Buy Now Pay Later (BNPL) services have revolutionized digital commerce by offering flexible, interest-free installment plans at the point of sale. For many shoppers, apps like Klarna provide essential access to credit and better cash flow management without the high interest rates typical of traditional credit cards. Whether you are looking for higher spending limits, no credit check options, or longer repayment terms, choosing the right alternative can save you significant money in fees and protect your long-term financial health.

While the primary appeal of Klarna alternatives is the zero-percent interest model, users must understand the underlying impact on their financial profile. Unlike traditional revolving credit, BNPL providers have varying reporting standards; however, missed payments are increasingly reported to major credit bureaus. As financial experts, we stress that while these tools provide immediate liquidity, they require strict discipline to avoid the “debt spiral” often associated with easy-access credit lines.

The BNPL landscape has evolved from a niche marketing tool into a robust financial sector. To provide you with the most trustworthy recommendations, we have evaluated these Klarna substitutes based on their transparent pricing, merchant network size, and consumer protection policies. Our analysis focuses on how each app handles credit reporting and late fee structures so you can make an informed decision based on your specific financial standing and shopping habits.

Top-Rated Buy Now Pay Later Apps to Use Instead of Klarna

1. Affirm

Founded in 2012, the app has over 6 million users and is one of the major competitors to Klarna. They can be used at over 6500 merchant sites and are known for their quick processing time. The app provides customers with flexible payment terms on check out of shopping. Unlike some of the competition, the loan amount varies with the merchant being chosen and is not fixed. This offers customers greater flexibility to pay as well as affords a higher purchase price.

Pros

- Offers a wide variety of payment and finance options.

- Fees are charged on transactions.

- Offers pre-qualification which means a higher credit offtake to the customer.

Cons

- High interest rate charged when payment schedules are broken.

2. Afterpay

Servicing over 8 million customers worldwide, this is a serious contender to replace Klarna for shopping needs. The use of a very attractive website only helps with marketing the offering. It is also possible to access the site as a mobile application on a smartphone. But customers must be warned that there are substantial fees charged for late payment of installments. So, people not sure of their cash flows must not use the product. The strong reason for using Afterpay is that there are minimal pre-purchase credit checks, which makes it a convenient option for those with a poor credit rating.

Pros

- Easy and fast approval process.

- Provides a seamless experience to shoppers.

- A range of payment options to suit the customer.

Cons

- Users must be prepared to stick strictly with the payment plans. There is little flexibility on offer.

3. Sezzle

This is another store like Klarna that stands out for the number of people signed up for the application. Servicing over 29,000 merchants, shoppers are bound to find a vendor supporting the goods that they want to purchase. Sezzle gives the option to the customer to defer payments for a purchase over a period of 6 months with 4 payment installments. It is also possible to reschedule a payment for a single time without charge.

Pros

- No hard check of creditworthiness.

- Transparent and easy-to-understand payment terms.

- No interest charged on installments.

Cons

- First-time users are offered a lower credit limit.

4. Quadpay

One of the strong points of Quadpay is that the customer needs to go through an approval process before a purchase can be made. This ensures that defaults are kept to a bare minimum. Payments are spread across 6 weeks as 4 equal installments. Each purchase has to be followed up with the payment of 1/4th the price. Quadpay is accessible only to those with a verifiable credit history and remains one of the more robust deferred payment platforms.

Pros

- The processing fees charged are kept to a bare minimum.

- A pre-purchase credit check ensures that only creditworthy individuals are taken abroad.

- A transparent pricing policy keeps things simple and clear.

Cons

- Since there is no limit on the credit extended, people often end up taking more liability than they can service comfortably.

5. Per Pay

This is a Klarna alternative that is available as an app on a smartphone. Deferred payment purchases can be made by just creating a profile on the application. This does not require a credit check to be done on the customer. Simple to use with an intuitive user interface, the app has a strong following right across the globe.

6. ViaBill

It is possible for customers using ViaBill to make payments monthly and at zero percent interest charged. The company focuses on bringing on board the smaller businesses by better integrating them with the website. This enables a seamless transaction and improves business for the participating merchants.

7. Laybuy

Laybuy is another one of the companies like Klarna that helps shoppers to pay in convenient installments rather than the full amount at purchase. The strong point of the app is that it has a strong user base, both with brick-and-mortar stores and online merchants. Most of the purchases that are made with Laybuy are to purchase fashion items and accessories. The purchase is divided into six installments spread over 5 weeks, and the customer pays 1/6th of the cost at the time of purchase.

Pros

- Nothing by way of establishment fees and sign-up amounts.

- Interest-free installments for the first 6 weeks.

- Honoured at both online and in-store purchases.

Cons

- Use is limited to some exclusive geographical locations.

8. GoCardless

The offering from GoCardless aims at taking on the credit card companies by offering credit at low-interest rates as possible. One of the notable features that the company offers is a hassle-free and smooth check-out during shopping.

9. J2Store

This is more of a browser plugin than an app and offers shoppers the choice of deferred payments on purchases. J2Store helps businesses by referring more customers and, at the same time, offering shoppers an installment payment process. The facility to use discount coupons during checkout ensures that the customer is given the best prices.

10. Venue

The Venue is a buy now and pay later app that is suited to the young and the old alike. Most of the major brands have a strong presence on the app, and it is noted for the low user charges the customers pay. It is possible for people without a credit history to avail themselves of the installment payments.

11. PayPal Credit

With PayPal introducing itself as a preferred payment option for shoppers, it was only a matter of time before the company introduced credit lines to its customers. The payment option has a long-standing history of the PayPal option and has found acceptance among shoppers. But the hard part is that it does check on the creditworthiness of the customer, and it is often the users of the payment system that gets precedence.

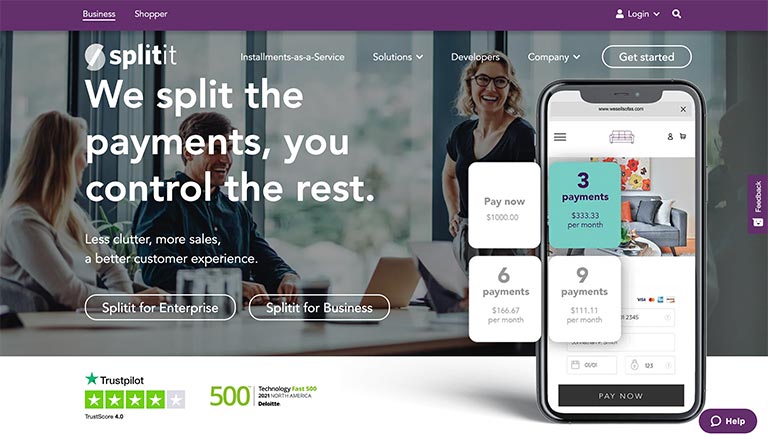

12. Splitit

This is an innovative split payment platform that does not charge anything for late payments. People using the app have often taken notice of the very friendly user interface that smoothens the payment process. It is possible to configure payments in up to 24 installments.

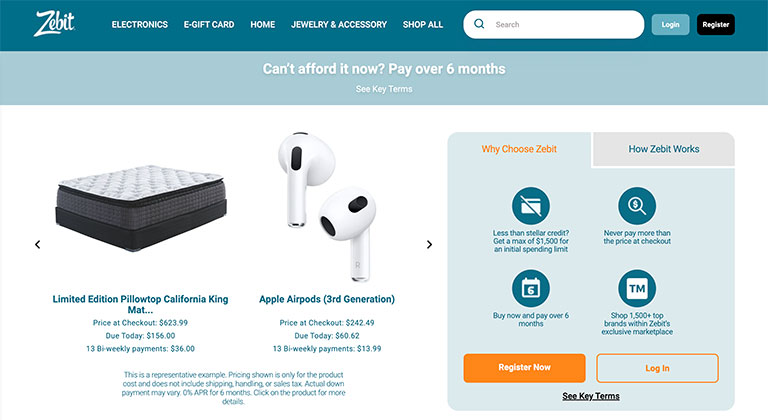

13. Zebit

A shopping website that allows credit sales, Zebit offers some of the most popular and used brands on sale. There is little by way of a creditworthiness check, which makes it rather convenient to use for daily purchases. Membership is free, and there is a substantial credit offering to even first-time users of the site.

14. Bread Pay

Offer a convenience that is lacking in other shopping sites. Each customer offered an interest rate charge after studying the credit history and creditworthiness. This is an application that is growing in use with each passing day. On offer is a wide range of goods and products that an average household might need at any time.

15. Partial.ly

16. Fingerhut

17. Limepay

18. G2Deals

19. Sunbit

Frequently Asked Questions

What are the differences between Klarna and Sezzle?

Klarna and Sezzle are similar apps in all aspects, the only difference being that Sezzle has just a single payment option, whereas Klarna has three payment options to choose from.

Conclusion

Sites like Klarna allow credit payments to customers who otherwise would not be using any credit lines themselves. It must be understood that when using Klarna and its alternatives, it is important that the shopper sticks to the payment schedule at all costs. The penal costs for late payments are rather steep, often higher than those for credit cards or other alternatives.

Carolyn

are they even safe to use?

Irene

When considering Buy Now Pay Later (BNPL) sites, it’s essential to prioritize safety. You should thoroughly assess these platforms for secure payment methods, transparent terms, and positive user feedback. Additionally, conduct thorough research to ensure a secure and trustworthy transactional experience.