Multiplayer gaming has become one of the most influential entertainment sectors in the digital world, transforming how people play, connect, and compete online. The landscape continues to expand rapidly as more players engage across devices, genres, and global regions. This growth reflects broader trends in interactive entertainment, social gaming experiences, and competitive online ecosystems.

From global esports tournaments drawing millions of viewers to communities built around shared gameplay, multiplayer gaming now plays a major role in digital culture and revenue generation. Explore the latest trends, user numbers, market size, and growth patterns shaping this dynamic segment below.

Editor’s Choice

- There are approximately 3.32 billion active video game players globally in 2026.

- Worldwide gaming market revenue is projected to hit $206.5 billion by 2028.

- The online gaming market is forecast to grow at a 9.4% CAGR between 2026 and 2034.

- Multiplayer titles comprise a significant portion of player engagement across PC, console, and mobile platforms.

- Mobile gaming accounts for over half of total gaming revenue in multiplayer segments.

- The esports industry value could reach $4.5 billion in 2026, expanding rapidly over the next decade.

- Competitive gaming viewership continues to grow, supported by major tournaments and streaming platforms.

Recent Developments

- Cloud gaming and cross-platform play are enabling seamless multiplayer experiences across devices.

- Free‑to‑play models dominate revenue generation through microtransactions and battle pass systems.

- Console launches like Nintendo Switch 2 and anticipation around titles such as GTA VI influence engagement patterns.

- Developers integrate social tools (voice chat, live streaming) directly into multiplayer games.

- Multiplayer content updates and seasonal events boost retention and player spending.

- Regional esports competitions gain prominence with rising sponsorship involvement.

- Expanding 5G infrastructure is lowering latency for competitive mobile multiplayer gaming.

- Cloud gaming revenue segments are forecast to grow at double‑digit rates through 2027.

Global Massive Multiplayer Online Games Market Statistics

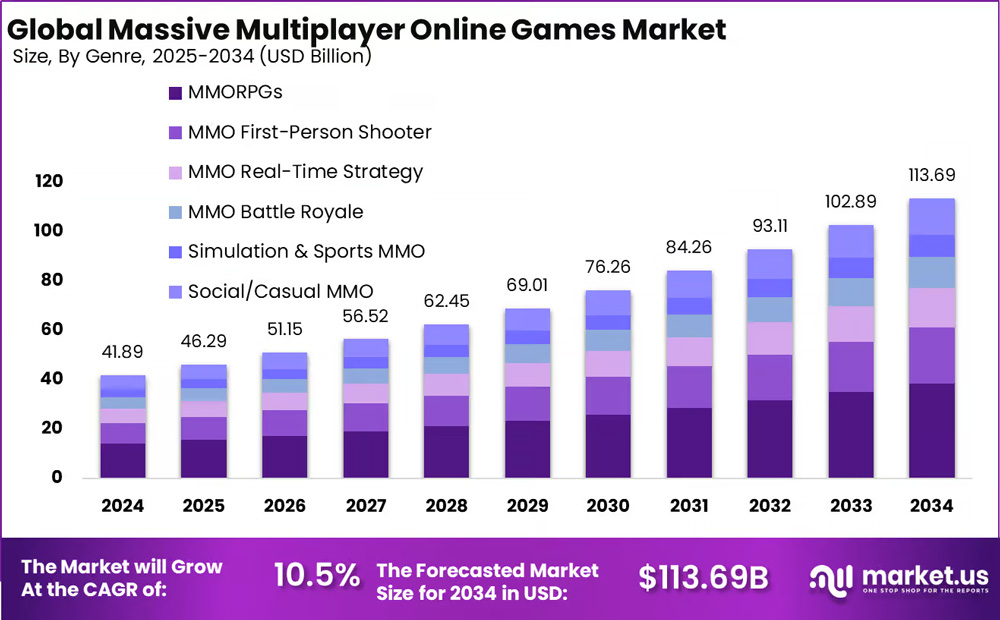

- The global MMO market size stood at $41.89 billion in 2024, establishing a strong base for long-term growth.

- In 2025, the market expanded to $46.29 billion, reflecting rising demand for online multiplayer gaming worldwide.

- The market reached $51.15 billion in 2026, driven by the increased popularity of MMORPGs and MMO shooters.

- By 2027, global MMO revenues grew to $56.52 billion, supported by higher engagement in social and casual MMO games.

- In 2028, the market crossed $62.45 billion, highlighting strong traction in battle royale and real-time strategy MMOs.

- The MMO games market climbed to $69.01 billion in 2029, showing consistent year-over-year expansion.

- In 2030, the total market size reached $76.26 billion, fueled by live-service models and in-game monetization.

- The market increased further to $84.26 billion in 2031, reflecting sustained growth across all major MMO genres.

- By 2032, global MMO revenues rose to $93.11 billion, indicating accelerating adoption of multiplayer online experiences.

- In 2033, the market surpassed the $100 billion mark, reaching $102.89 billion.

- The global Massive Multiplayer Online Games market is forecast to hit $113.69 billion by 2034, representing the highest projected value in the chart.

- Overall, the MMO market is expected to grow at a CAGR of 10.5%, underlining its strong long-term growth potential.

Revenue Growth Trends

- The online gaming sector is expected to grow at a 9.4% compound annual growth rate (CAGR) between 2026 and 2034.

- Free‑to‑play monetization models now generate the majority of multiplayer revenue.

- In‑game purchases, battle passes, and cosmetics drive ongoing spending growth.

- Esports sponsorship and advertising revenues are increasing at double‑digit rates.

- Mobile gaming revenue growth often outpaces console and PC segments.

- Seasonal content and live events boost quarterly revenue figures.

- Regional revenue contributions shift toward Asia‑Pacific in global share.

- Console and premium titles continue to contribute stable high‑end revenue slices.

Active Users Statistics

- Roblox reported over 111 million daily active users in Q2 2025 after rapid growth.

- PUBG Mobile maintains around 30 million daily active users as of early 2026.

- Large PC platforms like Steam report tens of millions of active monthly users.

- Mobile multiplayer engagement often surpasses console figures for daily activity.

- Games with strong live services see higher long‑term active user growth.

- Multiplayer titles with regular content releases retain more daily users year‑over‑year.

- Cross‑platform player counts show steady increases on both PC and consoles.

- Competitions and in‑game events correlate strongly with peaks in active user numbers.

Age Group Breakdown

- The largest global gamer segment is ages 18–34, making up about 38% of players.

- Players under 18 years old account for around 20% of the global gaming population.

- Ages 35–44 comprise roughly 14% of gamers, showing strong adult representation.

- Gamers 45 and older make up a meaningful share, with almost 21% combined between 45–64 and 65+ groups.

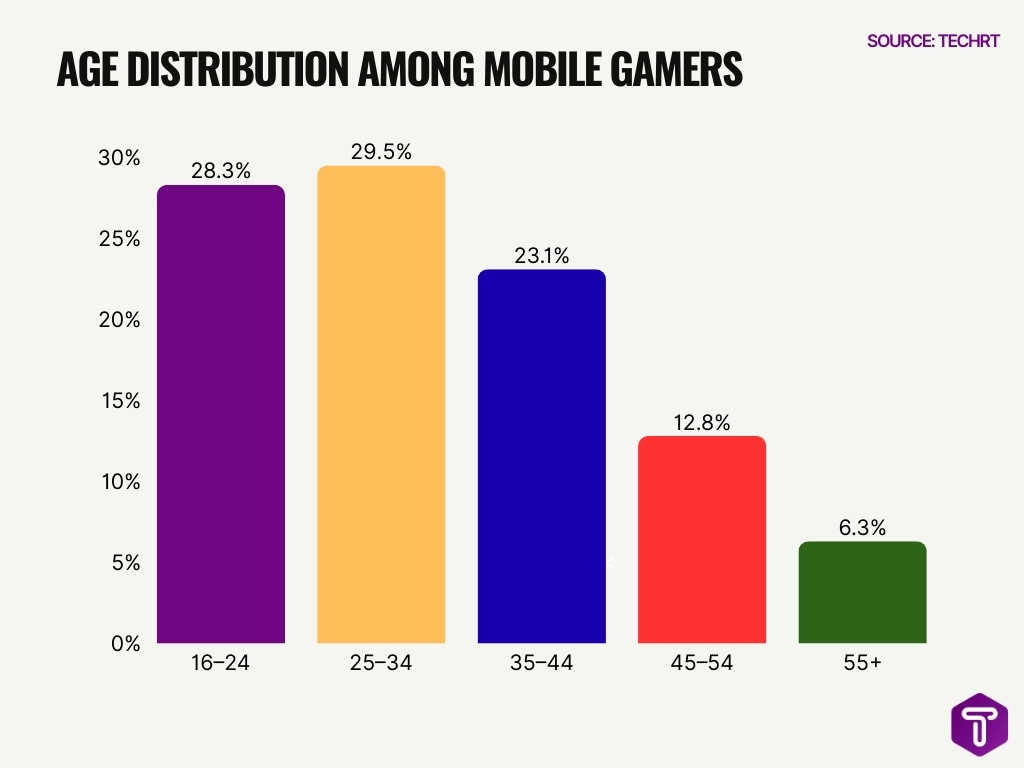

- Specific mobile gaming breakdowns show 29.5% of mobile players are 25–34 years old, and 28.3% are 16–24.

- A further 23.1% of mobile gamers are aged 35–44, showing participation beyond younger cohorts.

- 12.8% of mobile gamers are 45–54, indicating mature engagement in mobile gaming.

- 6.3% of mobile gamers are 55 and older, an increasingly visible group in modern gaming.

Player Demographics

- About 3.32 billion gamers worldwide as of 2026, with diverse demographic representation across age, gender, and region.

- Roughly 55% of gamers globally are male, and 45% are female, showing a near-balanced gender spread across all platforms.

- In the U.S., about 52% of gamers identify as male and 47% as female, with approximately 1% choosing non-binary or not specified.

- Nearly 80% of gamers are adults (18+), reflecting broader participation beyond teenagers.

- The average age of gamers globally is mid–30s, indicating strong participation from adult age groups.

- Women often lead in mobile gaming participation, with some studies showing female players are slightly more active on smartphone platforms.

- Gaming participation increases with mobile accessibility; over 70% of women and 80% of men in some surveys play games on mobile devices.

- Older age groups (50+) are increasingly active; nearly 29% of players in the U.S. are 50 or older.

Online Multiplayer Gaming Harassment by Gender

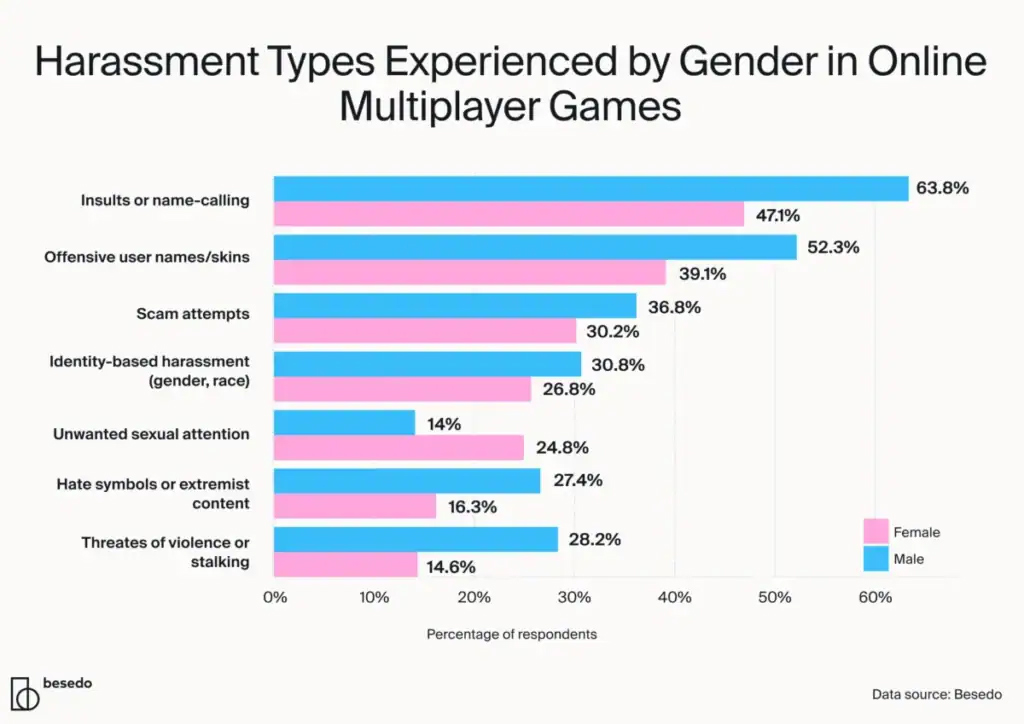

- Insults or name-calling are the most common issue, affecting 63.8% of male players compared to 47.1% of female players in online multiplayer games.

- Offensive usernames or character skins are experienced by 52.3% of males, while 39.1% of females report encountering this form of harassment.

- Scam attempts impact a significant portion of players, with 36.8% of men and 30.2% of women stating they have faced such incidents.

- Identity-based harassment, including attacks related to gender or race, is reported by 30.8% of male gamers and 26.8% of female gamers.

- Unwanted sexual attention shows a clear gender gap, affecting 24.8% of female players compared to just 14.0% of male players.

- Hate symbols or extremist content are encountered by 27.4% of men, notably higher than the 16.3% reported by women.

- Threats of violence or stalking are experienced by 28.2% of male gamers, nearly double the 14.6% reported among female gamers.

Platform Usage Breakdown

- Mobile dominates with 3.0 billion players, representing 83% of global gamers.

- PC gaming engages 936 million players, or 26% of the total audience.

- Console gaming attracts 645 million players worldwide, accounting for 18% of gamers.

- Cloud gaming sees 5.8% global penetration with 455.4 million users.

- Multi-device gamers comprise 72% playing across 2+ platforms, boosting engagement.

- US gamers total over 205 million, with 61% using multiple devices.

- Younger gamers (18-34) favor mobile and console at 38% of players.

- Steam boasts 132 million monthly active users for PC multiplayer.

- Cross-platform support reaches 92% on consoles, enhancing play.

PC Gaming Stats

- PC remains a key multiplayer platform with millions of active users globally, especially on multiplayer platforms like Steam.

- PC gaming often attracts players aged 25–34, a core demographic for competitive multiplayer.

- Many esports titles remain PC‑centric, contributing to high PC engagement.

- Multiplayer PC games frequently update with seasonal content, driving active user retention.

- PC usage shows stable participation relative to console among older gamer segments.

- PC gaming revenue contributes a notable share of the overall market due to microtransactions and DLC.

- Cross‑platform PC titles further expand multiplayer communities.

- Dedicated PC multiplayer events (tournaments) draw millions of viewers internationally.

Regional Player Counts

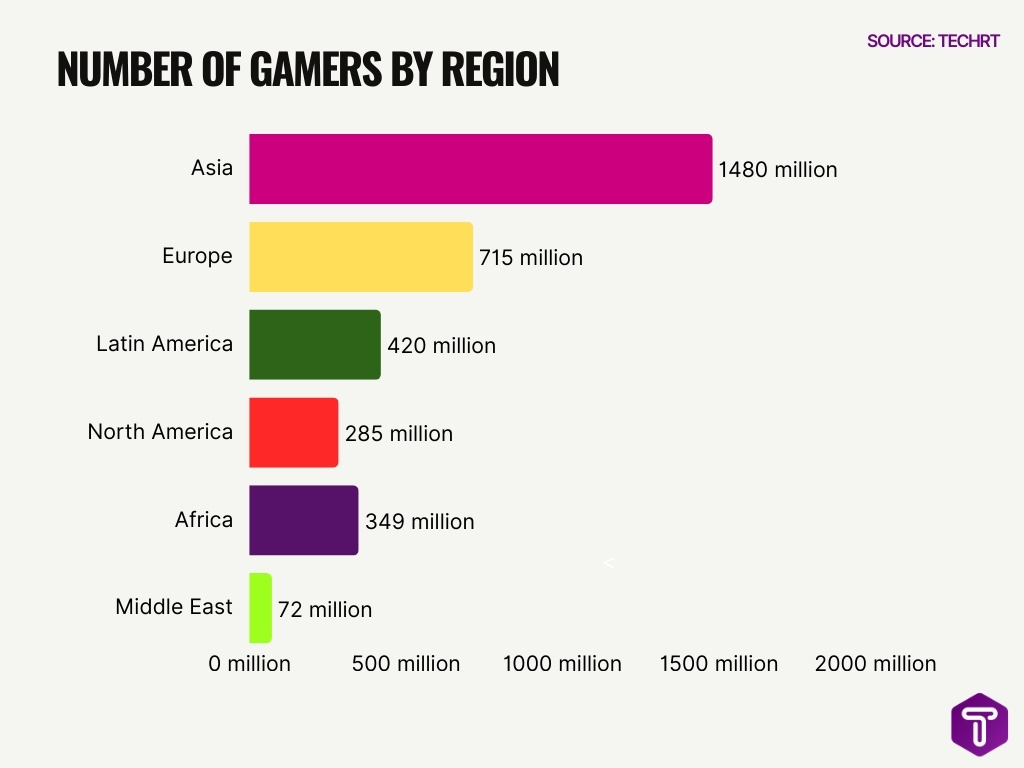

- Asia boasts 1.48 billion gamers, representing ≈46% of the global total.

- Europe has 715 million gamers, with 54% of those aged 6-64 actively playing.

- Latin America counts around 420 million players, led by Brazil‘s 93.1 million.

- North America features 285 million gamers, including over 205 million in the U.S.

- Africa‘s player base hit 349 million in 2024, growing 10% year-over-year.The

- The Middle East (MENA) has 72 million gamers, projected to reach 84.3 million by 2029.

- U.S. gaming revenue exceeded $46 billion in 2024, with 8.5% growth through 2025.

- Latin America‘s market grows at 12% CAGR, reaching $6 billion by 2025.

Console Multiplayer Data

- Console gaming drives 31% of Xbox One weekly usage via online multiplayer in the U.S.

- PlayStation boasts 123 million monthly active users across platforms, fueling large multiplayer communities.

- 55% of gamers play on consoles, with significant mobile (79%) and PC (42%) overlap.

- 92% of console games support cross-play with PC, boosting multiplayer engagement.

- Console sessions average 2-4 hours, far exceeding mobile’s 5-8 minutes.

- Call of Duty League Champs 2025 peaked at 353K viewers, enhancing esports visibility.

- The connected console market hit $30.14 billion in 2025 from online multiplayer features.

- Live-service multiplayer titles dominated 2025’s top 10 US console best-sellers on PlayStation and Xbox.

- Multiplayer/online titles account for 81% of total U.S. digital gaming playtime.

Mobile Gaming Figures

- Global mobile gaming revenue surpassed $130 billion in 2026, representing more than half of all gaming revenue worldwide.

- The number of mobile game users is expected to reach 2.5 billion by 2030, highlighting ongoing global engagement.

- Mobile games accounted for 49% of total gaming revenue in 2025, with $92.6 billion recorded that year.

- Mobile ad revenue in gaming hit $62.1 billion globally in 2025, driven by video formats and rewarded ad experiences.

- Playable ads saw click‑through rates up to 15.4%, outperforming static display formats.

- Technavio forecasts the mobile gaming market will expand by $82.4 billion between 2024 and 2029 at an ~11.3% CAGR.

- In the U.S., mobile gaming revenue is a substantial contributor to the broader $46.7 billion domestic gaming revenue reported in 2025.

- Asia‑Pacific remains a dominant region for mobile gaming, often accounting for over 50% of global market share.

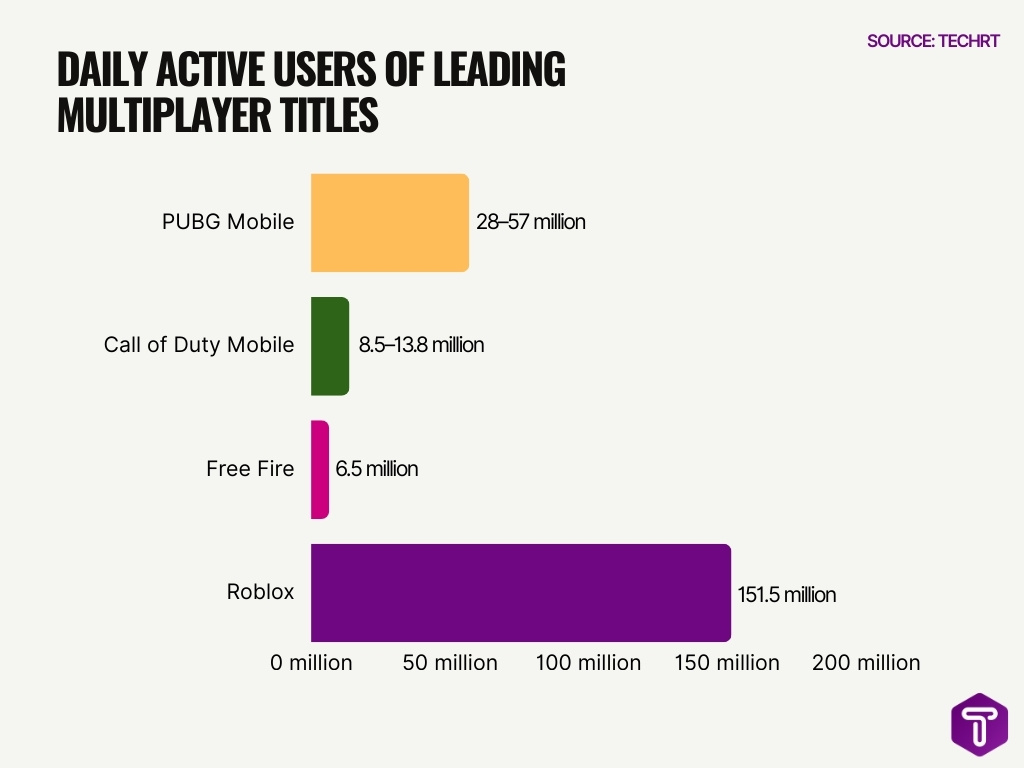

Top Games by Players

- PUBG Mobile averages 28M–57M daily active users in 2026.

- Fortnite has over 650 million registered players and 110–120 million monthly active users.

- Marvel Rivals hit a peak of 664,815 concurrent players post-launch.

- Pokémon Go maintains 27.7 million monthly active players as of early 2026.

- Mobile Legends: Bang Bang boasts over 110 million monthly active users globally.

- Call of Duty Mobile averages 8.5–13.8 million daily active users across platforms.

- League of Legends sustained 131 million monthly active users in 2026.

- Free Fire commands 36.8 million monthly and 6.5 million daily active users.

- Roblox reports 380 million monthly active users with 151.5 million daily.

Popular Game Genres

- Action and RPG genres captured around 21% each of the popularity share in 2025.

- Shooter games held 14.1% of PC gaming revenues in 2024, projected to grow 4.9% YoY.

- Adventure games led console revenues at 17.1% share, expected to rise 6.9%.

- PUBG Mobile averages 28–57 million daily active players in 2026.

- Puzzle games account for 15% of mobile revenues and 9.7 billion downloads.

- Simulation games topped mobile downloads with 9.8 billion in 2024.

- The strategy genre generated $10.6 billion globally in H1 2025.

- The mobile esports audience approached 400 million by 2025.

- The racing games market reached $1.56 billion globally.

Esports Engagement Metrics

- The global esports industry is valued at about $4.5 billion in 2026, with fast expansion projected over the next decade.

- Esports viewership surpassed 640 million global viewers in 2025, growing ~5% year‑over‑year.

- Enthusiasts (regular followers) numbered ~318 million, with occasional viewers at ~322 million in 2025.

- The Esports World Cup 2025 drew about 3 million live attendees and 750 million online viewers.

- Tournament ticket sales contributed $420 million in revenue in 2025.

- Mobile esports accounted for ~56% of all esports viewership, reflecting mobile gaming’s broader influence.

- Twitch and similar platforms continue generating billions of hours in esports streaming engagement.

- MOBA and FPS tournament formats remain dominant in competitive engagement metrics.

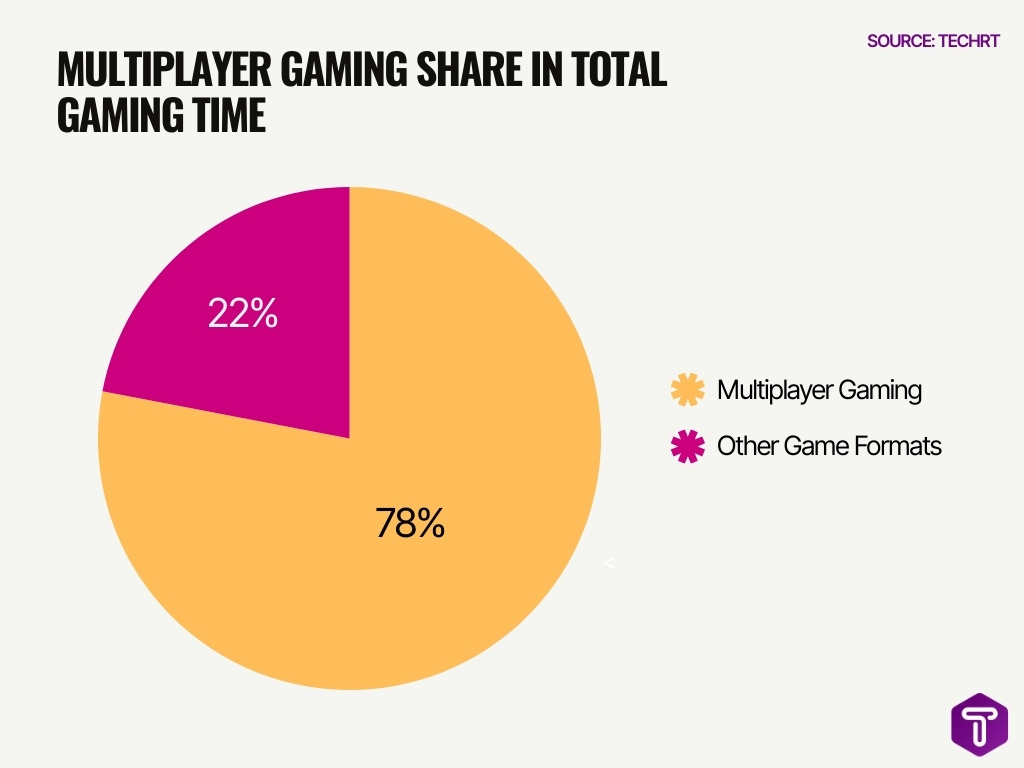

Multiplayer Gaming Share in Total Gaming Time

- Multiplayer gaming dominates engagement, accounting for 78% of total gaming time across all formats.

- Other gaming formats collectively represent just 22%, highlighting a significant gap in player time spent.

- The 78% share indicates that most players prefer social and competitive experiences over solo gameplay.

- With nearly four-fifths of total playtime, multiplayer modes drive the core engagement cycle in the gaming industry.

- The 22% allocation to non-multiplayer formats shows comparatively lower retention and session duration among players.

Revenue by Monetization

- In‑game purchases and microtransactions generated $71.1 billion in 2024, with projected increases in 2025.

- Mobile in‑app purchases nearing $130 billion in 2025 highlighted their dominance in revenue contribution.

- Ad revenue from mobile gaming was $62.1 billion in 2025, with video formats driving most of that spend.

- Rewarded ads accounted for ~45% of mobile ad revenues, showing engagement effectiveness.

- Statista projections estimate mobile gaming ad revenue could reach $124.45 billion by 2025.

- Subscription and premium content models continue to contribute meaningfully alongside free‑to‑play purchases.

- Sponsorships and advertising in esports are among the fastest‑growing segments, with ~45% CAGR projected.

- Merchandise, ticketing, and franchising add diversified revenue streams to ecosystem monetization.

Future Market Projections

- The mobile gaming market is forecast to expand from $306.81 billion in 2026 to ~$706.86 billion by 2032 at a ~14.8% CAGR.

- Esports revenue could grow dramatically, with industry size rising to $30.7 billion by 2036.

- Mobile esports viewership and engagement are expected to climb as smartphone access expands globally.

- Continued cross‑platform convergence will blur traditional barriers between PC, console, and mobile play.

- In‑app monetization growth is anticipated as developers refine ARPU strategies and diversify revenue models.

- Emerging technologies like AR/VR may introduce new multiplayer formats and engagement opportunities.

- Smaller markets in Africa and the Middle East could accelerate growth as connectivity improves.

- Innovation in live services and seasonal content updates will likely enhance retention and revenue potential.

Frequently Asked Questions (FAQs)

How many active gamers are there globally in 2026?

There are approximately 3.32 billion active video game players worldwide in 2026.

What is the projected global online multiplayer games market size by 2034 and its CAGR?

The global online multiplayer games market is projected to reach $44.17 billion by 2034 at a 10.8% CAGR.

What was the size of the global esports market in 2025 and its expected value by 2032?

The global esports market was estimated at $3.49 billion in 2025, expected to grow to $13.42 billion by 2032 at a 21.2% CAGR.

What was the global esports viewership in 2025?

Global esports viewership reached 640.8 million people in 2025.

How much revenue did global gaming generate in 2025, and what share did mobile gaming hold?

The global video game industry generated $260 billion in revenue in 2025, with mobile gaming contributing $92.6 billion or 49% market share.

Conclusion

The multiplayer gaming ecosystem stands at a robust intersection of scale, diversity, and financial growth. With mobile platforms driving revenue, esports expanding fan engagement, and diverse genres attracting players across all ages and regions, the industry’s momentum shows no signs of slowing. Leading titles like PUBG Mobile, Fortnite, and breakthrough newcomers continue to anchor player interest and marketplace innovation.

Monetization through in‑game purchases, advertisements, and evolving subscription models fuels ongoing financial gains. Looking ahead, future projections point toward continued expansion in revenue, viewership, and global access, making multiplayer gaming a cornerstone of digital entertainment for years to come.

Leave a comment

Have something to say about this article? Add your comment and start the discussion.