Apple’s ecosystem stands at an unprecedented scale, blending hardware, software, and services to create a tightly integrated user experience. With over 2.5 billion active Apple devices worldwide, the depth and reach of Apple’s hardware base now fuels not only device usage but also its booming services and digital platform growth. Real-world applications span from seamless cross-device workflows in business environments to unified entertainment and productivity experiences across iPhone, iPad, Mac, and Apple TV. As this article unfolds, you’ll discover the most important usage trends and data shaping Apple’s ecosystem.

Editor’s Choice

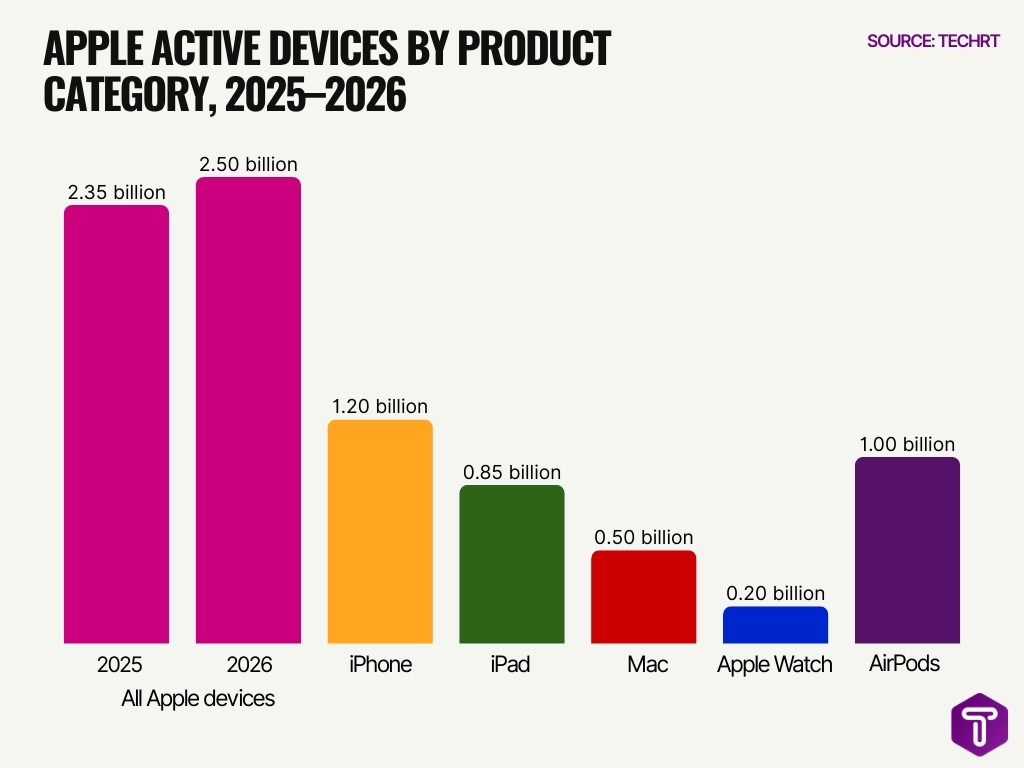

- Apple’s active device base has reached approximately 2.5 billion globally in early 2026, up from ~2.35 billion last year.

- An estimated 1.56 billion active iPhone users worldwide in 2026, up ~3.6% from the prior year.

- In the U.S., iPhone holds over 58% smartphone market share as of 2025.

- Apple’s App Store saw 850+ million average weekly users worldwide in 2025.

- iOS accounts for ~28% share of the global mobile operating system market.

- About 80% of iPhone users own at least one other Apple device (e.g., iPad or Apple Watch).

- iPhone shipments projected to push Apple ahead of Samsung as top global smartphone seller in 2025.

Recent Developments

- In fiscal Q1 2026, Apple reported $143.8 billion in revenue, a 16% year‑over‑year increase.

- iPhone revenue alone grew ~23% year‑over‑year in that quarter, driven by strong demand for the iPhone 17 lineup.

- Apple announced a strategic partnership to enhance Siri with Google’s Gemini AI.

- Mac sales declined modestly in early 2026 despite overall earnings growth.

- Apple Intelligence’s Visual Intelligence feature gained notable user engagement.

- Diverse Apple services (App Store, Apple TV+, iCloud) reported record usage metrics.

- App Store engagement hit record annual U.S. visitor figures in 2025.

- Apple expanded ecosystem integration, enhancing cross‑device continuity features across iOS, iPadOS, and macOS.

Apple Active Devices Worldwide

- Apple boasts 2.5 billion active devices worldwide as of early 2026.

- Active base surged from 2.35 billion in 2025, adding 150 million devices.

- iPhone leads with over 1.2 billion active units globally.

- iPad installed base exceeds 850 million devices.

- Mac active devices surpass 500 million worldwide.

- Apple Watch reaches 200 million active units.

- AirPods paired devices top 1 billion pairs.

- App Store served 2.5 billion devices, generating $138 billion in 2025.

- Services revenue hit $109 billion in 2025, driven by the ecosystem.

- 2.5 billion active devices exceeds populations of India (1.4 billion) and China (1.41 billion).

iPhone User Base and Growth

- The global iPhone user base is estimated at ~1.56 billion in 2026.

- This marks ~3.6% growth compared to the previous year.

- iPhone users comprise a significant share of Apple’s ecosystem strength.

- The United States has about 150+ million active iPhone users as of 2025.

- iPhone directly contributed over 50% of Apple’s total revenue in 2024.

- More than 3 billion iPhones have been shipped cumulatively since their launch.

- iPhone’s momentum is a key driver in Apple surpassing Samsung in global shipments in 2025.

- iOS holds about 28% of the global mobile OS market owing to iPhone adoption.

Mac Adoption and Market Share

- Macs command a 16.6% share in the premium PC segment globally as of 2025.

- Apple Silicon M-series Macs saw 52% sales growth since the 2020 transition.

- 58% of enterprise employees now use Macs, up 20% from 2023.

- Mac shipments reached 24.2 million units in 2025, 9% YoY increase.

- Mac revenue hit $40.1 billion in FY2025, 10% of Apple’s total.

- 71% of higher education students prefer or use Macs for coursework.

- 82% of creative professionals (design/video) rely on macOS workflows.

- macOS Sequoia adoption hit 65% among Mac users within 6 months.

- Apple’s ecosystem retains 92% of iPhone owners in Mac purchases.

Q1 iPad Revenue Trends and Key Insights

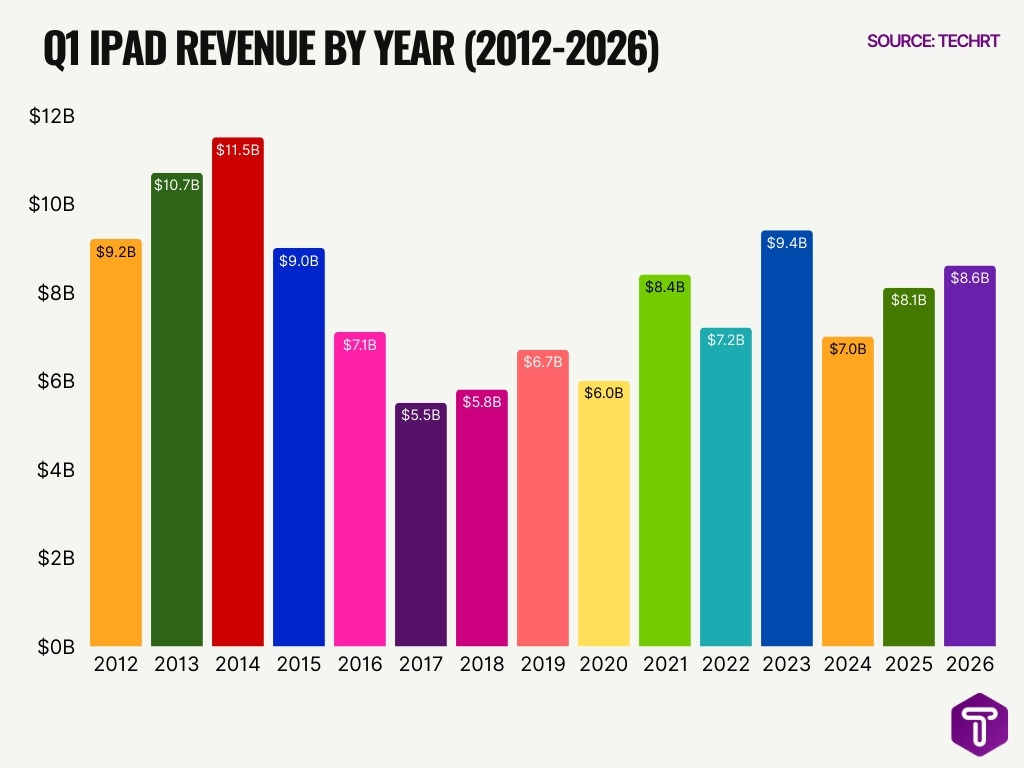

- Q1 iPad revenue peaked at $11.5 billion in 2014, marking the strongest first-quarter performance in the dataset.

- Revenue climbed from $9.2 billion in 2012 to $10.7 billion in 2013, showing strong early-decade momentum.

- After 2014, Q1 iPad revenue declined sharply to $7.1 billion in 2016, reflecting slowing tablet demand.

- The downturn continued as revenue bottomed out at $5.5 billion in 2017, the lowest point in the period analyzed.

- A gradual recovery began in 2018 with $5.8 billion, rising further to $6.7 billion in 2019.

- In 2020, Q1 revenue dipped slightly to $6.0 billion, likely influenced by market uncertainty and supply constraints.

- 2021 saw a strong rebound to $8.4 billion, driven by remote work, education demand, and device refresh cycles.

- Revenue softened again in 2022 at $7.2 billion, indicating post-pandemic normalization.

- Q1 2023 recorded $9.4 billion, the highest level since 2014, signaling renewed consumer and enterprise interest.

- In 2024, revenue eased to $7.0 billion, suggesting cyclical demand fluctuations.

- Forward-looking estimates show Q1 revenue rising to $8.1 billion in 2025 and $8.6 billion in 2026, pointing to a steady recovery trend.

- Overall, Q1 iPad revenue shows a long-term cyclical pattern, with periods of rapid growth followed by contraction and stabilization.

Apple Watch and Wearables Users

- The Apple Watch remains the world’s best‑selling smartwatch category in cumulative shipments and active users.

- An estimated 115+ million Apple Watch users worldwide were using the device as of late 2022.

- Wearables, Home, and Accessories (which includes Apple Watch and AirPods) contributed about 12% of Apple’s total revenue in 2025.

- Apple sold an estimated 39 million Apple Watch units in 2024, indicating continued demand in the health‑tracking and fitness segment.

- In 2024, around 66 million AirPods units were shipped, underscoring the combined strength of Apple’s wearables lineup.

- Wearables contributed to Apple’s ecosystem stickiness, as fitness and health tracking data often syncs with iPhones and Macs.

- Apple’s wearable devices, like Watch Series 10 and newer models, regularly integrate wellness features that expand their utility beyond notifications and timekeeping.

- Analysts project continued growth for wearables in 2026 as Apple enhances sensors and deepens ecosystem benefits.

AirPods Usage and Market Dominance

- AirPods are projected to surpass $100 billion in cumulative revenue by 2026, with 2.4% YoY growth.

- Apple held 23% global TWS earbuds market share in Q1 2025, shipping 18.2 million units.

- Global TWS shipments reached 78 million units in Q1 2025, up 18% YoY, led by AirPods.

- Industry trackers estimate Apple’s wearables category (including AirPods and Apple Watch) produced around $40 billion+ in revenue in 2025

- Apple commands over 50% TWS market share in North America.

- AirPods are expected to hold 21% global TWS market share in 2025.

- Apple wearables, led by AirPods and Watch, exceed peak iPod revenues by 50%.

- AirPods sold 110 million units in 2024, generating $24.5 billion.

- Xiaomi trails at 11.5% global TWS share behind Apple‘s dominance.

- Samsung holds 7% TWS market share, far behind AirPods’ leadership.

Apple Multi‑Device Ownership

- A large portion of Apple users holds more than one Apple device, boosting ecosystem integration.

- Surveys indicate that over 80% of iPhone owners also use at least one other Apple device (Watch, iPad, or Mac).

- Multi‑device ownership improves continuity features such as Handoff, Universal Clipboard, and AirDrop.

- Parents often add multiple devices for family members under shared Apple IDs and Apple One family plans.

- Devices connected via a single Apple account help increase subscribers to iCloud storage and services like Apple Music.

- Owning multiple devices correlates with higher average spending on Apple services and accessories.

- Device overlaps often result in higher digital service engagement due to device‑to‑device feature continuity.

- Multi‑device households show higher loyalty and retention, reflecting deeper ecosystem integration.

iPhone Retention Rate and Customer Loyalty

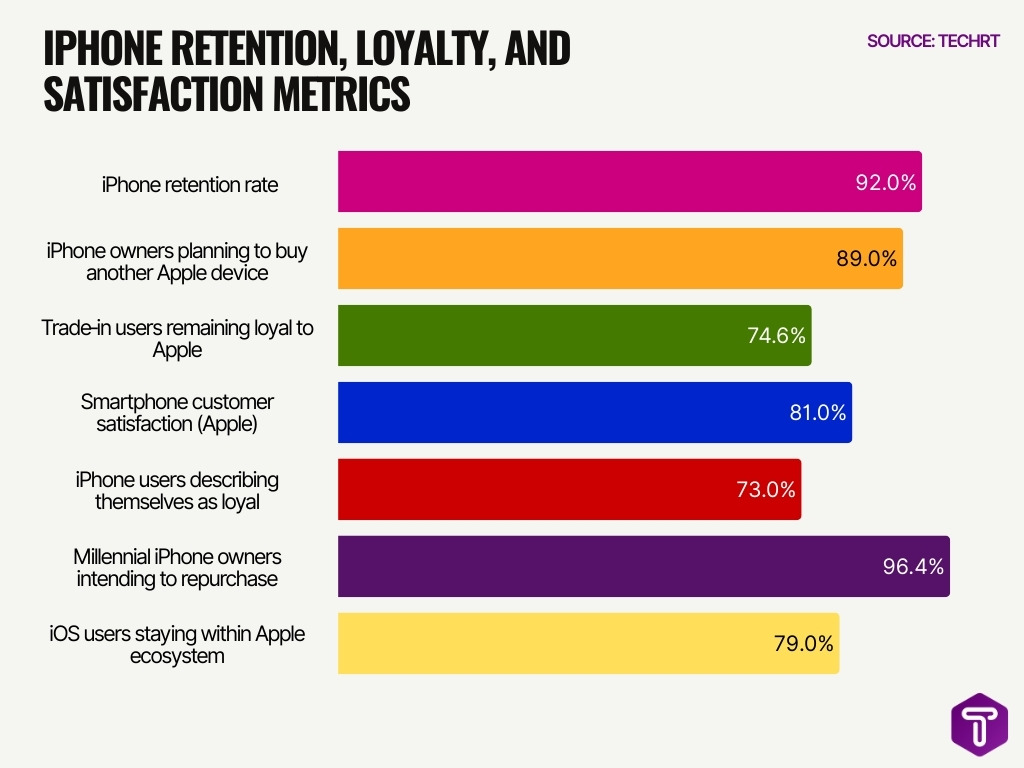

- Apple’s iPhone retention rate stands at 92% among users.

- Apple’s NPS is 61 in 2025, above the tech average of 58.

- 89% of iPhone owners plan to buy another Apple device next time.

- 74.6% of trade-in users remain loyal to Apple.

- 81% customer satisfaction score for Apple smartphones in surveys.

- 73% of iPhone users describe themselves as highly or somewhat loyal.

- 96.4% of Millennial iPhone owners intend to repurchase Apple.

- U.S. iPhone users hold devices for an average of 35 months (~2.9 years).

- 79% of iOS users stay within the Apple ecosystem, avoiding Android.

Apple Services Subscribers

- Apple services reached record usage levels in 2025 across key categories like App Store, Apple Music, Apple TV, and Apple Pay.

- The App Store averaged 850 million weekly users globally in 2025.

- Apple One bundles (Music, TV, Arcade, iCloud) are now available in more than 100 markets worldwide.

- Apple’s services revenue was reported at $109 billion in fiscal 2025, up significantly from the prior year.

- Apple Music hit all‑time highs in both listenership and subscriber growth in 2025.

- Apple Pay generated more than $100 billion in incremental merchant sales in 2025.

- Apple TV viewership increased by ~36% year‑over‑year as streaming demand grew.

- Record engagement across services highlights Apple’s success in expanding beyond hardware sales.

Apple Music User Base

- Apple Music reached ~108 million paying subscribers worldwide by the end of 2025, marking 16.1% annual growth.

- Apple Music holds a 30.7% market share among U.S. subscribers, second to Spotify.

- The service offers over 100 million songs across 167 countries.

- The 25-34 age group comprises 23% of subscribers, with 35-44 at 22%.

- Family plans support up to 6 members per household subscription.

- Apple Music generated $9.2 billion in revenue during 2023.

- Artists receive an average of $0.01 per stream on Apple Music.

- U.S. holds 30-31% of the global Apple Music market share.

- Shazam, tied to Apple Music, hit over 1 billion monthly recognitions in 2025.

- Taylor Swift ranks among the most‑streamed artists on Apple Music.

Apple TV+ Subscriber Growth

- Apple TV+ reached an estimated 45.9 million viewers globally in 2025.

- Apple TV+ paid subscribers totaled around 25 million, plus 50 million via promotions.

- Viewer hours on Apple TV jumped 36% year-over-year in December 2025.

- US Apple TV+ viewers grew from 44.1 million in 2024 to 45.9 million in 2025.

- The subscriber base increased 4.08% from 2024 to 2025 globally.

- Apple TV+ captured 16% of new paid subscribers in Q1 2025.

- Churn rate dropped to 7% for Apple TV+ in March 2025.

- Apple TV+ holds 9% SVOD market share in the United States.

- 60% of Apple TV+ viewers are female, 40% male.

- 45% of viewers aged 35-54 years dominate the Apple TV+ audience.

U.S. Apple Pay User Growth

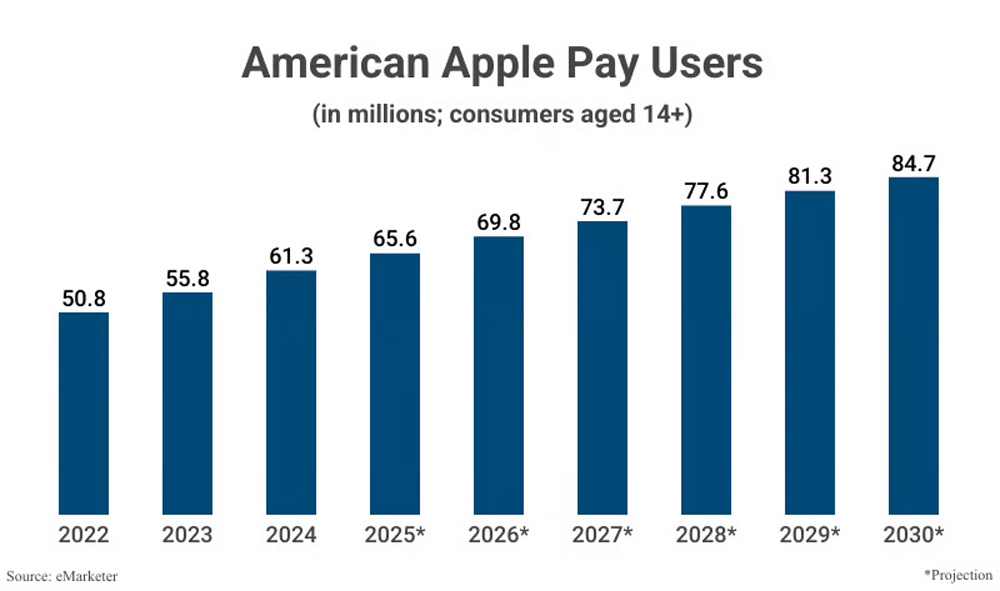

- Apple Pay users in the U.S. reached 50.8 million in 2022, marking the baseline for strong post-pandemic digital payment adoption.

- The user base grew to 55.8 million in 2023, reflecting rising trust in contactless and mobile payments.

- In 2024, Apple Pay adoption climbed to 61.3 million users, showing accelerating mainstream acceptance.

- Usage is projected to hit 65.6 million users in 2025, signaling continued expansion among consumers aged 14+.

- By 2026, the number of U.S. Apple Pay users is expected to reach 69.8 million, nearing the 70-million milestone.

- Adoption is forecast to rise further to 73.7 million users in 2027, driven by iPhone penetration and retail acceptance.

- In 2028, Apple Pay users are projected to total 77.6 million, reinforcing its role as a leading mobile wallet.

- The U.S. user base is expected to exceed 81.3 million in 2029, highlighting sustained year-over-year growth.

- By 2030, Apple Pay usage in the U.S. is projected to reach 84.7 million users, underscoring long-term dominance in digital payments.

App Store Usage and Downloads

- The Apple App Store hosts about 1.9–2.1 million apps available for download by 2026.

- Users download over 38 billion apps annually, reflecting steady growth in engagement year‑to‑year.

- iOS app downloads are expected to grow toward 38 billion by 2026, up from ~37 billion in 2025.

- Free apps account for roughly 95% of the App Store catalog, highlighting freemium and in‑app purchase models.

- Non‑gaming apps make up nearly 90% of available apps, underscoring diversity in utility and services.

- On average, over 2,100 new apps are added daily, showing an active developer ecosystem.

- Categories such as productivity, health, and education are among the fastest-expanding segments.

- Apple’s App Store remains a leading global distribution platform despite competition from Android’s Google Play.

App Store Revenue and Billings

- Apple’s App Store continues to generate major consumer spending with annual revenue near $90 billion in recent years.

- In‑app purchase revenue across both app stores reached tens of billions in early 2025, allocating a substantial portion to iOS.

- Games remain the highest revenue generator on the App Store, driving $80 + billion in 2025.

- Social networking apps on iOS contributed $16.7 billion in revenue, led by major global platforms.

- Entertainment apps such as streaming services generated $12.5 billion through in‑app spending.

- Health and fitness category revenue grew sharply by ~24% year‑over‑year in 2025.

- Overall, App Store revenue is projected to continue rising through 2026 as subscriptions and digital purchases expand.

- App Store billings include both digital goods and services, contributing significantly to Apple’s services segment growth.

Regional Distribution of Apple Users

- In the United States, iPhone holds a 58% smartphone market share in 2025.

- North America sees iOS at 52% market share among mobile OS users.

- Japan boasts a high 61% iPhone market share in 2025.

- India‘s iPhone shipment share reached a record 9% in 2025.

- China‘s iPhone market share stands at 24%.

- In Europe, iOS holds 39% of the mobile OS market share.

- Germany has 44% iOS market share in mobile OS.

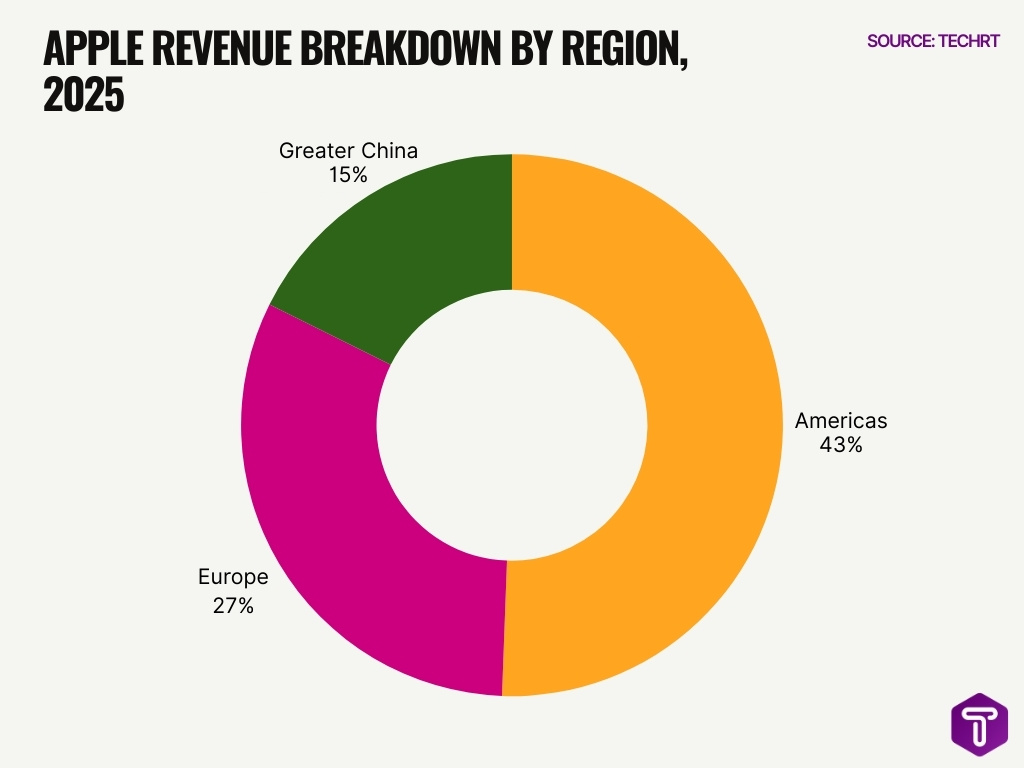

- The Americas generated 43% of Apple‘s total revenue in 2025.

- Europe contributed 27% to Apple’s revenue in 2025.

- Greater China accounted for 15% of Apple‘s revenue share in 2025.

Device Ownership by Demographics

- Apple device ownership reaches 72% among U.S. households earning $100K+ annually.

- 18-34 year-olds own iPhones at 65% rate vs 42% for those 55+.

- Multi-device Apple ownership peaks at 58% in the 25-44 age group.

- 37% of U.S. households with 2+ Apple devices subscribe to Family Sharing plans.

- College graduates show 49% Mac ownership, 3x higher than high school educated.

- Urban millennials own AirPods at 68% vs 41% rural peers.

- Gen Z urban users prefer Apple Pay at 81%, the highest demographic rate.

- 65+ iPhone adoption grew 28% since 2022, reaching 52% ownership.

Apple Ecosystem Engagement Metrics

- Apple’s App Store reached over 850 million average weekly active users globally in 2025.

- Apple services generated $109 billion in revenue in 2025, up from $20 billion in 2015.

- Apple Music surpassed 100 million subscribers worldwide by late 2025.

- Apple TV+ achieved 25 million subscribers and 7% churn rate in early 2025.

- iOS users averaged 4.2 hours daily on apps in 2025, a 5% YoY increase.

- Apple hit 1 billion total paid subscriptions across services by January 2025.

- 92% iPhone retention rate underscores strong ecosystem loyalty in 2025.

- Apple Pay processed over $100 billion in merchant sales globally in 2025.

- Over 2.2 billion active devices powered ecosystem engagement in 2025.

Frequently Asked Questions (FAQs)

How many active Apple devices are in use worldwide in 2026?

2.5 billion active Apple devices are in use globally in early 2026, up from 2.35 billion the previous year.

What is the weekly user count for Apple’s App Store?

The Apple App Store sees over 850 million average weekly users around the world.

What percentage of eligible users are projected to use Apple Pay by 2026?

Apple Pay penetration is expected to reach 23.3% of eligible users in 2026.

How many apps are available on Apple’s App Store as of recent counts?

There are about 2.095 million apps available on the Apple App Store in 2025.

What revenue milestone has Apple’s services ecosystem achieved?

Developers have earned more than $550 billion on Apple’s platform (App Store) since 2008, with services engagement hitting record levels in 2025.

Conclusion

Apple’s ecosystem remains among the most engaged and profitable in the tech world. Across devices, software, and services, billions of users interact daily with Apple platforms, from downloading mobile apps and streaming media to paying with Apple Pay and syncing devices.

With robust growth in App Store usage, expanding service revenues, and strengthening digital wallet adoption, the numbers point to an entrenched ecosystem that continues to deliver value to users and developers alike. As Apple expands regionally and evolves with new technology standards, the ecosystem’s influence on how people live, work, and connect globally is only set to deepen.

Leave a comment

Have something to say about this article? Add your comment and start the discussion.