Android’s open ecosystem has made personalization more than a perk; it’s an expectation. Whether users are tailoring home screens with launchers or swapping themes and widgets, Android customization shapes how people interact with their devices every day. In real‑world terms, brands like Samsung and Google lean on customization to boost engagement, and developers of third‑party launchers compete intensely to capture niche user preferences.

Across mobile markets, customization now influences app downloads, user retention, and smartphone choice. Dive into the full range of data below to grasp how Android personalization is evolving.

Editor’s Choice

- ~72–73% of smartphones globally run Android as of 2025, making customization statistically significant across device interactions.

- Android supports ~4.3 billion active users worldwide, an increase from earlier years.

- The Android launcher market was valued at ~$42.2 million in 2025.

- Forecasts show a market contraction at approximately 7.8% CAGR through 2031 for launchers.

- Asia‑Pacific leads regional launcher and overall Android usage engagement.

- Android 15 was the most widely used Android version in 2025, with over 26% share of devices.

- Users are expected to spend an expected ~4.5 trillion hours globally in apps by 2026, underscoring high interaction with personalized app environments.

Recent Developments

- The Android launcher market continues shifting due to device penetration and personalization demand.

- Many launchers now focus on lightweight performance and gesture controls to attract users.

- Increased integration of AI and enhanced UX features is influencing new customization app releases in 2026.

- Android OEMs like Google and Samsung have improved compatibility with third‑party launchers, boosting adoption metrics.

- Minimalist launcher designs are trending, with rising user ratings and adoption among large user segments.

- Privacy‑focused launchers are gaining traction as users express more concern over data collection.

- Community‑driven launcher development (open‑source) is growing, reflecting broader customization experimentation.

- Integration of adaptive features (like theme matching to wallpaper) is now common among top launchers.

Android Customization Overview

- Android customization spans launchers, themes, widgets, wallpapers, icon packs, and more, far beyond stock options.

- Global user preference surveys show Android users customize devices at significantly higher rates than iOS users.

- An estimated 72–73% of Android users engage with at least one form of personalization (launchers or themes) regularly.

- Custom launchers replace or enhance the default homescreen but also impact navigation behavior and session length.

- Widgets that show live content (weather, calendar) are now used by a growing percentage of Android users.

- Icon packs remain a popular way to unify home screen aesthetics.

- Android’s customization freedom is a differentiator in markets where users prize personalization.

- Customization often correlates with longer daily phone engagement as users interact with tailored content.

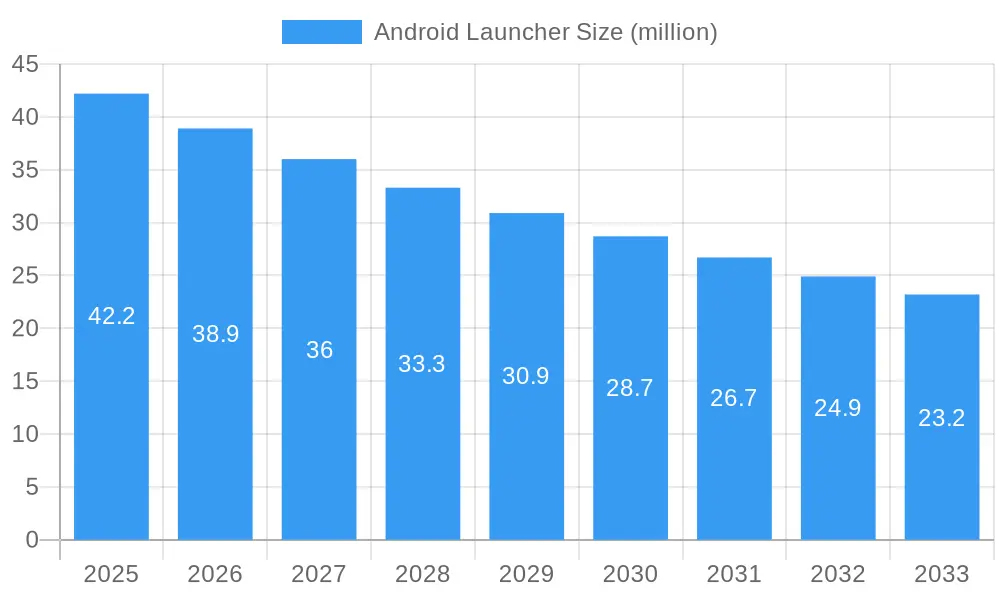

Android Launcher Market Size Trend (2025–2033)

- The Android launcher market is projected to reach 42.2 million users in 2025, marking the highest adoption level in the forecast period.

- Market size is expected to decline to 38.9 million in 2026, indicating an early downward trend in launcher usage.

- By 2027, the user base is forecast to drop further to 36.0 million, reflecting reduced reliance on third-party launchers.

- The market is estimated to shrink to 33.3 million users in 2028, continuing a steady year-over-year contraction.

- In 2029, Android launcher adoption is projected to fall to 30.9 million, crossing below the 31-million threshold.

- By 2030, the market size is expected to decline to 28.7 million, signaling a notable reduction in customization demand.

- The downward trend continues in 2031, with user numbers decreasing to 26.7 million.

- In 2032, the market is forecast to contract further to 24.9 million, highlighting long-term saturation risks.

- By 2033, Android launcher usage is projected to reach 23.2 million users, representing an overall decline of nearly 45% from 2025 levels.

Launcher Usage Statistics

- Nova Launcher, Niagara Launcher, and Smart Launcher 6 are among the top‑ranked launchers in 2025.

- More than 15 popular launchers have significant installs and active user communities.

- Minimalist launchers like Olauncher and Before Launcher show strong niche adoption.

- Microsoft Launcher has exceeded 50 million downloads, signaling mainstream cross‑platform interest.

- Launcher downloads and installs continue to grow year over year, with mobile app downloads surpassing 200 billion globally.

- User reviews indicate customization features directly influence launcher selection.

- Android users increasingly choose launchers for workflow efficiency and visual coherence.

- Many launchers now embed search bars and predictive suggestions to improve usability.

Theme Adoption Rates

- Official theme stores on Android (like HeyTap Theme Store) have 500 M+ downloads, showing widespread interest in native theming.

- Users often apply Material You dynamic themes, which adapt system colors to wallpaper selections, a key Android personalization feature.

- Custom themes typically include wallpapers, fonts, and UI accents, expanding beyond the stock look and feel.

- Android’s open design allows OEM theme layers on top of stock Android, fueling regional theme adoption.

- In 2025, user interest in third‑party themes grew as personalization became a differentiator in the mobile experience.

- Theme download rankings often place Theme Store, Themes + Widgets apps, and live wallpaper packs in the top personalization charts.

- Among US Android users, dark and AMOLED‑friendly themes are among the most installed, reflecting both aesthetic and battery‑saving preferences.

- Regional markets like India and Brazil show above‑average theme adoption as part of broader Android engagement.

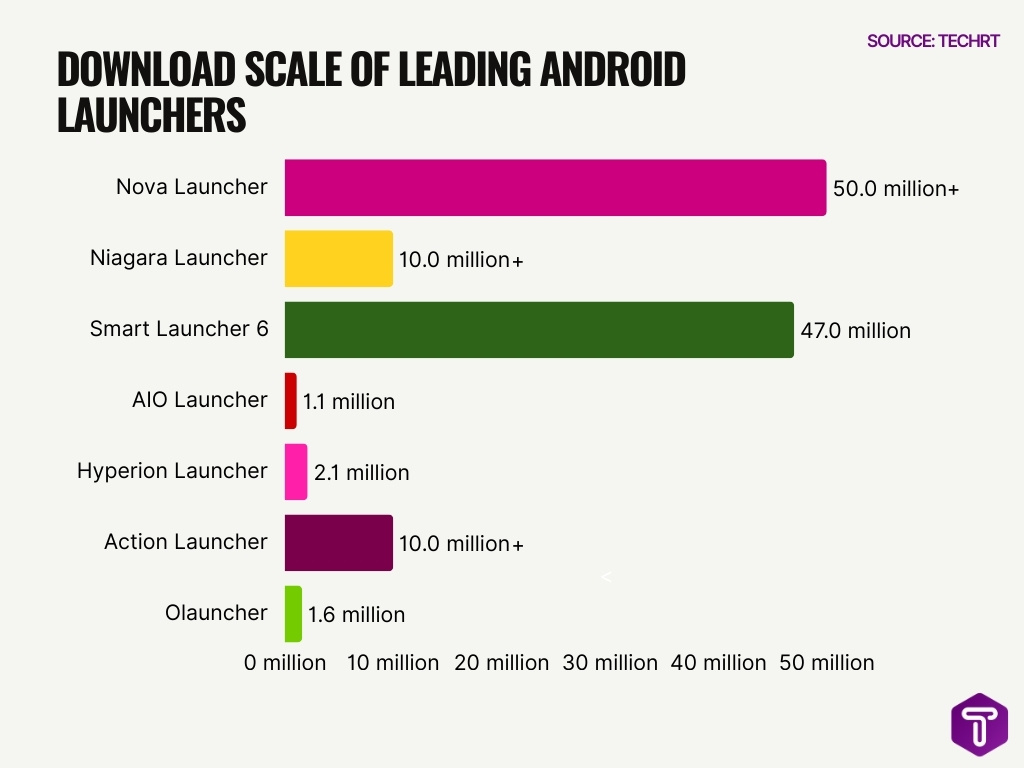

Popular Launcher Rankings

- Nova Launcher boasts over 50 million downloads and ranks #96 in India’s free personalization apps.

- Niagara Launcher holds a 4.7-star rating from 163K reviews with 10M+ downloads.

- Smart Launcher 6 features 47 million total downloads and 4.31 stars from 610K ratings.

- AIO Launcher records 1.1 million downloads with 4.43 stars across 16K ratings.

- Hyperion Launcher garners 2.1 million downloads and 3.64 stars from 17K reviews.

- Action Launcher attracts 10M+ downloads with 3.8 stars from 109K reviews.

- Microsoft Launcher tops charts for desktop integration, featured in the 2025 best lists.

- Olauncher achieves 1.6 million downloads and an exceptional 4.84 stars from 51K ratings.

Icon Pack Popularity

- Over 7.5 million downloads for Icon Pack Studio on the Google Play Store.

- 50 million+ downloads achieved by Nova Launcher, a top icon pack companion.

- Viral Icon Pack garners 3.6 million total downloads with 15K ratings.

- 61.62% of Android users engage with personalization apps, including icon packs.

- 6,800+ icons in popular packs like cartoon themes with 100+ wallpapers.

- Nova Icon Pack offers 6,475 icons, 34 wallpapers, and 10 KWGT widgets.

- 8.8 million downloads for Icon Pack Studio, averaging 9.6K daily recently.

- 12000+ icons in One UI style packs, supporting frequent updates for themes.

- Gradient and neon styles dominate, with 178 dedicated icon packs available.

- 5M+ downloads for Icon Pack Studio, enabling custom packs without launchers.

Widget Customization Stats

- Widgets remain core to home‑screen personalization, offering live info like weather, calendar, and music controls.

- Android widget use is expanding with feature‑rich options from productivity to utility categories.

- In 2025‑26, Android lock screen widgets rolled out more broadly with Android 16, increasing engagement.

- Widget customization includes interactive and scalable elements, far beyond static icons.

- Popular widget types include battery meters, clocks, and live updating feeds.

- Standalone widget packs often integrate with Material You for dynamic color matching.

- Productivity widgets (e.g., calendars and to‑do lists) show above‑average engagement among power users.

- Custom widgets often pair with launchers to create cohesive, user‑centric home screens.

Wallpaper Trends Data

- Live and 3D wallpapers continue ranking high in Android personalization categories.

- Wallpapers often serve as the first step in a full customization suite, influencing theme and icon choices.

- Popular downloads include AMOLED‑optimized dark wallpapers to reduce battery drain on OLED screens.

- Seasonal and event‑themed wallpapers see spikes during major global holidays and tech events.

- Community marketplaces (e.g., Zedge) have historically driven wallpaper downloads into the hundreds of millions.

- Users increasingly choose wallpapers that complement Material You adaptive color palettes.

- 4K and animated wallpapers remain top choices for high‑end devices.

- Wallpaper apps often reach top personalization chart placements globally.

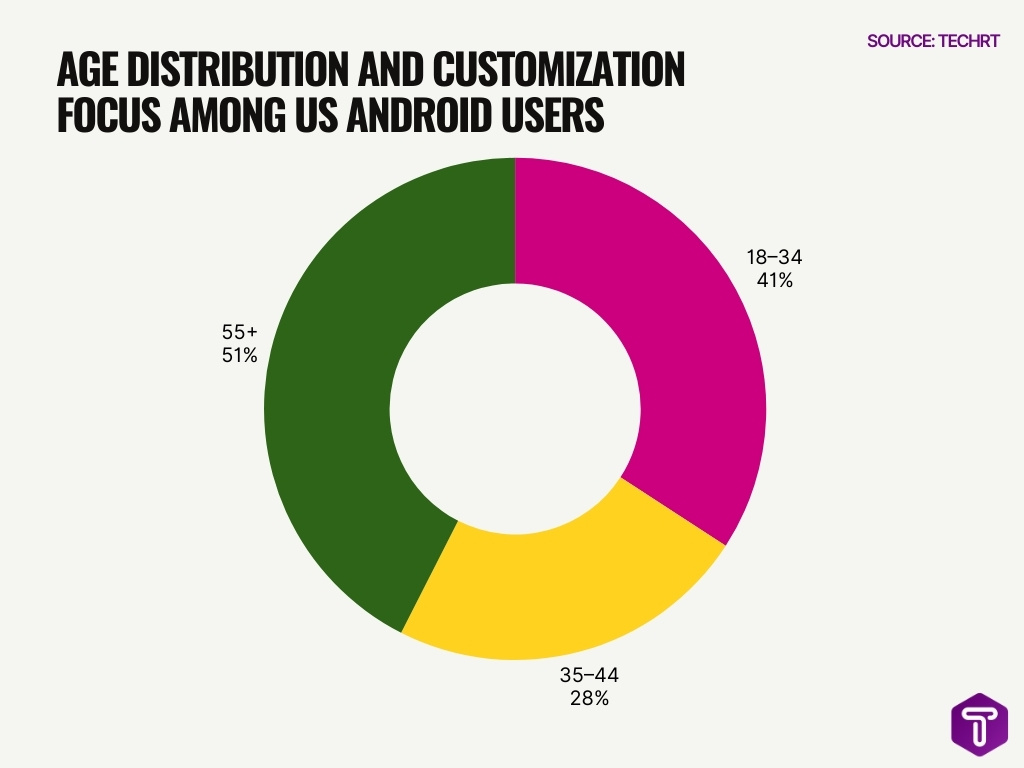

User Demographics Breakdown

- Android devices hold ~42% of the US smartphone market.

- Globally, Android users exceed ~4.3 billion active devices.

- 18–34 year-olds represent 41% of US Android users, favoring customization.

- The 35–44 age group accounts for 28% of Android users, prioritizing productivity widgets.

- Customization adoption reaches 65% among tech-savvy US and European Android users.

- Android 15 holds 25% global version share, unlocking advanced UI personalization.

- The 55+ demographics comprise 51% of the US Android base, sticking to basic wallpapers.

- Asian markets show 72% Android penetration, boosting regional personalization trends.

- India’s Android users aged 18–24 form 53%, with high widget usage.

Third‑Party vs Stock Usage

- A growing share of Android users prefer third‑party launchers over stock launcher defaults to gain deeper personalization.

- LineageOS, a third‑party open‑source Android OS variant, supports nearly 200+ devices and attracts enthusiasts seeking full system customization.

- Third‑party apps like Zedge, known for wallpapers, ringtones, and icons, have amassed 436 M+ downloads globally, showing high engagement in personalized content.

- Stock launchers such as Samsung One UI Home still appear in top US app usage rankings, reflecting that many users blend OEM features with customization tools.

- Despite Android’s open ecosystem, a significant portion of Android users do not install alternative launchers, favoring integrated stock experiences for simplicity.

- Community mods and custom ROMs like those tracked in academic studies show vast variation in third‑party usage patterns across regions and user skill levels.

- Security research indicates that third‑party modified apps carry a higher risk for malware, motivating some users to stick with stock sources.

- OEM software suites like Samsung’s Good Lock provide deep onboard customization, blurring lines between stock and third‑party experiences.

Popular Features Statistics

- Android screensavers and lock-screen wallpapers exceed 100K downloads in dedicated apps, with daily usage topping personalization features.

- Live wallpapers in personalization apps like Zedge average 85K weekly downloads across Europe in Q2 2025.

- Material You themes boost app engagement by 30-40% via adaptive color extraction on Android 12+ devices.

- Interactive widgets rank among the top home-screen additions, with Digital Wellbeing showing the most-used app stats directly.

- Custom icon packs like Icon Pack 2025 achieve 50M+ lifetime downloads in the category.

- Gesture-driven navigation in launchers like Nova garners top user ratings, with 6+ votes for seamless support.

- Dark mode toggles save up to 63% battery on AMOLED screens and is used by 65% of Android users regularly.

- Custom fonts and text size adjustments enable dynamic scaling via sp units for high accessibility adoption.

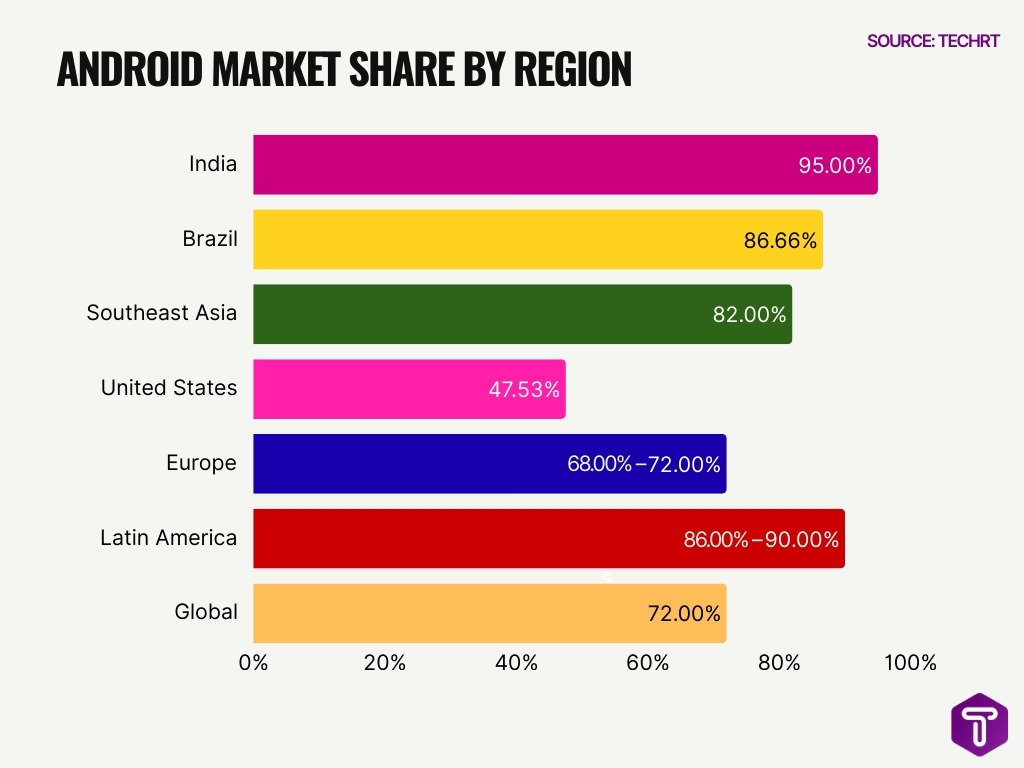

Regional Adoption Rates

- India boasts 95% Android market share, driving high personalization adoption.

- Brazil holds 86.66% Android dominance in South America, boosting widget and live wallpaper engagement.

- Southeast Asia sees 82% Android penetration, correlating with elevated custom launcher uptake.

- US Android users, at 47.53%, adopt personalization less than emerging markets, but reach significant levels.

- Europe maintains a 68–72% Android share, with balanced themes, widgets, and icon packs usage.

- Latin America Android at 86–90%, ranking high in live wallpaper and widget interactions.

- Asia-Pacific commands 35% launcher market, favoring aesthetic and utility widget combos.

- Global Android at 72% fuels customization in fragmented ecosystems.

Download and Install Metrics

- Android continues to dominate total mobile downloads worldwide, with a projected 143 billion Play Store downloads by 2026.

- Play Store hosts ~2 million apps as of 2025, a large ecosystem for personalization tools.

- Personalization app installs show strong year‑over‑year growth, mirroring broader app install trends.

- Free‑to‑install personalization apps dominate installs, aligning with the broader fact that ~97% of Play Store apps are free.

- Personalized launchers and widget packs often see daily active usage rates higher than niche utilities.

- Seasonal wallpaper and theme apps often rank in the top 100 in personalization categories during peak months.

- Download spikes for customization tools often align with new Android version launches.

- Emerging markets (e.g., India, Southeast Asia) contribute a large share of new installs due to rising smartphone penetration.

Revenue from Customization Apps

- Free apps with in-app purchases generate 98% of Google Play’s global revenue.

- 97% of Android apps are free, driving personalization revenue via micro-transactions.

- Android launcher market valued at $42.2 million in 2025 despite a –7.8% CAGR.

- Subscription models in apps yield 4.6x higher ARPU than ad-only personalization tools.

- 37% of apps feature paid ads, key to free customization apps’ income.

- 47% of in-app subscription revenue from weekly plans in premium theme suites.

- Freemium personalization apps convert 14% of trials to paid tiers on average.

- Icon Pack Studio exceeds 50 million downloads with in-app purchase revenue.

- One-time products like theme packs support up to 100 purchase options per app.

Growth Trends Forecast

- The global mobile app market is projected to grow toward $750–$800 billion by 2027, reflecting sustained opportunity for customizing apps.

- Android’s overall ecosystem share (~72–75%) supports ongoing growth in personalization use cases.

- Consumer time spent in apps may exceed 5.5 trillion hours by the end of 2026, expanding engagement opportunities.

- Personalization tools are expected to become more AI‑driven, shaping user experience adaptively.

- Feature‑rich widgets will drive deeper home‑screen customization adoption.

- Demand for personalized UI elements will continue rising with new Android features.

- Regional market growth rates in Asia and Latin America will outpace mature markets.

- Cross‑platform integration may broaden personalized ecosystem reach.

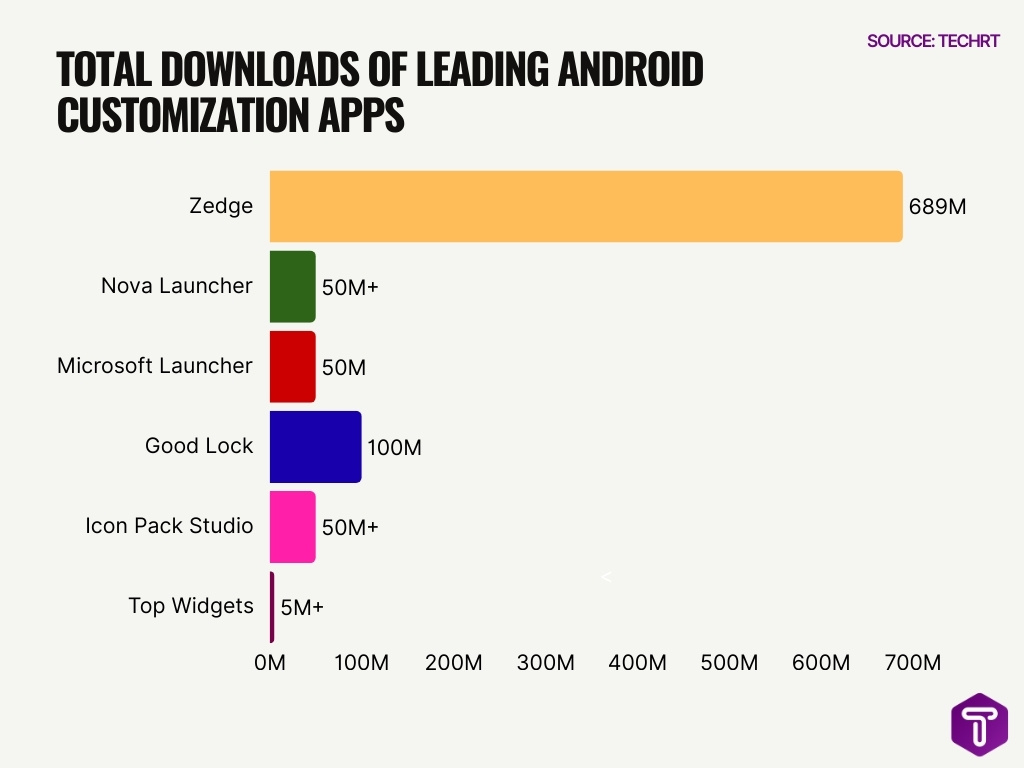

Top Customization Apps

- Zedge boasts 689 million total downloads with 23.3 million active users worldwide.

- Nova Launcher has surpassed 50 million installs on the Google Play Store.

- Microsoft Launcher records over 50 million downloads and 17.1 million reviews.

- Samsung’s Good Lock suite achieved 100 million downloads on Galaxy Store.

- Icon Pack Studio garners 50 million+ downloads for custom icon creation.

- KWGT Kustom Widget Maker enables advanced widgets for millions of users in 2025.

- Top Widgets app secures 5 million+ downloads for stylish home screen packs.

- The Android personalization apps market is valued at $42.2 million in 2025.

- Zedge peaks at 85K weekly downloads in Europe Q2 2025.

- 3.5 billion Android users drive demand for launcher customizations.

AI Personalization Usage

- 63% of mobile app developers integrate AI features into their apps.

- 44% of mobile apps use AI personalization for tailored content delivery.

- 72% of mobile apps deployed in 2025 incorporate AI-based personalization.

- 79% of executives view AI personalization as a key competitive differentiator.

- AI-powered personalization boosts app retention rates by up to 40%.

- 91% of consumers prefer brands with personalized recommendations.

- Apps with AI personalization achieve 71% higher engagement rates.

- Personalized in-app journeys yield 3.5x higher retention than generic ones.

- 70% of mobile apps leverage AI to enhance user experience.

Frequently Asked Questions (FAQs)

What percentage of global smartphones run Android as of 2026?

About ~72–73% of all smartphones globally run Android, making it the dominant mobile OS worldwide.

How many active Android users are there worldwide in 2026?

Android has approximately ~4.3 billion active users across the globe.

What was the estimated value of the global Android launcher market in 2025?

The Android launcher market was valued at around $42.2 million in 2025.

What is the forecasted CAGR for the Android launcher market through 2031?

The Android launcher market is expected to shrink at a –7.8% CAGR through 2031.

What share of the global mobile OS market did Android hold in 2025?

Android’s share of the global mobile OS market reached approximately 72.47% in 2025.

Conclusion

Android customization continues evolving through 2026, blending user demand with technical innovation. With Android’s dominant ~72–75% global share, personalization remains integral to how people interact with their devices. Trends in app downloads, revenue patterns, and AI‑powered features all point to sustained growth and innovation in the personalization space.

As users deepen their engagement with tailored launchers, widgets, and themes, developers and brands alike stand to benefit from understanding these usage and market trends. Explore the data above to see how Android customization shapes the future of mobile experiences.

Leave a comment

Have something to say about this article? Add your comment and start the discussion.