Video communication tools have become central to business and social interaction, especially as hybrid and remote work models take hold in the US and worldwide. In 2024, the global video conferencing market generated roughly $14.2 billion in revenue, with continued expansion expected through 2026 and beyond as organizations invest in flexible meeting solutions and enhanced collaboration tools.

From boardroom presentations to cross‑continental team standups, video conferencing affects how teams coordinate work and how healthcare and education services deliver virtual encounters. As we dive into the latest Video Conferencing Statistics, these figures reveal adoption trends, growth projections, and platform dynamics shaping the future of digital communication.

Editor’s Choice

- The global video conferencing market generated ~$14.2B in 2024, projected to grow through 2025 and 2026.

- The market is forecast to surpass $23B by 2032 at a CAGR of ~9.2%.

- Paid video conferencing subscriptions doubled since 2020, reaching ~89M in 2025.

- Zoom generated $4.6B in 2024 revenue, up year‑over‑year.

- Microsoft Teams holds ~32.29% market share among conferencing platforms.

- The cloud video conferencing market grew to $10.4B in 2024 with ~13.3% CAGR to 2025.

- The North American market is valued at ~$14.1B in 2024 and rising.

Recent Developments

- Zoom raised revenue forecasts for fiscal 2026, driven by AI feature demand and hybrid work adoption.

- Companies expand platform capabilities with AI transcription, automated summaries, and contextual tools to boost productivity.

- Hybrid meetings are now standard in workflows, not temporary fixes, as remote‑friendly operations expand.

- Security and privacy enhancements continue as end‑to‑end encryption becomes the baseline, especially in regulated sectors.

- Interoperability with CRM, calendars, and project apps is a growing trend in conferencing deployments.

- Telehealth platforms integrate real‑time video features, driving virtual healthcare consultations.

- 5G and improved broadband enable higher‑quality video streams across devices and geographies.

- Emerging markets see increased conference traffic as workforces and enterprises adopt hybrid models.

Global Video Conferencing Market Overview

- The video conferencing market was valued at ~$13.92B in 2024 and projected to grow substantially by 2033.

- Some forecasts estimate $33.3B in 2025 and climbing to $86.3B by 2035.

- Multiple reports show market CAGR in the 9%–10% range through the early 2030s.

- Growth is driven by organizations embracing continuous digital workflows.

- Cloud‑native conferencing offerings outpace on‑premises solutions.

- Enterprise segments contribute the largest revenue share globally.

- Consumer and SMB adoption continues rising, especially in hybrid and remote work.

- Emerging economies (APAC, Latin America) register accelerated adoption rates.

Global Video Conferencing Market Growth

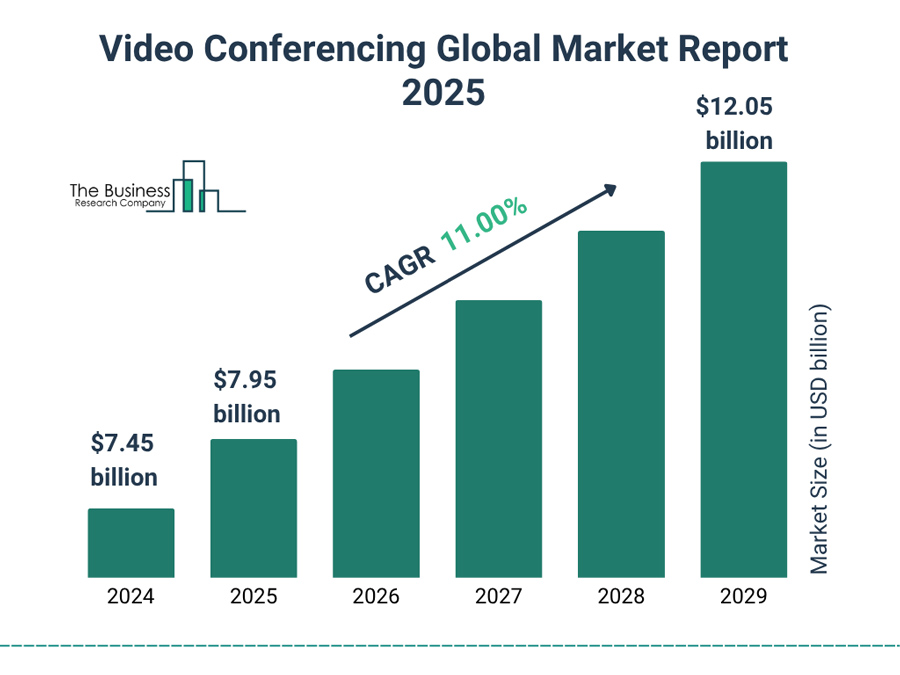

- The global video conferencing market is valued at $7.45 billion in 2024, reflecting strong demand driven by remote and hybrid work adoption.

- Market size is projected to reach $7.95 billion in 2025, showing steady year-over-year expansion.

- By 2026, the market is expected to grow to $8.75 billion, supported by rising enterprise collaboration needs.

- The market is forecasted to hit $9.60 billion in 2027, indicating accelerating adoption across business, education, and healthcare sectors.

- Video conferencing revenue is estimated to surpass $10.70 billion in 2028, marking a major growth milestone for the industry.

- By 2029, the global market is projected to reach $12.05 billion, representing significant long-term growth potential.

- From 2024 to 2029, the video conferencing market is expected to grow at a strong CAGR of 11.00%, highlighting sustained global expansion.

- Overall, the market is set to add more than $4.6 billion in new revenue between 2024 and 2029, underlining its increasing strategic importance for organizations worldwide.

Video Conferencing Adoption and Usage Rates

- Around 58% of companies use video conferencing for daily operations.

- Subscription counts have boosted to ~89M paid users by 2025.

- Daily participant counts remain in the hundreds of millions across major platforms.

- Cloud‑based solutions account for the majority of new deployments.

- Adoption climbs fastest in organizations with hybrid or remote workforce models.

- Usage among SMBs is increasing as flexible work becomes institutionalized.

- Consumer video conferencing for education and telehealth continues double‑digit growth.

- Tools adoption remains tightly linked to improved broadband and mobile availability.

Video Conferencing in Remote and Hybrid Work

- 86% of meetings include at least one remote participant, showing how hybrid formats dominate modern work meetings.

- 65% of corporate events are now held via video conferencing, up from 40% in 2020, reflecting hybrid event adoption.

- 89% of remote workers use video tools weekly, indicating pervasive use in distributed teams.

- For hybrid roles, nearly three in five employees prefer flexible work that includes virtual collaboration time.

- Demand for webcams and conferencing hardware surged over 50% as remote work increased, showing equipment adaptation.

- Video meetings help reduce commute stress and support remote work benefits tied to well-being.

- As hybrid work solidifies, video conferencing is now a core workplace tool, not an optional add‑on.

- Organizations report a near‑universal shift toward virtual meeting adoption since 2020 as hybrid norms settle.

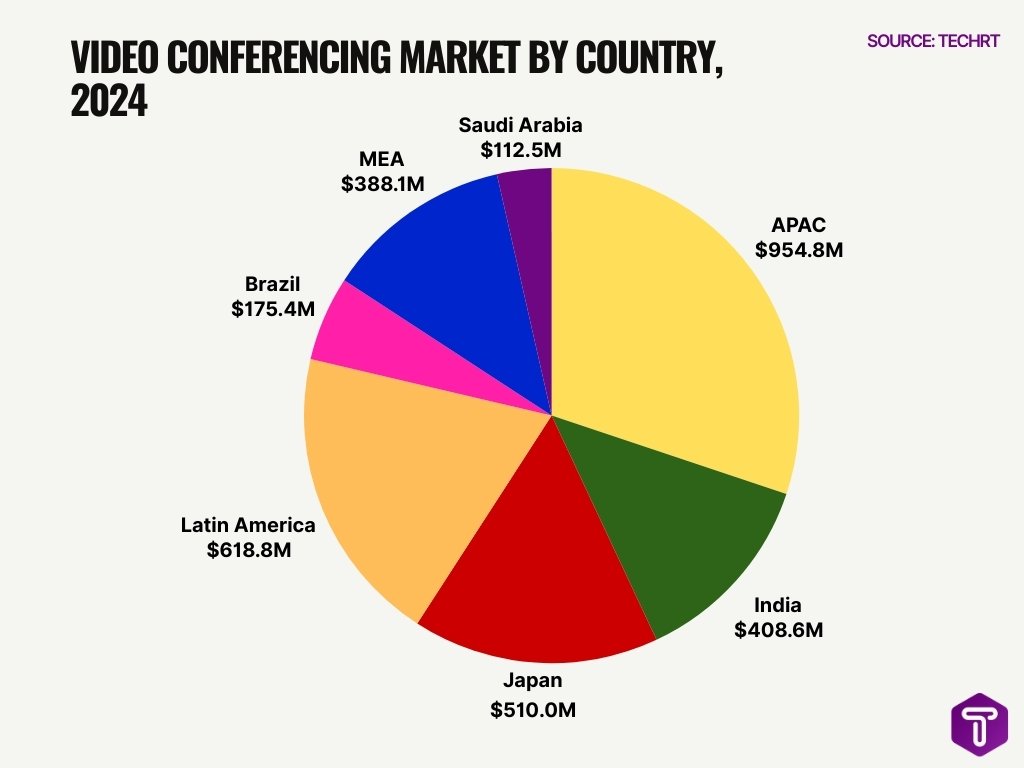

Regional Breakdown of the Video Conferencing Market

- North America dominated the video conferencing market with $14.1 billion in 2024.

- Europe generated $3 billion in 2024, projected to grow at 7.7% CAGR to 2033.

- APAC video conferencing equipment reached $954.8 million in 2024 with 15.3% CAGR.

- India’s video conferencing market hit $408.6 million in 2024, growing at 12.35% CAGR.

- Japan market stood at $510 million in 2024, expanding at 9.5% CAGR.

- Latin America recorded $618.8 million in 2024, forecasted to reach $1.34 billion by 2033.

- Brazil achieved $175.4 million in 2024 with 9.1% CAGR growth.

- Middle East & Africa generated $388.1 million in 2024, rising at 9.3% CAGR.

- The Saudi Arabian market was valued at $112.5 million in 2024, targeting $297.2 million by 2033.

- Cloud conferencing in APAC leads as the fastest-growing segment globally.

Video Conferencing in Business and Enterprise Settings

- 58% of companies use video conferencing daily, making it a standard business communication channel.

- 89% of organizations deploy multiple video conferencing platforms, showing enterprise tool diversification.

- Enterprises with 1,000+ employees spend an average of $242,000 per year on conferencing services, highlighting business investment.

- Cloud‑based solutions make up 73% of the conferencing market, showing enterprise preference for scalable services.

- About one in three Americans uses live video chat with businesses, reflecting external engagement usage.

- Video conferencing expands into customer service and CRM workflows across business units.

- Leadership and managers see video meetings as key to decision speed and workflow alignment.

- Most enterprises now integrate video platforms with project tools for unified communication.

Meeting Volume and Time Spent in Video Meetings

- 72% of workers lose time due to tech issues like audio problems or frozen video during meetings.

- One‑third of meetings span multiple time zones, adding complexity and time drag.

- Around 65% of people report wasting time in meetings, up from 60% a year earlier.

- 80% of workers say they’d be more productive with fewer meetings, signaling efficiency concerns.

- Video meetings are now standard throughout typical workweeks across sectors.

- Average employee meeting loads have increased since 2020 with hybrid work adoption.

- Tech hurdles remain a top challenge for meeting efficiency.

- Cross‑functional meetings contribute to collaboration but can consume significant daily hours.

Video Conferencing by Company Size and Industry

- Large enterprises hold 61.2% of video conferencing revenues, dominating market spend ahead of SMBs.

- SMBs accounted for only 40% of total video conferencing usage pre-pandemic, trailing large firms.

- Large enterprises spend an average of $242,000/year on video conferencing tools.

- SMEs are expected to capture 63.9% market share in 2025 with scalable cloud solutions.

- Hybrid workers average 5.4 video calls/week, driving SMB investments in conferencing.

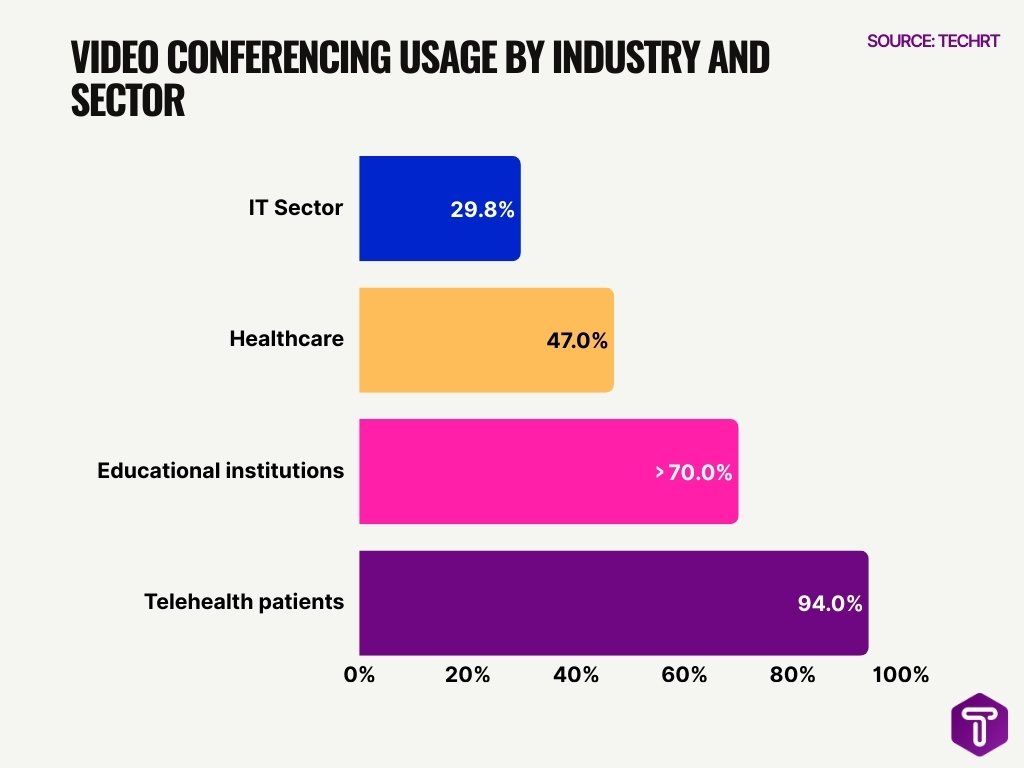

- The IT sector commands 29.8% of conferencing revenues, leading industry adoption.

- Healthcare video conferencing grew 47% from 2023-2025 for telehealth consultations.

- Over 70% of educational institutions adopted video conferencing for remote learning.

- 94% of telehealth patients are willing to repeat virtual visits post-2024.

- 58% of organizations use video conferencing daily for operations.

Productivity and Collaboration Impact of Video Conferencing

- 94% of businesses cite productivity as the top benefit of video conferencing.

- 89% of remote employees feel more connected to teams via video conferencing.

- 98% agree that video conferencing enhances communication and collaboration.

- 77% of remote workers report higher productivity from home using video tools.

- Video conferencing reduces business travel needs by 47%, boosting efficiency.

- 55% of businesses see increased employee engagement from video conferencing.

- 96% confirm video conferencing improves connectivity for remote teams.

- Remote employees save 72 minutes daily on commutes, aiding focus.

- Companies save $11,000 per employee yearly with video conferencing.

Employee Engagement and Satisfaction with Video Meetings

- 70% of workers think virtual meetings are less stressful than in‑person gatherings.

- 71% find it easier to present in virtual meetings than in live settings.

- 67% believe video meetings are as productive as in‑person sessions.

- 58% of introverts report Zoom fatigue compared to 40% of extroverts, reflecting engagement challenges.

- Employees often feel engagement improves when cameras are encouraged.

- Satisfaction is tied to meeting relevance and format design.

- Workers prefer concise meetings with clear agendas.

- Continuous improvements in conferencing UX help engagement over time.

User Preferences for Devices and Platforms in Video Calls

- Webcam demand surged over 50% amid hybrid work, with the market growing from $9.88B in 2025 to $14.35B by 2030 at 7.75% CAGR.

- 77% of employees prefer laptops or desktops for reliable video calls at work.

- 31% of users join video calls via mobile phones, ideal for on-the-go meetings.

- 68% of all video calling occurs on mobile devices, surpassing desktops.

- Zoom holds 55.91% market share, favored for seamless integrations with CRM and calendars.

- Security drives enterprise choice, with the video conferencing security market growing 15% annually.

- 73% of hybrid workers prioritize platforms with reliable connectivity and low lag.

- 96% report better satisfaction from high audio/video quality in video conferencing.

- 78% of 18-34 year-olds prefer video over phone calls, varying by age and role.

Popular Video Conferencing Platforms During the Pandemic

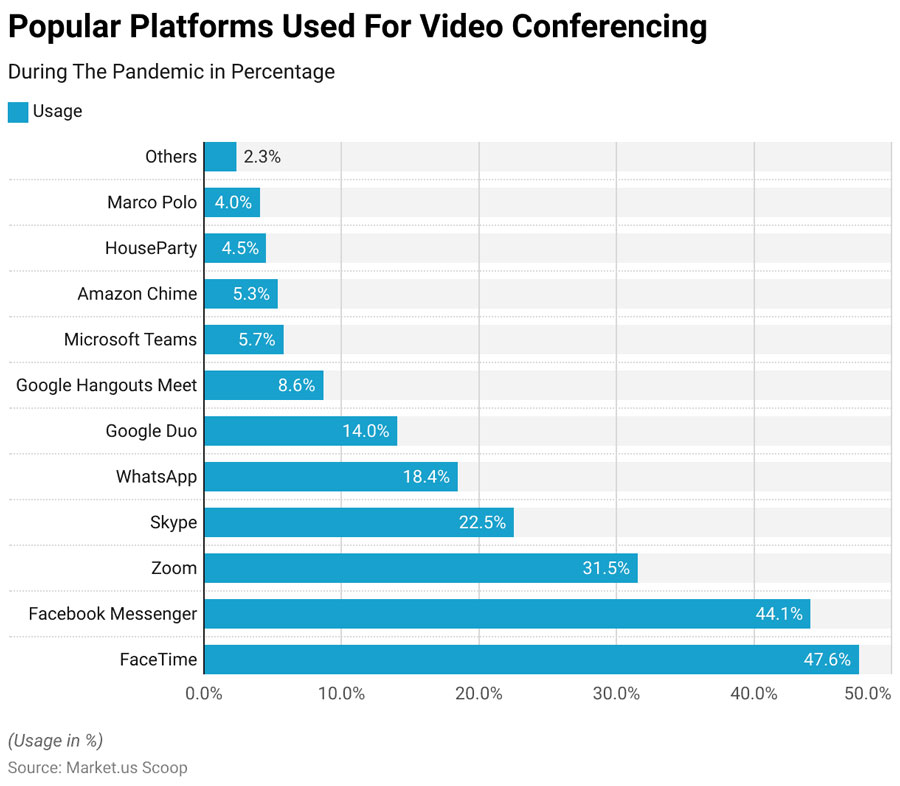

- FaceTime dominated usage with 47.6%, making it the most widely used video conferencing platform during the pandemic period.

- Facebook Messenger followed closely at 44.1%, highlighting its strong role in social and personal video communication.

- Zoom emerged as the leading professional platform, reaching 31.5% usage due to its rapid adoption for remote work, education, and virtual meetings.

- Skype maintained a solid presence with 22.5% usage, reflecting continued reliance on legacy video calling solutions.

- WhatsApp accounted for 18.4%, emphasizing its popularity for mobile-first and casual video calls.

- Google Duo captured 14.0% usage, supported by its deep integration with Android devices.

- Google Hangouts Meet recorded 8.6%, primarily used for business meetings and online classes.

- Microsoft Teams reached 5.7%, showing early-stage enterprise adoption during the pandemic.

- Amazon Chime held a 5.3% share, catering mainly to corporate and AWS-linked users.

- HouseParty and Marco Polo remained niche platforms, with 4.5% and 4.0% usage, respectively.

- Other video conferencing tools collectively represented just 2.3%, indicating a highly concentrated market dominated by a few major platforms.

Cost Savings and ROI from Video Conferencing

- Many organizations report significant travel cost reductions after adopting video conferencing, often cutting travel budgets by 20–30% annually.

- Video conferencing helps SMBs reduce office overhead by enabling hybrid work instead of maintaining large physical spaces.

- For enterprises with 100 employees, reducing unnecessary meetings via video tools can save ~$2.5 million per year in lost productivity.

- Larger firms (5,000 employees) can exceed $100 million in savings annually through optimized virtual collaboration.

- Employers can save an estimated $11,000 per year per remote worker when considering productivity and office costs.

- Reducing commute‑related expenses also improves overall employee well-being and discretionary spending.

- Integration of conferencing with productivity tools (e.g., calendars, project management) increases ROI by streamlining workflows.

- Organizations employing automated meeting summaries and AI assistance see time savings in post‑meeting follow‑ups, enhancing ROI.

- Cloud conferencing adoption continues to lower IT maintenance costs compared with on‑premises setups.

- In the education and telehealth sectors, video conferencing reduces physical infrastructure needs while expanding service reach.

Security, Privacy, and Compliance in Video Conferencing

- End‑to‑end encryption has become a necessary expectation for enterprise conferencing to meet compliance standards.

- Tools now offer multi‑factor authentication and advanced access controls to prevent unauthorized entry.

- Hybrid work broad adoption has heightened data privacy concerns, especially under GDPR in Europe or CCPA in the U.S.

- Large providers continuously push updates against threats like “meeting bombing” and credential stuffing.

- Industries like healthcare and finance often require secure, compliant conferencing channels with audit logs and data retention controls.

- Cloud conferencing vendors emphasize zero‑trust security as a design principle.

- Role‑based access and encrypted recordings are standard in enterprise conferencing packages.

- Regulatory frameworks prompt frequent updates to privacy settings and consent management tools in conferencing platforms.

- Security certifications (e.g., ISO/IEC standards) are increasingly used as purchase criteria by large buyers.

- AI‑based anomaly detection now flags unusual access patterns in real time, reducing security risk.

Video Conferencing Quality, Reliability, and Performance Metrics

- Over 11 million video conferences occur daily in the US, highlighting massive scale.

- Zoom requires 3.8 Mbps upload for 1080p group HD calls to ensure smooth quality.

- The 4K video conferencing market is valued at $3.5 billion in 2024, growing to $10.2 billion by 2034.

- Video packet loss is noticeable above 0.05%, severely impacting quality at 2%.

- Fiber-5G integration reduces latency by 88%, from 10ms to 1.2ms.

- Average MOS score for VoIP/video calls ranges from 3.5 to 4.2, targeting 4.3 for excellent quality.

- Microsoft Teams telephony offers 99.999% uptime SLA, allowing just 5.26 minutes of annual downtime.

- Paid subscriptions reached 89 million in 2025, doubling since 2020, with 86% weekly remote use.

- 5G enables HD/4K standards, boosting frame rates to 30 fps from 15 fps.

- Enterprise SLAs guarantee 99.9%+ uptime, monitoring latency under 150ms for video.

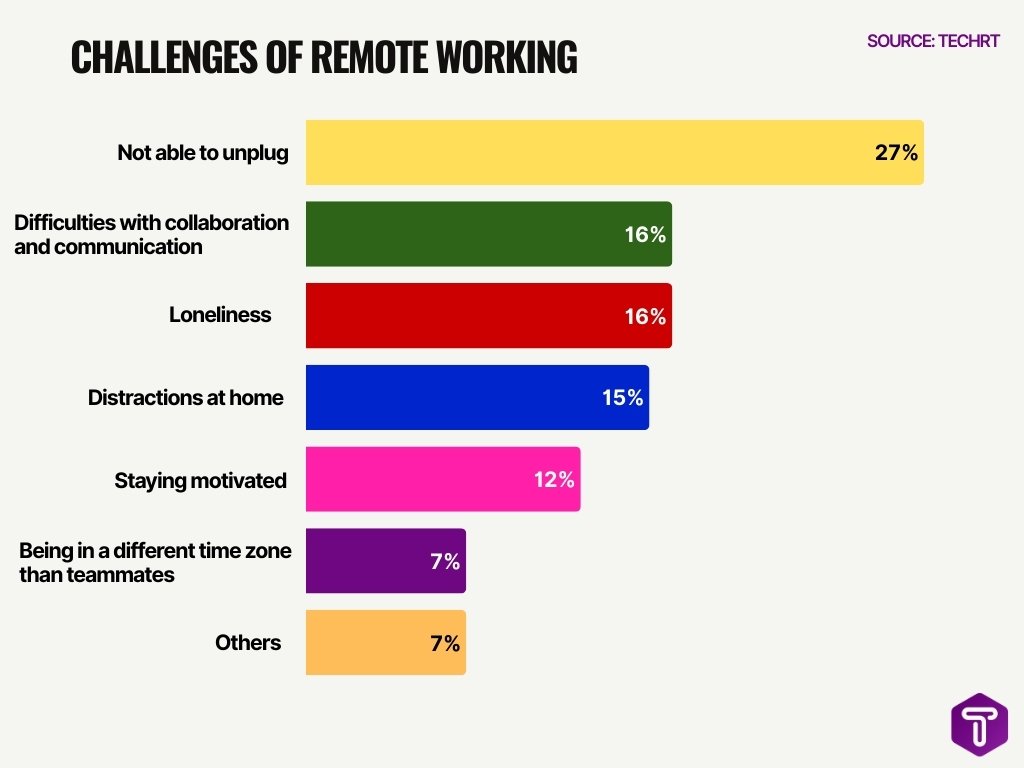

Challenges of Remote Working: Key Statistics and Insights

- Not being able to unplug (27%) is the biggest challenge, showing that many remote workers struggle with work-life balance and switching off after work hours.

- Difficulties with collaboration and communication (16%) highlight how remote setups can weaken teamwork and slow down decision-making.

- Loneliness (16%) affects a significant share of remote employees, emphasizing the social isolation linked to long-term remote work.

- Distractions at home (15%) remain a major concern, impacting focus, productivity, and time management.

- Staying motivated (12%) reflects challenges in maintaining self-discipline and engagement without a traditional office environment.

- Being in a different time zone than teammates (7%) creates scheduling and coordination issues, especially for global teams.

- Other challenges (7%) indicate additional remote work difficulties that vary by role, industry, and work environment.

AI and Advanced Features in Video Conferencing Tools

- AI assistants in video conferencing save businesses 20-30% in productivity through automated summaries.

- Over 11 million daily video conferences leverage AI features like noise suppression and real-time translation.

- The AI video translation market reaches $5.04 billion in 2025, boosting global collaboration.

- 69% of users rely on AI virtual assistants for intelligent scheduling and calendar integration.

- AI noise suppression distinguishes speech from hundreds of noise types in meetings.

- 83% of global workers prefer hybrid setups enhanced by AI speaker framing and audio leveling.

- The transcription industry, powered by AI summaries, is expected to grow to $35 billion by 2032.

- AI-powered security in conferencing detects anomalies via pattern recognition in real-time.

Future Trends and Forecasts in Video Conferencing

- The video conferencing market is forecast to grow from ~$14.17 billion in 2024 to significantly higher valuations by 2033.

- Some projections put global conferencing tools at ~$22.5 billion by 2025 and beyond as remote work tools deepen enterprise adoption.

- CAGR estimates for the market range from the mid‑8% to 12%+ territory through the late 2020s.

- Cloud and AI‑enhanced conferencing solutions are expected to expand faster than on‑premises systems.

- Hybrid work normalization will keep video conferencing central to business and education.

- Continued 5G rollout and improvements in connectivity will raise baseline video quality worldwide.

- Integration with virtual and augmented reality may usher in immersive meeting experiences in the next decade.

- Security and compliance trends will drive adoption in regulated sectors (healthcare, government).

- Platform ecosystems combining collaborative workflows with conferencing are predicted to dominate enterprise IT stacks.

- Video conferencing adoption is expected to remain robust across both developed and emerging markets.

Frequently Asked Questions (FAQs)

What is the projected global video conferencing market value in 2025?

The global video conferencing market is expected to reach $37.29 billion in 2025 from USD 33.04 billion in 2024.

At what CAGR is the video conferencing market forecast to grow through 2033?

The video conferencing market is projected to grow at a compound annual growth rate (CAGR) of 9.6% from 2026 to 2033.

What market share does Zoom hold in the global video conferencing industry?

Zoom dominates the global video conferencing market with approximately 55.91 % market share.

How many daily users does Zoom report worldwide?

Zoom has over 300 million daily active users across its platform.

What CAGR is forecast for the video conferencing hardware market through 2030?

The video conferencing hardware market is projected to grow at a 15.4 % CAGR to reach USD 14.38 billion by 2030.

Conclusion

Video conferencing is no longer a niche tool; it’s a foundation of digital collaboration. Usage patterns show Zoom and Teams as dominant platforms, while AI and security enhancements strengthen performance and compliance. As hybrid work continues, organizations will increasingly rely on conferencing to connect teams, reduce costs, and innovate workflows. The near‑term future points to broader adoption, deeper integration with enterprise systems, and richer, AI‑enabled meeting experiences, ensuring video conferencing remains essential in an interconnected world.

Leave a comment

Have something to say about this article? Add your comment and start the discussion.