Snapchat continues to rank among the top social platforms worldwide, blending messaging, visual storytelling, and immersive features like augmented reality (AR). Snapchat’s global footprint is stronger than ever, with hundreds of millions of users engaging daily and monthly across diverse regions. This growth shapes how brands engage Gen Z and Millennials and influences trends in digital communication and mobile media.

From AR-driven campaigns to subscription services like Snapchat+, real‑world examples, including retail brands using AR try‑on features and local businesses leveraging Snap ads, illustrate Snapchat’s evolving impact. Let’s explore key numbers driving Snapchat.

Editor’s Choice

- 943 million monthly active users (MAU) as of Q3 2025, marking year‑over‑year growth.

- 477 million daily active users (DAU) recorded in Q3 2025.

- Snapchat+ subscriptions were at ~16 million in early 2025, up sharply from prior years.

- Over 8 billion AR Lens uses per day by Snapchatters.

- India alone accounts for 250 million Snapchat users, the largest country base.

- Users aged 18–24 represent about 37% of the platform’s global audience.

- Average usage often exceeds 30 minutes daily for core Snapchatters.

Recent Developments

- Q3 2025 reporting confirmed Snapchat’s MAU climbed ~7% year‑over‑year to approximately 943 million.

- DAU hit 477 million by Q3 2025, growing about 8% YoY.

- Snapchat expanded Spotlight content engagement with monthly active figures surpassing 550 million in mid‑2025.

- AR usage remains a focal point; AR Lenses are used over 8 billion times daily.

- Snapchat introduced the Lens+ tier under Snapchat+ to offer premium AR experiences.

- Snap launched AI‑powered tools in Lens Studio, enabling rapid creation of AR content.

- Other Revenue (primarily Snapchat+) grew ~64% YoY in Q2 2025, reflecting diversified income streams.

- Trend reports show creator posts rising +40% from 2023, highlighting increased content creation.

Overview of trends in Snapchat usage

- Snapchat remains a visual‑first social destination with strong daily engagement.

- Daily opens often exceed 30 times per user, reflecting habitual use.

- Users spend around 30 minutes or more per day on Snapchat.

- The platform sees significant AR engagement, with hundreds of millions interacting daily with Lenses.

- Snapchat’s Spotlight continues drawing user attention for short‑form video content.

- Brands are increasingly integrating Snap Ads into campaigns to reach younger demographics.

- Snapchat holds a top‑10 global rank among social platforms by MAU.

- Growth trajectory in emerging markets continues, albeit with regional variation.

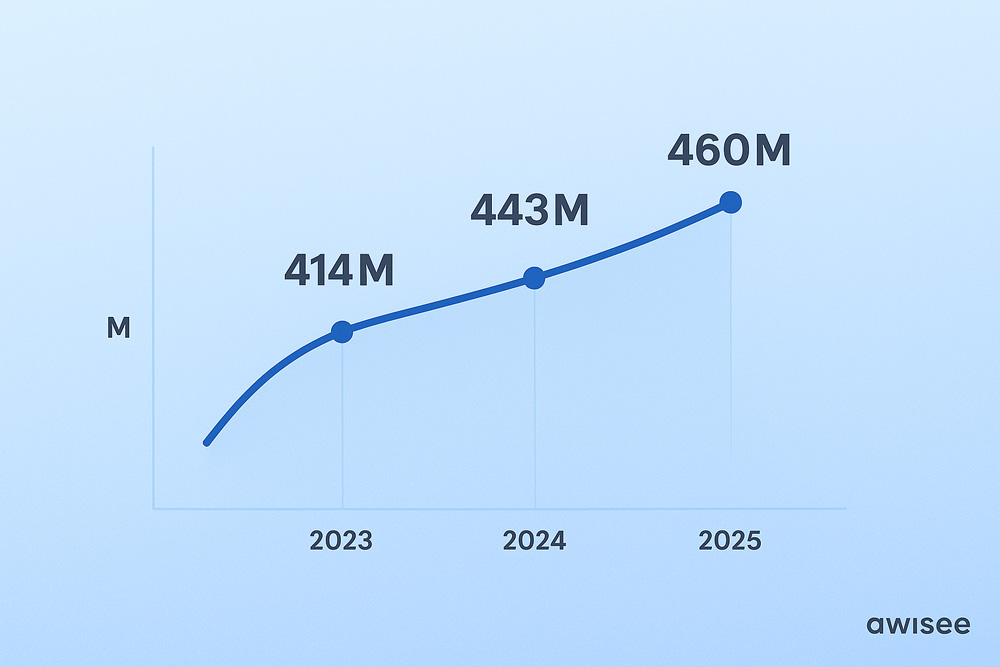

Snapchat User Growth: Year-on-Year Trends (2023–2025)

- Snapchat’s global user base reached 414 million users in 2023, marking a strong foundation for future growth.

- In 2024, Snapchat users increased to 443 million, adding +29 million users year-over-year.

- By 2025, the platform expanded further to 460 million users, reflecting continued adoption.

- Overall, Snapchat gained +46 million new users between 2023 and 2025.

- User growth remained consistently positive, highlighting Snapchat’s sustained relevance in the social media market.

- Although growth slowed slightly in 2025, the platform still recorded a solid upward trend in total users.

- The steady rise in users signals strong engagement, brand loyalty, and ongoing market expansion.

Daily active users on Snapchat

- 477 million DAUs reported in Q3 2025, up ~8% from the prior year.

- Daily users increased from 453 million at the end of 2024.

- Snapshot mid‑2025 figures show 469 million DAUs in Q2 2025, up ~9% YoY.

- DAU growth outpaced MAU growth in many quarters, indicating stronger daily retention.

- DAU consistently places Snapchat among the top social platforms by daily reach.

- Progressive DAU increases reflect steady platform adoption through 2025.

- Seasonal and event‑driven usage spikes often contribute to daily activity boosts.

- Comparisons show steady expansions from 2023 to 2024 for Snapchat’s active user base.

Monthly active user base of Snapchat

- 943 million MAUs reported in Q3 2025.

- Snapchat surpassed 900 million MAUs earlier in 2025.

- This figure represents a ~7% year‑over‑year increase.

- MAUs climbed from ~850 million in 2024.

- Growth in MAUs aligns with expanded feature adoption globally.

- Strong MAU figures emphasize Snapchat’s global reach and retention.

- Monthly engagement remains diversified across core features such as Stories and Spotlight.

- MAU trends underscore Snapchat’s staying power among competitors.

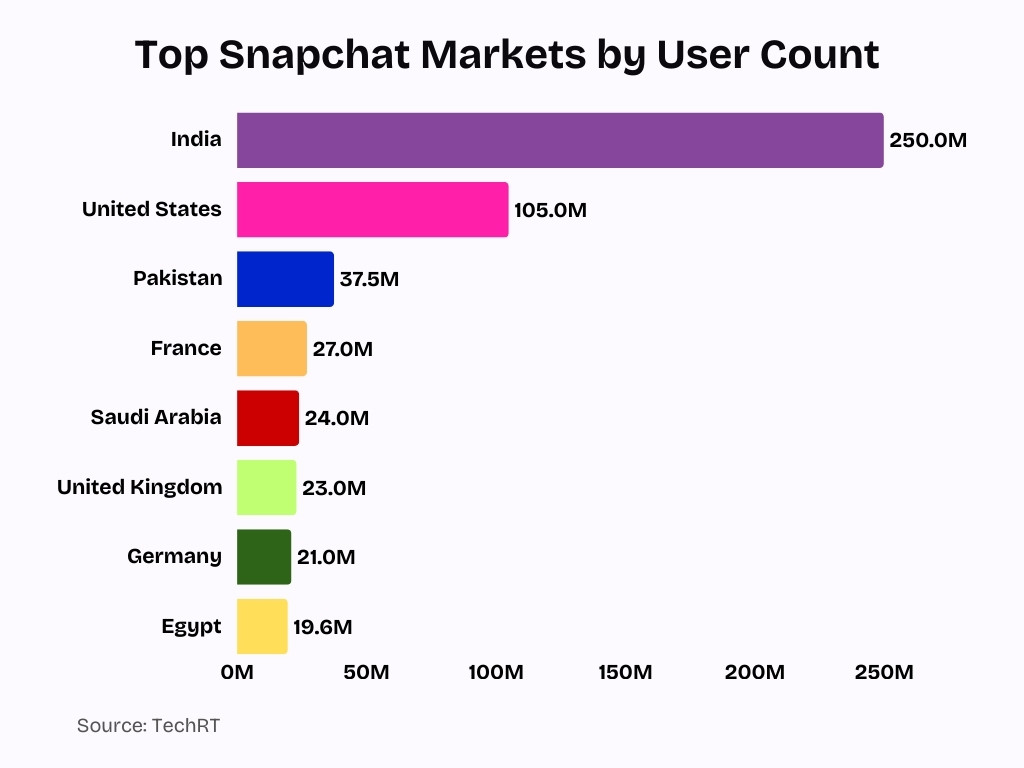

Country‑wise statistics of Snapchat users

- India has 250 million users (the largest national base in 2025).

- United States ~105 million users, ranking second globally.

- Pakistan ~37.5 million users, third largest market.

- France ~27 million users, a leading European market.

- Saudi Arabia ~24 million users, underscoring regional diversity.

- United Kingdom ~23 million users, strong presence in Western Europe.

- Germany has ~21 million users among European Snapchatters.

- Egypt ~19.6 million users, showing growth in the Middle East/North Africa.

Market share positioning of Snapchat among social platforms

- Snapchat ranks 5th among top social platforms with 943 million MAU in 2025, behind Facebook’s 3.07 billion and Instagram’s 3 billion.

- Snapchat’s global MAU hit 900 million+ in 2025, up from 850 million in 2024.

- Snapchat+ subscriptions reached 16 million globally by mid-2025.

- 90% of 13-24-year-olds use Snapchat, dominating younger demographics over Facebook.

- Gen Z comprises 37% aged 18-24 and 26% aged 25-34 of Snapchat users in 2025.

- Snapchat recorded 460 million DAU in 2025, with users averaging 30 minutes daily.

- Spotlight drew 550 million MAU and accounted for 40% of time spent in Q2 2025.

- Snapchat outperforms Threads’ 400 million MAU in Gen Z traction among global youth in 2025.

- TikTok engagement hits 7.5–10% for small accounts vs Snapchat’s 5–7% in 2025.

- India MAU for Snapchat surged to over 250 million in 2025.

Regional user distribution across Snapchat

- India leads as the largest national user base for Snapchat, with 250 million users.

- The United States follows with approximately 105 million Snapchat users in 2025.

- Pakistan ranks third with roughly 37.5 million users, highlighting South Asia’s importance.

- European regions combined contribute ~97 million daily active users, reflecting broad adoption across diverse markets.

- North America alone accounts for about 100 million DAUs, underlining strong penetration.

- The UK represents a key European Snapchat audience with ~23 million users.

- Beyond the top markets, Snapchat sees traction in Middle Eastern and North African countries with notable penetration.

- Regional adoption varies widely, with some markets (e.g., Saudi Arabia) showing exceptionally high penetration.

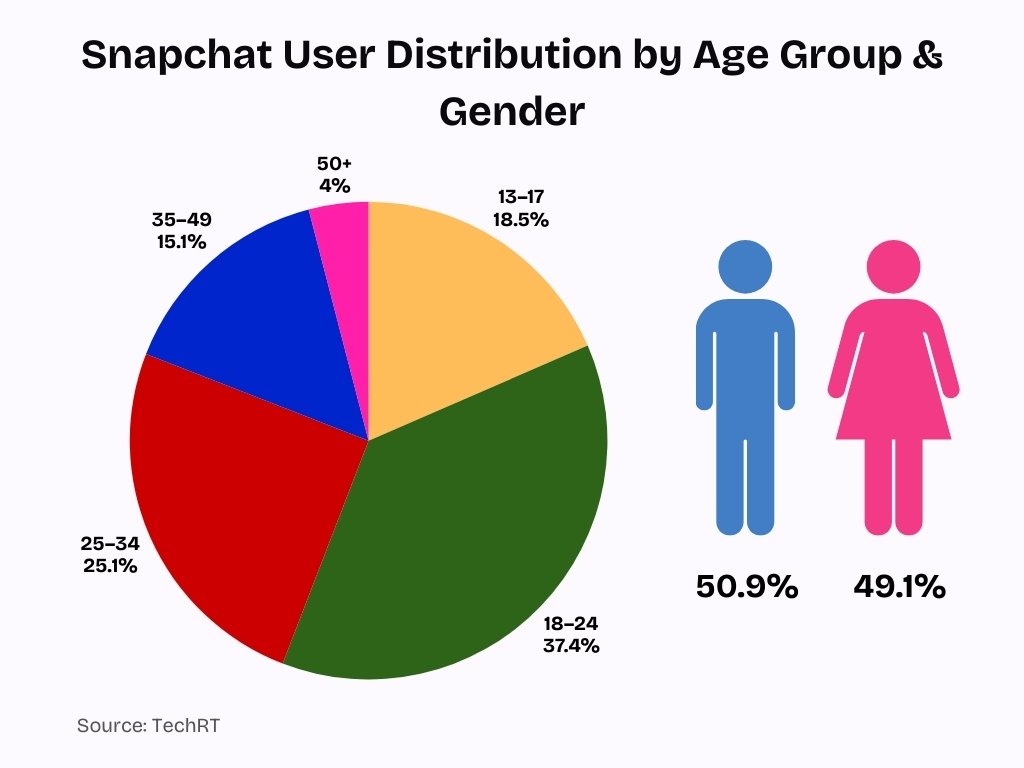

Age‑based analysis of Snapchat demographics

- The 18–24 age group accounts for ~37% of Snapchat’s global audience in 2025.

- Users aged 13–24 make up more than 50% of the total Snapchat user base.

- Teens aged 13–17 represent ~18.3% of users, highlighting a strong youth presence.

- The 25–34 cohort comprises ~24.8%, indicating solid millennial participation.

- Users aged 35–49 make up ~14.9%, showing mid‑age representation.

- Those 50+ represent about 4% of Snapchat’s base, indicating less adoption among older adults.

- In the U.S., 48% of internet users aged 15–25 use Snapchat.

- Snapchat’s age spread highlights its position as a predominantly younger‑skewing platform overall.

Gender distribution among Snapchat users

- Snapchat’s global gender split is nearly balanced, with roughly 50% male and 49.1% female users.

- The near parity suggests broad appeal across genders in 2025.

- Slight variations exist by region, but the global balance remains consistent.

- In the U.S., demographic data also indicates a similar gender distribution among young users.

- Balanced gender adoption helps Snapchat support advertising strategies targeting both men and women equally.

- The gender profile aligns with usage trends seen across major youth‑oriented platforms.

- Brand campaigns on Snapchat often reflect this balance in audience planning.

Gen Z and Millennial engagement with Snapchat

- Snapchat reaches ~75% of 13–34‑year‑olds in over 25 countries, tying closely to Gen Z and millennial cohorts.

- Up to 90% of daily Snapchat users are aged 13–34 in key markets like India, emphasizing younger engagement.

- Gen Z engagement on Snapchat has seen notable increases in time spent and interaction rates.

- Millennials remain active, particularly in features like Stories and Spotlight.

- Brands targeting Gen Z often prioritize Snapchat for AR lenses and short‑form content campaigns.

- Snapchat’s AR and visual tools resonate strongly with creative and expressive youth behaviors.

- Engagement among younger cohorts contributes substantially to daily user contributions across features.

- Gen Z users drive trends in interactive and ephemeral content more than older cohorts.

User engagement patterns on Snapchat

- Snapchat users open the app an average of 30+ times per day, showing habitual engagement.

- 5+ billion Snaps are created daily across the platform, reflecting constant active sharing.

- Over 300 million daily users interact with AR Lenses, a major engagement driver.

- 350 million daily users engage with Snap Map, signaling strong location‑based interaction.

- Stories completion rates remain high, with around 65 % of users watching full Story videos.

- Spotlight creator activity contributes to broad user participation and shared content consumption.

- Short‑form vertical videos under 60 seconds now account for over 60 % of video content.

- Video Lenses see engagement durations 4.5× longer than static filters.

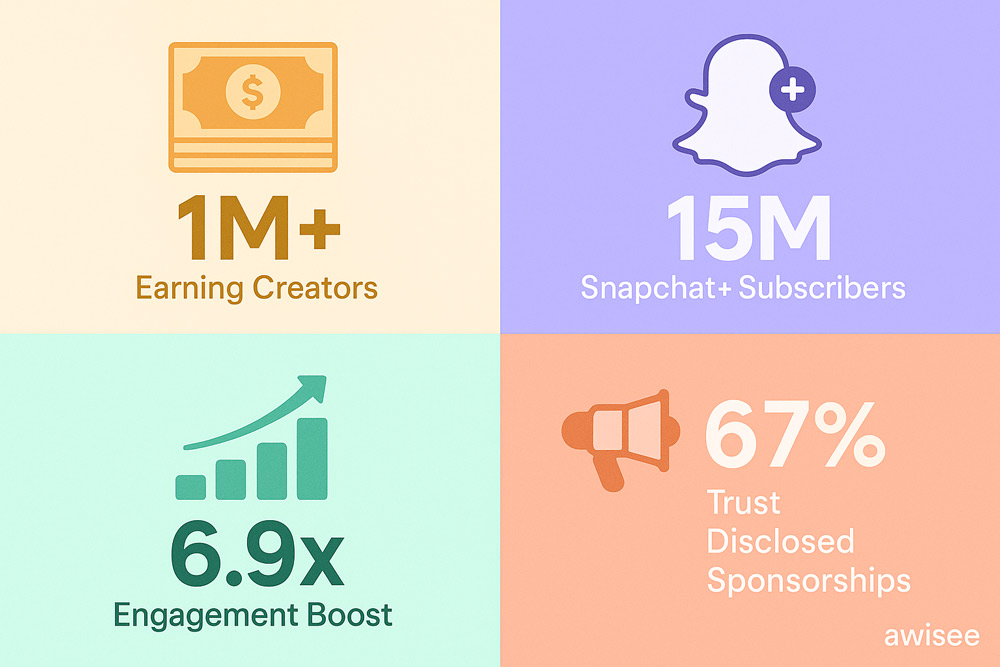

Key Snapchat Creator Economy & Trust Statistics

- Over 1M+ creators are actively earning income through Snapchat, highlighting a strong and growing creator economy.

- Snapchat+ has surpassed 15 million paid subscribers, showing rising demand for exclusive and premium features.

- Creators on the platform see up to a 6.9× engagement boost, indicating higher user interaction and content visibility.

- 67% of users say they trust creators more when sponsored content is clearly disclosed, reinforcing the importance of transparency.

Time spent per user on Snapchat

- The average Snapchat user spends ~30 minutes per day on the app, with many opening it over 30 times daily.

- Users aged 18–24 spend about 28–35 minutes daily on Snapchat, more than older groups whose usage can drop below 15 minutes.

- In the U.S., some studies report that Snapchat ranks 2nd with around 90 minutes of daily use among certain teen cohorts.

- Time spent viewing Spotlight has surged, with total Spotlight watch time growing by around 125–175% year‑over‑year.

- Snapchat users typically spend roughly 30 minutes per day, close to the 21–26 minute range reported in earlier global estimates.

- Compared with the global average of 141 minutes per day on social media, Snapchat captures about 20–25% of a typical user’s total social time.

- Daily active users often spend at least 30 minutes on Snapchat, helping drive billions of video views and Snaps created each day.

- AR Lens usage is intense, with 300M+ users engaging with AR daily and lenses generating around 12.6 seconds of active attention per interaction.

Stories and Spotlight usage within Snapchat

- Snapchat’s Stories feature remains core, with 65 %+ completion rates for story videos.

- Spotlight has expanded to 550 million+ monthly active users in mid‑2025.

- Stories and Spotlight combined contribute significantly to overall platform engagement trends.

- Spotlight video creation has increased 40 %+ since 2023, reflecting creator interest.

- Spotlight videos often feature vertical, short‑form content, aligning with broader social trends.

- Engagement with Spotlight often exceeds traditional Stories among younger users.

- Snapchat remains competitive in short‑form content against TikTok and Reels.

- Spotlight’s growth underscores Snapchat’s shift toward content discovery beyond direct messaging.

Messaging, Snaps, and Snap Map features on Snapchat

- Snapchatters create over 5+ billion Snaps every day, equal to about 2.4 million Snaps per minute, underscoring massive real‑time messaging volume.

- Messaging is the most popular activity on Snapchat, with around 85% of users regularly using chat and messaging features daily.

- Snapchat has about 453–460 million daily active users, providing a large base for frequent private messaging and Snap exchange.

- Over 350–400 million people use Snap Map monthly, making location‑based sharing a major engagement driver on the platform.

- More than 300 million daily active users interact with AR features, often combining lenses, stickers, and Snaps in their chats.

- Roughly 65% of users send direct messages each day, showing that private chat is central alongside Stories and Spotlight viewing.

- Users spend about 30 minutes per day on Snapchat, much of it switching between messaging, Snaps, Stories, and Snap Map.

- Around 60–69% of Snapchat users view Stories daily, while 65% watch friends’ Stories, complementing high chat and Snaps activity.

- Millions of users maintain Snap Streaks over 100 days, with a record streak above 4,000 consecutive days, illustrating highly habitual messaging behavior.

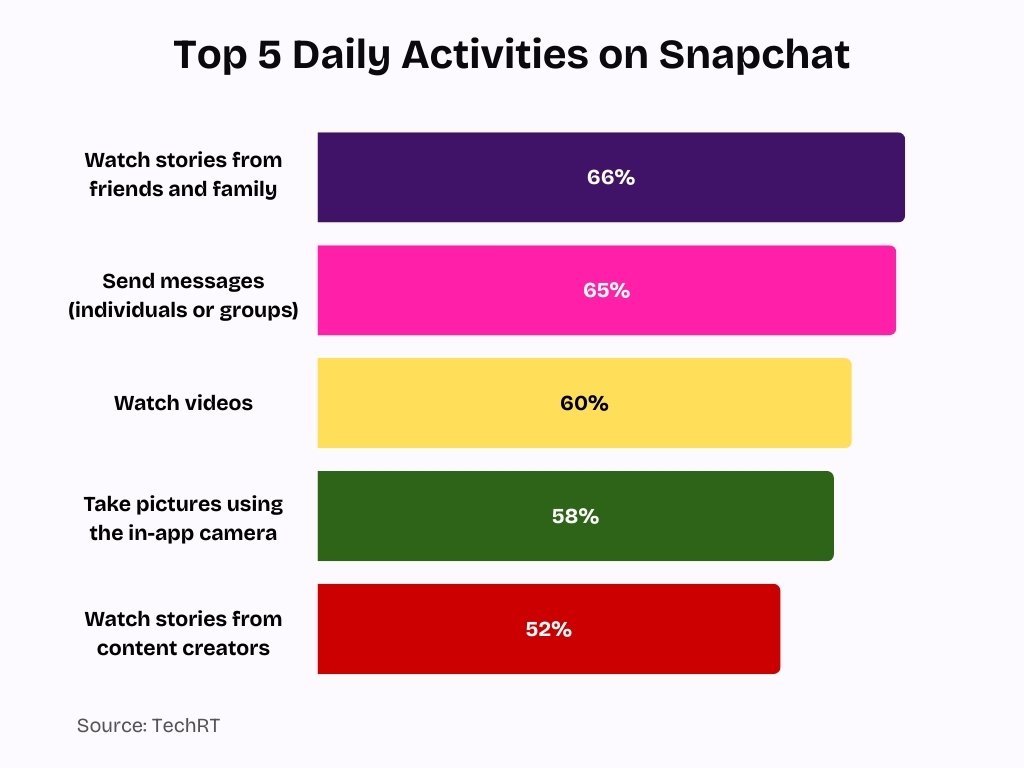

Top Daily Activities on Snapchat

- Watching stories from friends and family leads usage, with 66% of Snapchat users engaging in this activity daily, making it the most popular behavior on the platform.

- Direct messaging remains core to Snapchat’s appeal, as 65% of users send messages to individuals or groups every day.

- Video consumption is a major engagement driver, with 60% of users regularly watching videos on Snapchat.

- Snapchat’s camera-first design stays highly relevant, as 58% of users take pictures using the in-app camera daily.

- Creator content continues to gain traction, with 52% of users watching stories from content creators, reflecting growing interest in influencer-led and professional content.

Augmented Reality lens interactions on Snapchat

- Snapchatters use AR Lenses over 8 billion times per day globally.

- 350 million+ users engage with AR daily, showcasing mass adoption.

- Over 400,000 developers have created 4+ million AR Lenses.

- More than 500 million users have used AI‑powered Lenses over 6 billion times.

- Approximately 300 million+ daily users interact with AR Lenses.

- AR interaction extends to creative, shopping, and educational scenarios.

- AR Lenses contribute to higher engagement times compared to static filters.

- Snapchat’s AR tools remain a leading differentiator against competitors.

Subscription uptake for Snapchat+

- Snapchat+ subscription revenue grew 54 % year‑over‑year to $190 million in Q3 2025.

- Snapchat+ subscribers are estimated to be around 16–17 million in 2025.

- The premium tier adds revenue beyond advertising streams.

- Snapchat+ uptake increased significantly from roughly 7 million subscribers in early 2024.

- Snapchat+ features include early access to new tools and creative lenses.

- Growth in Snapchat+ reflects monetization beyond core app usage.

- Subscription users tend to be higher‑engagement Snapchatters.

- Snapchat continues evolving premium offerings to increase retention.

Revenue growth and financial performance of Snapchat

- Snap Inc.’s Q3 2025 revenue reached about $1.51 billion, up ~10 % year‑over‑year.

- Annual revenue for the 12 months ending Q3 2025 was about $5.77 billion, up nearly 12 %.

- Other revenue, largely Snapchat+, was $190 million in Q3 2025, a 54 % increase.

- Advertising remains the primary revenue driver, supported by high engagement.

- Revenue growth shows resilience amid competitive challenges.

- Snap narrowed net losses and improved cash flow, indicating financial stabilization.

- Snap forecasted continued revenue growth into Q4 2025.

- Financial performance underscores the value of diversified monetization.

Frequently Asked Questions (FAQs)

How many monthly active users does Snapchat have in 2025?

Snapchat has surpassed 943 million monthly active users globally in 2025.

What is Snapchat’s daily active user count in 2025?

Snapchat records around 460 million daily active users in 2025.

How many people are subscribed to Snapchat+ as of 2025?

Snapchat+ has approximately 17 million paying subscribers worldwide in 2025.

What percentage of Snapchat users are aged 18–24?

Users aged 18–24 make up about 38 % of Snapchat’s total user base in 2025.

What was Snapchat’s revenue figure in early 2025?

Snapchat reported revenue of approximately $1.36 billion in Q1 2025.

Conclusion

Snapchat’s user base continues expanding, with nearly a billion monthly users and hundreds of millions engaging daily. Engagement spans Stories, AR Lenses, messaging, and premium subscriptions, showing the platform’s multi‑modal appeal. Snapchat+ and augmented reality features contribute significantly to both engagement and revenue, highlighting Snapchat’s ability to innovate beyond core communication tools. Market performance and financial results signal ongoing growth, even amid competitive pressures. These figures confirm Snapchat’s sustained relevance for social connection, creative interaction, and brand engagement.

Leave a comment

Have something to say about this article? Add your comment and start the discussion.