Snapchat continues to redefine how people interact through visual communication, with filters and AR lenses now central to user engagement. From everyday selfies to immersive world lenses, these features have become essential for social expression and brand storytelling. Snapchat’s user base has expanded significantly, with AR engagement increasingly driving daily activity, advertising impact, and creative innovation. Real‑world applications range from beauty brands using try‑on filters to boost conversions to entertainment campaigns that drive millions of shares globally. Let’s explore the latest figures and trends shaping Snapchat Filter Statistics, starting with the most compelling insights.

Editor’s Choice

- Snapchat reported 477 million daily active users (DAU) as of Q3 2025, up from ~453 million in early 2025.

- Monthly active users (MAU) for Snapchat reached 943 million globally, showing strong platform reach.

- Over 350 million users engage with augmented reality (AR) features daily, driving core filter usage.

- Approximately 75% of daily active users interact with AR filters, illustrating widespread adoption.

- Snapchatters engage with AR lenses for more than 4.5 trillion views annually, indicating massive content usage.

- Sponsored beauty lenses were used by nearly 113 million Snapchatters globally in 2024.

- AR lens plays exceed 8 billion per day, reflecting robust engagement.

Recent Developments

- Snapchat’s AR ecosystem continues to expand with creator‑made lenses surpassing trillions of views worldwide.

- Premium feature adoption (Snapchat+) grew to 17 million subscribers by Q3 2025.

- Snapchat has increasingly integrated analytics tools to help creators optimize engagement metrics.

- AR lens creation tools, such as Lens Studio, remain centrally important to creative output and platform growth.

- Branded selfie lenses and sponsor filters have expanded brand collaboration opportunities.

- Snapchat continues to innovate with products like Spectacles, the 5th generation, enhancing AR experiences beyond phones.

- Partnerships with fashion and media events leverage AR filters for immersive audience engagement.

Snapchat Filter Statistics Overview

- Snapchat’s AR features engage 350M users daily, aligning with growing interaction rates.

- AR filter adoption among daily active users is estimated at 75% and rising.

- Snapchatters have played AR lenses over 8 billion times daily across the platform.

- Snapchat reports over 943 million monthly users worldwide as of 2025.

- Lens engagement data shows AR features often outperform traditional content in user interaction.

- Creator lenses contribute to a multi-trillion-view count annually across the platform.

- The AR filter experience remains a key differentiator compared with other social networks.

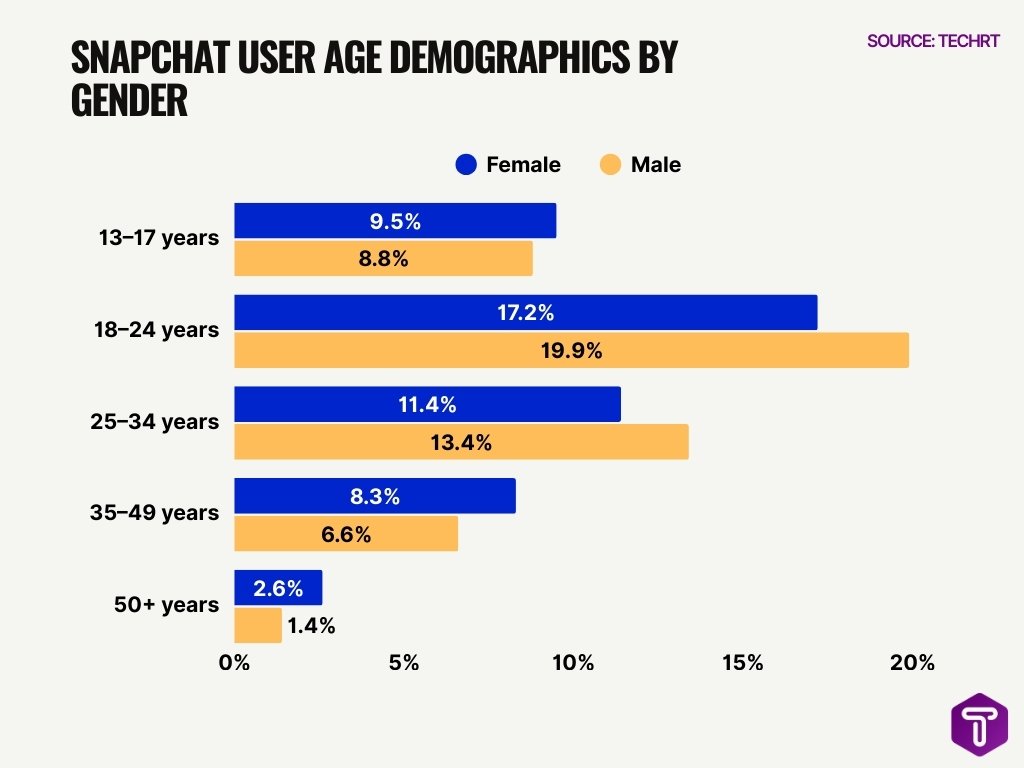

Snapchat User Age Demographics

- Young users dominate Snapchat, with the 18–24 age group accounting for the largest share of users, including 19.9% males and 17.2% females.

- The 25–34 age segment represents a strong secondary audience, comprising 13.4% male users and 11.4% female users, highlighting Snapchat’s appeal beyond teens.

- Teen users aged 13–17 remain highly active on the platform, with 9.5% female and 8.8% male participation.

- Usage begins to decline after age 35, as the 35–49 age group contributes 8.3% of female users and 6.6% of male users.

- Snapchat adoption is lowest among older adults, with the 50+ age group making up just 2.6% females and 1.4% males.

- Male users lead in the core 18–24 and 25–34 demographics, reinforcing Snapchat’s strength among young adult men.

- Female users slightly outnumber males in the 13–17, 35–49, and 50+ age brackets.

- Overall, Snapchat’s audience is heavily concentrated under 35 years old, making it a prime platform for youth-focused and Gen Z marketing campaigns.

Snapchat Filters and Lenses Key Facts

- Snapchat AR lenses generated 4.5 trillion views in the last year alone.

- Snapchat+ subscribers (premium service) climbed to 17M globally by late 2025.

- Beauty and try‑on lenses have near-universal appeal, with 113M global users in 2024 experiencing them.

- AR lenses accounted for an estimated 75% of all daily engagement among DAUs.

- Snap’s analytics platforms help creators track views, interactions, and demographic behavior.

- Sponsored lenses frequently post higher interaction times vs. standard ads.

- Snapchat’s AR engagement continues to outpace many other ad formats.

Snapchat AR Filter Usage Statistics

- Daily engagement with AR features is reported at 350M users.

- AR filters comprise approximately 75% of daily interactions on Snapchat.

- AR lens plays surpass 8 billion daily across global users.

- Snapchatters watch sponsor‑driven beauty content for millions of hours globally.

- Snapchat continues to invest in AR creator tools for broader lens design participation.

- Engagement with AR filters remains strong in markets like North America and Europe.

- Snapchat’s AR lens reach extends to nearly all active users in key segments.

Daily Engagement with Snapchat Filters and Lenses Statistics

- Snapchat sees 350M AR users daily, highlighting consistent usage.

- AR filters are a major engagement driver for over 75% of active users.

- Snapchatters open the app 30–40 times per day on average.

- Daily activity includes billions of interactions with lenses and filters.

- Stories and lenses drive a significant portion of time spent on the app (avg ~30 min/day).

- Daily AR lens plays contribute substantially to user session length.

- Snapchat’s daily Snaps sent surpass 5 billion globally.

- AR engagement is reported to be higher than many other content types on Snapchat.

Monthly Engagement with Snapchat Filters and Lenses Statistics

- Snapchat’s global monthly active user base reached ~943 million in 2025, up from ~850 million in 2024, reflecting steady growth.

- Over 1 billion Snaps are shared publicly every month, underscoring ongoing engagement with camera features including filters and lenses.

- Snapchatters send more than 5 billion Snaps per day, contributing to massive monthly activity flow.

- Monthly AR engagement remains high, with over 350 million users accessing Snap Map regularly.

- Beauty and try‑on AR experiences engage over 100 million users monthly, showing demand for immersive interactive lenses.

- Around 1 billion geofilters are used monthly, indicating high participation in location‑based filter experiences.

- Snapchat’s monthly Spotlight content views exceed 350 million per day, often incorporating lens-enhanced videos.

- Snapchat+ premium features, including enhanced AR filter access, contribute to 17 million monthly subscribers as of Q3 2025.

- Time spent on Snapchat averages ~30 minutes per user per day, which aggregates to significant monthly engagement.

- Snapchat’s AR ecosystem accounts for a large share of overall engagement time on the platform.

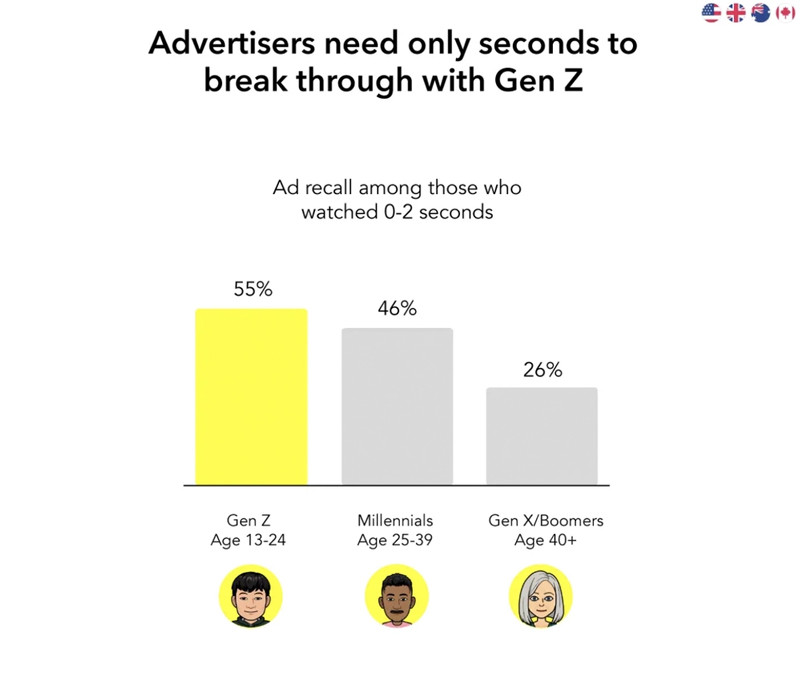

Gen Z Ad Recall Proves Impact in the First 2 Seconds

- Gen Z (Ages 13–24) achieved a 55% ad recall rate after watching ads for just 0–2 seconds, highlighting their strong responsiveness to short-form messaging.

- Millennials (Ages 25–39) recorded a 46% ad recall rate within the same 0–2 second viewing window, showing solid engagement but trailing Gen Z.

- Gen X and Boomers (Ages 40+) showed significantly lower immediate impact, with only 26% ad recall after 0–2 seconds of exposure.

- The data confirms that advertisers can break through fastest with Gen Z, who outperform Millennials by 9 percentage points and Gen X/Boomers by 29 percentage points.

- Results are based on a 2020 Kantar Context Lab study commissioned by Snap Inc., analyzing 2,000 participants across the US, UK, Canada, and Australia using full-screen skippable video ads.

Snapchat Filters and Lenses User Demographics Statistics

- 38% of Snapchat’s user base is aged 18–24, the largest demographic globally.

- Snapchat remains popular with Gen Z and Millennials, with 60% of users aged 13–24 engaging regularly.

- U.S. data shows 48% of internet users aged 15–25 use Snapchat, highlighting strong youth penetration.

- The gender split on Snapchat is nearly even: ~50.7% male and ~48.4% female users.

- Snapchat attracts a global audience: India leads with ~213.9 million users, followed by the United States with ~104.5 million.

- Snapchat usage declines with age: only ~3.8% of users are 50+, indicating a younger core audience.

- Teens and young adults contribute most to AR filter interactions, with 75% of daily active users engaging AR features.

- In North America, Snapchat engagement includes ~100 million daily active users.

- Europe contributes ~97 million daily users, displaying strong cross‑continental usage.

- “Rest of World” DAUs account for ~235 million, driven by growth outside Western markets.

Snapchat AR Filter Usage by Age Group Statistics

- The 13–24 age group dominates Snapchat usage, representing the majority of AR engagements.

- Users aged 18–24 account for ~38% of the overall audience, often the most active with AR lenses.

- Snapchat’s AR filters see stronger interaction among users aged 13–34 than older age brackets.

- Engagement drops significantly after age 35, where usage of advanced AR features declines.

- Gen Z (13–24) accounts for a substantial share of AR usage, driving trends in meme and beauty filters.

- Young adults (25–34) are active with branded AR content and shopping‑oriented lenses.

- Snapchat’s AR demographic trends support its role as a Gen Z and Millennial‑centric platform, crucial for targeted AR campaigns.

- Teens under 18 make up nearly 18% of users, contributing significantly to playful and trend‑driven filter use.

- Older adults (35+) engage less with AR features but still use core Snapchat functions like Stories and messaging.

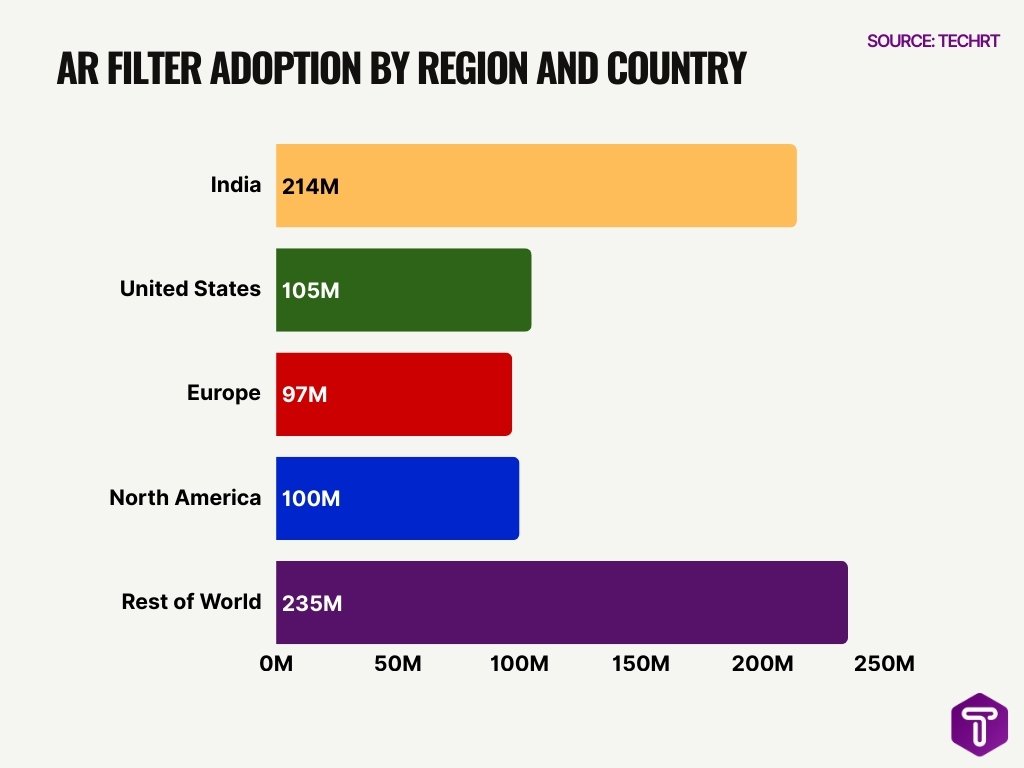

Snapchat AR Filter Usage by Region and Country Statistics

- India leads Snapchat AR with ~214M users and 80B+ monthly lens plays.

- 85% of Indian Snapchatters use AR lenses daily for connections.

- The United States has ~105M users, with high AR lens engagement among teens.

- Europe boasts 97M DAUs, integrating AR in social interactions.

- The rest of the world drives growth with 235M DAUs and rising AR adoption.

- North America reports 100M DAUs, strong in AR filter usage.

- APAC sees high AR try-on interactions, led by India‘s volume.

- Saudi Arabia achieves 76% penetration, topping AR usage rates.

- 75% of global Snapchatters (~350M) engage AR filters regularly.

Sponsored and Branded Filters Usage Statistics

- Sponsored AR lenses show higher engagement times than traditional ad formats, boosting interaction.

- Users engaging with AR lenses exhibit ~6.4× higher swipe‑to‑purchase intent than standard video ads.

- Branded AR content often results in greater purchase consideration and brand recall among users.

- Geofilters tied to events and promos generate significant monthly usage spikes.

- Sponsored beauty lenses engage millions globally, with 100M+ users trying virtual products monthly.

- AR ads on Snapchat deliver stronger engagement than many display ad benchmarks.

- Brands leveraging AR filters report higher social shares and organic spread of campaigns.

- Snapchat’s ad reach (709M) provides broad exposure for branded lens campaigns.

- AR filter effectiveness remains especially relevant for youth‑oriented brands targeting Gen Z.

Beauty and Face Filters Usage Statistics

- Beauty and face filters remain among the most engaged filter types on Snapchat.

- Over 100 million users engage with AR shopping and beauty try‑on lenses monthly.

- Snapchatters interacting with beauty AR lenses show higher conversion intent in fashion and makeup categories.

- Virtual try‑on features help users visualize products like glasses, makeup, and accessories.

- Beauty lens campaigns reduce online product return rates by offering better fit previews.

- Trend‑driven beauty filters often become viral, boosting usage beyond functional try‑ons.

- Snapchat’s data shows sustained increases in daily lens plays linked to face‑tracking filters.

- These filters support user self‑expression, which drives repeat engagement across demographics.

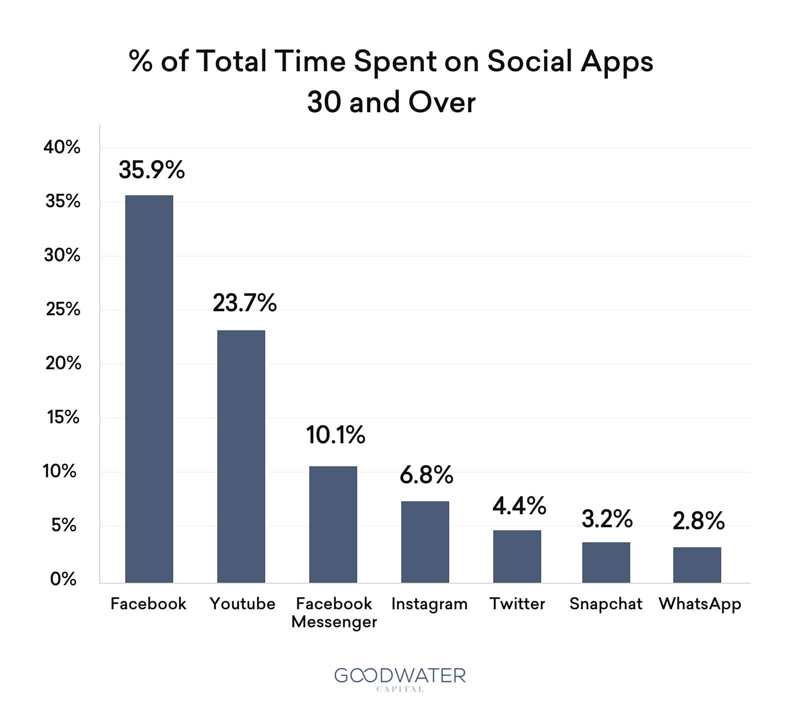

Social Media Usage Trends Among Users Aged 30 and Over

- Facebook dominates social media usage among users aged 30 and above, accounting for a substantial 35.9% of the total time spent on social apps, making it the clear market leader in this age group.

- YouTube ranks as the second most-engaged platform, capturing 23.7% of total social app time, highlighting the strong preference for video-based content consumption among older users.

- Facebook Messenger secures the third position, representing 10.1% of total time spent, indicating that private messaging and direct communication remain key engagement drivers.

- Instagram contributes a moderate share of usage at 6.8%, suggesting steady but secondary engagement compared to Facebook and YouTube for users over 30.

- Twitter accounts for 4.4% of total social app time, reflecting selective usage primarily for news, updates, and real-time discussions rather than prolonged engagement.

- Snapchat captures only 3.2% of usage time, reinforcing its position as a platform with a stronger appeal among younger demographics.

- WhatsApp records the lowest share at 2.8%, indicating that while widely used for communication, it drives shorter, more functional interactions rather than extended browsing sessions.

Fun, Meme, and Trend Filters Usage Statistics

- Snapchatters play 8+ billion AR lenses per day, with over 70% of all Snaps including a lens or filter, underscoring how trend‑driven filters boost daily stickiness.

- Around 75% of Snapchat’s ~477 million daily active users (≈358 million people) interact with AR features, showing that fun and meme lenses reach far beyond core AR enthusiasts.

- Viral AR lenses like “AI Yearbook” and “90s High School” each surpassed 1+ billion views, illustrating how meme and seasonal filters can rapidly go viral among casual users.

- Snapchat reports 80+ billion Lens uses per month, indicating that playful and trend‑based filters are a core driver of daily engagement and return behavior.

- Over 350 million people engage with Snapchat AR experiences daily, and 400,000+ creators have produced more than 4 million lenses, providing a constant flow of meme‑driven filter content.

- Beauty and fashion AR try‑on content drove 262 million hours of views in 2024, with 113 million Snapchatters using beauty lenses, reflecting heavy usage of fun and seasonal filters around trends.

- AR ads on Snapchat generate about 2.4× higher ad awareness and 1.8× higher brand recognition than standard ads, highlighting how trend‑anchored lenses fuel social shares and challenges.

- Snapchat users open the app 30–40 times per day on average, with AR engagement cited as a leading driver of these repeat visits and experimental filter plays.

- Selfie‑focused sharing lenses achieve an influence index near video ads (AR 24% vs video 27%), and Snapchatters are 1.2× more likely to share AR content than users on other apps, amplifying viral trend filters.

AR Shopping and Try‑On Filters Usage Statistics

- Snapchatters engaged with AR shopping lenses over 5 billion times since last year.

- 250 million Snapchat users have used AR try-on filters in the past year.

- Zenni Optical’s AR lenses achieved over 60 million try-ons and 42% higher ROAS.

- Ulta Beauty’s AR makeup lens generated 30 million try-ons and $6 million in sales in two weeks.

- Users engaging with AR lenses show 6.4x higher swipe-to-purchase rates than video ads.

- AR shopping lenses boost conversions by up to 11x compared to traditional methods.

- 92% of Gen Z want to use AR for shopping experiences.

- AR experiences are 3x more engaging than standard mobile shopping.

- 100 million users monthly access Snapchat’s AR shopping features like try-ons.

- AR try-ons increase sales conversions by 94% for interactive products.

Event, Holiday, and Seasonal Filters Usage Statistics

- Seasonal lenses see usage spikes during cultural holidays like Halloween, Christmas, and New Year’s, drawing millions of user interactions.

- Event‑driven lenses often see engagement rates 2–3× higher than off‑season content.

- Snapchat filters tied to events encourage users to share Snaps beyond the platform, amplifying brand reach.

- Holiday season AR lenses help drive the highest daily return rates as users seek festive ways to express themselves.

- Sports event lenses for major tournaments (e.g., World Cup, Olympics) see millions of plays daily during peak periods.

- Snapchat often offers region‑specific themed lenses that align with local festivities, improving cultural relevance.

- Seasonal lens campaigns often drive higher increases in time spent within the app than baseline daily use.

- Brands frequently roll out limited‑time filters tied to product launches or promotions, enhancing seasonal engagement.

Snapchat Lens Creation and Creator Ecosystem Statistics

- Over 375,000 creators have published more than 4 million AR lenses via Lens Studio.

- Over 400,000 lens creators have utilized Lens Studio worldwide.

- 350 million Snapchat users engage with AR lenses daily.

- 350 million people use Snapchat’s AR features every day, representing 75% of DAUs.

- 8+ billion AR lens plays occur daily on Snapchat.

- Over 70% of all snaps include an AR lens or filter.

- AR lens campaigns generate 6.4 times higher purchase intent than traditional video ads.

- AR ads deliver 2.4x higher ad awareness and 1.8x higher brand recognition than non-AR ads.

- India leads globally with the highest number of published Snapchat lenses.

- 85% of Snapchatters in India use lenses for social connections during festivals.

Snapchat Brand Awareness, Usage, and Engagement in the U.S.

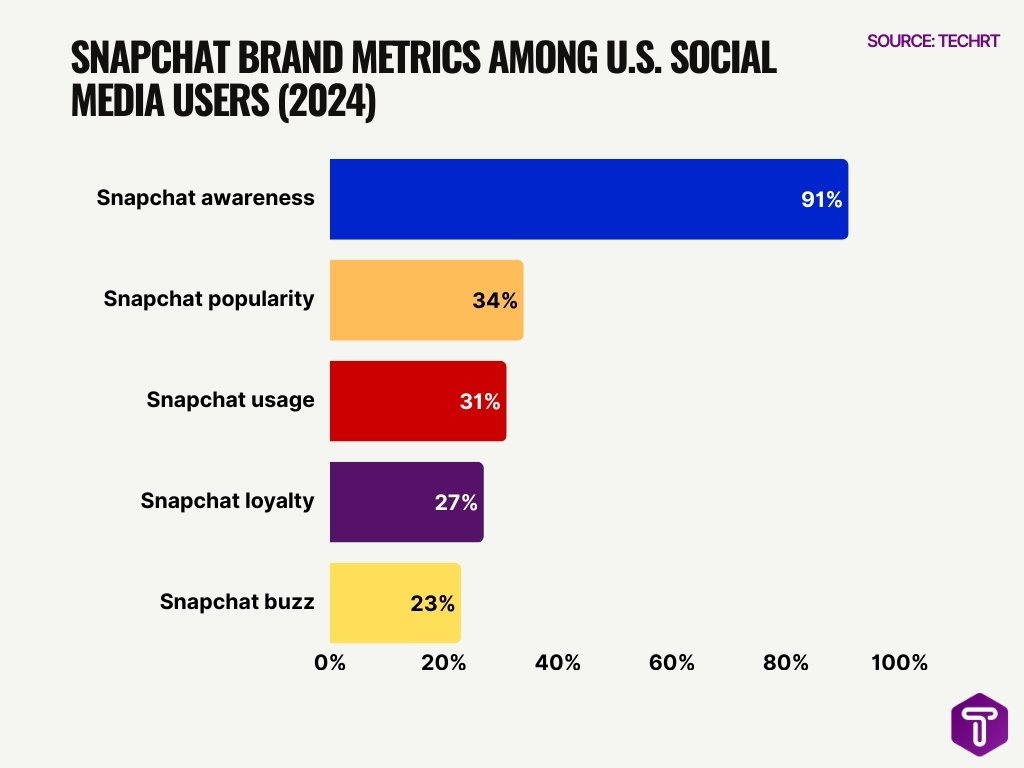

- Snapchat awareness stands at a dominant 91%, indicating that the platform has achieved near-universal recognition among U.S. social media users.

- Despite high visibility, Snapchat’s popularity is reported at 34%, showing that only about one-third of users actively consider the platform as a preferred social network.

- Snapchat usage reaches 31%, suggesting a noticeable gap between brand awareness and regular platform adoption.

- User loyalty remains moderate at 27%, highlighting opportunities for Snapchat to strengthen long-term user retention and habitual engagement.

- Snapchat buzz measures 23%, reflecting comparatively lower levels of online discussion, word-of-mouth, and social chatter around the platform.

- The contrast between very high awareness (91%) and lower usage and loyalty figures signals a challenge in converting recognition into consistent engagement and advocacy.

Snapchat Filters’ Impact on Advertising Performance Statistics

- Snapchat was ranked the #2 preferred ad platform by consumers in 2025.

- AI‑enhanced Snap ad products delivered stronger brand connection outcomes for advertisers.

- AR ads on Snapchat show measurable brand association lift, which helps advertisers strengthen recall.

- Dynamic and sponsored AR formats are helping reduce dependency on static creatives.

- Performance ad innovations allow businesses to optimize campaigns more efficiently using automated tools.

- Global advertisers on Snapchat often see higher engagement per dollar spent compared with many traditional social channels.

- AR lenses contribute significantly to conversion‑oriented ad strategies, especially in younger demographics.

- Brands adopting Snapchat AR campaigns often report better KPIs on traffic and sales metrics.

- Better measurement tools help advertisers track ROI more transparently across campaigns.

Future of Snapchat Filters and AR Experiences Statistics

- Snapchat is planning to launch consumer‑oriented AR smart glasses (“Specs”) in 2026, expanding beyond phones.

- AR GenAI lenses have already seen over 6 billion sessions among users experimenting with generative effects.

- More than 500 million users have engaged with AR GenAI lenses, highlighting future growth potential.

- Future AR lens campaigns are expected to integrate more AI‑driven personalization and conversational layers.

- Snapchat’s roadmap includes deeper AI integration for creators and advertisers to tailor lens content.

- AR commerce is projected to expand rapidly, with shoppable experiences becoming a core revenue driver by 2026.

- Lens Studio enhancements will focus on cross‑device AR content creation, including wearables and glasses.

- Snapchat’s future AR engagement is expected to align with broader trends in visual discovery and immersive social behaviors.

- Increasing investment in AR and AI signals Snapchat’s long‑term strategy for interactive and commerce‑focused lenses.

Frequently Asked Questions (FAQs)

How many Snapchat users engage with AR filters daily?

Approximately 350 million Snapchatters use AR filters or lenses every day

What percentage of Snapchat users interact with AR content daily?

About 75% of Snapchat’s daily active users engage with augmented reality features such as filters and lenses.

How many Snapchat daily active users (DAUs) were reported in 2025?

Snapchat had around 460 million to 477 million daily active users in 2025.

What share of Snapchat’s users are aged 13–24?

Roughly 60% of Snapchat users fall into the 13–24 age group.

How many geofilters are used on Snapchat each month?

Over 1 billion geofilters are used by Snapchat users every month.

Conclusion

Snapchat’s AR filters and lenses have moved far beyond playful overlays; they are now impactful engagement tools and advertising drivers for brands and creators. From shoppable AR experiences that mimic real‑world try‑ons to performance metrics that outpace traditional ads, Snapchat’s innovations in AR are shaping how users interact with content and commerce. With advancements like AI‑enhanced lenses, creator ecosystems, and upcoming AR wearables, Snapchat continues to push the boundaries of immersive social engagement. As brands prioritize interactive experiences and measurable ROI, Snapchat’s AR ecosystem remains a vital component of digital strategy and beyond.

Leave a comment

Have something to say about this article? Add your comment and start the discussion.