Samsung Electronics continues to shape global technology with impressive financial results and rapid market shifts. The company’s record annual revenue of 333.6 trillion Korean won ($231 billion) highlights its role as a core player in semiconductors, mobile devices, and display technologies. Strong growth in memory chip demand and AI‑enhanced devices illustrates Samsung’s impact on data centers and consumer electronics alike.

In the U.S., its competitive smartphone market share and investments in AI‑driven mobile units underscore Samsung’s relevance to both enterprise and everyday users. Explore the full article for in‑depth statistics and trends shaping Samsung’s landscape.

Editor’s Choice

- 333.6 trillion won in total annual revenue for Samsung in 2025 ($231 billion).

- Operating profit jumped 33% in 2025 to 43.6 trillion won.

- Quarterly revenue hit 93.8 trillion won (Q4 2025), an all‑time high.

- Samsung held around 18.2% global smartphone market share at the end of 2025.

- The memory business saw record‑high sales and strong AI chip demand.

- Samsung plans to expand AI‑powered mobile devices to 800 million units in 2026.

- Next‑gen memory technology (HBM4) samples are already in customer hands.

Recent Developments

- Samsung Electronics reported 15.4% quarterly revenue growth in Q3 2025.

- Memory division revenue and profits reached new quarterly highs in Q3 2025.

- Display unit reported $1.4 billion operating profit in Q4 2025.

- AI‑centric smartphone sales strengthened Samsung’s mobile division growth.

- The company announced earnings guidance of around 93 trillion won in Q4 2025.

- Samsung’s Galaxy AI devices are expected to expand from 400 million to 800 million units in 2026.

- Analysts forecast significant growth in memory chip revenue due to AI demand.

- South Korean firms Samsung and SK Hynix combined market cap surpassed major Chinese tech firms in Asia in early 2026.

Overview Statistics on Samsung

- Samsung Electronics is among the world’s largest technology companies by revenue.

- The company ranked fourth globally in tech revenue as of 2023 data.

- Samsung’s revenue increased over 10% year‑on‑year in 2025.

- Operating profit rose 33%+ in 2025 compared with 2024.

- Net profit in 2025 was around 45.2 trillion won ($31.6 billion).

- Samsung’s mobile and semiconductor businesses lead revenue segments.

- The company’s brand value recently exceeded $100 billion for the first time.

- Samsung’s global presence spans electronics, chips, and displays.

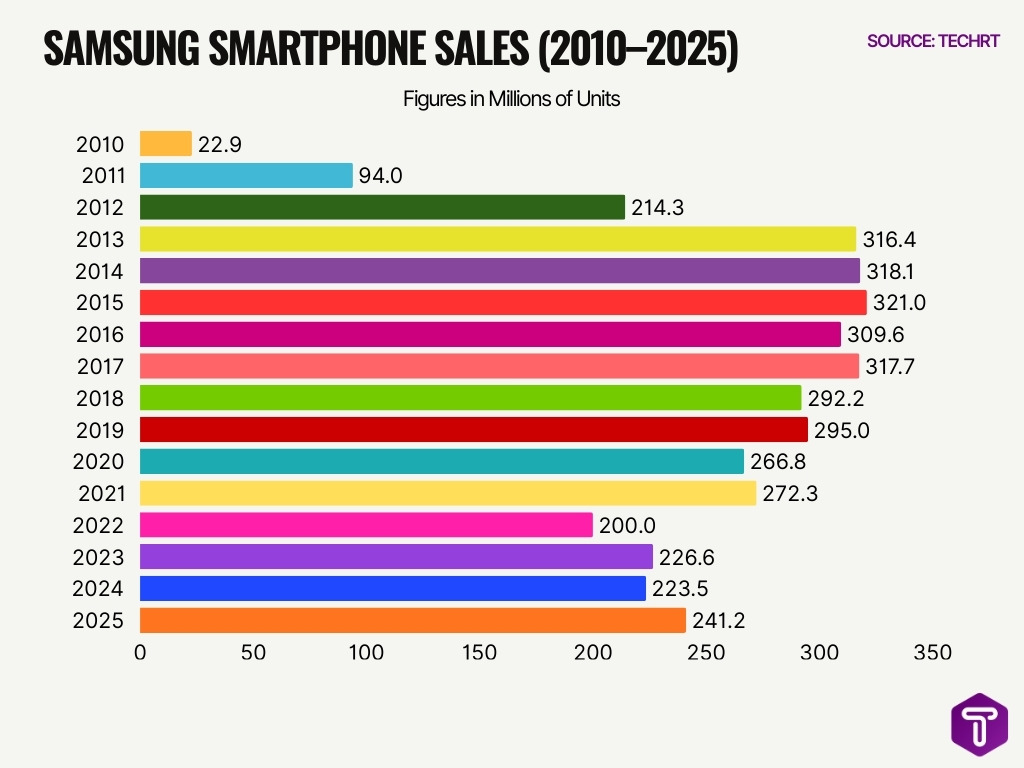

Samsung Smartphone Sales Performance

- Samsung’s smartphone sales surged from 22.9 million units in 2010 to 214.3 million units in 2012, reflecting rapid early global expansion.

- Annual shipments reached 316.4 million units in 2013, establishing Samsung as a dominant leader in the global smartphone market.

- The company recorded its all-time peak sales of 321 million units in 2015, marking its strongest performance year.

- Sales declined slightly to 309.6 million units in 2016, signaling the beginning of market saturation and rising competition.

- Shipments fell to 292.2 million units in 2018, highlighting pressure from Chinese and premium smartphone brands.

- In 2019, sales remained stable at 295 million units, showing short-term resilience.

- During the COVID-19 period, Samsung’s sales dropped to 266.8 million units in 2020, impacted by supply chain disruptions.

- A moderate recovery followed in 2021, with shipments increasing to 272.3 million units.

- In 2022, sales declined sharply to 200 million units, representing one of the weakest performances in over a decade.

- Post-pandemic recovery began in 2023, with sales rebounding to 226.6 million units.

- Shipments remained relatively stable in 2024 at 223.5 million units, indicating market consolidation.

- In 2025, Samsung recorded a strong rebound to 241.2 million units, reflecting renewed demand and product innovation.

Key Facts and Figures about Samsung

- Samsung’s Device eXperience (DX) unit accounted for the majority of sales in early 2025.

- In Q2 2025, Samsung shipped 58 million smartphone units.

- Galaxy S24 series sold approximately 37 million units in 2024.

- Samsung’s smartphone market share jumped from 23% in Q2 2024 to 31% in 2025 (U.S. data).

- Samsung’s memory division growth has bolstered profit margins.

- Samsung Display’s small‑to‑medium panel sales kept unit revenues stable.

- The company’s revenue diversification spans electronics, semiconductors, and mobile tech.

- Galaxy AI integration is a new key competitive focus for product differentiation.

Financial Performance Statistics of Samsung

- Samsung’s consolidated revenue for 2025 reached 333.6 trillion won ($231 billion).

- Operating profit jumped to 43.6 trillion won in 2025.

- Net income surpassed 45.2 trillion won in 2025.

- Q4 2025 revenue saw an 8.9% quarterly increase and 23.7% yearly gain.

- Samsung’s profit margin improved due to memory chip price hikes.

- Revenue growth has been consistent across successive quarters of 2025.

- Samsung Electronics’ consolidated sales outpaced analysts’ 2025 forecasts.

- The company maintained a stable cash flow supporting dividends and growth.

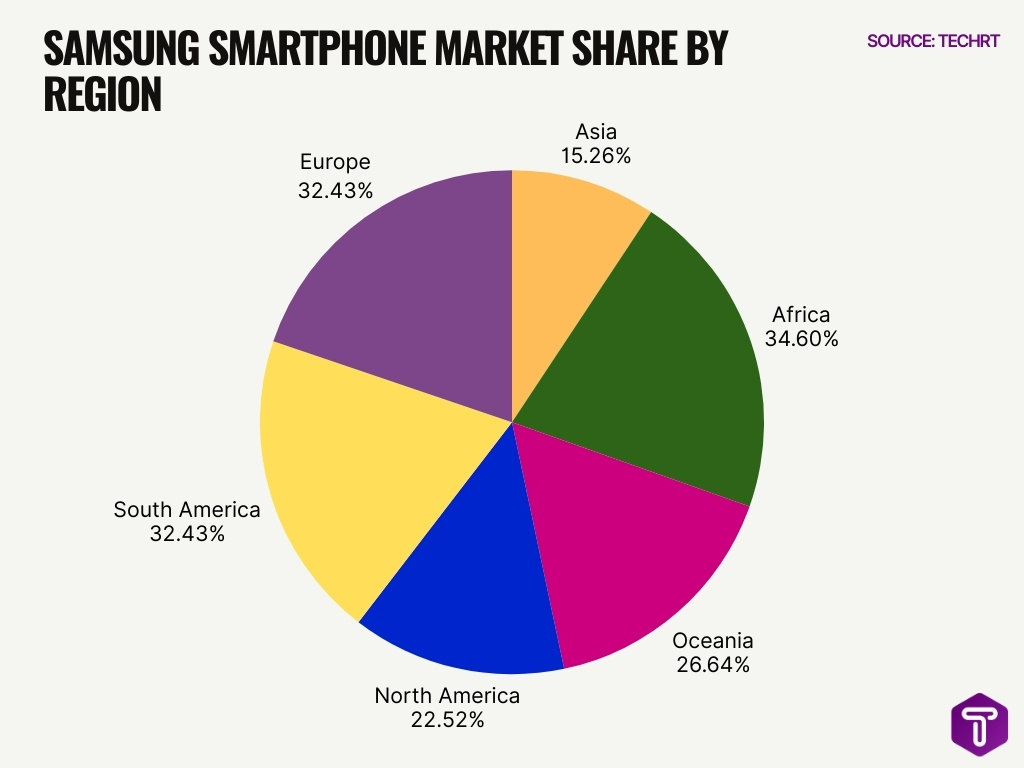

Samsung Smartphone Market Share by Region

- Africa leads globally with the highest Samsung smartphone market share at 34.60%, highlighting the brand’s strong dominance across emerging markets.

- Europe and South America are tied for second place, each recording a solid 32.43% share, reflecting strong consumer loyalty and widespread adoption.

- Oceania maintains a stable position with 26.64% market share, showing consistent demand for Samsung devices in the region.

- North America holds a moderate share of 22.52%, indicating strong competition from other major smartphone brands.

- Asia records the lowest presence for Samsung at just 15.26%, suggesting intense rivalry from local and regional manufacturers.

- Overall, Samsung performs strongest in Africa, Europe, and South America, where its market share exceeds 30%, reinforcing its leadership in these regions.

Annual Revenue Figures for Samsung

- 333.6 trillion won in total annual revenue for 2025.

- This represented a 10.9% year‑on‑year increase from 2024.

- Q4 2025 alone generated 93.8 trillion won.

- Q3 2025 revenue was 86.1 trillion won.

- The DX Division led with a higher contribution compared to the past year.

- Revenue from memory and chip sales surged due to AI demand.

- The India operations reported over ₹1.11 trillion in revenue in FY25.

- Samsung’s quarterly revenue milestones reflect robust global demand.

Operating Profit and Net Income of Samsung

- In FY 2025, Samsung Electronics recorded KRW 43.6 trillion in operating profit, up more than 33% year‑on‑year.

- The company delivered KRW 45.2 trillion in net income in 2025, up over 30% from the prior year.

- In Q4 2025, Samsung’s operating profit jumped to KRW 20.1 trillion, another record high.

- The Device Solutions (DS) Division (semiconductors) accounted for a dominant share of profit in 2025, driven by memory pricing and strong demand.

- Samsung’s Q4 2025 chip‑making business posted KRW 16.4 trillion in operating profit on robust memory sales.

- In contrast, the mobile division saw softer profit in Q4 2025 due to competitive pricing and inventory adjustments.

- Samsung’s semiconductor profit surge reflected global chip industry strength and pricing hikes in 2025.

- Analysts project continued profit growth in early 2026 as AI‑related memory demand expands.

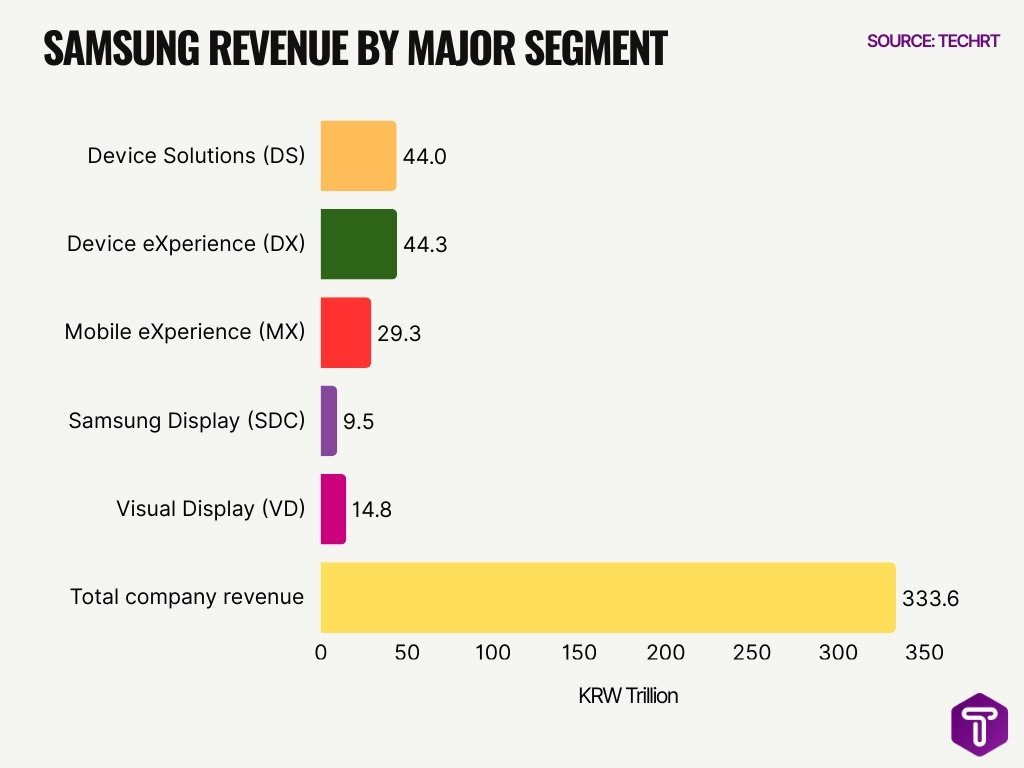

Business Segment Breakdown for Samsung

- Device Solutions (DS) posted KRW 44.0 trillion revenue in Q4 2025, up 33% QoQ.

- Samsung’s total 2025 revenue reached KRW 333.6 trillion, with DS leading segments.

- The Device eXperience (DX) division saw 8% QoQ revenue decline in Q4 2025 due to smartphone competition.

- The DX division reported KRW 44.3 trillion in revenue for 2025, with KRW 1.3 trillion in operating profit.

- Mobile eXperience (MX) generated KRW 29.3 trillion in Q4 2025, achieving double-digit annual profit.

- MX and Networks posted KRW 25.8 trillion (~$18.9B) in Q4 2024, steady into 2025.

- Samsung Display (SDC) achieved KRW 9.5 trillion in revenue in Q4 2025, with KRW 2.0 trillion in profit.

- SDC expanded to KRW 6.4 trillion in Q2 2025, growing mobile and large displays.

- Visual Display (VD) maintained KRW 14.8 trillion in Q4 2025 amid premium TV sales.

- Semiconductor capex hit KRW 47.5 trillion in 2025, displays at KRW 2.8 trillion.

Semiconductor Business Statistics of Samsung

- Samsung’s memory business achieved record Q4 2025 revenue of KRW 37.1 trillion, up 62% YoY, driven by HBM expansion.

- Device Solutions posted Q4 2025 revenue of KRW 44.0 trillion with KRW 16.4 trillion operating profit, a 33% QoQ sales increase.

- Q3 2025 Device Solutions revenue hit KRW 33.1 trillion, yielding KRW 7.0 trillion operating profit amid HBM3E growth.

- Samsung captured 34.8% global DRAM market share in Q3 2025 with $13.942 billion in revenue, leading the $40 billion market.

- Samsung held 29.1% NAND flash market share in Q3 2025, generating $5.366 billion from the $18.4 billion market.

- Semiconductors drove 2025 full-year operating profit to KRW 43.6 trillion on KRW 333.6 trillion total revenue.

- Q4 2025 consolidated revenue reached a record KRW 93.8 trillion, with KRW 20.1 trillion operating profit fueled by memory.

- Foundry business started mass production of 2nm GAA in Q4 2025, targeting double-digit 2026 revenue growth.

- Samsung’s Device Solutions represented over 75% of Q4 operating profit, dominating company earnings via memory chips.

Memory Chip and Storage Data from Samsung

- Samsung’s memory business generated ₩37.1 trillion in Q4 2025 revenue, up 62% YoY.

- Memory revenue reached an all-time quarterly high in Q4 2025, driving DS Division sales to ₩44.0 trillion.

- Memory chips contributed nearly 40% of Samsung’s projected $64 billion Q4 2025 revenue.

- Samsung’s Q4 2025 memory sales jumped 34% YoY to $25.9 billion, with DRAM at $19.2 billion.

- NAND sales hit $6.7 billion in Q4 2025, supporting enterprise and AI markets.

- DS Division posted ₩16.4 trillion operating profit in Q4 2025, fueled by HBM and premium products.

- Samsung held 34.8% global DRAM market share in Q3 2025, leading with 29.1% in NAND.

- HBM market share for Samsung was 22% in Q3 2025, behind SK hynix’s 57%.

- Samsung plans HBM4 mass shipments starting Q1 2026 at 11.7Gbps performance.

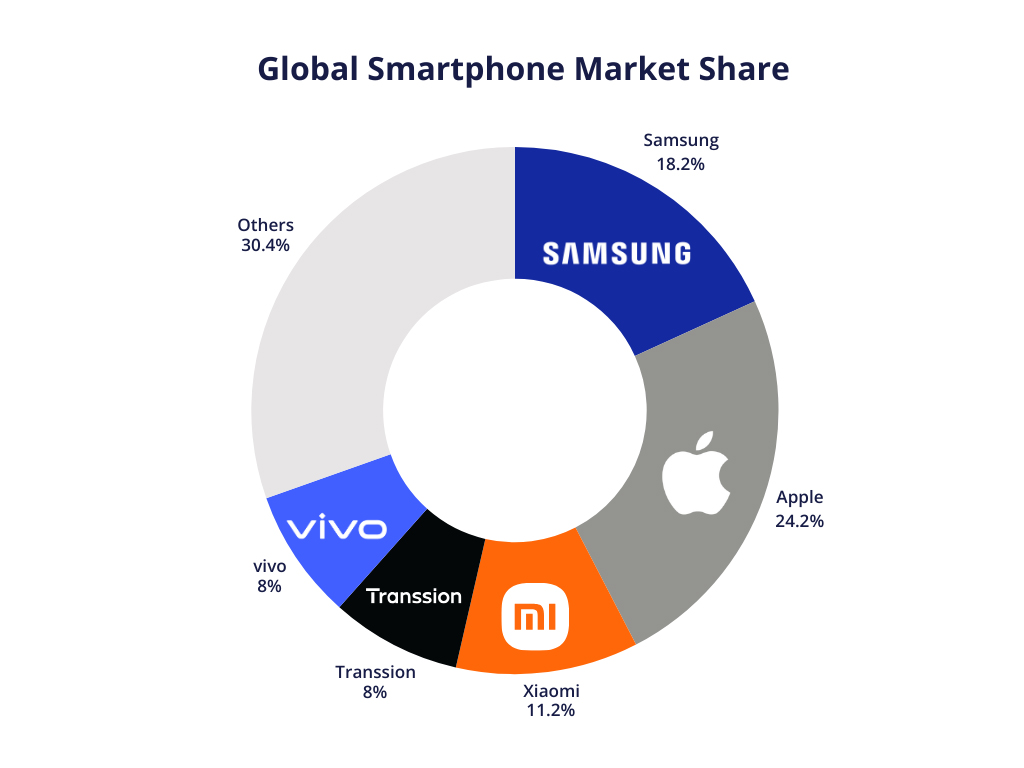

Global Smartphone Market Share

- Apple leads the global smartphone market with a dominant 24.2% share, highlighting its strong premium brand positioning and loyal customer base.

- Samsung holds the second-largest position with 18.2%, maintaining its presence across flagship, mid-range, and budget smartphone segments.

- Xiaomi secures a solid 11.2% market share, driven by its competitive pricing strategy and strong performance in emerging markets.

- Transsion captures 8% of the global market, reflecting its growing influence in Africa and other price-sensitive regions.

- Vivo also accounts for 8% market share, supported by its expanding retail network and youth-focused smartphone lineup.

- The “Others” category represents the largest combined segment at 30.4%, indicating strong competition from multiple smaller and regional smartphone brands.

- Together, the top three brands, Apple (24.2%), Samsung (18.2%), and Xiaomi (11.2%), control over 53.6% of the global smartphone market, showing high market concentration among leading players.

- Brands outside the top five collectively hold nearly one-third (30.4%) of the market, underlining ongoing fragmentation and opportunities for emerging manufacturers.

Display and OLED Panel Insights on Samsung

- Samsung Display held a 41% global OLED revenue share in 2025.

- Global OLED monitor shipments reached 3.2 million units in 2025, up 64% YoY.

- Samsung Display targeted 1.43 million QD-OLED monitor panels shipped in 2025, up 50%.

- Samsung led the QD-OLED monitor market with 71.2% share in 2025.

- Small- and medium-sized displays drove solid results from boosted smartphone, IT, and automotive sales in Q4 2025.

- Large displays posted higher sales responding to year-end peak demand for TVs and monitors in Q4 2025.

- Samsung Display reported $6.6 billion in revenue and $1.4 billion in operating profit in Q4 2025.

- Global OLED monitor panel shipments totaled 3.3 million units in 2025.

Galaxy Series Performance by Samsung

- The Samsung Galaxy Z Fold7 continued to drive foldable demand in late 2025 with strong consumer interest following its July 2025 launch.

- The Galaxy Z Flip 7 also contributed to foldable shipments as a mainstream clamshell model during 2025.

- Foldable phone sales propelled Samsung to regain a 64% share of the global foldable market in Q3 2025.

- Foldable devices accounted for about 2.5% of all smartphone shipments in Q3 2025, up 14% YoY.

- Galaxy Z Fold7 achieved its strongest launch ever, with 50% higher sales than the Z Fold6.

- The Galaxy Z TriFold was unveiled in late 2025 for global release in 2026, showcasing Samsung’s multi‑form foldable strategy.

- Samsung’s flagship Galaxy S25 series continued to bolster premium performance metrics through 2025.

- Mid‑range Galaxy A and M series maintained volume strength, capturing broader global demand.

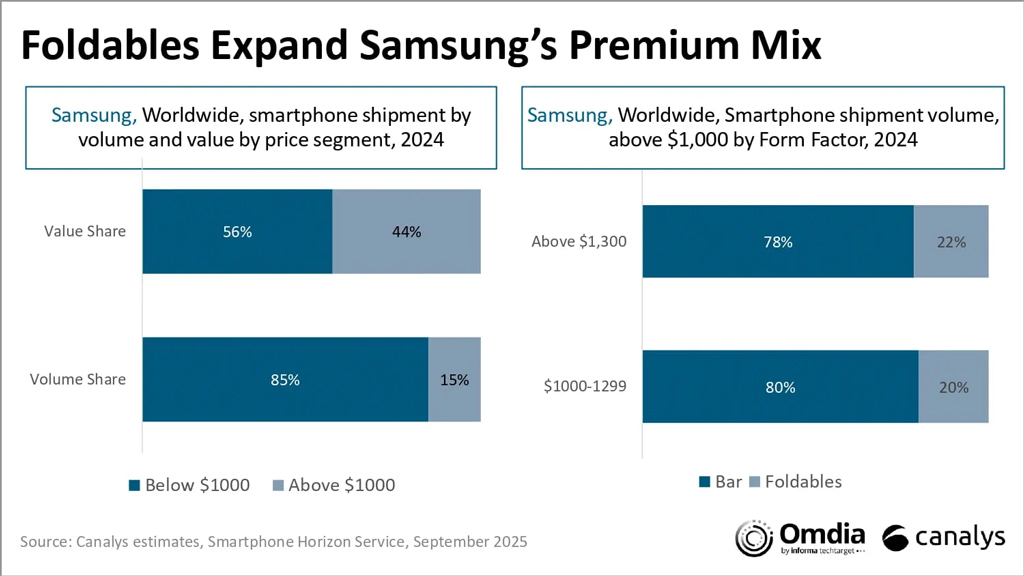

Foldables Expand Samsung’s Premium Smartphone Mix

- Smartphones priced below $1,000 accounted for a dominant 85% of Samsung’s total shipment volume, but contributed only 56% of overall shipment value, underscoring their lower average selling prices.

- Premium devices above $1,000 made up just 15% of shipment volume, yet generated a substantial 44% of Samsung’s total smartphone value, highlighting the importance of high-end models for revenue growth.

- In the $1,000–$1,299 price segment, traditional bar phones led with 80% of shipments, while foldable devices captured 20%, showing meaningful premium adoption.

- For smartphones priced above $1,300, foldables increased their share to 22%, compared with 78% for bar-style phones, indicating stronger traction at ultra-premium price points.

- Foldable smartphones consistently represented around one-fifth of Samsung’s premium shipments, reinforcing their role in expanding the company’s high-value portfolio.

- Despite lower overall volumes, foldables are disproportionately contributing to Samsung’s premium value mix, helping lift average selling prices.

- The data highlights a clear shift where Samsung’s revenue growth is increasingly driven by premium and foldable smartphones, rather than mass-market volume devices.

Smartphone Shipment Volume of Samsung

- In Q4 2025, Samsung shipped 61.2 million smartphones, contributing to its best quarter since 2013.

- The global smartphone market grew 1.9% in 2025, with 1.26 billion units shipped.

- Samsung’s shipments rose 7% YoY in 2025, paralleling Apple’s increase.

- Across 2024, Samsung shipped 258 million smartphones, up 3.1% from 2023.

- The Galaxy S25 series contributed 30+ million units to overall shipment figures.

- Mid‑range Galaxy A15 and A35 models contributed 40% of total smartphone shipments in 2024.

- Shipments of foldables (Z Fold and Flip variants) reached 18 million units in 2024 and 2025.

- Monthly shipment trends showed seasonal peaks during holiday and product launch cycles.

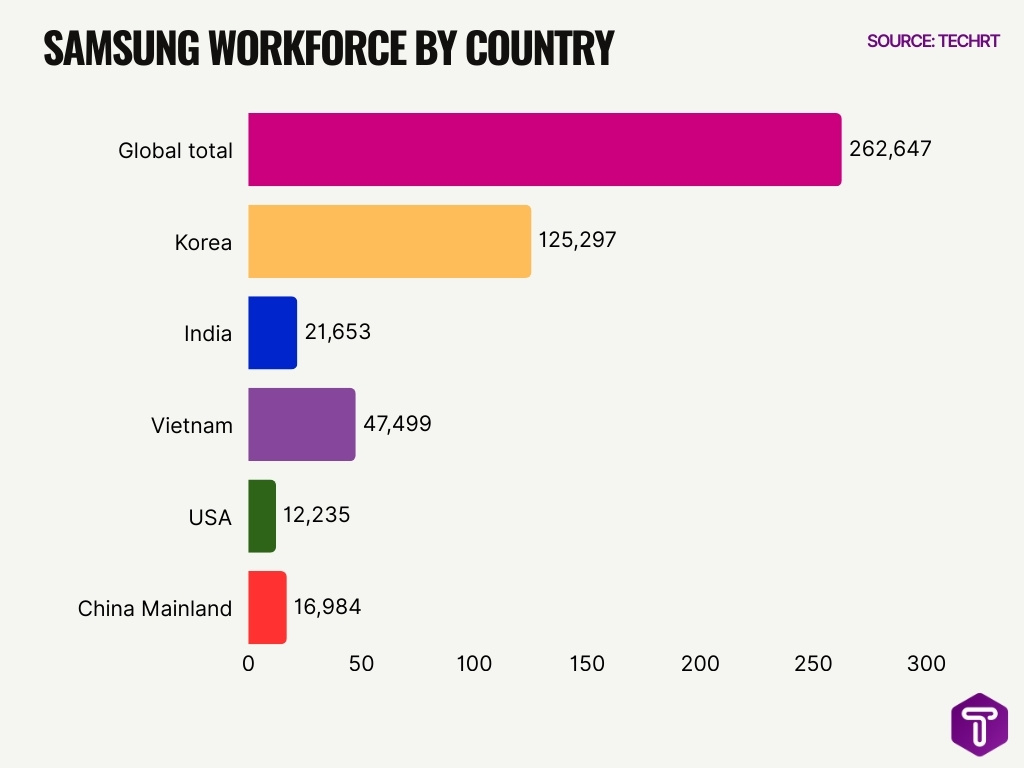

Global Workforce Statistics at Samsung

- Samsung Electronics employed 262,647 people worldwide at the end of 2024.

- The workforce declined from 270,278 in 2022 to 262,647 in 2024.

- Korea hosts 125,297 employees, roughly 48% of global staff.

- India employs 21,653 Samsung workers as of the end of 2024.

- Vietnam has the largest overseas workforce at 47,499 employees.

- The USA employs 12,235 Samsung staff as of the end of 2024.

- China Mainland has 16,984 employees.

- Samsung operates 22 R&D centers across 15 countries worldwide.

- Samsung hired 4,716 new workers in Korea during 2024.

Research and Development Spending by Samsung

- Samsung’s R&D spending reached a record KRW 37.7 trillion in 2025.

- In Q4 2025, R&D investments totaled KRW 10.9 trillion, up KRW 2 trillion QoQ.

- R&D expenditures in the first half of 2025 hit KRW 18 trillion.

- Q1 2025 R&D spending rose 16% YoY to KRW 9 trillion.

- In 2024, R&D costs achieved a record KRW 35 trillion with a 10.9% revenue ratio.

- Samsung’s 2025 total revenue was KRW 333.6 trillion, making R&D 11.3% of revenue.

- Samsung holds 464,205 patents globally, with over 82% active as of 2025.

- Samsung secured 7,054 US patents in 2025, topping global rankings.

- Samsung Group earned 10,709 US patents granted in FY 2025.

- Samsung operates 22 R&D centers across 15 countries.

Sustainability and ESG Metrics from Samsung

- Samsung’s sustainability strategy aims for net-zero Scope 1 & 2 emissions by 2030 (DX) and 2050 (DS).

- In 2024, 93.4% of energy consumption at DX sites came from renewable sources.

- Samsung reduced the average power consumption of major products by 31.5% vs. 2019.

- Samsung incorporated 31% recycled materials in plastics used across product lines.

- Samsung deployed e‑waste collection programs in 80 countries worldwide.

- DS Division sites earned “Platinum Zero Waste‑to‑Landfill” certification globally.

- Samsung expanded human rights risk assessments across major global regions in 2024.

- Social programs such as Samsung Software·AI Academy invested billions of won in training youth.

Frequently Asked Questions (FAQs)

What was Samsung Electronics’ total revenue for the full year 2025?

Samsung Electronics posted 333.6 trillion won in total annual revenue in 2025.

How much operating profit did Samsung record in 2025 compared with the previous year?

Samsung’s operating profit jumped by 33% to 43.6 trillion won in 2025.

What global smartphone market share did Samsung hold in Q3 2025?

Samsung captured approximately 19% global smartphone market share in Q3 2025.

How many smartphone units did Samsung ship in Q4 2025, and what share of the global market did that represent?

Samsung shipped 61.2 million smartphones in Q4 2025, representing about 18.2% global market share.

How many Galaxy AI‑enabled mobile devices does Samsung plan to have in 2026?

Samsung aims to expand Galaxy AI‑enabled devices to 800 million units in 2026, up from 400 million.

Conclusion

Samsung’s performance underscores a resilient global presence, with significant growth in foldable devices, sustained smartphone shipments, and competitive market share across regions. Heavy R&D spending and patented innovation have supported advancements in displays, semiconductors, and AI‑enabled devices. The company also continues to expand sustainability and ESG commitments, from renewable energy usage to e‑waste initiatives, while cultivating a large global workforce that underpins its broad business footprint.

As Samsung navigates intensified competition and fast‑shifting tech trends, these statistics reveal key strengths and strategic directions shaping its future.

Leave a comment

Have something to say about this article? Add your comment and start the discussion.