Smartphones remain at the center of personal and professional life, shaping how we communicate, work, and consume media. Over 7.43 billion devices are in active use around the world, nearly matching the global population, while U.S. smartphone ownership stands above 90% among adults.

In retail, this high penetration drives mobile‑first shopping experiences and app‑based businesses, and in enterprise sectors, smartphones are essential tools for remote workflows. These trends make understanding ownership lifecycles and replacement patterns crucial for industry forecasts and consumer planning. Explore the data that follows to see how these habits are evolving.

Editor’s Choice

- 7.43 billion smartphones are active globally in 2025.

- The global smartphone user base is forecast to reach ~5.12 billion by 2026.

- 82.2% of people in the United States own a smartphone.

- Android holds ~72–72.5% global OS market share in 2025.

- The average global smartphone replacement cycle was about 2.4 years in 2025 and is trending downward.

- The average smartphone lifespan is ~2.5–3 years worldwide.

- High‑end devices often last 4–7 years with careful usage.

Recent Developments

- In 2025, the average smartphone replacement cycle was ≈2.4 years, indicating faster device turnover globally.

- Android maintained a ~72.5% global OS share in mid‑2025.

- U.S. ownership continues rising, reaching 91% smartphone penetration.

- Foldable phones are growing faster, though still a small share of total units.

- Daily smartphone usage averages over 4 hours and 30 minutes, reflecting deeper engagement.

- Mobile devices now account for the majority of digital and e‑commerce traffic.

- The shift toward AI‑powered processors in devices is expected to climb.

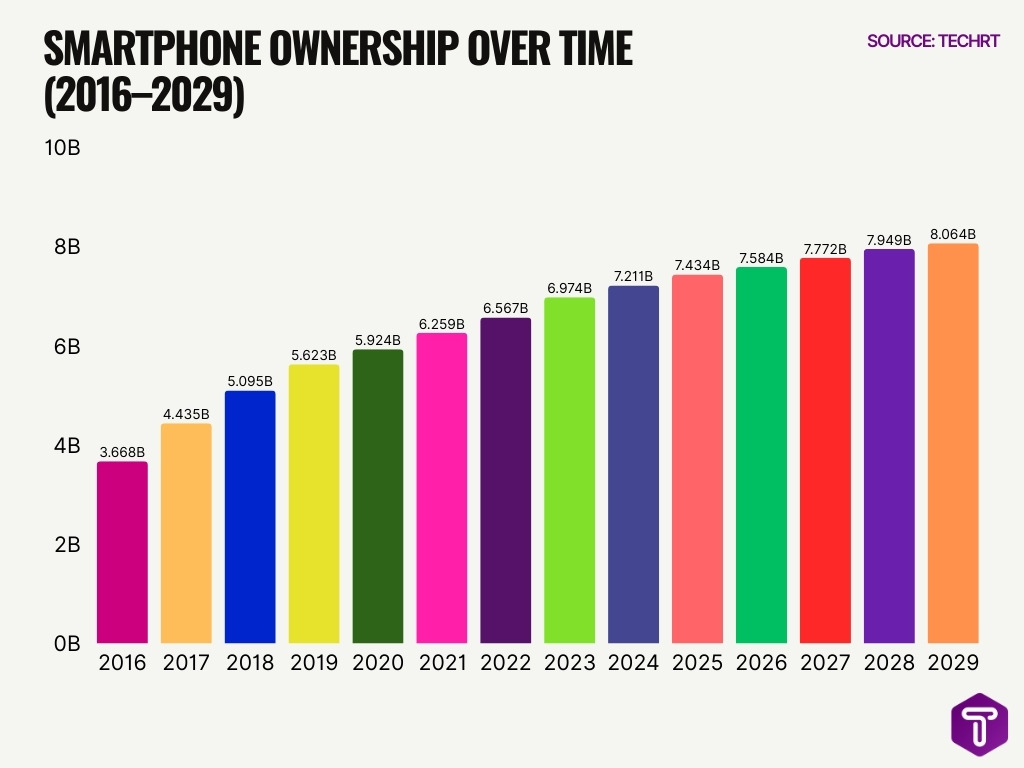

Global Smartphone Ownership Growth Trends

- Global smartphone users increased from 3.668 billion in 2016 to 8.064 billion by 2029, showing a massive long-term expansion in worldwide adoption.

- The fastest growth occurred in 2017, when users surged by +767 million, representing a peak annual growth rate of 20.91%.

- Between 2016 and 2018, the user base expanded by more than 1.4 billion people, highlighting the early-stage boom period of smartphones.

- Annual growth slowed from 14.88% in 2018 to just 5.35% in 2020, reflecting increasing market maturity.

- In 2021, smartphone users reached 6.259 billion, with an addition of +335 million users and 5.65% growth year-over-year.

- By 2022, global adoption crossed 6.567 billion users, while growth moderated further to 4.92%.

- Despite slowing trends, 2023 recorded a rebound with +407 million new users and a 6.2% growth rate.

- From 2024 onward, yearly growth dropped below 3.5%, starting at 3.4% in 2024 and falling to 1.45% by 2029.

- Between 2024 and 2026, the market added only about 620 million users, compared to nearly 2 billion users added from 2016 to 2018.

- By 2026, total users surpassed 7.584 billion, signaling near-saturation levels in many major markets.

- In 2027, global smartphone ownership climbed to 7.772 billion, with growth limited to 2.48%.

- By 2028, users reached 7.949 billion, adding just +177 million users at a 2.28% growth rate.

- In 2029, smartphone adoption is projected to reach 8.064 billion users, with the slowest recorded growth of 1.45%.

- Overall, the data shows a clear transition from rapid adoption (2016–2018) to stabilized, low-growth expansion (2024–2029).

- The long-term trend highlights a shift in the smartphone industry’s focus from new user acquisition to device upgrades, services, and ecosystem monetization.

Global Average Smartphone Lifespan

- The average global lifespan for smartphones is ~2.5–3 years.

- High‑end devices with careful upkeep can reach 4–7 years.

- Lifespan varies with hardware quality, battery degradation, and software support.

- Older global data suggested cycles of ~21 months, showing a trend toward longer usage today.

- Consumer preference for premium flagships extends ownership duration.

- Regional differences exist, with developed markets showing longer use.

- Rising secondary markets extend life via resale and reuse.

- Repairs and refurbishing also extend the practical lifespan of devices beyond original replacement cycles.

India Smartphone Replacement Cycle

- In India, more than half of users replace phones after ≥2 years.

- Around 10.8% replace within 6 months, a smaller segment.

- 11.4% hold phones for 1 year before upgrading.

- India’s expansive 1.16 billion active devices market drives diverse replacement behavior.

- Cost sensitivity influences longer ownership for mid‑range phones.

- Rising smartphone penetration supports mobile commerce growth.

- Secondary markets in India help extend device life.

- Regional networks of repair shops support extended usage in rural areas.

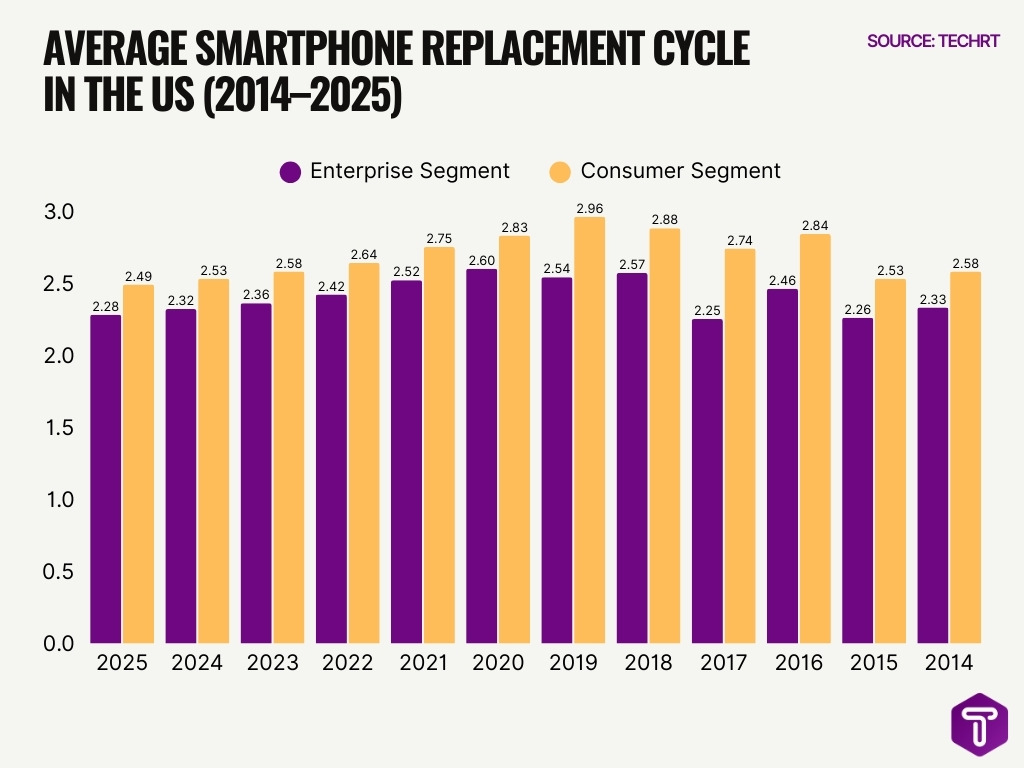

Average Smartphone Replacement Cycle in the US

- The consumer smartphone replacement cycle peaked at 2.96 years in 2019, representing the longest average ownership period during the past decade.

- The enterprise segment lifespan reached its highest level at 2.60 years in 2020, reflecting delayed corporate upgrades during the pandemic.

- From 2020 to 2025, the consumer lifespan declined from 2.83 years to 2.49 years, showing a 0.34-year reduction in average usage time.

- Over the same period, the enterprise replacement cycle fell from 2.60 years in 2020 to 2.28 years in 2025, marking a 0.32-year decrease.

- Between 2014 and 2019, consumer usage increased from 2.58 years to 2.96 years, indicating a phase of extended device retention.

- After 2019, both segments entered a consistent decline phase, with yearly averages dropping through 2025.

- In 2021, consumers still held devices for 2.75 years, while enterprises averaged 2.52 years, showing relatively stable post-pandemic usage.

- The gap between consumer and enterprise ownership remained narrow, typically between 0.20 and 0.30 years throughout the period.

- By 2025, consumers will replace smartphones every 2.49 years, while enterprises will upgrade every 2.28 years, highlighting accelerated refresh cycles.

- The long-term trend from 2014 to 2025 shows a shift from longer retention periods to faster upgrade behavior, driven by 5G adoption, performance demands, and carrier incentives.

iPhone Ownership Duration Stats

- As of 2025–2026, Apple’s iPhone holds roughly 27–28% of the global smartphone market share.

- In the United States, iPhones command ~58% of the smartphone market, reflecting stronger penetration than globally.

- More than 1 billion iPhones are active worldwide, while Android devices number above 3 billion active units.

- Consumer surveys show 61% of iPhone users keep their previous device for two years or more, pointing to longer ownership durations.

- Among those, ~29% retain iPhones for more than three years, suggesting greater retention versus Android.

- Apple’s consistent OS support and security updates contribute to longer device lifespans compared with many Android alternatives.

- iPhone’s lifespan durability often exceeds that of competitors due to extended software support, with many models supported for 5–7+ years.

- The presence of ~51 distinct iPhone models to date underscores Apple’s long and evolving product history.

Android Ownership Duration Stats

- Android continues to dominate globally, with ≈72–75% of the mobile OS market share in 2026.

- Android’s broad market share reflects over 3 billion active devices worldwide.

- Android users are generally more likely to replace devices sooner than iPhone users, with a higher proportion replacing within 2–3 years.

- Android’s popularity in emerging markets contributes to shorter average ownership cycles due to affordability and upgrade incentives.

- The diversity of Android manufacturers leads to wider variance in lifespan, with flagship devices often lasting longer than budget models.

- Android’s open ecosystem facilitates broader software compatibility but can lead to slower or fewer OS updates on some models, influencing replacement timing.

- Despite market dominance, Android users, on average, hold devices shorter than iPhone users, with fewer owners maintaining their handset beyond three years.

- Android’s global OS share stability suggests persistent long‑term engagement even as individual device durations vary widely.

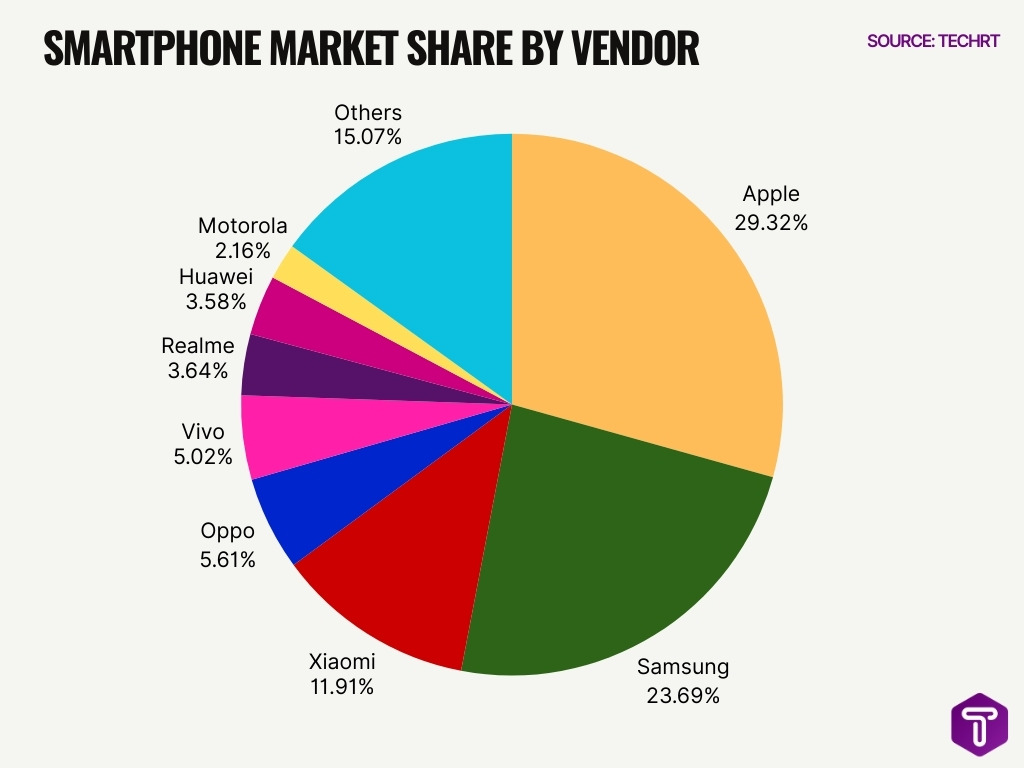

Smartphone Market Share by Vendor

- Apple leads the global smartphone market with a dominant share of 29.32%, making it the largest vendor worldwide in terms of market presence.

- Samsung secures the second position with a strong market share of 23.69%, reflecting its continued influence across premium and mid-range segments.

- Xiaomi ranks third globally, capturing 11.91% of the market and strengthening its footprint in price-sensitive and emerging markets.

- Oppo holds 5.61% market share, placing it among the top five smartphone brands with solid performance in Asia-focused regions.

- Vivo accounts for 5.02%, showing steady adoption in the mid-range and offline retail segments.

- Realme controls 3.64% of the market, driven by its budget-friendly smartphones and youth-oriented branding.

- Huawei maintains 3.58% share, demonstrating resilience despite regulatory and supply chain challenges.

- Motorola records 2.16%, sustaining a niche but loyal customer base in select regions.

- Other smartphone brands collectively represent 15.07%, highlighting the fragmented and competitive nature of the global market.

Samsung Phone Lifespan Data

- Samsung remained one of the top global smartphone vendors with ~20.3% worldwide share in early 2026.

- Samsung devices often have a practical lifespan of ~3–6 years, depending on usage and model class.

- Premium Galaxy S‑series handsets typically receive software updates for at least 4–5 years, which supports longer usability.

- For example, newer Galaxy S models like the S24 and beyond are projected to have OS support lasting ~7 years due to extended update commitments.

- Midrange Samsung smartphones tend to have shorter lifespans due to slower update cadences and hardware constraints.

- Samsung’s lifespan patterns vary by region, with users in developed markets holding phones longer compared to emerging regions.

- Repairability and accessory ecosystems contribute to lengthening practical device life when consumers fix issues rather than replace them.

- Samsung’s broad portfolio means lifespan outcomes differ widely across its models.

Other Brands Lifespan Comparison

- Xiaomi holds ≈14.1% global smartphone market share in Q1 2025.

- Vivo and OPPO each command around 8–13% of the global market in 2025.

- Xiaomi, Oppo, and Huawei smartphones average a 2–4 year lifespan due to battery degradation.

- Fairphone devices average 4.7 years of usage with up to 8–10 years of software support.

- OPPO Reno batteries retain 80% capacity after 4 years or 1600 charge cycles.

- Apple iPhones retain over 50–64% resale value after one year, outpacing others.

- Xiaomi phones retain over 20% resale value, lower than premium brands.

- Smartphones depreciate 40% in the first year and 65% by year two across brands.

- Huawei and Xiaomi show faster 2–4 year replacement cycles than leaders.

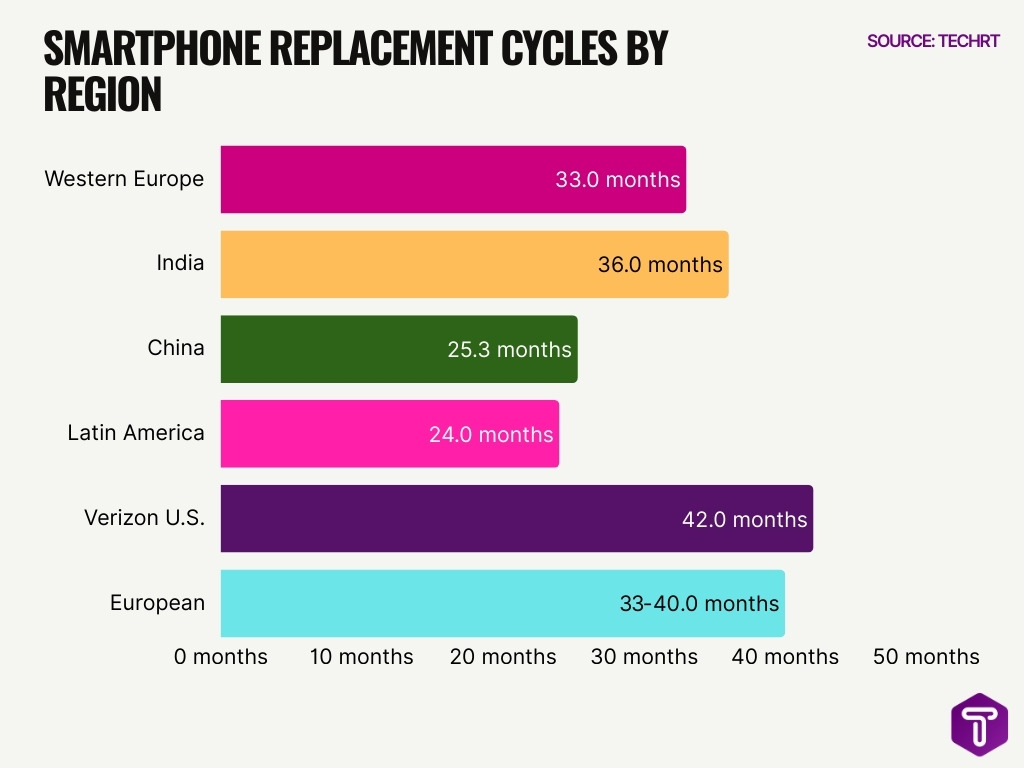

Regional Smartphone Lifecycle Differences

- Global smartphone replacement rate stabilized at 23.7% in 2024.

- U.S. consumers plan to replace smartphones within 1-2 years by 25% in 2025.

- Western Europe’s smartphone replacement cycle is forecast to shorten to 33 months by 2025.

- India’s average smartphone replacement cycle currently reaches 36 months.

- China’s smartphone upgrade cycle averaged 25.3 months recently.

- Latin America’s smartphone renewal cycle extended beyond 24 months due to economic factors.

- Verizon U.S. customers hold phones beyond 42 months average upgrade cycle.

- The European average smartphone replacement cycle was estimated at 33–40 months (≈2.7–3.3 years) around 2020–2025

Historical Lifespan Trends

- Smartphones averaged ~21 months of lifespan globally in the mid-2010s.

- The US replacement cycle reached 21.7 months in 2012.

- The global smartphone replacement cycle was 21 months in 2016.

- Pre-smartphone mobiles had 4.6–4.8 year median lifespans in 2000–2005.

- 47% of smartphone failures occurred in the first 2 years, according to surveys.

- Battery issues caused 42% of smartphone problems.

- Consumers expect 5.2 years of smartphone use, but average 2.7 years of actual use.

- The US upgrade cycle is extended to 33 months by 2019.

- Smartphone batteries endure 850 cycles before dropping below 80% capacity.

Consumer vs Enterprise Lifespan

- Historically, enterprise smartphone lifespans have aligned with business asset cycles, often slightly longer than consumer durations.

- In the U.S., enterprise devices once averaged ~2.6 years of usage before replacement.

- Consumer segments show faster turnover due to fashion trends and personal preference drivers.

- Enterprise decisions weigh security support and total cost of ownership, leading to targeted upgrade cycles.

- Consumer upgrade frequency often correlates with social and tech trends more than functional necessity.

- Business lifecycles may integrate device‑as‑service models that standardize replacement timing.

- Enterprise lifespans are influenced by corporate policy and IT refresh schedules.

- Overall, enterprise devices trend toward slightly longer useful lives when properly managed.

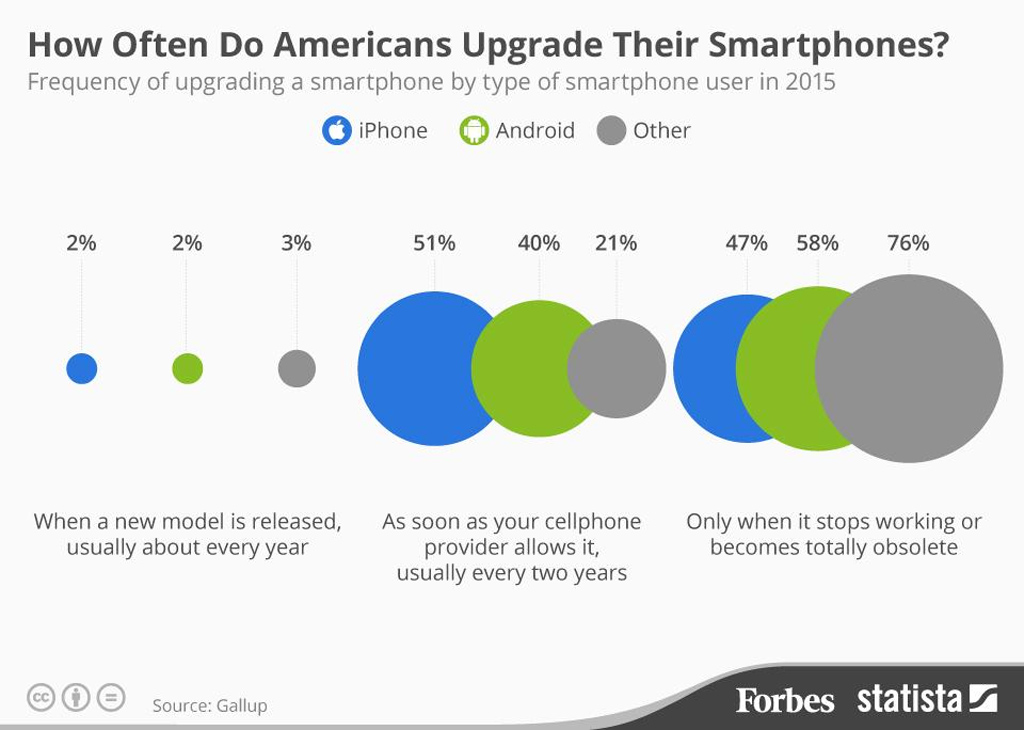

Smartphone Upgrade Frequency Among Americans

- Only 2% of iPhone users and 2% of Android users upgrade their smartphones every year when a new model is released, showing that annual upgrades are rare among most users.

- Just 3% of users on other platforms replace their phones yearly, confirming that frequent upgrading is uncommon across all device types.

- A majority of iPhone users (51%) prefer upgrading every two years when their carrier allows, making this the most popular upgrade cycle among Apple users.

- Among Android users, 40% upgrade their smartphones every two years, reflecting a strong preference for carrier-based replacement plans.

- Only 21% of users on other platforms follow a two-year upgrade cycle, indicating lower participation in structured upgrade programs.

- Nearly 47% of iPhone users wait until their device stops working or becomes obsolete before upgrading, highlighting a strong tendency toward long-term device use.

- An even higher 58% of Android users replace their phones only after failure or obsolescence, showing a more cost-conscious and durability-focused behavior.

- A striking 76% of users on other platforms upgrade only when their phones become unusable, making them the most conservative group in terms of device replacement.

Upgrade Frequency by Demographics

- 18-24-year-olds upgrade iPhones within 1-2 years at 32%, higher than older groups.

- 55-64-year-olds retain iPhones for 3+ years at a 43% rate, showing greater device loyalty.

- 65+ users keep iPhones beyond 3 years at 65%, the highest retention among age demographics.

- 61% of iPhone users hold devices for 2-3 years, compared to 43% of Android users.

- 29% of iPhone owners retain phones for 3+ years, versus 21% for Android users.

- North America has the shortest replacement cycle at around 24 months, shorter than Europe’s 40 months.

- Western Europe’s smartphone lifespan averaged 40 months in 2020, dropping to 33 months by 2025.

- Premium phone users in India upgrade every 2-2.3 years, faster than entry-level at 3.5-5 years.

- Households earning $75,000+ show 98% smartphone ownership with quicker upgrades than lower-income households.

Battery Impact on Lifespan

- Lithium‑ion batteries typically last ~2–3 years before notable degradation.

- Smartphone batteries endure roughly 500–2,500 charge cycles before significant capacity loss.

- Battery health often drops to ~80% capacity after ~800 cycles under EU repairability standards.

- Battery wear is often perceived as the first sign a phone needs replacement.

- New battery management algorithms aim to preserve capacity beyond traditional lifespans.

- Environmental conditions (heat, humidity) accelerate battery degradation.

- Battery impact is significant because it directly affects daily usability and performance.

- Many users replace their devices when battery performance drops, even if other specs remain viable.

- Some manufacturers now guarantee multi‑year battery performance through optimized firmware.

- Plans for EU labels include battery life and charge cycle metrics to guide consumer expectations.

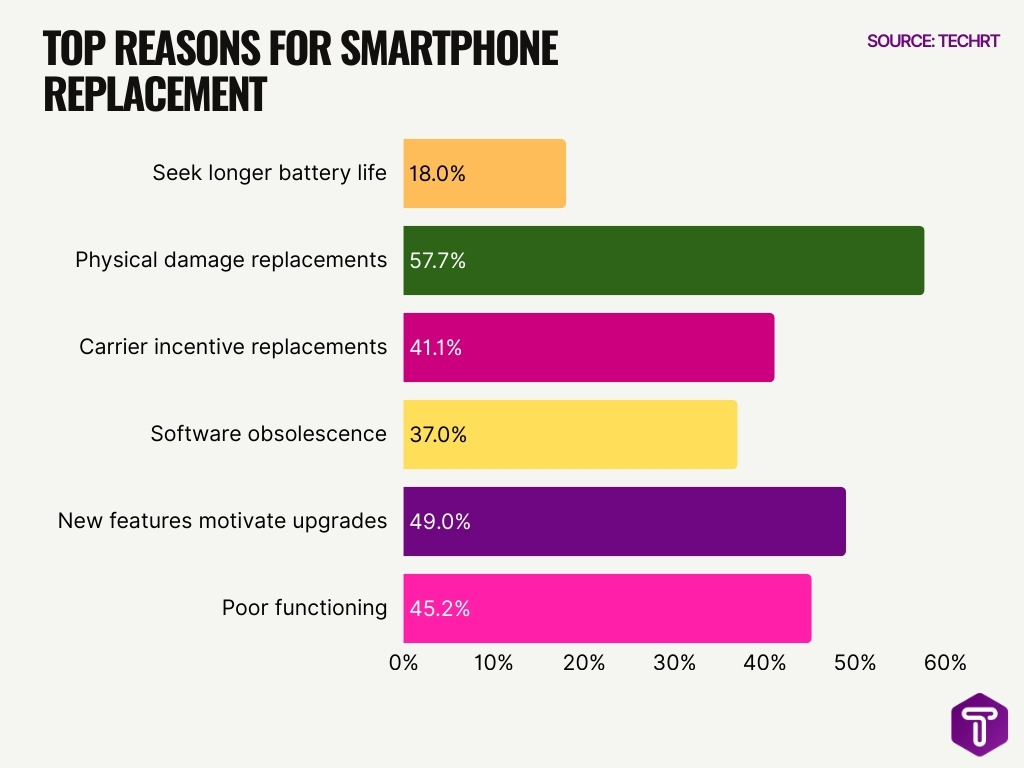

Reasons for Smartphone Replacement

- Battery degradation prompts ~18% of UK users to seek longer battery life when replacing smartphones.

- Physical damage, like broken screens, drives 57.7% of replacements among UK consumers.

- New features motivate 49% of Nigerian users to upgrade their smartphones.

- Carrier incentives, such as operator upgrades, influence 41.1% of UK smartphone replacements.

- Software obsolescence, including technological issues, causes 37% of UK users to replace devices.

- Poor functioning leads 45.2% of Chinese consumers to discard old smartphones.

- Screen damage accounts for 71% of all smartphone repair cases globally.

- US users now replace smartphones roughly every 2.1 years on average, driven by carrier incentives and upgrade programs.

- Psychological obsolescence from fashion trends shortens device lifespans in Italy.

- Trade-in programs delivered $1.34 billion in value to consumers in Q2 2025.

Factors Affecting Phone Lifespan

- Premium smartphones last 4-5 years with proper care, outperforming budget models.

- Battery capacity drops 20% after 500 charge cycles.

- iPhones receive updates for 5-7 years, extending functional life.

- Over 50 million U.S. screens crack annually from drops.

- At 30°C, battery lifespan reduces by 20%; at 45°C, by 50%.

- Gaming drains battery 30-40% faster than standard use.

- Smartphones average 2.53 years globally.

- Software updates can cut battery life by up to 15%.

- Repair costs reach 15-40% of the new phone price for displays.

Trends in Smartphone Replacement Cycles

- The global smartphone replacement cycle averaged 2.4 years in 2025, pointing to more frequent upgrades than in earlier years.

- 40.4% of users upgrade every 2-3 years.

- Annual global replacement rate stabilized at 23.7% in 2024.

- 75% cite battery degradation as the primary upgrade reason.

- 95% of 18-29-year-olds own smartphones with higher upgrade rates.

- 55-64 year-olds keep phones 43% beyond 3 years; 65+ at 65%.

- The used smartphone market is expected to grow at 15.11% CAGR from 2025 to 2035.

- The Western Europe cycle will be shortened to 33 months by 2025.

- 57.4% of iPhone users trade in on upgrade, extending cycles via the secondary market.

- 42% of enterprises plan shorter endpoint refreshes due to AI gains.

Frequently Asked Questions (FAQs)

How many people worldwide own a smartphone as of 2025?

≈4.69 billion people worldwide own a smartphone in 2025, with global smartphone users projected to reach ~5.12 billion by 2026.

What is the smartphone ownership penetration rate in the United States?

About 91% of adults in the United States currently own a smartphone.

What is the average global smartphone replacement cycle in 2025?

The global smartphone replacement cycle averaged 2.4 years in 2025.

How long, on average, does a smartphone last before replacement?

The average lifespan of a smartphone is about 2.53 years in 2024–2025, with some premium models lasting longer.

What percentage of Indian households possess at least one smartphone?

Approximately 85.5% of Indian households now own at least one smartphone.

Conclusion

The smartphone ownership lifecycle reflects a maturing global market that balances longer ownership with technology’s ever‑present innovation push. Users are holding devices longer, often driven by improved durability, extended software support, and environmental awareness. Meanwhile, battery health, feature demand, and economic incentives continue to shape when and why upgrades occur.

Across regions, demographics, and device classes, the smartphone lifecycle now often spans multiple years, challenging brands to innovate responsibly while meeting evolving consumer expectations. As we move deeper into the decade, understanding these trends will be crucial for manufacturers, carriers, and users alike.

Leave a comment

Have something to say about this article? Add your comment and start the discussion.