Wearable health technology is reshaping how people monitor their bodies and manage wellness every day. From basic step counters two decades ago to today’s multi‑sensor devices, wearables now influence personal and clinical health decisions worldwide. This shift has a practical impact on remote patient monitoring programs used by hospitals for chronic disease follow‑ups and in corporate wellness plans that help employers reduce healthcare costs. Below, explore the latest data shaping the wearable health landscape.

Editor’s Choice

- The global wearable health market is growing rapidly, driven by rising health awareness and tech adoption.

- The Wearable medical devices market is valued at over $91B in 2024 and projected to expand significantly by 2032.

- Smartwatch users worldwide reached more than 455M in 2025.

- Fitness tracker shipments comprised over 35% of wearable device shipments in 2024.

- Consumer wearables hold the largest market share in 2024.

- Smartwatch market share was about 46% of the wearable tech sector in 2024.

- Adoption is rising across age groups, with younger adults showing the highest usage rates.

Recent Developments

- Wearable technology shipments continued to grow, with 136.5M units shipped in Q2 2025, a 9.6% increase from Q2 2024.

- Smartwatch user base expanded to 562.86M globally in 2025, up from about 454.7M in 2024.

- Fitness trackers accounted for more than 35% of all wearable device shipments in 2024.

- Consumer wearables remained the dominant category in the 2024 market share.

- Smartwatches led device type share at around 46% of the wearable tech market in 2024.

- Remote monitoring wearables are forecast to grow faster than fitness‑only devices.

- North America maintained leadership in market value and deployment of advanced wearables.

- Asia Pacific is projected to have the highest CAGR over the coming years.

- Smartwear integration with AI features expanded in late 2025 product launches.

- Clinical wearables continue to be adopted in population health initiatives globally.

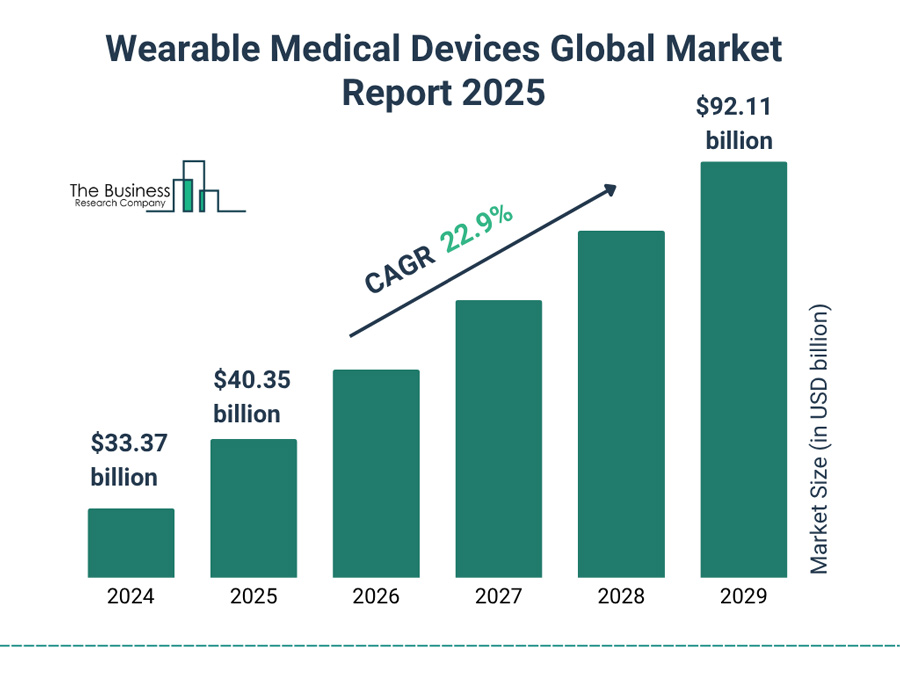

Wearable Medical Devices Global Market Growth

- The global wearable medical devices market was valued at $33.37 billion in 2024, highlighting strong early adoption across healthcare systems.

- In 2025, the market is projected to reach $40.35 billion, reflecting accelerating demand for remote health monitoring and digital health solutions.

- Market expansion continues in 2026, with revenues estimated at $48.65 billion, driven by increased use of smart medical wearables.

- By 2027, the market is expected to grow to approximately $58.78 billion, supported by advancements in sensor technology and AI-enabled diagnostics.

- The market size is forecast to hit $70.93 billion in 2028, indicating wider integration of wearables in preventive and chronic care management.

- By 2029, the wearable medical devices market is projected to surge to $92.11 billion, underscoring long-term growth momentum.

- The market is expected to grow at a robust CAGR of 22.9%, signaling rapid innovation, rising health awareness, and increasing healthcare digitization worldwide.

Adoption of Wearable Health Devices Worldwide

- Over 580M wearable devices were shipped globally in 2024.

- Fitness trackers formed the largest shipment category at 35%+ share of total wearables.

- Smartwatch user count surpassed 455M in 2025.

- Adoption rates among younger adults (18‑34) are the highest for fitness tracking devices.

- Nearly 50% of wearable users rely on these devices daily.

- Roughly 92% of smartwatch users use their device for health tracking.

- A large percentage of physicians (about 88%) want patient home monitoring data from wearables.

- Market penetration continues to rise across Europe, North America, and the Asia Pacific.

- Tech advancements and lower prices drive broader adoption in emerging markets.

- Wearable use in clinical settings (e.g., rehab and chronic care) is growing.

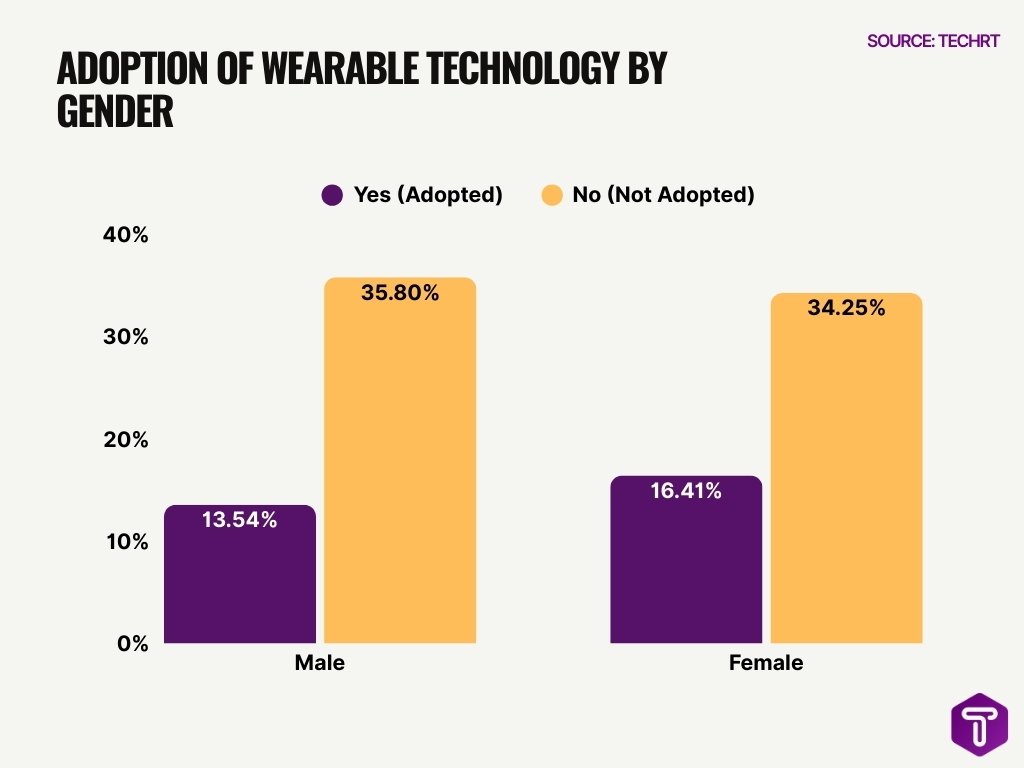

Wearable Technology Adoption Trends by Gender

- Female users show higher adoption, with 16.41% reporting the use of wearable technology, compared to 13.54% among male users.

- The adoption gap indicates that women are more inclined toward health and fitness-focused wearables than men.

- A substantial 35.80% of males reported no adoption, making men the largest non-adopting group.

- Similarly, 34.25% of females stated they do not use wearable technology, though this figure remains slightly lower than that of males.

- Overall data suggests that non-adoption outweighs adoption across both genders, signaling strong growth potential for the wearable technology market.

- The gender-based comparison highlights an opportunity for targeted marketing strategies to convert non-users into adopters.

Demographics of Wearable Health Device Users

- 44.5% of U.S. consumers owned wearable devices in 2022, with ownership highest among younger adults.

- 25-34-year-olds represented 24.1% of wearable owners, showing peak adoption in this group.

- Users aged 35-54 account for ~30% of smartwatch owners, driving strong mid-life uptake.

- 65+ adults had 82% lower odds (OR 0.18) of wearable ownership compared to 18-24-year-olds.

- 31% of U.S. adults earning $75,000+ annually use fitness trackers or smartwatches, vs 12% below $30,000.

- Households with $200,000+ income had 2.27 times higher odds of wearable ownership.

- Urban residents comprised 45.6% of wearable owners, compared to 12.6% rural areas.

- Advanced degree holders showed 2.23 times higher odds of owning wearable health devices.

- 55% of wearable owners use devices for fitness training, prioritizing activity monitoring.

- 35% of owners track sleep, and 57% more physical activity with wearables.

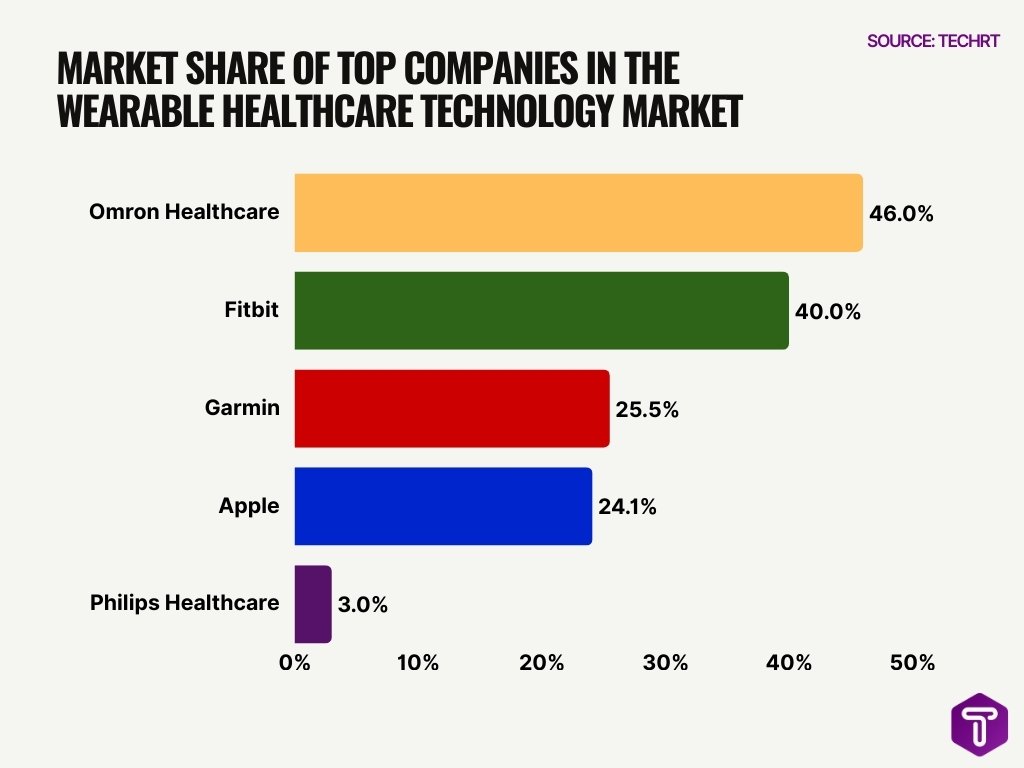

Competitive Landscape of Leading Wearable Healthcare Technology Companies

- Omron Healthcare dominates the market with a commanding 46.0% market share, establishing itself as the clear industry leader in wearable healthcare technology.

- Fitbit secures a strong 40.0% share, reflecting its widespread adoption and continued relevance in health-focused wearables.

- Garmin holds 25.5% of the market, highlighting its solid position in fitness, wellness, and health monitoring devices.

- Apple captures a notable 24.1% market share, underlining the growing impact of smartwatches in healthcare monitoring.

- Philips Healthcare accounts for a modest 3.0% share, indicating a specialized and niche presence within the wearable healthcare segment.

- Overall, the data show a highly competitive market, where the top two players alone exceed 80% combined share, signaling strong market concentration.

Types of Wearable Health Devices and Sensors

- Smartwatches hold 39% of the wearable electronics market share in 2025.

- Wrist-worn devices, including fitness trackers, shipped 45.6 million units globally in Q1 2025, up 10.5% YoY.

- The sleep tech devices market grows at 16.7% CAGR from 2025 to 2032 due to rising popularity.

- The CGM systems market reaches $12.8 billion in 2025, expanding in diabetes care.

- Smart wearable ECG monitors are valued at $1.98 billion in 2024, growing 10.33% annually.

- The wearable pulse oximeters (SpO2) market surges with 7.54% CAGR through 2028 in affordable devices.

- Smart clothing market hits $2.15 billion in 2025, at 15.38% CAGR for biometric sensors.

- Oura Ring dominates smart rings with 74% market share in H1 2025.

- Wearable patches are valued at $12.16 billion in 2025 for clinical diagnostics.

- Wearable AI kits reach $32.2 billion in 2025, enabling predictive analytics.

Fitness Tracker and Smartwatch Health Statistics

- Smartwatch shipments exceeded 560 million units in 2025, up significantly from previous years, underscoring continued consumer demand.

- Fitness trackers accounted for roughly 35% of all wearable device shipments in 2024, a leading share among device types.

- Smartwatches make up about 46% of the total wearable tech market share by revenue.

- Activity monitoring remains a primary feature: over 90% of smartwatch users track some aspect of health metrics daily.

- In the U.S., the smart wearables market was valued at over $22 billion in 2024 and is projected to grow to more than $26 billion in 2025.

- Among U.S. users, smartwatches dominate revenue with approximately 46% market share in 2024.

- A large majority of fitness tracker users report using devices for heart rate monitoring and step counting as core functions.

- Daily wearable health use correlates with higher physical activity levels across demographic segments.

Smart Rings, Patches, and Smart Clothing Health Statistics

- The smart rings market reached $441.58 million in 2025, projected to hit $5.45 billion by 2035 at 28.56% CAGR.

- Wearable bioelectronic skin patches valued at $14.1 billion in 2025, expected to grow to $48.5 billion by 2034 at 14.7% CAGR.

- Smart clothing in the healthcare market is at $857.1 million in 2024, forecasted to reach $3.6 billion by 2030 with 27% CAGR.

- 80% of U.S. hospitals integrate smart rings and wearables for remote patient monitoring and health data aggregation.

- Home-based ECG patch monitoring yielded 3.9% atrial fibrillation diagnosis rate vs. 0.9% in routine care after 4 months.

- Ring pulse oximeters show over 90% agreement with PSG for sleep stages and breathing data in clinical validation.

- The wearable patches market is estimated at $12.16 billion in 2025, rising to $24.75 billion by 2034 at 8.26% CAGR.

- The smart clothing market hit $5.16 billion in 2024, projected to reach $21.48 billion by 2030, growing at 26.2% CAGR.

- Smart ring adherence averaged 52.5 days out of 56 for sleep tracking, surpassing sleep diary adherence.

- Biometric wearables in chronic care reduce hospital readmissions by 15% and boost insulin adherence by 20%.

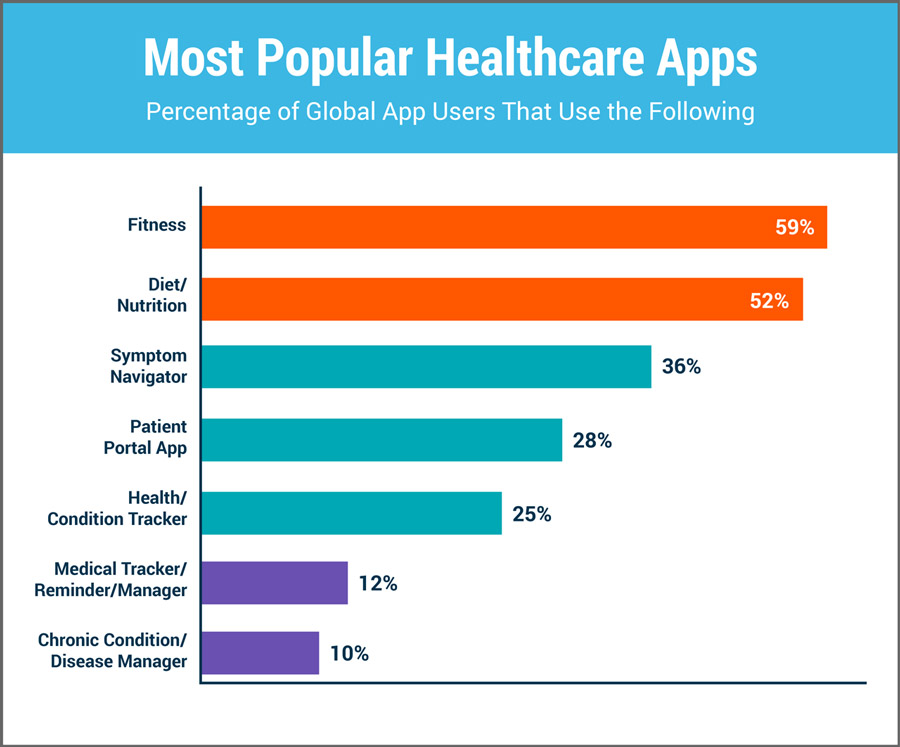

Most Popular Healthcare App Categories Worldwide

- Fitness apps dominate healthcare app usage, with 59% of global app users actively using them, highlighting strong demand for exercise tracking, workouts, and physical wellness tools.

- Diet and nutrition apps rank second, used by 52% of users, reflecting growing interest in healthy eating, calorie tracking, and personalized nutrition plans.

- Symptom navigator apps are used by 36% of users, showing a significant reliance on self-assessment and early health guidance tools.

- Patient portal apps reach 28% adoption, indicating rising engagement with digital access to medical records, appointments, and healthcare providers.

- Health and condition tracker apps are used by 25% of global users, supporting ongoing monitoring of vital signs and health metrics.

- Medical tracker, reminder, and management apps account for 12% usage, suggesting moderate adoption of medication reminders and treatment management solutions.

- Chronic condition and disease manager apps are the least used, with 10% of users, pointing to untapped growth potential in long-term digital disease management tools.

Clinical‑Grade vs Consumer Wearable Health Devices

- The wearable medical devices market (clinical‑grade) was valued at approximately $42.7 billion in 2024 and is projected to reach about $168.3 billion by 2030.

- Consumer wearables hold the largest market share of general wearable health tech due to widespread integration with smartphones and lifestyle usage.

- Clinical‑grade devices typically require regulatory clearance and are intended for medical diagnostics or treatment support, unlike many consumer devices.

- Clinical wearables dominate remote patient monitoring programs and are increasingly prescribed in chronic disease care plans.

- Growth rates for clinical wearables often exceed those of consumer devices, reflecting healthcare system demand.

- Consumer devices focus on wellness while clinical devices adhere to accuracy and validation standards for medical use.

- Integration of clinical wearable data with electronic health records (EHRs) has shown significant improvements in health outcome predictions.

- Clinical devices are critical for hospital‑led telehealth and RPM initiatives due to validated measurement accuracy.

Chronic Disease Management with Wearable Devices Statistics

- Wearables play a growing role in diabetes and cardiovascular disease management by helping patients and clinicians monitor trends continuously.

- Use of CGM wearable devices is steadily increasing, with the CGM market valued at about $12.2 billion in 2024 and forecast to exceed $32 billion by 2033.

- Wearables assist older adults in maintaining independence by enabling remote health tracking of chronic conditions.

- Healthcare providers increasingly recommend wearable data to adjust medication and treatment plans based on real‑time metrics.

- Patient engagement with wearable chronic care tools correlates with better self‑reported health outcomes.

- Continuous biometric data from wearables supports preventive interventions in chronic disease progression.

- Wearables are regularly included in disease management programs for hypertension, diabetes, and respiratory illnesses.

- Adoption of wearables within chronic care is rising despite challenges in data trust and integration.

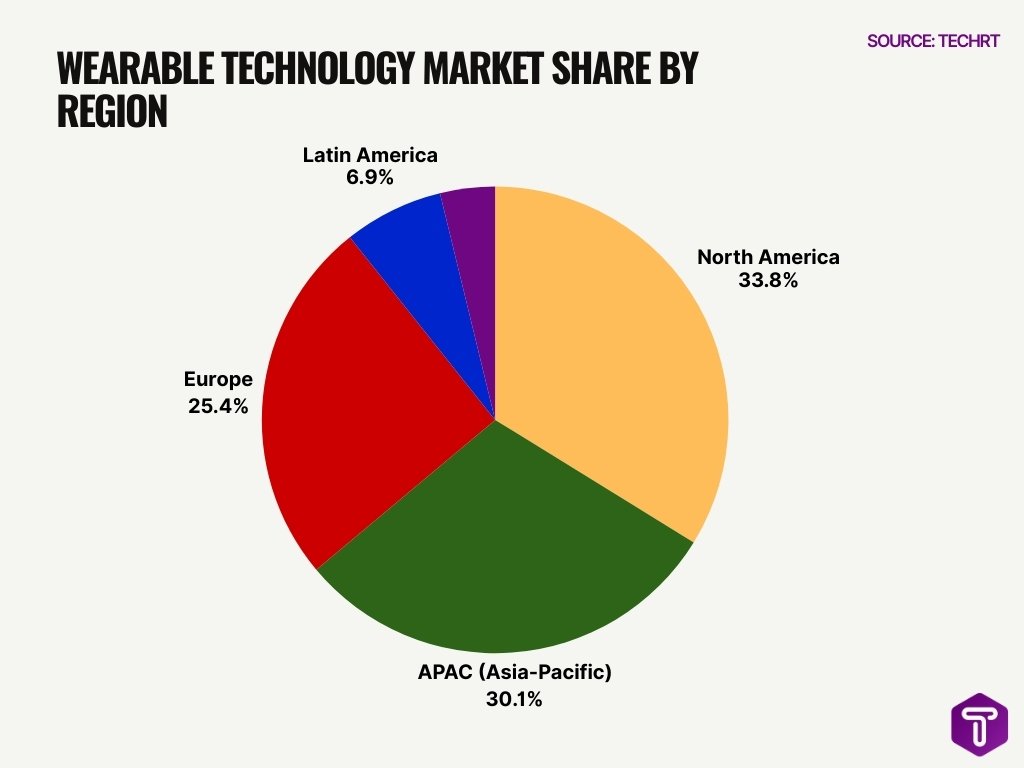

Wearable Technology Market Share by Region

- North America and APAC together command over 63% of global market share, underlining their dominant role in shaping wearable technology trends worldwide.

- North America leads the global wearable technology market, capturing 33.8% of the total market share, driven by high consumer adoption, advanced healthcare systems, and the strong presence of major wearable brands.

- APAC emerges as the second-largest region, accounting for 30.1% of the market, supported by large population bases, rising disposable incomes, and rapid digital health adoption across countries like China and India.

- Europe holds a significant 25.4% share, reflecting steady demand for health-focused wearables, strong regulatory support, and increasing use of devices for preventive healthcare and fitness tracking.

- Latin America represents 6.9% of the market, indicating moderate but growing adoption, fueled by expanding mobile connectivity and increasing health awareness.

- The Middle East and Africa (MEA) account for 3.8%, the smallest regional share, highlighting an early-stage market with long-term growth potential as infrastructure and healthcare digitization improve.

Remote Patient Monitoring and Telehealth Wearable Statistics

- Remote patient monitoring (RPM) increasingly leverages wearable data for continuous vital sign tracking.

- Smarter sensors and cloud‑based platforms enhance RPM capability in 2025 and beyond.

- Wearable integration with telehealth services enables clinicians to track long‑term patient trends without in‑office visits.

- Adoption of RPM wearable programs is rising across home health services.

- Data from wearables reduces unnecessary clinic visits and can alert providers to early warning signs.

- Telehealth providers report improved patient engagement using wearable metrics dashboards.

- Wearable‑enabled RPM increases medication adherence through reminders and alerts.

- Integration of wearable data into telehealth billing remains an evolving financial model in U.S. healthcare.

Heart Rate, ECG, and Cardiovascular Monitoring Statistics

- Over 70% of smartwatch users regularly track heart rate for cardiovascular health.

- 18% of US adults with cardiovascular disease use wearable devices.

- The wearable heart monitoring market is valued at $3.0 billion in 2024, projected to reach $24.7 billion by 2034.

- ECG smartwatches show 83% sensitivity and 88.4% specificity for atrial fibrillation detection.

- PPG smartwatches achieve 97.4% sensitivity and 96.6% specificity in AF detection.

- Only 12% of adults over 65 with CVD use wearables, versus 34% aged 18-49.

- 25% of smartwatch users utilize ECG functionality for arrhythmia detection.

- HRV from wearables enables 78% accuracy in high vs low stress classification.

- 55.8% of primary/cardiovascular care patients actively use wearable devices.

Blood Pressure, Blood Oxygen, and Glucose Monitoring Statistics

- The wearable blood pressure monitoring device market was valued at about $2.9 billion in 2024 and could exceed $8.1 billion by 2031.

- Blood oxygen (SpO₂) sensors are now common on mid‑ and premium‑tier wearables.

- Continuous glucose monitoring (CGM) is a fast‑growing sub‑segment within medical wearables.

- True noninvasive glucose sensors on general smart wearables remain unapproved and unsupported by regulators.

- Wearable blood pressure tools are increasingly paired with smartphone apps for user insights.

- Adoption of multi‑vital monitoring wearables aids early identification of hypertension and hypoxia trends.

- Integration between CGM data and fitness wearable dashboards helps with holistic health tracking.

- Advancements in sensor accuracy are making continuous vital monitoring more reliable.

Sleep Tracking and Recovery Monitoring Statistics

- Wearables have increased home sleep tracking adoption, with many mainstream devices offering sleep stage analysis and duration measurement as standard.

- Advanced sleep tracking biometric systems have begun monitoring breathing patterns and sleep disturbances at home with high accuracy.

- Smart sleep apparel and sensor‑embedded clothing innovations reached accuracy rates around 98.6% in differentiating sleep states in research settings.

- Multiple wearable devices track REM, deep, and light sleep, with users reporting improved awareness of sleep quality trends.

- Sleep metrics from wearables correlate with daytime recovery and physical performance improvements among regular users.

- Continuous sleep tracking supports early identification of insomnia and apnea patterns, informing clinical discussion.

- Daily sleep consistency metrics improve when users receive wearable reminders and insights.

- Health systems increasingly consider wearable sleep data for population‑level sleep health assessment.

- Recovery monitoring via wearables is used by athletes and clinicians to assess readiness and overtraining risk.

Stress, Mental Health, and Mood Monitoring Statistics

- The stress tracking devices market was valued at approximately $3.3 billion in 2025 and is projected to reach around $3.5 billion in 2026.

- Smart wearables are expected to hold about 57% of the stress tracking market share in 2025.

- Global wearable and digital mental health monitoring markets are estimated at around $2.5 billion in 2025.

- Mental health tracking devices are forecast to grow to $17.9 billion by 2035, expanding at a ~13.8% CAGR from 2025–2035.

- Adoption of stress and mood monitoring features on wearables is rising as users seek real‑time emotional insights.

- Continuous stress metrics from wearables combine physiological signals like HRV and skin conductance for better trend detection.

- Wearable data helps individuals identify stress triggers and recovery effectiveness through longitudinal trends.

- Integration of mood tracking with smartphone apps supports daily mental well-being check‑ins.

- Clinicians increasingly consider wearable mental health metrics when developing personalized behavioral health plans.

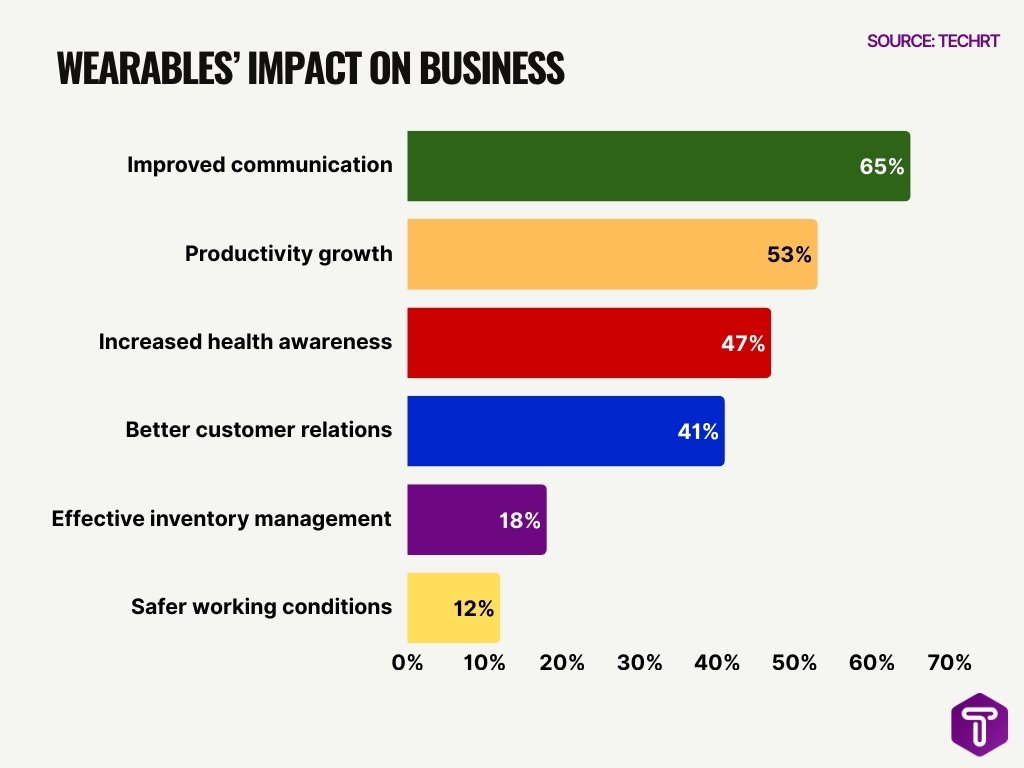

Wearables’ Impact on Business: Key Data Insights

- Improved communication leads to all benefits, with 65% of businesses reporting better internal and operational connectivity through wearable technology.

- Productivity growth is a major outcome, as 53% of organizations see measurable efficiency gains after adopting wearables.

- Increased health awareness is highlighted by 47% of companies, showing wearables’ role in monitoring and improving employee wellbeing.

- Better customer relations are reported by 41% of businesses, driven by real-time data access and faster service response.

- Effective inventory management remains a niche benefit, with 18% of firms leveraging wearables to streamline stock tracking and logistics.

- Safer working conditions are noted by 12% of respondents, indicating early adoption of wearables for workplace safety and risk reduction.

Privacy, Security, and Trust Concerns in Health Wearables

- 75% of patients worry about the privacy of their health data from wearables.

- 64% express concerns over data security in wearable devices.

- 40% of wearable users fear data security risks with their devices.

- A 2021 breach exposed 61 million Apple and Fitbit health records online.

- 76% of top wearable makers’ policies rate high risk for transparency reporting.

- 65% show high risk in vulnerability disclosure per privacy policy analysis.

- 48% of Britons are concerned that wearable data reveals their lifestyle to companies.

- 33 vulnerabilities, including 18 critical, were found in the common wearable data transfer protocol.

- Over 1 million IoT medical devices were exposed in the 2025 healthcare breach.

- Breaches make 41% reluctant to share wearable data due to security fears.

Accuracy and Reliability of Wearable Health Measurements

- Sensor accuracy remains a central focus, as reliable measurements are essential for clinical and personal use.

- Studies show variation in data quality and balanced estimations across many wearable models.

- Machine learning enhancements improve pattern recognition and health event prediction from wearables.

- Researchers develop advanced algorithms like autoencoder networks to boost stress detection accuracy above 90% in some tests.

- Continuous refinement of wearable measurements aims to reduce false‑positive alerts in health monitoring.

- Clinical‑grade sensors tend to demonstrate higher validity and reproducibility compared to many consumer wearables.

- Device calibration remains essential for accurate glucose, blood pressure, and oxygen saturation tracking.

- Real‑world performance often varies by user behavior, placement, and external conditions.

- Standardization efforts could enhance comparability across wearable device metrics.

AI and Data Analytics in Wearable Health Devices Statistics

- AI‑enabled wearable systems reached $55.69 billion in 2026, growing at a 27.83% CAGR.

- Over 1,250 AI medical devices gained FDA approval by mid-2025, with 76% in radiology.

- 35% of adults used AI health wearables in 2024 for monitoring.

- AI wearables achieve 97.1% accuracy in arrhythmia anomaly detection.The

- The AI-powered wearables market grew from $43.64 billion in 2025 to $310.56 billion by 2033.

- Wearable AI improves health prediction accuracy by 23.8%.

- AI scribes from wearables reduce physician documentation time by nearly 10%.

- Over 60% of telehealth patients share real-time wearable data with doctors.

- India leads with 25% adoption of AI-powered health solutions via wearables.

- AI wearables cut chronic disease hospitalizations by 25% through early detection.

Future Trends in Wearable Health Technology and Digital Health

- Wearables will integrate more deeply into holistic digital health ecosystems with telehealth and AI.

- Multimodal sensing and AI may support early detection of neurological disorders through gait and speech patterns.

- Wearables could extend beyond health tracking to predictive and preventive diagnostics.

- Enhanced interoperability with EHRs and clinical systems will expand their role in care coordination.

- Personalized patient coaching driven by AI may improve preventive health engagement.

- Hybrid models blending in‑clinic and remote care are projected to grow by 2030.

- Wearable data analytics will support population health and research insights.

- AI‑powered predictive care models will become more prevalent as data volumes rise.

- Emerging wearable form factors, like smart textiles, could broaden monitoring beyond wrist devices.

Frequently Asked Questions (FAQs)

What was the global wearable technology market size in 2025?

$219.3 billion global wearable technology market size in 2025.

What CAGR is projected for the wearable medical devices market through 2032?

~15.9% CAGR expected for the wearable medical devices market from 2025 to 2032.

How much did the wearable healthcare devices market grow from 2024 to 2025?

From $41.07 billion in 2024 to $45.29 billion in 2025.

What share do smartwatches hold in the wearable band market in 2025?

69% market share of smartwatches in the wearable band segment in H2 2025.

What was the estimated value of the U.S. smart wearables market in 2024?

$22.17 billion estimated value for the U.S. smart wearables market in 2024.

Conclusion

Wearable health technology is no longer limited to step counts and basic vitals; it is a central component of digital health transformation. Today’s wearables deliver complex insights into sleep, stress, mental wellness, and chronic care. Clinicians use device data for remote monitoring, while AI analytics elevate predictive capacity and personalized care. Privacy and accuracy challenges remain focal points for trust and adoption, yet improvements in integration, interoperability, and AI promise richer healthcare experiences. As wearables evolve with deeper analytics and broader clinical acceptance, their role in shaping future healthcare delivery continues to expand.

Leave a comment

Have something to say about this article? Add your comment and start the discussion.