Smart home technology is changing the way households operate, offering convenience, security, and energy savings. From voice-activated assistants to connected thermostats, the ecosystem of devices continues expanding rapidly, reshaping everyday life across the US and the globe. Today, millions of Americans manage lights, locks, and appliances through apps and voice commands, while businesses integrate smart tech into buildings to boost efficiency and safety. These trends show smart homes are more than gadgets; they are practical tools used in residential and commercial settings to improve comfort and reduce costs. Explore how these smart home adoption trends are shaping the future of connected living.

Editor’s Choice

- The global smart home tech market continues to expand rapidly, driven by convenience, security, and automation needs.

- The smart home devices market value is expected to reach between $81B and $145B in 2025 across major forecasts.

- North America leads adoption, contributing approximately 36% of global growth.

- Voice control accounts for about 50% of smart home interactions in 2025.

- In the US, around 45% of households with internet have at least one smart device.

- Average smart home owners report about 4.8 connected devices per household.

- Convenience and security remain top drivers, with about 46% adopting for convenience and 17% for remote monitoring.

Recent Developments

- At CES 2026, major brands highlighted AI-powered ecosystems and smarter appliances that enhance connected living.

- A new open standard for smart locks (Aliro) is set to launch in 2026 to improve interoperability and security.

- Smart home innovation increasingly includes AI-driven gadgets that target health, automation, and home robotics.

- Integration standards like Matter are gaining traction, helping devices across brands work together more seamlessly.

- Privacy and data security concerns are rising, prompting calls for better transparency and user controls.

- Manufacturers are investing more heavily in responsible smart technology deployment.

- Advances in AI and IoT are making smart homes more intuitive and context-aware.

Smart Home Devices Market Growth Overview

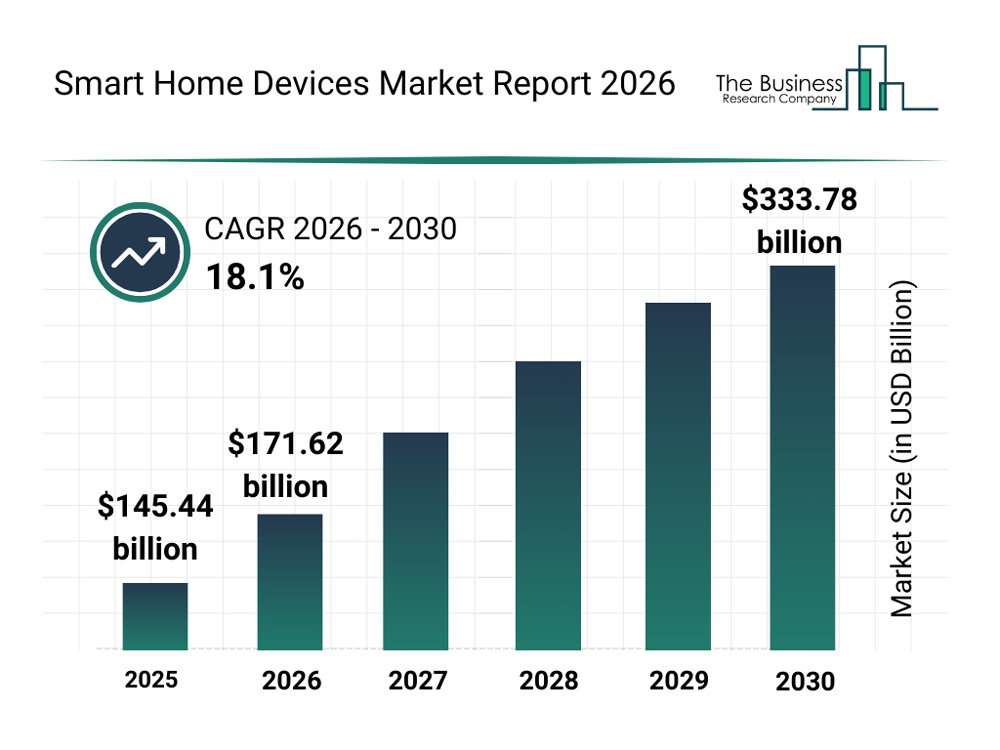

- The global smart home devices market was valued at $145.44 billion in 2025, reflecting strong early adoption across residential and commercial sectors.

- In 2026, the market is expected to grow to $171.62 billion, highlighting accelerating demand for connected home technologies.

- The market shows continued expansion in 2027, crossing the $200 billion mark as smart devices become more mainstream.

- By 2028, the smart home devices market is projected to reach approximately $240 billion, driven by rising IoT integration and automation use cases.

- The market is estimated to grow further to around $290 billion in 2029, supported by advancements in AI-enabled smart home solutions.

- By 2030, the global smart home devices market is forecasted to hit $333.78 billion, underscoring long-term growth momentum.

- The market is projected to expand at a robust CAGR of 18.1% from 2026 to 2030, indicating sustained investment and adoption trends.

Number of Smart Homes Worldwide

- By 2025, an estimated 478 million households globally are equipped with smart devices.

- Worldwide smart home households are projected to reach around 672 million by 2027.

- In the US, approximately 45% of internet households have at least one smart home device.

- Nearly 1 in 5 US households own six or more smart devices.

- More than 80% of American homes now contain some form of smart technology.

- Rising IoT connectivity continues to expand the number of networked households worldwide.

- Emerging markets are seeing faster adoption as middle-class tech ownership increases.

Regional Smart Home Adoption (North America, Europe, Asia, Others)

- North America leads with the largest share of smart home market growth at around 36%.

- Asia Pacific is among the fastest-growing regions due to rapid urbanization and tech adoption.

- Europe shows steady expansion driven by energy management and security use cases.

- The Middle East and Africa display early but accelerating smart home interest.

- Latin America adoption continues to grow alongside smartphone and broadband penetration.

- North America and Europe command the highest smart home revenue shares.

- Regional growth reflects broader digital infrastructure investment and modernization trends.

Country-Wise Smart Home Adoption Leaders

- The United States leads with over 57% of households adopting at least one smart home device in 2025.

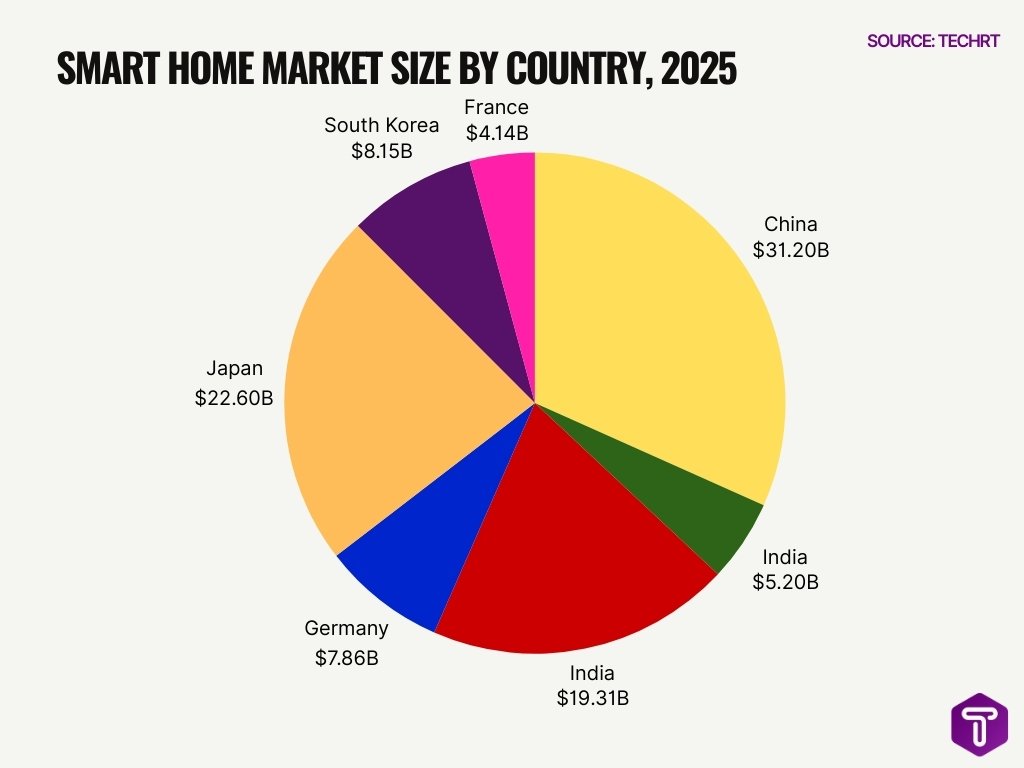

- China’s smart home market reaches $31.2 billion in 2025, growing at 15.8% CAGR through 2033.

- In the UK, 15 million households own at least one smart home device, with professional security monitoring up 31% in 2025.

- India’s smart home market is valued at $5.20 billion in 2025, projected to hit $19.31 billion by 2030 at 30% CAGR.

- Germany’s smart home market is expected to be at $7.86 billion in 2025, with 40% adoption rate alongside the UK in Western Europe.

- Japan’s smart homes market grows at 10.8% CAGR from 2025-2033, reaching $22.6 billion by 2033.

- South Korea’s smart home market is valued at $8.15 billion in 2025, expanding at 17.33% CAGR to 2030.

- France’s smart home market hits $4.14 billion in 2025, with 11.6% growth driven by security and energy efficiency.

- Western Europe sees 40% smart home adoption in leaders like the UK and Germany.

Smart Home Household Penetration Rate

- In the United States, about 77.6% of households had adopted smart home technology by 2025.

- US household penetration is expected to exceed 80% in 2026 as devices become mainstream.

- Global smart home penetration is rising from 14.2% in 2022 to nearly 28.8% by 2027.

- In the UK, penetration could approach 98.8% of households by 2027.

- Penetration has accelerated since 2020 as device prices decline.

- Adoption is highest in North America and Europe compared with other regions.

- Younger households show consistently higher penetration rates.

- Demand for security, convenience, and energy efficiency continues driving adoption.

Smart Home Device Ownership Rates

- Nearly 48% of American homes own at least one smart home device.

- Smart security cameras are present in about 66% of smart device households.

- Smart sound systems appear in 57% of connected homes.

- Smart doorbells or door cameras are installed in 52% of smart households.

- Smart lighting devices are used in 35% of smart homes.

- Voice assistants remain among the most commonly owned smart devices.

- Smart appliances are growing steadily but remain less common than core devices.

- Ownership rates are higher in households with children and younger adults.

Average Number of Smart Devices per Household

- US households now average 18 connected devices, including smart home and IoT products.

- About 18% of US households own six or more smart home devices.

- Many connected homes integrate speakers, cameras, thermostats, and lighting systems.

- New smart home owners often install three to five devices within the first year.

- Smart TVs and streaming devices increase overall connected device counts.

- Global IoT device totals reached 21.1 billion in 2025.

- Wearables and sensors further increase household connectivity averages.

- Smart plugs and low-cost sensors contribute to rising device counts.

Adoption by Type of Smart Home Device

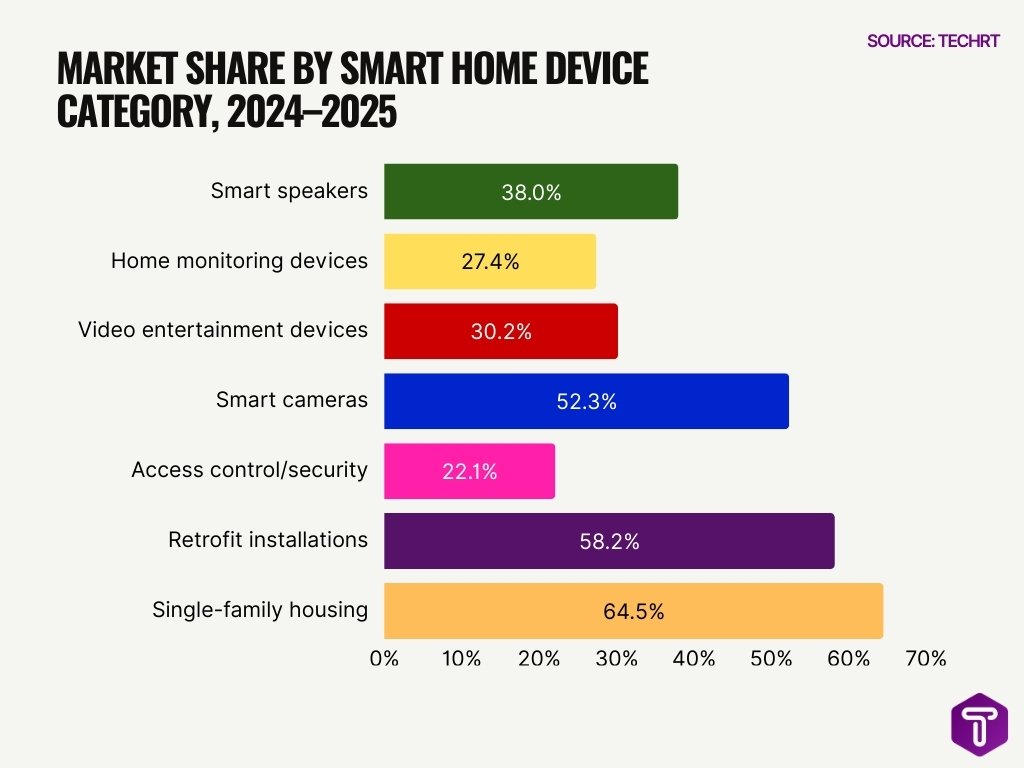

- Smart speakers commanded 38% of the total smart home device share in 2024.

- Home monitoring/security devices captured 27.4% market share with 244.4 million units shipped in 2024.

- Video entertainment devices led shipments at 30.2% share, 269.7 million units in 2024.

- Smart cameras dominated the security segment with 52.3% revenue share in 2024.

- Access control/security components held 22.1% of the smart homes market revenue in 2024.

- Retrofit installations accounted for 58.2% of smart homes market installations in 2024.

- Single-family housing represented 64.5% of smart homes revenue share in 2024.

- Smart security camera market valued at USD 7.76 billion in 2024, 7.2% CAGR.

- Smart appliances’ household penetration reached 12.9% globally in 2025.

Adoption of Smart Security and Surveillance Devices

- Smart cameras and security systems are used in 66% of smart homes.

- Smart doorbells or door cameras appear in 52% of connected households.

- Over 40% of users prioritize security devices when adopting smart technology.

- Smart lock and sensor adoption continues to increase as costs decline.

- Professional monitoring services are increasingly bundled with devices.

- Security adoption strongly correlates with remote access features.

- Early adopters frequently cite security as a primary motivation.

- Voice assistant integration boosts security system usage.

Adoption of Smart Lighting and Energy Management Devices

- The smart lighting market is valued at $18.57 billion in 2025, expected to grow to $43.39 billion by 2030.

- 21.5% of households projected to use smart lighting by 2027, rising from 6.6% in 2022.

- 13% of US internet households have smart light bulbs; 6% use full lighting control systems.

- 10% of German households (3.7 million) adopted smart energy management systems, including lighting, in 2022.

- 28% of internet users apply connected devices for home energy management via smart lights.

- Global smart plug shipments reached 8.5 million units in 2021, forecasted to hit 104 million by 2030.

- Smart lighting reduces home lighting energy by 7–27% through automation and sensors.

- 50% of consumers choose smart lighting featuring remote access and voice assistant integration.

- The outdoor motion sensor lights market is expected to reach $435.71 million in 2024, with 9.3% CAGR growth.

- 48% of smart indoor lighting users note electricity usage reductions after installation.

U.S. Smart Home Device Adoption Growth

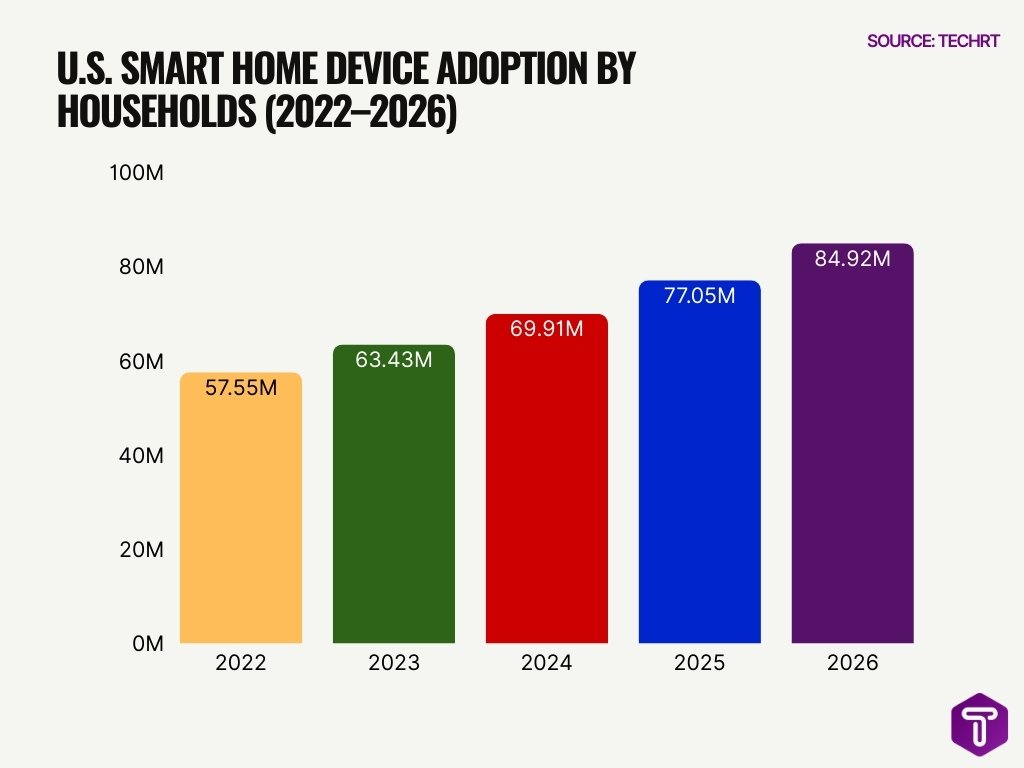

- The number of U.S. households using smart home devices reached 57.55 million in 2022, reflecting strong post-pandemic demand for connected home technologies.

- Adoption increased to 63.43 million households in 2023, showing steady year-over-year expansion as smart devices became more affordable and accessible.

- In 2024, smart home usage climbed to 69.91 million households, driven by growing interest in home automation, security, and energy efficiency.

- The market is projected to reach 77.05 million households in 2025, indicating accelerating adoption across both new and existing homes.

- By 2026, smart home device usage is expected to surge to 84.92 million U.S. households, highlighting the technology’s transition from early adoption to mainstream household penetration.

- Overall, the U.S. smart home market is set to add over 27 million households between 2022 and 2026, underscoring sustained long-term growth and rising consumer reliance on connected home solutions.

Adoption of Smart Thermostats and Climate Control Devices

- Smart thermostats are installed in approximately 28% of US homes.

- Adoption increased by roughly 25% between 2023 and 2025.

- Climate devices play a central role in energy efficiency strategies.

- Utility rebates continue supporting thermostat adoption.

- Smart HVAC systems help reduce heating and cooling costs.

- Voice integration increases device engagement.

- Advanced systems include humidity and occupancy sensors.

- Awareness and education continue driving adoption growth.

Adoption of Smart Speakers and Voice Assistants

- Smart speakers held the largest device share at about 38%.

- The global smart speaker market reached $14.25B in 2025.

- Voice control supports daily automation and hands-free use.

- North America remains the largest smart speaker revenue region.

- Asia Pacific shows the fastest adoption growth.

- Standalone speakers account for roughly 41% of the market.

- Alexa and Google Assistant lead major platforms.

- Integration with other devices drives continued adoption.

Commercial vs Residential Smart Device Adoption

- Residential adoption accounts for 85% of all smart device installations worldwide.

- Global smart buildings market projected to reach $554B by 2033.

- The US smart building market is valued at $24.66B in 2024.

- 41% of US internet households own smart home devices.

- Commercial buildings prioritize energy management with 60% adoption rate.

- The smart home market grew 22.5% annually through 2024.

- 91% of commercial operators deploy smart security systems.

- The average US household owns 8.2 smart devices.

- Commercial smart systems are planned for 75% of new builds.

- IoT consumer devices outnumber enterprise 3:1 globally.

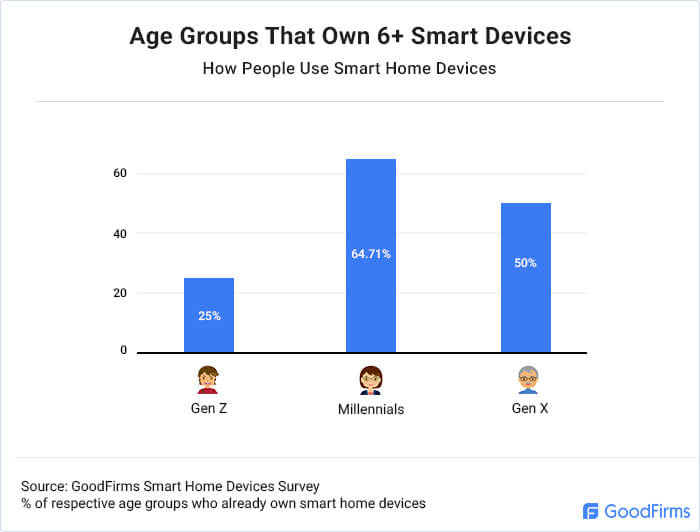

Smart Home Device Ownership by Age Group

- Millennials lead smart home adoption, with 64.71% owning six or more smart devices, making them the most tech-integrated generation.

- Gen X shows strong adoption, as 50% of users in this group already own 6+ smart home devices, reflecting growing comfort with connected living.

- Gen Z trails older generations, with only 25% owning six or more smart devices, indicating lower purchasing power or early-stage adoption.

- The data highlights a clear generational gap in advanced smart home usage, with Millennials nearly 2.6× more likely than Gen Z to own multiple devices.

- Higher ownership among Millennials and Gen X suggests greater reliance on automation, security, and energy management solutions in established households.

- The trend indicates that smart home ecosystems are currently driven by mid-age consumers, rather than younger first-time buyers.

Barriers to Smart Home Adoption

- Cost remains the top barrier, cited by about 53% of consumers.

- Privacy concerns affect roughly 33% of potential buyers.

- Technical complexity deters about 23% of consumers.

- Interoperability challenges remain a concern across platforms.

- Some consumers question value beyond convenience.

- Price sensitivity influences adoption decisions.

- Setup complexity discourages less technical users.

- Many consumers wait for proven reliability before purchasing.

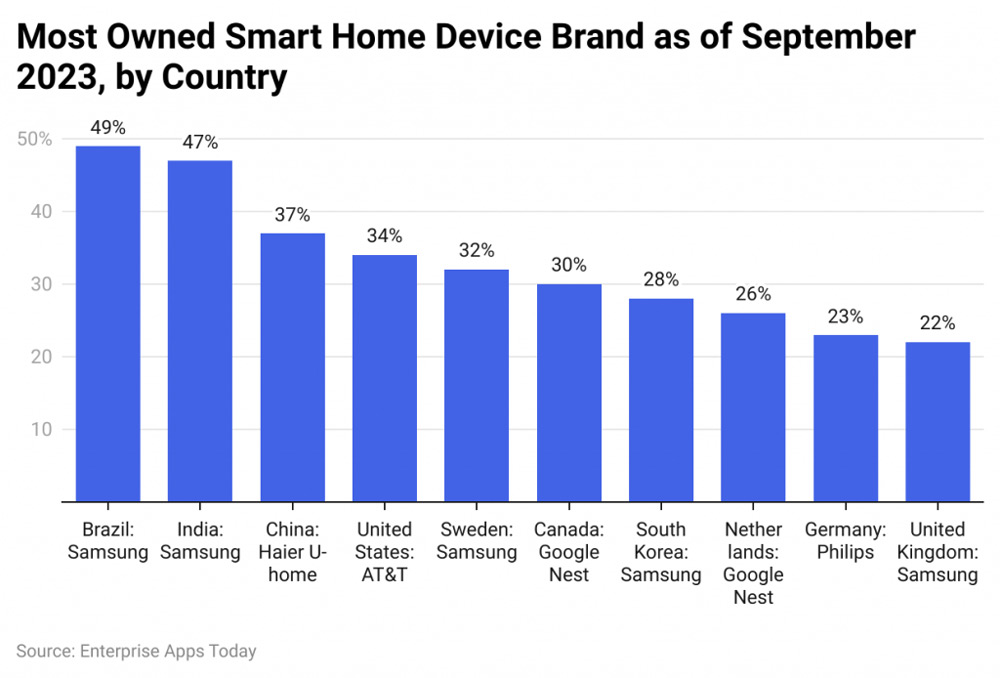

Most Owned Smart Home Device Brands by Country

- Samsung dominates globally, leading smart home device ownership in Brazil (49%), India (47%), Sweden (32%), South Korea (28%), and the United Kingdom (22%).

- Brazil records the highest brand dominance, with nearly half of households (49%) owning Samsung smart home devices.

- India shows strong Samsung penetration, where 47% of consumers identify it as their most owned smart home brand.

- China stands out as the only market led by a local brand, with Haier U-home capturing 37% ownership.

- In the United States, AT&T leads smart home device ownership at 34%, reflecting the influence of telecom-driven ecosystems.

- Google Nest holds a strong position in North America and Europe, leading in Canada (30%) and the Netherlands (26%).

- Germany favors specialized smart home brands, with Philips emerging as the most owned at 23%.

- South Korea’s market remains competitive, despite Samsung’s home advantage, with ownership reaching 28%, lower than in other Samsung-led countries.

- No single brand exceeds 35% ownership in most Western markets, indicating fragmented and competitive smart home ecosystems.

Privacy and Data Security Concerns

- IoT devices face an average of 820,000 hacking attempts daily in 2025, a 46% increase from the previous year.

- 87.22% of IoT users report high privacy concerns regarding data collection.

- 75% of consumers distrust how connected devices share data.

- 55% do not trust smart devices to protect their privacy.

- 63% of people find connected devices creepy due to constant monitoring.

- More than 50% of IoT devices have critical vulnerabilities exploitable by hackers.

- One in three data breaches now involves an IoT device.

- 76.2% of smart home adoption decisions are influenced by security and privacy concerns.

- 91.5% of IoT device transactions on corporate networks remain unencrypted.

- 27% of smart homeowners express privacy concerns, up from 23% in 2022.

Popular Smart Home Platforms and Ecosystems

- The smart home platforms market is valued at $23.4B in 2025.

- Major ecosystems include Amazon Alexa, Google Home, Apple HomeKit, Samsung SmartThings, and others.

- Cloud-based platforms dominate due to remote access convenience.

- Residential users represent about 90% of platform usage.

- Open standards like Matter improve cross-brand compatibility.

- E-commerce remains the primary distribution channel.

- Telecom bundled smart home offerings continue expanding.

- Competition drives rapid innovation in AI and integration.

Smart Home Adoption Growth Forecasts

- The global smart home market is forecast to grow from $89.8B in 2025 to $116.4B by 2029.

- Long term projections show growth from $121.6B in 2025 to over $633B by 2032.

- Broader market estimates place the value near $489B by 2035.

- Connected IoT devices are expected to reach 39 billion by 2030.

- AI integration will continue accelerating adoption.

- Infrastructure improvements will support sustained growth.

- Consumer demand for convenience and efficiency remains strong.

- Commercial and residential adoption will expand in parallel.

Frequently Asked Questions (FAQs)

What percentage of U.S. homes have at least one smart home device?

About 48% of American homes now have at least one smart home device.

How many connected IoT devices are expected globally by the end of 2025?

There will be approximately 21.1 billion connected IoT devices worldwide in 2025.

What is the estimated value of the global smart home devices market in 2025?

The global smart home devices market is projected to be worth $81.0 billion in 2025.

By what CAGR is the global smart home devices market expected to grow through 2035?

The global smart home devices market is forecasted to grow at a 17.0% CAGR through 2035.

How many smart homes worldwide are projected to be in 2027?

Homes with smart devices are projected to reach 672.6 million by 2027.

Conclusion

Smart home adoption continues to expand rapidly, driven by convenience, connectivity, and evolving consumer expectations. Younger demographics lead usage, while cost and privacy remain key barriers to wider adoption. Platform ecosystems and interoperability standards are shaping how devices work together, and forecasts point to strong growth across both residential and commercial markets. As IoT technologies mature and users demand smarter, more secure solutions, smart homes are positioned to become a standard feature of modern living.

Leave a comment

Have something to say about this article? Add your comment and start the discussion.