriptions.

- 5G adoption continues to accelerate in North America, where penetration is among the highest globally.

- 5G rollout has boosted mobile video, AR/VR, and interactive app usage due to lower latency and higher speeds.

- 4G subscriptions are declining as users migrate to faster networks.

- Experts expect 5G subscriptions to keep growing and possibly reach the majority share of total mobile subscriptions by the late 2020s.

- Emerging markets are expanding 5G coverage as infrastructure investment increases.

- 5G adoption is a key driver of enhanced mobile internet experiences, from video quality improvements to cloud gaming.

Frequently Asked Questions (FAQs)

How many people worldwide were using the internet in 2025?

More than 6 billion people, equal to about 74% of the global population, were using the internet in 2025.

What share of global internet traffic comes from mobile devices in 2025?

Mobile devices accounted for approximately 58.3% of global web traffic in 2025, with desktops at ~39.8% and tablets under 2%.

How many unique mobile users were there globally in October 2025?

There were about 5.78 billion unique mobile internet users worldwide in October 2025.

What percentage of the global population had access to 5G in 2025?

5G networks covered around 55% of the world’s population by late 2025.

How many cellular mobile connections were active in India in late 2025?

India had about 1.06 billion active cellular mobile connections, equal to roughly 72.5% of its population by late 2025.

Conclusion

Mobile internet usage underscores a fundamental shift in how people connect, consume content, and engage with digital services. Continued growth in data consumption, fueled by video streaming and social engagement, reflects the central role of mobile connectivity in daily life. Significant expansion of 5G networks continues to enhance user experiences and unlock new use cases, while top mobile apps shape patterns of interaction and engagement across demographics.

From emerging markets to highly developed economies, mobile internet stands as a cornerstone of global digital participation, with trends pointing to deeper integration into commerce, entertainment, communication, and productivity in the year ahead.

Leave a comment

Have something to say about this article? Add your comment and start the discussion.