Video call apps have become essential tools, powering both personal and professional communication across the globe. From remote teams collaborating in real time to families connecting across continents, these platforms have reshaped how we interact online. In business settings, tools like Zoom and Microsoft Teams enable daily meetings and client presentations, while in everyday life, apps such as WhatsApp and FaceTime help people stay connected with loved ones.

With continued adoption and rapid innovation, it’s worth exploring how usage trends and market dynamics are evolving in the video call app landscape. This article section dives into the latest statistics shaping this shift.

Editor’s Choice

- The global video conferencing market is projected to grow from $37.29 billion in 2025 to $60.17 billion by 2032.

- Zoom holds an estimated 55.91% share of the global video conferencing market.

- Zoom hosts around 300 million daily meeting participants in 2025.

- WhatsApp has over 6.3 billion total downloads worldwide as of 2024.

- Messaging apps like WhatsApp and WeChat each exceed 1 billion monthly active users.

- Video calling usage on WhatsApp grew by about 20% recently.

- Skype was officially discontinued in May 2025, marking a shift in legacy usage.

Recent Developments

- Zoho’s Arattai app added video call support for Android TVs in early 2026, expanding device reach.

- WhatsApp updated features for group coordination and video calls for New Year events, highlighting improved engagement tools.

- Skype, once a pioneer in video calling, was shut down by Microsoft in May 2025 after declining usage.

- Google Duo features are being fully integrated into Google Meet by late 2025, ending legacy support.

- Zoom expanded its AI-enabled features in 2025 to support hybrid work and automate tasks.

- Microsoft Teams continued to grow its user base alongside Zoom, reflecting strong enterprise demand.

- Many video call platforms are improving security and privacy options in response to user concerns.

Global Video Call Apps Overview

- WhatsApp remains one of the top communication apps worldwide, with video call capability integrated into messaging.

- WhatsApp usage statistics show the app among the top 3 communication apps in the U.S. and globally.

- WhatsApp and similar messaging platforms (WeChat, Telegram) each exceed 1 billion users.

- Zoom’s video conferencing service alone accounts for hundreds of millions of participants daily.

- Leading video conferencing platforms (Zoom, Microsoft Teams, Google Meet, Cisco Webex) jointly dominate over 60% of the market.

- Messaging platforms like FaceTime and Messenger also provide simple video call options for personal use.

- Discord, Signal, and Telegram offer video calling features alongside messaging and community tools.

Video Calling App Market Size and Growth

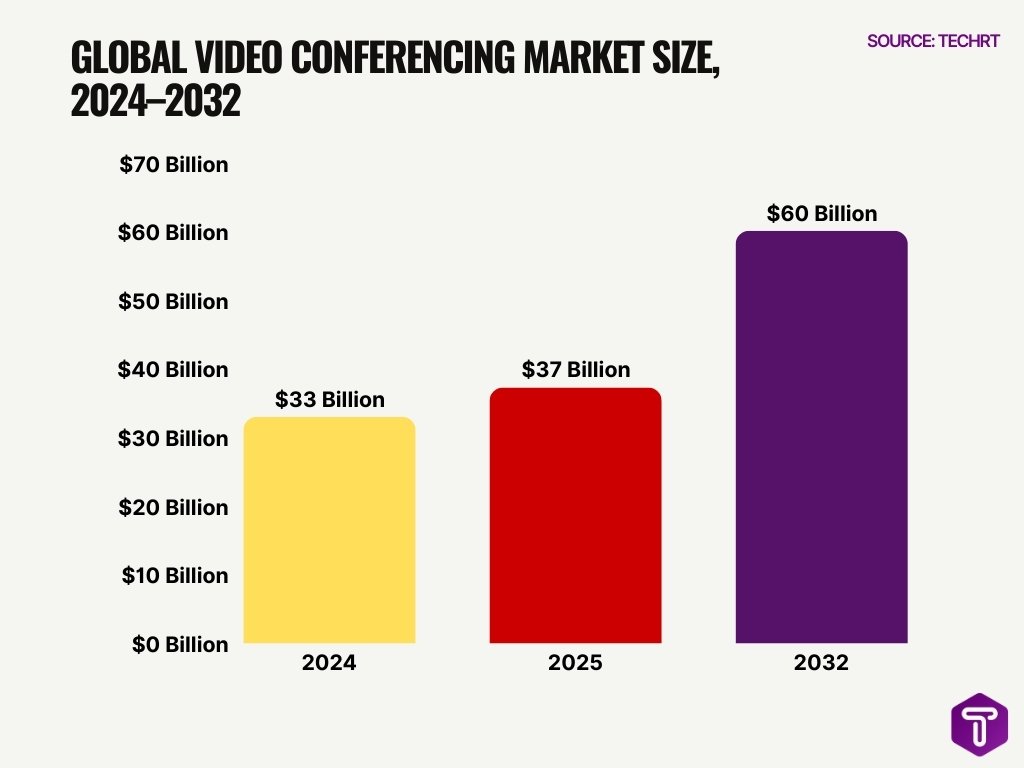

- The global video conferencing market was valued at $33.04 billion in 2024.

- It is expected to reach approximately $37.29 billion in 2025.

- Forecasts project growth to $60.17 billion by 2032 at about 7.1% CAGR.

- Another forecast estimates the broader video conferencing market could nearly double from 2024 to 2033.

- North America accounted for about 30.96% of the market share in 2024.

- The U.S. segment is projected to grow at a strong rate through 2032.

- Expansion is driven by hybrid work adoption and digital communication demand globally.

Number of Video Call App Users Worldwide

- Zoom reports around 300 million daily meeting participants as of 2025.

- Messaging platforms like WhatsApp have reached over 6.3 billion total downloads by 2024.

- WhatsApp’s video calling usage has grown roughly 20% recently.

- WhatsApp and WeChat each surpass 1 billion active users.

- Skype had about 300 million users worldwide before its 2025 closure.

- Microsoft Teams sees tens of millions of daily users alongside Zoom.

- Other platforms like Google Meet and Discord support millions of active users with frequent video calls.

Regional Adoption of Video Call Apps

- North America commands 37.9% of the global video conferencing market share in 2025.

- India leads with 535.8 millionWhatsApp monthly active users, driving video calling dominance.

- Brazil shows 98.9% WhatsApp penetration, fueling messaging video calls in Latin America.

- Latin America achieves over 92% WhatsApp usage among internet users for video features.

- Europe accounts for 27.4 million Microsoft Teams downloads from 2020-2023, boosting hybrid work.

- Asia-Pacific video conferencing market grows at 14% CAGR through 2030 due to high adoption.

- India records over 50 million minutes daily on WhatsApp video calls.

- Zoom secures 55.91% market share in video conferencing, popular in European hybrid tools.

- Nigeria leads in mobile video calling reach at over 75% of internet users monthly.

- Global video conferencing market hits $37.29 billion in 2025, led by North America.

Device and Platform Usage for Video Calling

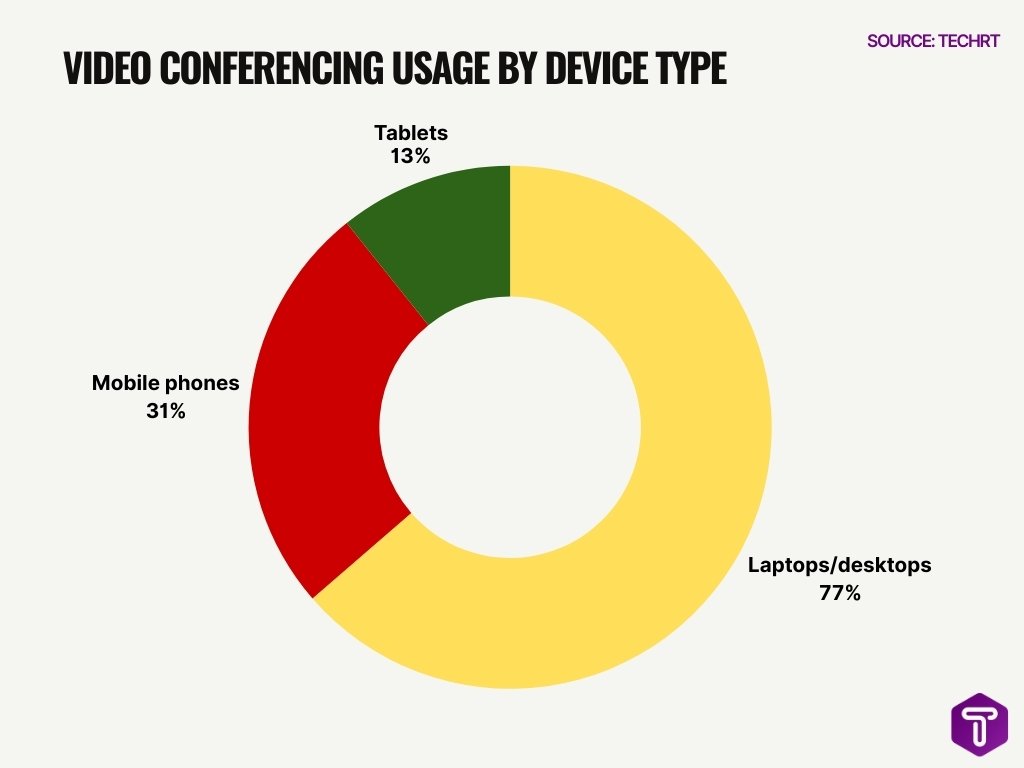

- Mobile devices drive 42% of video conferencing sessions, with desktops/laptops covering the 58% remainder.

- 77% of users access video calls via laptops or desktops.

- 31% of people use mobile phones for video conferencing access.

- 13% join video calls using tablets.

- 35.5% of global internet users make mobile video calls monthly.

- 58% of professionals face software/technical issues in video conferences.

- Zoom holds 57% of the video conferencing market share.

- Google Meet serves 5,795 companies with native Android/iOS/web support.

- 68% of U.S. homes own smart TVs supporting video calling apps.

Consumer vs Business Video Calling Usage

- Approximately 68% of video conferencing sessions are work‑related, while 32% are social or personal.

- On weekdays, business calls peak midmorning and early afternoon, while personal calls spike in the evening.

- Business users are 2.5x more likely to use virtual backgrounds compared to personal calls.

- 49% of healthcare providers now use Zoom for patient consultations, while others rely on Doxy.me or Teams.

- In companies with fewer than 100 employees, 67% use video calls for client communication; among large enterprises, this rises to 89%.

- 61% of companies with hybrid work models use at least two video calling platforms.

- Personal calls often occur on messaging apps like WhatsApp or Messenger, while business calls usually use Zoom, Teams, or Meet.

- Personal users join video calls for events, check‑ins, or social gatherings, increasing weekend usage.

Most Popular Video Call Apps by Users

- Zoom hosts over 300 million daily active users worldwide.

- WhatsApp enables 2.4 billion video calls monthly, totaling over 2 billion minutes daily.

- Google Meet reaches 300 million monthly users with 29.39% market share.

- Microsoft Teams has 320 million monthly active users, popular in enterprises.

- Facebook Messenger sees 700 million accounts in calls daily across platforms.

- FaceTime is used by 47.6% of surveyed users for video calls, dominant on Apple devices.

- Discord records 200 million+ monthly active users, with 4 billion voice minutes daily.

- Telegram boasts 1 billion monthly active users, growing 46% yearly.

- Zoom leads with 55.91% global video conferencing market share.

- Skype users dropped to over 36 million, retiring in May 2025.

Market Share of Leading Video Call Apps

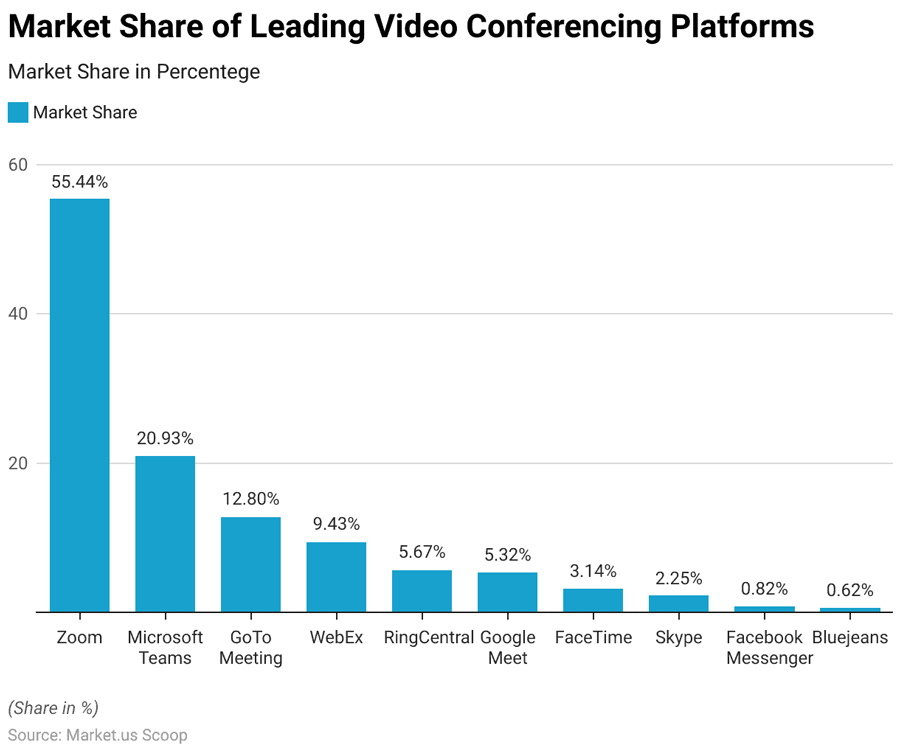

- Zoom dominates the global video conferencing market with a commanding 55.44% market share, making it the clear industry leader by a wide margin.

- Microsoft Teams ranks second, capturing 20.93% of the market, driven largely by its deep integration with enterprise and Microsoft 365 users.

- GoTo Meeting holds a solid position with 12.80% market share, reflecting its continued adoption among business and professional users.

- Cisco WebEx accounts for 9.43%, maintaining relevance in corporate and large-enterprise video communication environments.

- RingCentral secures 5.67% of the market, supported by its unified communications and cloud-based collaboration offerings.

- Google Meet follows closely with 5.32% market share, benefiting from widespread usage across Google Workspace customers.

- FaceTime captures 3.14%, highlighting its popularity within the Apple ecosystem despite limited cross-platform availability.

- Skype’s market share stands at 2.25%, indicating a significant decline compared to its earlier dominance in video calling.

- Facebook Messenger contributes just 0.82%, showing minimal penetration as a dedicated video conferencing solution.

- BlueJeans holds the smallest share at 0.62%, reflecting its niche presence in an increasingly competitive market.

Video Calling in Remote and Hybrid Work

- 52% of U.S. remote‑capable workers are in hybrid roles, with 27% fully remote.

- 83% of global employees prefer hybrid work, blending office and remote days.

- Remote workers save commute time, contributing to increased video call adoption.

- Remote work trends directly drive video meeting usage above pre‑pandemic levels.

- Hybrid employees often schedule calls across a broader range of hours, including early mornings and evenings.

- Leaders in remote roles may spend 3+ hours per day in virtual meetings.

- Workers report higher stress reduction and better work‑life balance compared with fully onsite work.

- Video calls are central to team alignment, performance reviews, and project updates.

Video Calling Usage in Education and E‑Learning

- About 30% of U.S. students have taken at least one online course as of 2025, showing how digital learning is embedded in education.

- 63% of high school students engage with digital learning tools daily, indicating frequent video interaction for instruction.

- Over 995 million people worldwide are expected to use online learning platforms by 2029.

- The global e‑learning market is projected to reach ~$457.8 billion by 2026, driven by mobile and video learning adoption.

- More than 60% of Fortune 500 companies use e‑learning solutions for training, supporting internal video‑based instruction.

- Digital learning platforms increasingly incorporate live video sessions for classes, tutorials, and collaboration.

- Europe and Asia are forecasted to see strong growth in the online learning market through the late 2020s.

- Video call tools integrated into education allow remote classroom participation and real‑time student feedback.

- Video conferencing platforms are now common in corporate training and certification programs.

Video Call Duration Trends: Business vs Personal Use

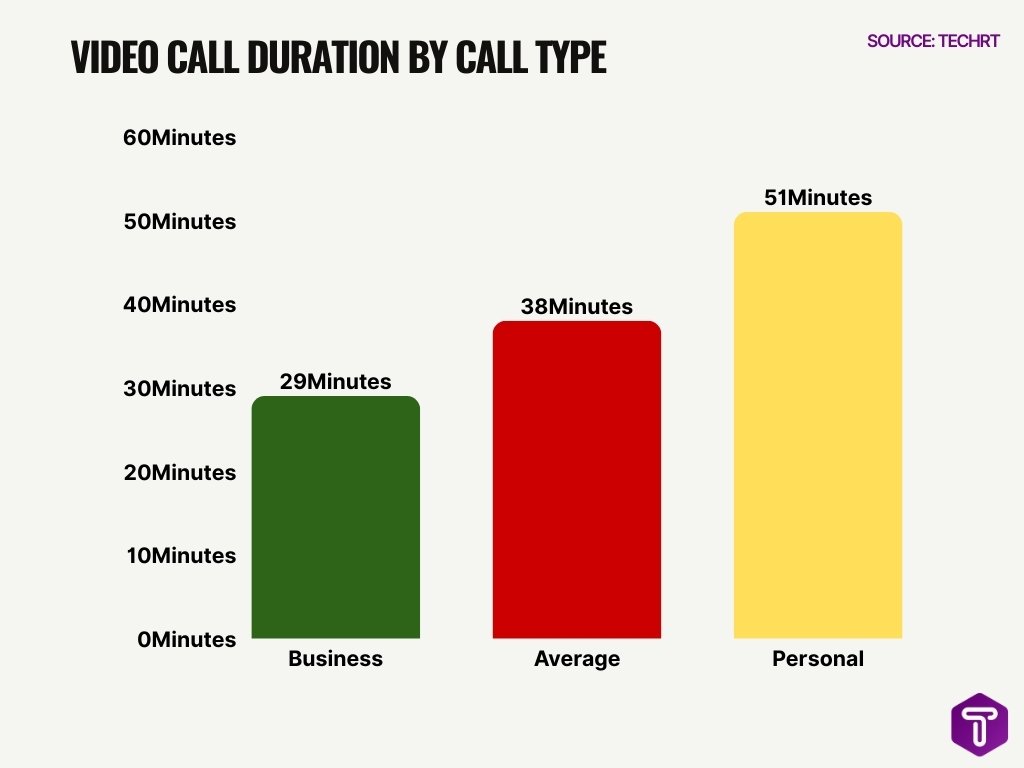

- Personal video calls average 51 minutes, making them the longest call type, driven by casual conversations and social engagement.

- Business video calls last only 29 minutes on average, reflecting structured meetings and agenda-driven communication.

- The overall average video call duration is 38 minutes, showing a balance between professional efficiency and personal interaction.

- Personal calls are 22 minutes longer than business calls, highlighting a significant gap between work and non-work usage.

- Business calls are nearly 43% shorter than personal calls, emphasizing time optimization in professional environments.

- The data shows a clear usage pattern, where work-related calls prioritize efficiency, while personal calls focus on engagement and connection.

- The difference in duration across call types suggests that the use case strongly influences how long users stay on video calls.

Demographics of Video Calling App Users

- WhatsApp boasts ~3 billion monthly active users worldwide, many engaging in video calling features.

- 51.8% of WhatsApp users are male and 48.1% female globally.

- 27% of WhatsApp users fall in the 26-35 age group, the largest demographic.

- 41.5% of female internet users aged 16-24 made mobile video calls monthly in Q3 2024.

- 35.5% of male internet users aged 16-24 used mobile video calls in the past month, Q3 2024.

- Over 75% of internet users in Nigeria make mobile video calls monthly, the highest regionally.

- 72.5% of 18-24 year-olds reported the highest video telehealth usage rates.

- Older adults ≥65 years showed 77 visits per 100 patients in telemedicine during the pandemic peak.

- 59% of telemedicine users are female, higher than 48% among non-users.

- Young adults under 65 were more likely to engage in telehealth than those 65+.

Video Calling for Telehealth and Telemedicine

- The global telehealth market is expected to expand from about $153.8 billion in 2025 to $191.9 billion in 2026.

- Forecasts suggest telehealth could grow to over $1.4 trillion by 2035 at a CAGR near 25%.

- As of 2025, telemedicine services reach urban adoption rates (~34%) versus rural (~19.6%) in the U.S. and elsewhere.

- Usage patterns show older adults (65+) use virtual care (~43.3%) more than younger adults.

- Women use telehealth services (33.8%) more than men (26.3%), pointing to demographic differences.

- Telehealth convenience (65%) and speed (46%) are major reasons patients choose video consultations.

- Telehealth video calls reduce travel time for patients in rural areas and expand provider reach.

- Platforms designed for telemedicine emphasize ease of use and reliability as top priorities for adoption.

- Security and privacy are critical concerns when using video call apps for health consultations.

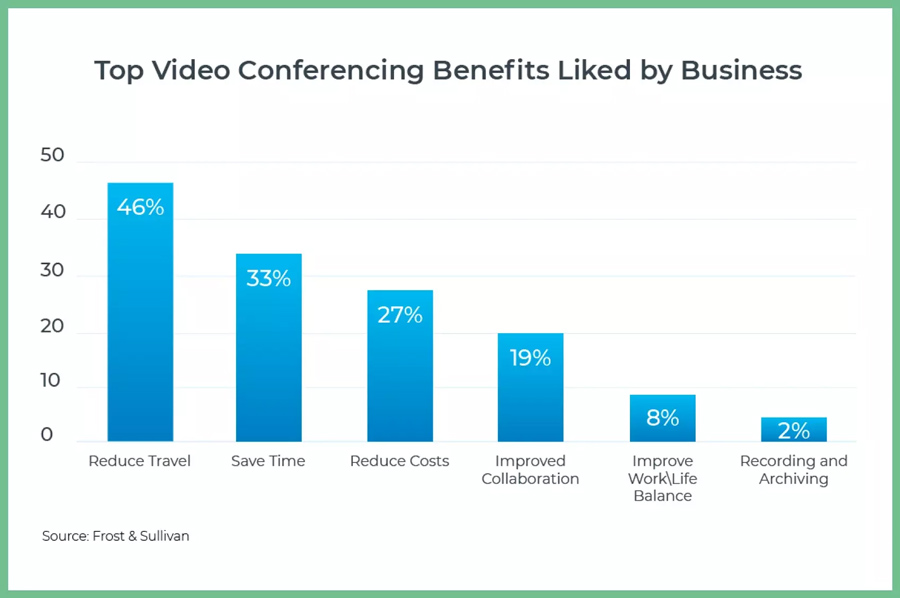

Top Business Benefits of Video Conferencing

- Reducing travel is the most valued benefit, with 46% of businesses citing it as the primary reason for adopting video conferencing.

- Saving time ranks second, as 33% of organizations report faster meetings and quicker decision-making through video calls.

- Cost reduction is a key driver, with 27% of businesses highlighting lower expenses on travel, accommodation, and logistics.

- Improved collaboration is noted by 19% of companies, enabling better teamwork across remote and distributed teams.

- Work-life balance improvements are recognized by 8% of respondents, reflecting reduced commuting and flexible work arrangements.

- Recording and archiving meetings is a niche benefit, mentioned by only 2%, indicating lower prioritization compared to operational gains.

User Preferences and Behavior in Video Calls

- 66% of telehealth users prioritize call quality and reliability when choosing a video provider.

- 58% of users emphasize usability and ease of use in provider selection.

- Privacy and security are decision drivers for ~58% of users, indicating rising concerns.

- Device compatibility is important to 50% of users, reflecting multi‑platform expectations.

- Cost is a factor for ~45% of users when selecting video call services.

- Hybrid work and personal communication behaviors often favor mobile and web‑based calling tools.

- App engagement data shows nearly half of users open mobile apps 11+ times daily, hinting at habitual use of communication features.

- Millennials and Gen Z lead frequent app usage and digital communication adoption.

Security and Privacy Statistics in Video Call Apps

- 97% of IT professionals express concern over protecting privacy in video conferences.

- Over 3 billion users rely on WhatsApp’s end-to-end encryption for video calls.

- 79% of employed users adopted two-factor authentication by 2021, rising from 28% in 2017.

- Telemedicine saw 276 million health records exposed in 2024 breaches.

- 58% of users in 2024 viewed online service benefits as outweighing privacy concerns.

- 100 million user messages leaked from the video chat app Tigo in 2023.

- 5,176 confirmed data breaches occurred globally in 2025 per Verizon DBIR.

- 83% of large businesses prioritize video calling tools with strong security.

- Over 133 million records were exposed in 725 healthcare breaches in 2023.

Monetization and Revenue of Video Call Apps

- Video conferencing platforms generated $14.2 billion in revenue in 2024, continuing into 2025.

- Paid subscriptions and enterprise plans form a major part of this revenue base.

- Cloud‑based solutions now represent ~73% of market revenue, signaling a shift from on‑premise models.

- In‑app purchases and usage‑based pricing together account for nearly 19% of annual revenue.

- Messaging apps and freemium models grow revenue through business APIs and premium tiers.

- Enterprise users often purchase bundled communication and collaboration services.

- Security and advanced feature add‑ons drive additional monetization.

- Market growth and subscriptions are expected to expand alongside hybrid work and telehealth demand.

Frequently Asked Questions (FAQs)

How many monthly users does WhatsApp have, making it a major video call app?

WhatsApp has over 3 billion monthly active users worldwide.

How many daily meeting participants use Zoom, showing its dominance in video conferencing?

Zoom reports over 300 million daily meeting participants.

What percentage of the global video conferencing market share does Zoom hold?

Zoom holds about 55.91% of the global video conferencing market share.

What estimated percentage of companies use three or more video calling platforms?

An estimated 62% of companies use three or more video calling platforms.

How many active users does Skype still have as of 2025, before its shutdown?

Skype had approximately 300 million active users worldwide in 2025.

Conclusion

Video call apps remain central to communication across work, learning, health care, and social interaction. Usage patterns and growth trends show massive adoption and evolving preferences shaped by mobility, security, and ease of use. Education and telehealth stand out as sectors where video communication has transformed access and outcomes. With businesses and consumers favoring higher quality, privacy, and integration with broader app ecosystems, the video calling future is firmly tied to broader digital and mobile engagement trends. Continued innovation in AI, compliance, and monetization will define how these platforms grow with users’ needs.

Leave a comment

Have something to say about this article? Add your comment and start the discussion.