Samsung system apps play a major role in how millions of Galaxy device users interact with their devices daily. These apps, such as Samsung Wallet, Samsung Pay, and Samsung Pass, come preinstalled on Samsung phones and are designed to streamline payments, security, and everyday tasks. With Samsung holding a growing share of the US smartphone market (rising from 23% to 31% between 2024 and 2025), the influence of these built‑in apps is increasing alongside device adoption. These apps are critical in real‑world scenarios like contactless payments at retail points and secure biometric login for banking. Explore below to understand how widespread and impactful Samsung system apps have become.

Editor’s Choice

- Samsung’s US smartphone market share increased to ~31% by mid‑2025, affecting built‑in app usage.

- Samsung Galaxy devices accounted for a ~38% increase in global shipments year‑over‑year.

- Android, the platform that powers Samsung system apps, had ~3.9 billion users globally in 2025.

- Android market share stood at ~72.8% worldwide in late 2025.

- Samsung system apps are preinstalled on millions of Galaxy smartphones and tablets worldwide.

- Samsung Wallet and Samsung Pay are available across Galaxy phones, wearables, and tablets.

- Samsung Pass simplifies authentication using biometric data on Samsung devices.

Recent Developments

- In 2025–2026, Samsung will update core system apps to support expanded payment and security features.

- Samsung Wallet now integrates loyalty programs and digital IDs in select regions.

- Smart Call and Spam protection enhancements were rolled out to reduce unwanted calls.

- Samsung Pass added additional biometric support for password and authentication management.

- Security patches for system apps are released more frequently via monthly updates.

- Samsung has expanded app support across Galaxy tablets and wearable devices.

- Integration with Samsung Account services now improves cross‑device syncing.

- Enhanced privacy controls for Samsung system apps were highlighted in the 2025 Samsung releases.

Overview of Samsung System Apps

- Samsung Wallet, a central hub for digital cards and passes, is preloaded on most Galaxy devices.

- Samsung Pay offers NFC and MST payment support across compatible devices.

- Samsung Pass provides fingerprint and face‑recognition login for apps and websites.

- Smart Call identifies spam and provides caller insights.

- Samsung system apps come with automatic updates through Galaxy Store or system updates.

- These apps are integrated into Samsung’s One UI experience, creating a consistent UX.

- Core system apps help secure device authentication and digital transactions.

- These apps are optimized to work with Samsung hardware like Knox security.

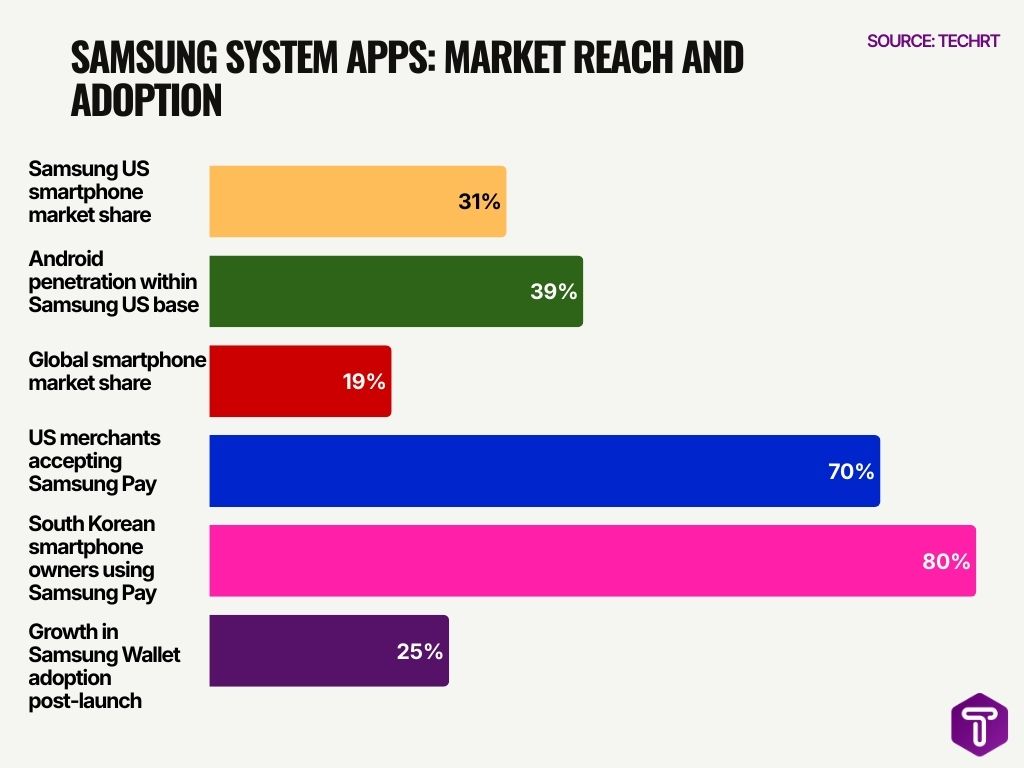

Market Reach Driven by Samsung System Apps

- Samsung holds a 31% share of the US smartphone market, driving substantial Android installs among 38-40% total Android penetration.

- Galaxy Store is pre-installed on 1.2 billion Samsung devices worldwide across 188 countries.

- Samsung shipped 60.6 million smartphones in Q3 2025, securing 19% global market share.

- Over 400 million Galaxy devices will be eligible for system apps like Galaxy AI by the end of 2025.

- More than 70% of Galaxy S25 users actively engage with system AI apps daily.

- Over 70% of US merchants accept Samsung Pay via NFC and MST compatibility.

- 80% of South Korean smartphone owners use Samsung Pay regularly.

- Samsung system apps span phones, tablets, and wearables like the Galaxy Watch with Google Play integration.

- 25% growth in Samsung Wallet adoption post-launch, boosted by bank partnerships.

Growth Trends in Samsung System Apps

- Preinstalled app engagement rises with Samsung’s expanded device shipments.

- As Samsung’s US market share grows, system apps reach more users locally.

- Android’s continued global dominance boosts Samsung’s system app exposure.

- Rapid adoption of digital wallets increases usage of Samsung Wallet and Pay.

- Frequent UI enhancements improve retention rates among Galaxy users.

- Integration with wearables expands engagement beyond smartphones.

- Strong enterprise adoption of secure login (via Samsung Pass) grows quarterly.

- Deep OS integration reduces churn compared to third‑party app alternatives.

User Base Insights for Samsung System Apps

- Over 1 billion Galaxy users worldwide access system apps daily.

- 77% of Samsung users in Southeast Asia actively use Galaxy AI system features.

- Samsung Pay holds 14% global mobile wallet share with 150 million active users.

- 35 million active Samsung Pay users in the US, where 70% merchants accept it.

- Samsung Pass enables secure biometric logins for millions of Galaxy device owners.

- 90 million Samsung smartphone users in India engage core system apps regularly.

- Users launch 9-10 apps daily on average, including Samsung system utilities.

- 25% growth in Samsung Pay adoption in India and Brazil due to NFC infrastructure.

- Galaxy Store pre-installed on 250 million devices boosts system app retention.

- 12% annual increase in Samsung Pay user base via software updates and syncing.

Most Used Features Within Samsung System Apps

- Samsung Wallet boasts over 150 million global active users with 15% growth in 2025, supporting digital IDs and payments.

- NFC tap-to-pay accounts for 85% of Samsung Pay transactions across Galaxy phones.

- Samsung Pay within Wallet processed $342 billion in transactions in 2025.

- Biometric login via Samsung Pass secures credentials for millions using fingerprint or face recognition.

- Samsung Internet, default on Galaxy devices, reaches 109 million users with 1.93% market share.

- Samsung Health surpassed 10 million MAU in South Korea and 70 million globally.

- Galaxy Store averaged 19.4 million monthly active users in EEA during 2025.

- Samsung News delivers content with high engagement on Galaxy home screens.

- Device Care utilities optimize battery and performance, frequently accessed by Galaxy owners.

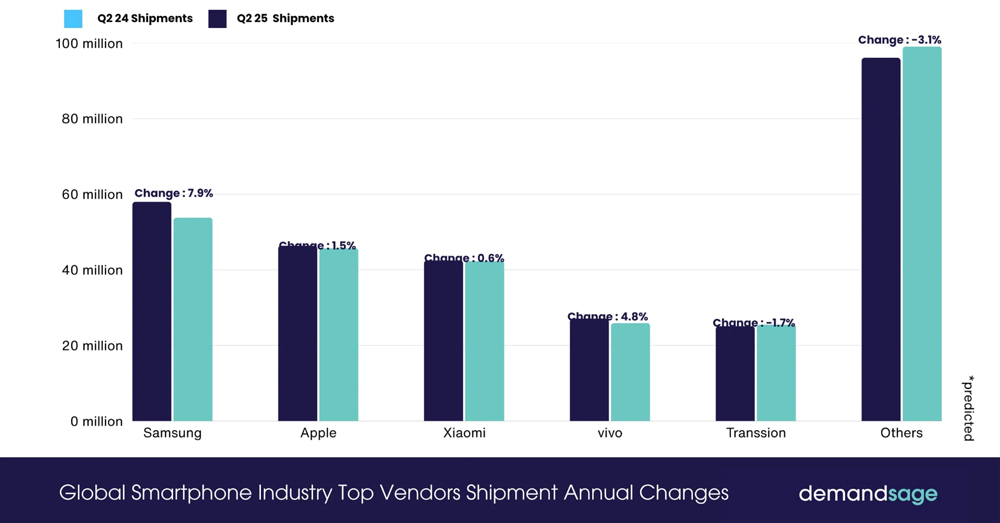

Global Smartphone Shipment Trends

- Samsung led the market with shipments increasing from ~53 million to ~57.2 million units, reflecting a strong 7.9% year-over-year growth.

- Apple maintained steady momentum, with shipments rising slightly from ~45.5 million to ~46.2 million units, marking a 1.5% YoY increase.

- Xiaomi showed near-flat performance, as shipments edged up from ~42.0 million to ~42.3 million units, translating to a modest 0.6% growth.

- Vivo delivered notable expansion, growing shipments from ~25.0 million to ~26.2 million units, achieving a 4.8% YoY increase.

- Transition faced mild contraction, with shipments declining from ~25.8 million to ~25.4 million units, resulting in a 1.7% year-over-year drop.

- The Others category saw a significant slowdown, falling from ~98 million to ~95 million units, representing a 3.1% decline, indicating ongoing market consolidation.

Daily and Monthly Engagement With Samsung System Apps

- The average smartphone user interacts with about 10 apps daily and 30 monthly across device ecosystems, indicating regular use of system apps.

- Galaxy users are likely to open Samsung system apps every day for essentials like payments, browsing, and health tracking.

- 70% of all US digital media time is spent on mobile apps, which includes frequent engagements with built‑in system apps.

- Loyalty and finance features in Wallet and Pay boost weekly interactions for rewards and purchases.

- Browsing via Samsung Internet contributes to daily screen interactions for news, shopping, and search.

- Samsung Health sees recurring weekly or daily use from committed fitness users.

- Notifications and system alerts drive repeat opens of system utilities.

- App engagement is often higher for apps with integrated push features (e.g., Wallet reminders).

- Monthly active system app users far exceed niche third‑party utilities due to preinstallation.

Screen Time Statistics for Samsung System Apps

- The average smartphone user spends about 2 hours and 51 minutes per day on mobile apps, a figure that includes time in system apps.

- Built‑in apps like Samsung Wallet and Internet claim a proportion of that daily app time through essential tasks.

- Users checking messages, browsing, and making payments contribute to consistent screen time on system apps.

- Wellness tracking via Samsung Health adds regular daily engagement for activity monitoring.

- Utility apps (device care, settings) are opened weekly for maintenance and optimization.

- Daily pay or wallet checks during commuting contribute to usage spikes during peak hours.

- Screen time on browser apps (Samsung Internet) is higher for younger demographics.

- Preinstalled apps draw more consistent attention than most downloaded third‑party utilities.

Data Usage Patterns in Samsung System Apps

- Mobile apps consume 90% of total smartphone data usage, with system apps contributing substantially.

- Samsung Internet tops charts as a leading data consumer among browsers due to media loading.

- Samsung Pay Framework can use up to 2.88GB monthly, even without active transactions.

- Samsung Health reports show up to 5GB monthly from step tracking and syncing.

- Push services enable consistent background data for Samsung alerts and Wallet notifications.

- Galaxy Store updates fetch modest data during routine device synchronization.

- The average smartphone now uses 21.1GB of cellular data monthly, boosting system app patterns.

- Users restrict background data on system apps to save battery and meet data caps.

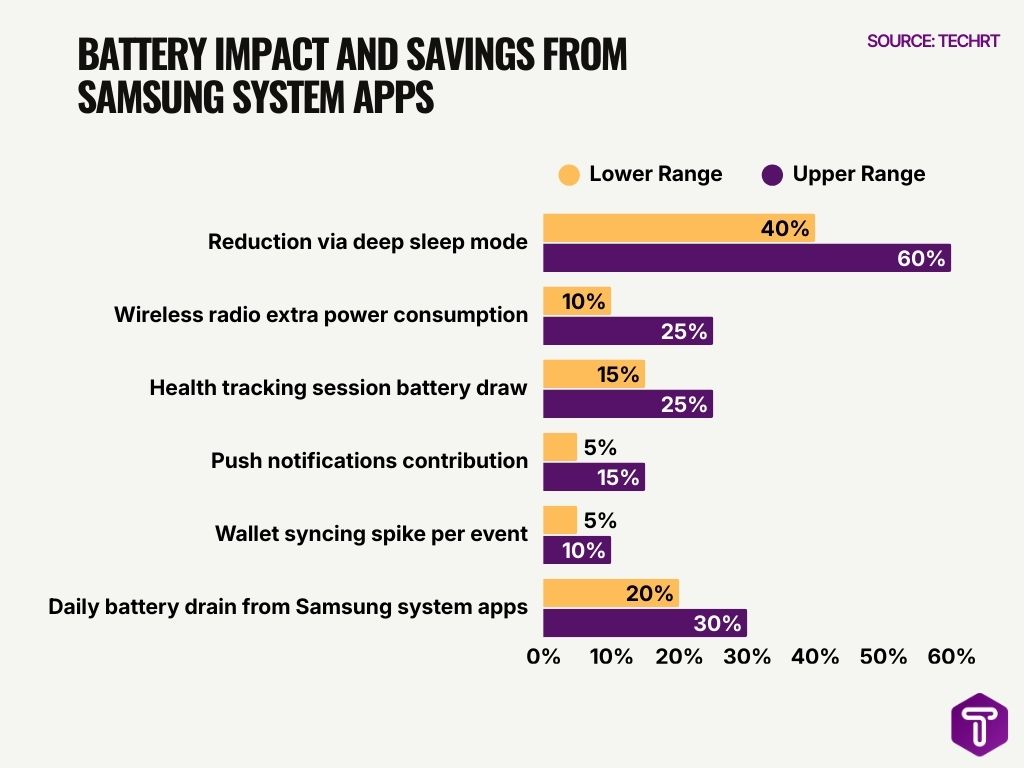

Battery Impact of Samsung System Apps

- Samsung system apps drain up to 20-30% of daily battery through background processes.

- Deep sleep mode in Application Management reduces unused app drain by 40-60%.

- Wireless radio from system tasks consumes 10-25% more power per Trepn Profiler.

- Browser media sessions use 2x power vs transaction apps, up to 50% faster drain.

- Health tracking with GPS and heart rate draws 15-25% during activity sessions.

- Push notifications keep the radio active, adding 5-15% persistent daily drain.

- Wallet syncing causes periodic spikes of 5-10% battery every few hours.

- One UI optimizations curb idle app drain by 20% on average.

Storage Consumption by Samsung System Apps

- Preinstalled Samsung system apps like Wallet occupy up to 701 MB of baseline storage.

- One UI system storage totals around 17.56 GB on the Galaxy S23 Ultra.

- Samsung Internet browser reaches 465 MB total with 5 GB cache in heavy use.

- Samsung Health app consumes 1.1 GB, including 763 MB of activity data after years.

- Samsung Wallet app uses 451 MB total with 18 MB of data on average devices.

- Galaxy Store themes average 2-5 MB per theme, up to 12 MB with sounds.

- System storage claims 12-15% of total device capacity on Samsung phones.

- Clearing caches frees significant space from browser and app data accumulation.

- One UI 6 accurately separates ~18 GB difference into the ‘Other Files’ category.

Performance Metrics Influenced by Samsung System Apps

- One UI 8 boosts Galaxy S25 single-core performance by 32% to 3,057 points from 2,314.

- Galaxy Store tracks new downloads, device downloads, and sales metrics for developer apps.

- Samsung Internet Browser scores 37.9 on Speedometer, competitive with Chrome‘s 41.62.

- Samsung Pay integration reduces transaction times by 25% in retail case studies.

- Samsung Health processes sensor data every second for real-time heart rate tracking.

- One UI optimizations enable 3x faster CPU and 30% better power efficiency in Galaxy Watch7.

- Background tasks in One UI limit processes to 3-4 for improved multitasking performance.

- System app updates via Galaxy Store reduce crashes through optimization and bug fixes.

Uninstall and Disable Behaviors for Samsung System Apps

- Some preinstalled Samsung system apps cannot be fully uninstalled, only disabled via Settings → Apps, depending on the app’s role in device function.

- Disabling a system app removes it from the app drawer and stops background activity, but may not stop all system services tied to it.

- Samsung allows uninstall or disable options only for certain non‑critical system apps on some devices.

- Android uninstall trends show that the majority of Android apps see high churn, with ~66% uninstall rate across Android apps in 2024, compared to about 23% on iOS.

- Across all categories, many apps are uninstalled within 30 days of install, with nearly ~50% turnover, reflecting user pruning behavior on mobile devices.

- General mobile app metrics show ~21–25% of users abandon an app after first use, highlighting friction drivers for uninstalls.

- While not specific to Samsung, users often remove apps due to performance, limited use, or privacy concerns.

- Disable features often are preferred when uninstall isn’t supported to preserve storage and reduce background processes without losing core OS functionality.

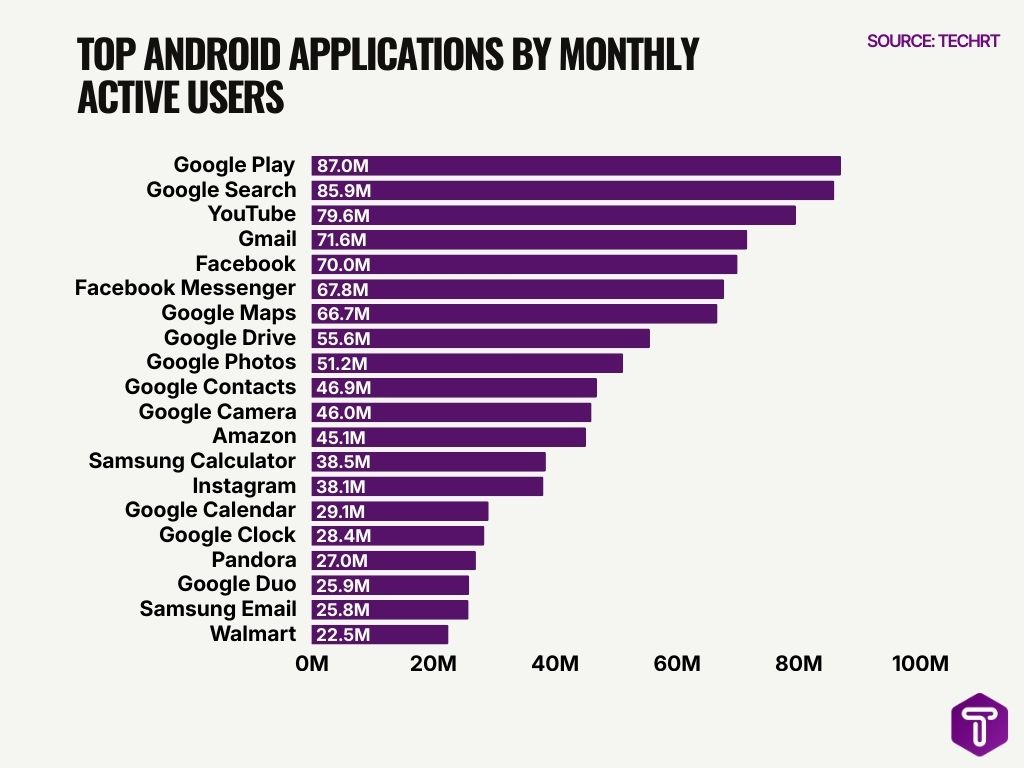

Top Android Applications by Monthly Active Users

- Google Play leads Android app usage with 87 million MAUs, making it the most widely used app on the platform.

- Google Search follows closely, attracting 85.9 million users, highlighting its role as a core Android utility.

- YouTube records 79.6 million monthly active users, reinforcing its dominance in mobile video consumption.

- Gmail reaches 71.6 million MAUs, driven by deep integration with Android devices.

- Facebook maintains strong engagement with 70 million Android users.

- Facebook Messenger reports 67.8 million MAUs, showing high reliance on instant messaging.

- Google Maps attracts 66.7 million users, reflecting frequent use for navigation and local discovery.

- Google Drive sees 55.6 million MAUs, indicating widespread adoption of cloud storage on Android.

- Google Photos reaches 51.2 million users, supported by automatic photo backup features.

- Google Contacts records 46.9 million MAUs, emphasizing daily dependency on contact management.

- Google Camera stands at 46 million users, driven by default installation on many devices.

- Amazon has 45.1 million Android users, highlighting strong mobile shopping demand.

- Samsung Calculator reaches 38.5 million MAUs, showing high engagement with OEM system apps.

- Instagram records 38.1 million monthly users, maintaining its position as a leading social platform.

- Google Calendar attracts 29.1 million users, supporting productivity and scheduling needs.

- Google Clock records 28.4 million MAUs, reflecting frequent daily utility usage.

- Pandora reaches 27 million users, maintaining relevance in mobile music streaming.

- Google Duo stands at 25.9 million MAUs, driven by video calling adoption.

- Samsung Email records 25.8 million users, showing continued reliance on native email apps.

- Walmart closes the list with 22.5 million MAUs, highlighting steady mobile retail engagement.

User Satisfaction Regarding Samsung System Apps

- 92% of Samsung Pay users report high satisfaction, surpassing Apple Pay’s 84%.

- 93% of Samsung Pay users rate it for its intuitive design and reliability.

- Samsung Pay achieves over 80% monthly active user rate in digital wallets.

- 96% of small businesses find Samsung Pay transactions easy to process.

- Samsung Wallet holds a 4.2-star rating on Google Play from 11.4 million reviews.

- Samsung Internet Browser Beta scores 4.3 stars from 93.6K reviews.

- 76% of users prioritize easy access and speedy solutions in Samsung services.

- 67% of Samsung Pay users link multiple cards, boosting convenience.

- Samsung Knox receives 27/30 strong ratings in Gartner’s security assessment.

Privacy and Data Collection in Samsung System Apps

- Nearly 70% of Android apps, including Samsung system apps, show inconsistencies between privacy statements and actual data flows.

- 17% of mobile apps claim no personal data collection yet transmit it, raising transparency issues for Samsung preinstalled apps.

- Samsung Galaxy Store, preinstalled on 250 million devices, collects usage analytics via developer tools.

- 88% of European Gen Z and millennials worry about Samsung device privacy daily.

- 6 Android models, including Samsung, continuously share data with third parties without opt-out.

- Samsung experienced data breaches exposing 3,000+ US customers’ info in 2022 and 270,000 German records in 2025.

- 67% of surveyed users fear financial theft from mobile data collection in Samsung ecosystems.

- KCC flagged 187 preinstalled Samsung apps for potential privacy interference in 2025.

- Nearly half of Europeans are unaware of what data their Samsung devices collect.

- Samsung Knox protects biometric data in isolated environments compliant with GDPR Class 3 standards.

Top 10 Mobile App Development Trends in 2026

- Embedded Intelligence & Generative AI is becoming a core app capability in 2026, enabling smarter automation, real-time insights, and AI-driven user experiences.

- Cross-device & multi-platform ecosystems are gaining traction as users expect seamless app continuity across smartphones, tablets, wearables, and desktops.

- Immersive and contextual UX using AR, VR, edge computing, and voice interfaces is redefining how users interact with mobile applications.

- Security, privacy, and sustainable design are now table stakes, with apps prioritizing data protection, regulatory compliance, and energy-efficient development.

- Low-code and no-code platforms combined with modular architectures are accelerating app development speed and reducing time-to-market.

- 5G and emerging 6G networks, along with edge computing, are enabling ultra-low latency apps and support for new device form factors.

- Hyper-personalization is driving engagement in 2026, with apps delivering tailored content, recommendations, and feature-as-a-service models.

- Super-apps and embedded ecosystems are expanding, allowing multiple services to operate within a single unified application experience.

- Subscription-first and value-layer monetization models are becoming dominant, shifting focus from one-time purchases to recurring revenue streams.

- Global and localization strategies are essential in 2026, helping apps scale internationally while delivering region-specific experiences.

Security and Vulnerabilities in Samsung System Apps

- Samsung’s Knox platform reached 4 million enterprise users within two years of launch.

- Samsung Knox vulnerabilities include 3 major flaws (CVE-2016-1919, CVE-2016-1920, CVE-2016-3996), allowing access to protected data.

- Galaxy App Store had 2 vulnerabilities (CVE-2023-21433, CVE-2023-21434) enabling unauthorized app installs and JavaScript execution.

- July 2025 security patch fixed 40 vulnerabilities, including 1 critical and 21 high-risk Android issues, plus 17 Samsung-specific issues.

- October 2025 update patched 33 vulnerabilities, with 13 high-severity from Google and 20 Samsung SVEs.

- November 2025 patch addressed 36 security vulnerabilities in Android OS and Samsung apps, including Exynos flaws.

- December 2025 bulletin fixed 57 core Android vulnerabilities, 6 critical, plus 11 Samsung flaws.

- Auto Blocker blocks apps from unauthorized sources, USB updates, and malware images in messaging apps.

- 77% of top Android apps request read external storage permissions, risking data exposure in Samsung environments.

- Samsung provides monthly security patches for One UI and system apps, extending support up to 7 years.

AI Integration Across Samsung System Apps

- Over 70% of Galaxy S25 users actively engage with Galaxy AI features in system apps.

- Samsung targets Galaxy AI delivery to more than 400 million devices by the end of 2025.

- Google Gemini usage among Samsung users has tripled with One UI 8 integration.

- 91% of Galaxy S25 users in India utilize Galaxy AI across system frameworks.

- Galaxy AI now supports 22 languages for real-time translation in calls and apps.

- 45% of smartphone users now talk to devices as often as typing, boosted by AI communication tools.

- Touch response speed improved by up to 12% via AI optimizations in One UI.

- Live Translate and Chat Assist enable seamless multilingual productivity in system apps.

- Samsung Health AI provides Energy Score insights from sleep, activity, and heart data trends.

Frequently Asked Questions (FAQs)

How many global active users does Samsung Pay have as of 2025?

Samsung Pay has surpassed 150 million global active users with around 15% year‑over‑year growth reported.

What share of the global mobile payment market does Samsung Pay hold?

Samsung Pay accounts for approximately 14% of the global mobile payment market, ranking it among the top three mobile wallets worldwide.

What percentage share of the global smartphone market did Samsung hold in late 2025?

Samsung captured about 20% of the global smartphone market share in late 2025, according to market trackers.

In how many countries is Samsung Pay available as of 2025?

Samsung Pay operates in 29 countries globally and is continuing to expand.

What was Samsung’s US smartphone market share increase from Q2 2024 to Q2 2025?

Samsung’s share of the US smartphone market rose from 23% in Q2 2024 to 31% in Q2 2025, marking a ~35% increase.

Conclusion

Samsung system apps continue shaping smartphone interactions through built‑in tools that support payments, security, browsing, and daily device management. Engagement trends suggest system apps remain core parts of user routines, even as uninstall behavior and privacy concerns highlight areas for ongoing refinement. Security frameworks like Knox and Auto Blocker strengthen defenses, while AI features under One UI and Galaxy AI demonstrate Samsung’s commitment to contextual experience and innovation.

As users increasingly expect seamless, secure, and intelligent mobile tools, these system apps will play a central role in how people interact with their devices, balancing functionality with privacy and performance in the evolving mobile landscape.

Leave a comment

Have something to say about this article? Add your comment and start the discussion.